Macro Regime Tracker: The Powell Fade

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

The news today that caused ES to sell off fell directly in line with the macro view on interest rates I laid out here:

The “news” about Powell being fired, which eventually turned out to be false, does not change how inflation risk is functioning in the underlying economy.

This is why fading the ES selling worked intraday:

See all systematic strategies, models, and tear sheets below.

Main Developments In Macro

Federal Reserve Commentary

Bostic (Atlanta Fed):

“Everything is on the table, want data to guide us”

“Right now, I’d wait on cutting interest rates”

“We’re seeing signs inflation pressures are up”

“We may be at inflection point for inflation”

“May be 2026 before we see full tariff effects”

“Want to make sure I’m laser-focused on economy”

Logan (Dallas Fed):

“Supports holding rates to keep cooling inflation”

“Also possible softer labor market could require cuts soon”

“Base case calls for continued restrictive policy”

Barr (Vice Chair for Supervision):

“Regulation must evolve with financial system”

“Relaxing rules can create vulnerabilities”

“Past cycles of boom, bust tied to weakened regulation”

Hassett (former NEC Chair):

“Inflation data has been fine”

“The Fed has been very, very slow”

US Economic Data

US Industrial Production (June):

+0.3% m/m (above +0.1% est.)US MBA Mortgage Applications:

Fell 10% last week

US Trade & Tariff Policy

Trump:

Reiterates 20% “penalty” tariff on China for fentanyl

Says China has been helping with fentanyl

“Only interested in ‘low interest people’ for Fed Chair”

Criticized Powell repeatedly: called him a “knucklehead”, “terrible”

Spoke with GOP about possibly firing Powell, but “not planning” to

Ties Powell’s Fed renovations to “fraud” and calls it “sort of” fireable

White House / Trade Developments:

US to ban Chinese tech in submarine cables (FT)

Brazil sends US letter urging dialogue on tariffs

Canada tightens steel quotas on some countries

Switzerland-US trade deal awaits Trump’s sign-off

EU-US trade talks ongoing, aiming for deal before Aug. 1

EU adopts new sanctions on Russia

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Here is a summary of all models and their directional strengths:

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

US Market Wrap: S&P 500 Rises as Political Firestorm Around Fed Chair Powell Fizzles…. Defensive-Led Rebound, Tariff Creep Lingers

The S&P 500 eked out a 0.09% gain on Wednesday, regaining its footing after early jitters tied to speculation that President Trump might fire Fed Chair Jerome Powell. Risk appetite recovered following Trump’s on-camera denial that he had imminent plans to remove Powell calming fears of a full-blown institutional crisis and helping equities close modestly higher. Beneath the surface, however, the rebound was narrow and driven primarily by defensives, as Communication Services and Energy dragged. Two-year yields dropped five basis points on dovish PPI data, and the dollar snapped its recent rally.

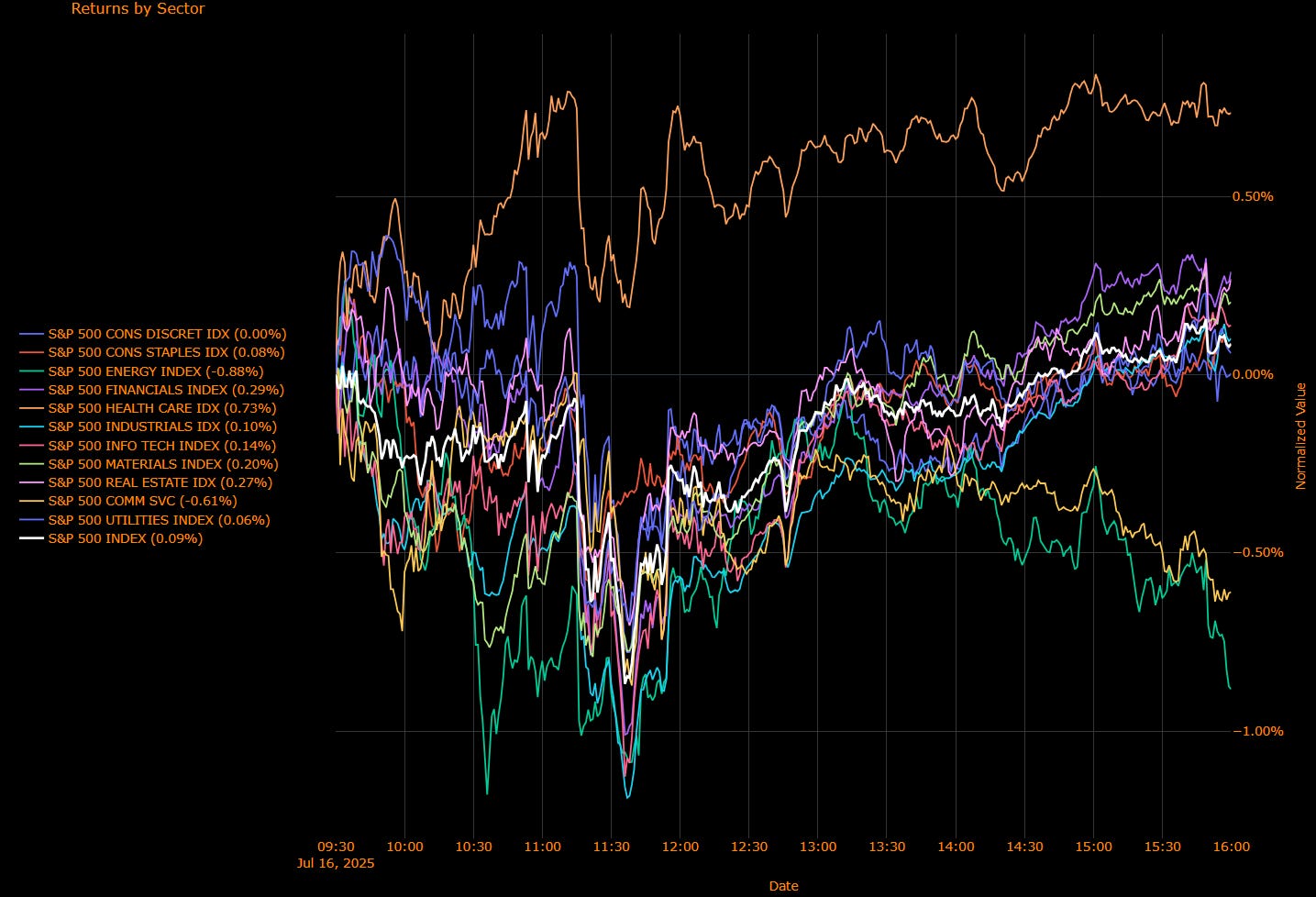

Sector Contribution Breakdown

(Weighted Return Contribution to S&P 500)

Health Care (+0.07 pp) – The largest positive contributor, led by strength in pharma and biotech. Johnson & Johnson earnings beat helped the group buck broader macro noise.

Info Tech (+0.05 pp) – Modest lift as chipmakers stabilized on optimism around China export licenses. Nvidia and AMD underpinned strength in semis.

Financials (+0.04 pp) – Helped by earnings-driven resilience in large banks. Morgan Stanley and Bank of America topped estimates.

Industrials & Real Estate (+0.01 pp each) – Quiet contributions; REITs stabilized with lower yields. Industrial gains were more idiosyncratic than thematic.

Energy (–0.03 pp) – Weighed down by a near 1% drop in the sector index. Weakness in oil services and E&Ps despite flat WTI prices suggests ongoing concern over global demand and tariff-linked input cost creep.

Comm Services (–0.06 pp) – The biggest drag, with weakness in streaming and digital platforms as valuation pressure resumed.

Other sectors — including Consumer Discretionary, Staples, Materials, and Utilities — were effectively flat and contributed near zero.

Sector Performance Breakdown

(Unweighted Daily Returns)

Health Care (+0.73%) – Strongest performer. Broad rally across biotech, pharma, and equipment. Johnson & Johnson’s bullish outlook gave investors a reason to rotate back into perceived quality.

Financials (+0.29%) – Extended gains post-earnings, supported by strong trading revenue and resilient NII trends. Tailwinds from lower yields offset ongoing regulatory overhang.

Real Estate (+0.27%) – Recovered modestly as 10-year yields dipped. Demand for income-generating assets picked up slightly after recent underperformance.

Materials (+0.20%) / Staples (+0.08%) / Utilities (+0.06%) – Mild gains for defensives amid volatility elsewhere. Viewed as safety plays while political noise unfolded.

Industrials (+0.10%) / Info Tech (+0.14%) – Small but notable gains. Chip stocks provided the backbone of tech’s advance; industrials were helped by select names like United Airlines on improved guidance.

Comm Services (–0.61%) / Energy (–0.88%) – Only sectors meaningfully lower. Comm Services declined on renewed selling in large-cap platforms; Energy slumped despite muted crude moves.

Consumer Discretionary (0.00%) – Directionless. Tariff-exposed retail names struggled, offset by strength in autos and housing stocks.

Macro Overlay: Powell Reprieve Calms Markets, but Fed Path Unchanged

Trump Walks Back Powell Threat, Market Breathes a Sigh of Relief

The day’s major catalyst was political, not economic. Speculation around Jerome Powell’s job security sparked early uncertainty, after reports emerged that Trump discussed firing him with GOP lawmakers. Markets steadied as Trump denied any active plans to remove Powell, clarifying that the idea had been floated only “in concept.” That was enough to douse immediate volatility and avoid a deeper institutional crisis repricing but Powell’s independence now feels more exposed, not less.

PPI Flat: Trade Pressures Blunted by Soft Services

The June PPI came in unchanged, well below expectations, with service costs softening sharply (particularly in travel and lodging). That gave further comfort to doves betting on disinflation and helped firm expectations for a September rate cut though markets remain split. Importantly, while headline pressures are muted, goods inflation continues to show signs of tariff pass-through, echoing the dynamic seen in CPI. That leaves open the question: is inflation quiet or just delayed?

Fed Independence Becomes a Macro Variable

Bank CEOs, including Moynihan and Solomon, publicly defended the Fed’s autonomy a striking moment that underscores how fragile perceptions of central bank credibility have become. Analysts note that if Powell were actually removed, a dollar selloff and a front-end bond rally could swiftly follow. The fact that markets didn’t panic yesterday is a sign they don’t yet see it as imminent but the episode has clearly shifted the Overton window around political interference.

A Narrow Bounce, Not a Broad-Based Reacceleration

Despite the green on the screen, Wednesday’s rally was defensive in character and lacked true leadership. Tech and health care kept the tape afloat, but cyclicals failed to meaningfully re-engage. Energy’s slump and the breakdown in Communication Services highlight that risk appetite remains tentative. The Fed story is far from over, and trade-related inflation is still creeping in through the back door.

The key now is whether upcoming PCE and labor market data can anchor expectations for a September cut. Until then, equities may continue to chop sideways, caught between resilient earnings and an increasingly unstable macro-political backdrop.

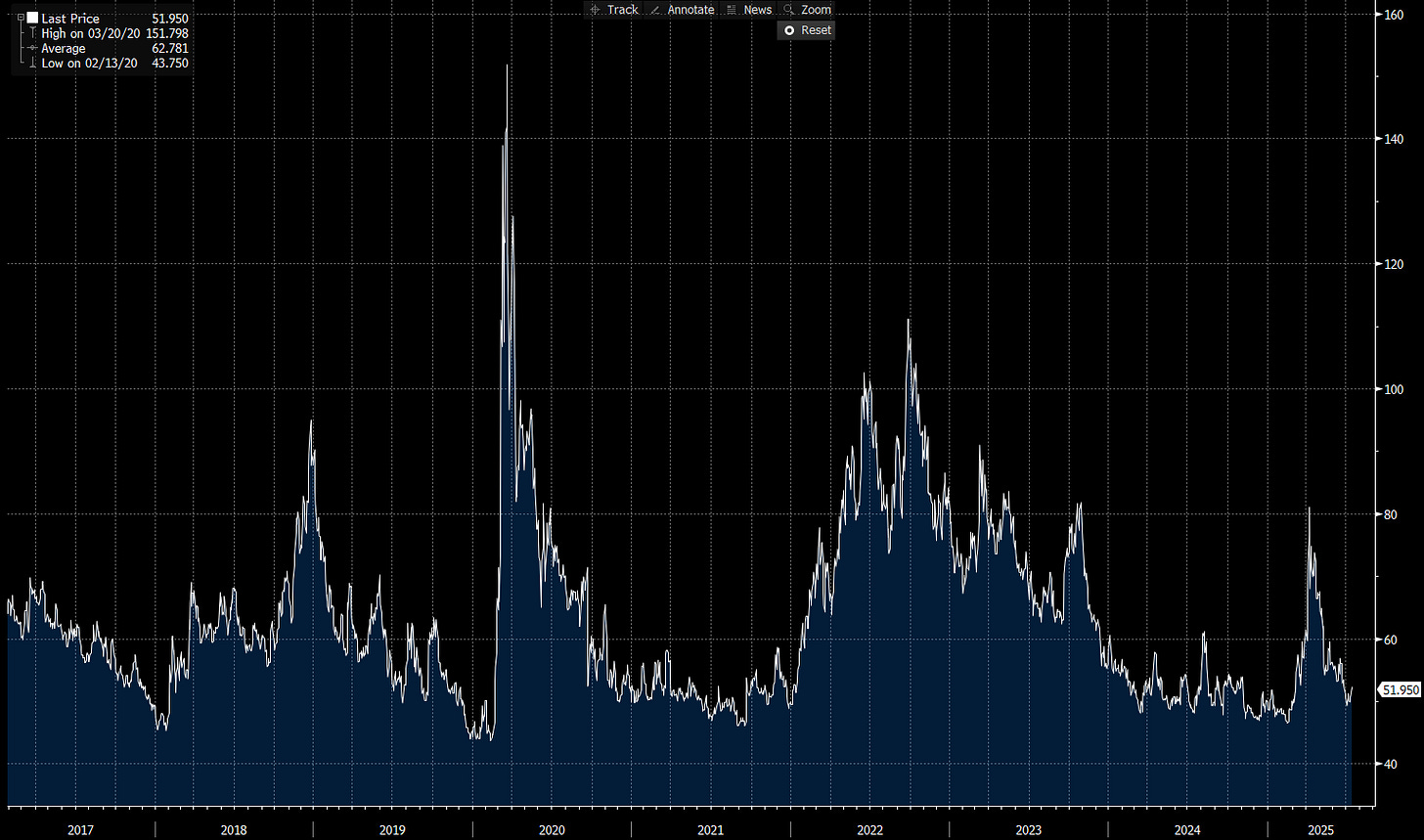

US IG Credit Wrap: Spreads Hold at 51.95 bp as Volatility Dips and Political Risk Lingers

Current IG Spread: 51.95 bp | 5-Year Average: 62.78 bp | 2020 High: 151.80 bp

Investment-grade credit spreads remained steady at 51.95 bp on Wednesday, sitting comfortably below the five-year average and close to their tightest levels since the pandemic. Despite geopolitical noise and soft-but-complicated inflation prints, the market’s pricing of corporate risk appears tranquil maybe too tranquil. With Powell’s job momentarily secure and macro data giving mixed signals, IG credit is caught between comfort and complacency.

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

Macro Overlay: Calm Spreads, Political Stormclouds, and PPI Fatigue

Powell Unfired, Market Unmoved

After a flurry of speculation, President Trump walked back comments suggesting he might remove Fed Chair Jerome Powell. The newsflow sparked early equity jitters but failed to move the needle in credit markets. That’s telling. Either investors believe Powell is safe, or they’ve priced in political drama as ambient noise. Still, the fact that firing the Fed chair was even entertained may explain why credit spreads are stable — but not tightening further.

PPI Flat, but Tariff Risks Still Ticking

June’s PPI print was unchanged on the month and undershot expectations, adding to the argument that disinflation is ongoing. However, as with CPI, the composition matters. Durable goods prices particularly in consumer-facing sectors — are quietly creeping higher. That trend, driven by tariff pass-through, hasn’t hit earnings yet. But with Q2 results starting to roll in, the risk is growing that margin compression becomes a dominant theme in upcoming guidance.

Dispersion Is Quietly Creeping Back

The IG index may be stable, but the cracks are forming beneath the surface. Lower-tier BBBs and companies with trade-sensitive cost bases (e.g. retail, consumer products, transportation) are beginning to underperform. Bid-ask spreads have widened slightly, and desks report reduced risk appetite for new issues from import-heavy names. That sort of dispersion can precede broader repricing or signal the start of a credit cycle rotation.

Primary Market Watch: Calm Before the Supply Storm

New issuance remains muted, but syndicate desks expect activity to ramp up now that CPI and PPI are behind us and earnings blackouts begin to lift. Borrowers may look to front-load funding needs ahead of August illiquidity. The wild card is whether this issuance surge hits into fragile market conditions. If dealer books fill too quickly especially in a week where geopolitical noise resurfaces supply indigestion could push spreads wider even without fundamental deterioration.

Complacency Creeps In, But Cushion Is Thin

At 51.95 bp, IG spreads are resting in a “too quiet” zone. There’s no panic and no clear catalyst for widening but the conviction behind current levels is thinning. Political volatility is rising, tariff pass-through is real (if slow), and the Fed remains boxed in until the July PCE report.

If the next catalyst is positive a Fed dovish tilt, benign earnings spreads could grind tighter. But if Powell’s job security falters again, or if PCE data echo the sticky inflation seen in goods, the unwind could be fast and asymmetric.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

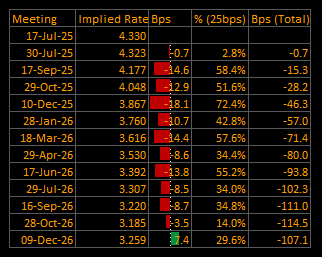

Short-End Rates Wrap: Curve Holds at –106.3 bp as Powell Risk Eases, But Easing Path Remains Politicized

Cumulative Implied Easing: –106.3 bp | Terminal Rate Seen at 3.27% (Dec 2026)

Front-end rate markets barely budged Wednesday, with the OIS curve showing 106 basis points of implied easing through December 2026. That’s down modestly from earlier in the week, reflecting a touch more skepticism around front-loaded cuts — even as Powell’s job security received a temporary reprieve. Traders continue to see a steady path of cuts starting in September, but conviction is fraying at the edges. The curve remains orderly, but fragile.

OIS-Implied Policy Path

Key Meetings:

17-Jul-25: 4.330%

30-Jul-25: 4.323% (–0.7 bp)

17-Sep-25: 4.174% (–14.9 bp)

29-Oct-25: 4.043% (–13.1 bp)

10-Dec-25: 3.866% (–17.7 bp)

09-Dec-26: 3.267% (–8.5 bp)

Macro Overlay: Fewer Shocks, More Drift But Repricing Risks Persist

Powell Stays (For Now), but Politics Is Embedded

Wednesday’s market tone was steadier, thanks to President Trump walking back speculation of Jerome Powell’s imminent removal. But the damage is done: political risk is now embedded in the front-end curve. The PPI print flat on the month reinforced the idea that disinflation continues, but traders were more focused on governance risk than macro. That makes the September FOMC less about data and more about credibility.

The Fed’s path looks stable, but its leadership doesn’t.

September Cut Probability Holds, But It’s Becoming a Binary Event

The 17-Sep-25 meeting remains the expected starting point for the easing cycle, with ~60% odds of a 25 bp move priced. That probability has hovered near the same level for a week, even after back-to-back soft CPI and PPI prints. It’s a sign the market wants confirmation via Powell’s guidance and the July PCE not just trailing inflation numbers.

September is still live… but traders are waiting for someone to pull the trigger.

Back-End Anchored, But Slope Is Shallowing

Implied rates for late 2026 have barely moved. The market sees the Fed finishing near 3.25%, but how it gets there is increasingly unclear. The cumulative easing path is compressing slightly: –106.3 bp versus –108.4 bp earlier this week. It’s not a wholesale unwind, but it reflects growing doubt that the Fed will be able to front-load cuts without political or macro resistance.

Traders trust the destination… less so the roadmap.

Risk Premiums Thin as Repricing Sensitivity Rises

With the Fed seen staying on hold through summer, and a slow easing cycle into 2026, short-end trades are still carry-rich but increasingly twitchy. The curve is priced for near-perfect glidepath: tariffs fade, Powell stays, inflation softens, earnings hold up. Any deviation — political, economic, or fiscal could push the front-end sharply wider.

The market doesn’t need a shock. It just needs something to break the rhythm.

📉 Final Word: Calm Now, But the Next Data Point Matters More Than Ever

The short-end has digested Powell drama, flat PPI, and a soft CPI print without flinching. That suggests resilience or perhaps just fatigue. But with cumulative cuts still over 100 bp, and little cushion left for surprises, we are entering a period of heightened sensitivity. It’s no longer about whether the Fed can cut it’s about how cleanly they can land the plane without political turbulence, inflation flare-ups, or credibility slip-ups.

The easing path is priced. Now it has to survive the data, the politics, and the pressers.

Tactical Portfolio

Morning Trade(s) and Market thread

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.