Macro Regime Tracker: The Set Up For FOMC

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

I have laid out the macro views for the cycle and the short end in the following reports:

As always, all the systematic models and strategies are laid out below. Thanks

Main Developments In Macro

Global Macro & Trade Developments

KOREA SAYS IT MAY BE HARD TO REACH DEAL WITH US AT APEC: YONHAP

BESSENT: OVERALL FRAMEWORK IS READY ON SOUTH KOREA TRADE

BESSENT: VERY CLOSE ON SOUTH KOREA, NOT QUITE READY BY WEDS.

LULA: WILL HAVE DEFINITIVE SOLUTION WITH US ‘WITHIN A FEW DAYS’

ALCKMIN: PRIVATE SECTOR PARTICIPATION IN US-BRAZIL TALKS IS KEY

ALCKMIN: MORE THAN 1/3 OF BRAZIL EXPORTS SUBJECT TO 50% TARIFFS

BRAZIL’S ALCKMIN: US GOVERNMENT IS YET TO MAKE SPECIFIC DEMANDS

SHEINBAUM: CLOSE TO REACHING US DEAL ON NON-TARIFF BARRIERS

SHEINBAUM SAYS US EXTENDING TRADE DEADLINE FOR SEVERAL WEEKS

SHEINBAUM SAYS SHE SPOKE WITH TRUMP ON SATURDAY

SHEINBAUM TO DISCUSS TRADE AGAIN WITH TRUMP IN SEVERAL WEEKS

TRUMP: THINK WE’LL HAVE A SUCCESSFUL TRANSACTION WITH XI

BESSENT SAYS WE HAVE A FRAMEWORK FOR TRUMP, XI TO DECIDE ON

TRUMP: WE’LL LET CANADA KNOW WHEN TARIFFS TAKE EFFECT

CARNEY SAYS HE WILL MEET WITH CHINESE PRESIDENT XI AT APEC

CARNEY TO DISCUSS BILATERAL ‘COMMERCIAL RELATIONSHIP’ WITH XI

WANG YI HOPES US WORKS IN SAME DIRECTION WITH CHINA: XINHUA

RUBIO HAD CALL WITH CHINESE FOREIGN MINISTER WANG YI TODAY

RUBIO, FOREIGN MINISTER WANG YI DISCUSSED TRUMP-XI MEETING

STATE DEPARTMENT COMMENTS ON RUBIO CALL IN A STATEMENT

LI QIANG CALLS FOR SUPPORTING HONG KONG IN JOINING RCEP: XINHUA

US Macro & Market Data

AMD PACT WITH US TO CONSTRUCT TWO SUPERCOMPUTERS: RTRS

NEXTERA, GOOGLE TO ACCELERATE NUCLEAR ENERGY DEPLOYMENT IN US

GOOGLE, NEXTERA ENERGY PARTNER TO REOPEN IOWA NUCLEAR PLANT: FOX

Solid Inflows to US Equity Funds: Deutsche Bank Strategists

Trade Progress Boosts Risk Appetite as Gold Slumps: Macro Squawk

HOUSE SPEAKER MIKE JOHNSON TALKS TO REPORTERS ABOUT SHUTDOWN

JOHNSON: MORE CHALLENGING TO FIND WAYS TO SHIFT FUNDS AROUND

International Macro & Policy Backdrop

BULLOCK: RBA’S RATE MIGHT NOT COME DOWN AS FAR AS OTHERS

BULLOCK: CENTRAL BANKERS BIT CONFUSED ABOUT SANGUINE MARKETS

BULLOCK: EMPLOYMENT MARKET OUTCOMES BETTER THAN SOME COUNTRIES

OPEC+ BASE CASE SCENARIO IS SMALL HIKE FOR NOW, DELEGATES SAY

PAN SAYS PBOC TO RESUME GOVT BOND TRADING IN MARKET: XINHUA

ARGENTINA’S MERVAL STOCK GAUGE SURGES 20% AFTER MILEI WIN

ARGENTINE PESO JUMPS 10% AFTER MILEI’S MIDTERM ELECTION WIN

TRUMP: MILEI HAD A LOT OF HELP FROM US

ZELENSKIY: UKRAINE TO EXPAND STRIKES AGAINST RUSSIAN REFINERIES

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data,

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

******** UPDATED CODE TO BE RUN TOMORROW ********

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

US Market Wrap: Tech Steady, Breadth Improves as Trade Tensions Ease (S&P +0.32%)

Risk stayed constructive with the S&P 500 up +0.32%. The tone was buoyed by continued US-China trade de-escalation headlines and a supportive earnings backdrop, while rate markets were calm and liquidity healthy into a heavy megacap results week.

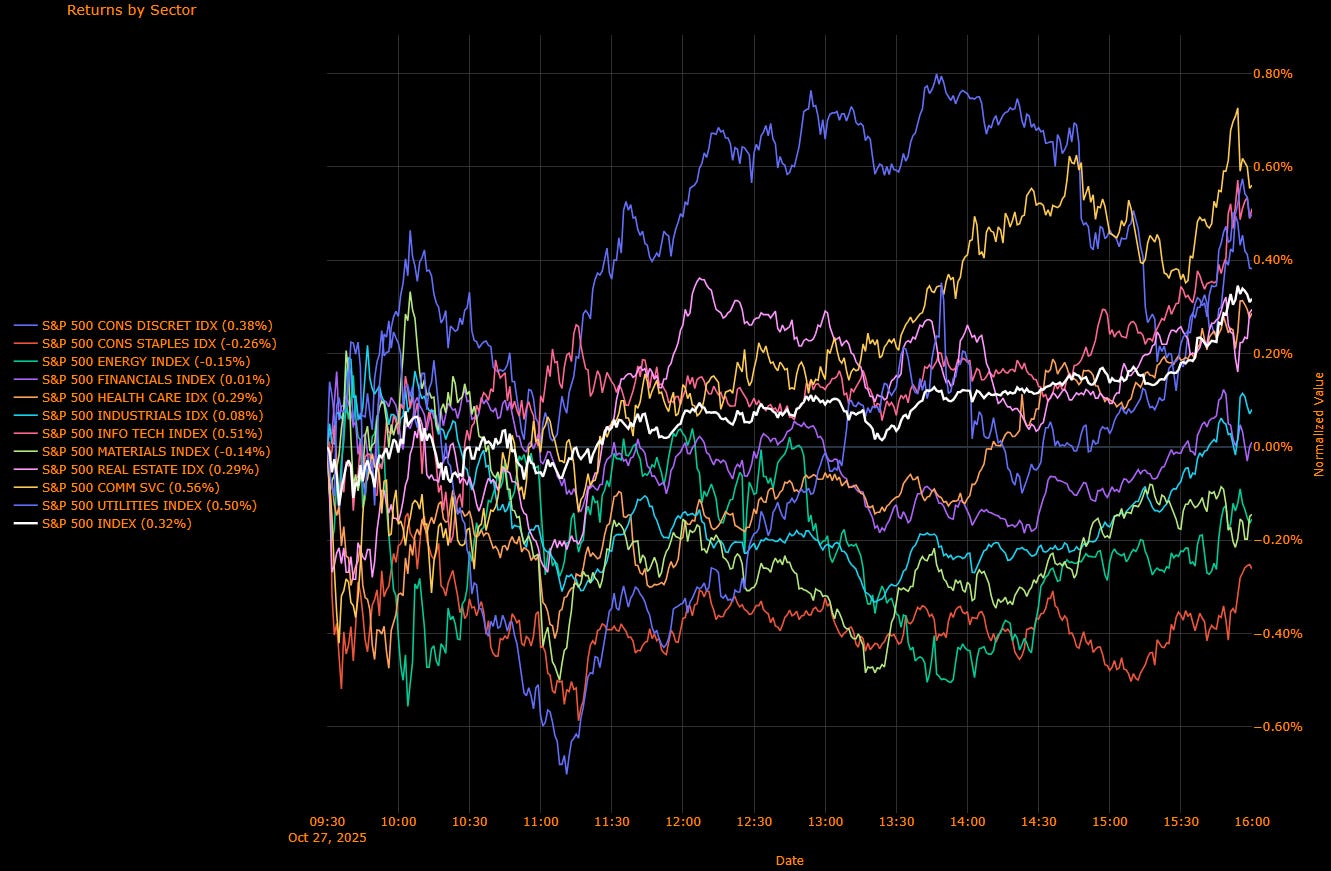

Sector Attribution

Weighted Return Contribution (Index +0.32%)

Leaders: Info Tech (+0.18%), Comm Services (+0.06%), Discretionary (+0.04%), Health Care (+0.03%), Industrials (+0.01%), Real Estate (+0.01%), Utilities (+0.01%)

Drags: Staples (−0.01%), Materials (≈−0.00%), Energy (≈−0.00%); Financials flat

Unweighted Performance (Breadth)

Leaders: Comm Services (+0.56%), Utilities (+0.50%), Info Tech (+0.51%), Discretionary (+0.38%), Health Care (+0.29%), Real Estate (+0.29%), Industrials (+0.08%)

Laggards: Staples (−0.26%), Energy (−0.15%), Materials (−0.14%)

Read: Participation broadened beyond megacaps. Tech and Comm Services stayed in charge on AI/data-center momentum, while Utilities and Health Care caught a steady-rates bid. Weakness in Staples/Energy/Materials looked like rotation, not stress.

Macro Overlay

Tape & Catalysts

Trade thaw: Negotiators lined up deliverables for a Trump–Xi summit, keeping risk appetite intact and supporting US-listed China proxies.

Earnings in focus: With MSFT, GOOGL, META, AMZN, AAPL reporting mid-week, the market is leaning on resilient profit stories; sales beats are running strong.

Rates/FX: 2-yr auction cleared essentially on-the-screws (~3.50%) with solid indirect participation, signaling steady foreign demand. The USD was little changed; gold steadied after slipping below $4,000; crypto mixed.

Global tone: Asia mixed after Nikkei > 50,000; Australia softer. Oil was little changed near the low-60s.

The Read-Through

Re-risking via earnings + diplomacy: Equities are digesting macro noise as trade headlines improve and profit momentum holds.

Quality + duration mix: Tech leadership persists, but Utilities/Health Care participation hints at a balanced “growth plus carry” bid.

No rates shock: Calm auctions and contained yields keep the equity multiple supported.

What I’m Watching Next

Megacap prints & guides: Do AI capex and cloud run-rates validate Tech’s leadership?

Trade optics: Any concrete deliverables from the Trump–Xi track that sustain the risk bid.

Rotation durability: Whether Utilities/Health Care outperformance extends (maturing momentum) or flips back to pure cyclicals.

Bottom line: A calm, earnings-led grind higher with trade diplomacy as a tailwind and rates cooperation keeping the runway clear.

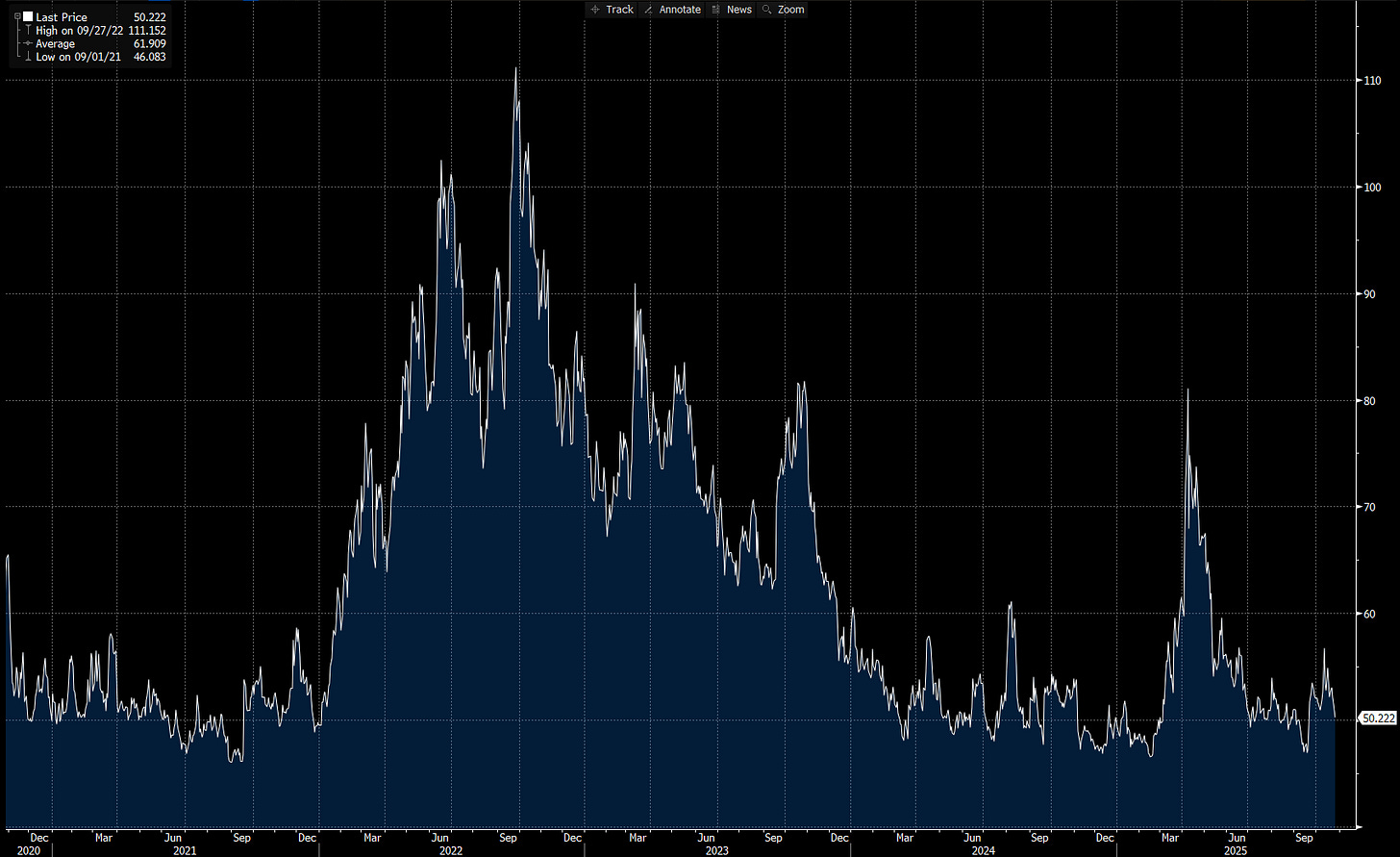

US IG Credit Wrap: Risk-On Holds, Spreads Anchored; Trade Optimism Keeps Carry Alive (IG OAS ≈50.2 bp)

Investment-grade credit stayed resilient even as equities pushed to new highs and oil held near $60. The index option-adjusted spread remains locked around 50 bp, well inside the five-year average (~61.9 bp) and still roughly 6 bp above cycle tights (~46 bp). Despite sharp moves in equities and commodities, credit markets continue to signal a stable, low-vol environment, classic carry conditions rather than stress or exuberance.

Where We Sit (from today’s chart)

IG OAS: ~50.2 bp (last 50.22)

5-yr avg: ~61.9 bp → ~12 bp inside

Cycle tights: ~46.1 bp → ~4 bp above

2022 wides: ~111.2 bp → ~61 bp tighter

Read: The OAS remains mid-range, comfortably normalized and anchored. The spread market refuses to chase the equity rally or flinch at cross-asset volatility, reflecting confidence in liquidity, fundamentals, and a benign policy path.

Tape & Macro Overlay

Equities:

The S&P 500 added +0.32%, extending record territory as US–China trade diplomacy and a solid corporate earnings slate buoyed sentiment. Breadth improved, with Tech, Communication Services, and Health Care leading.

Rates/FX:

USTs were little changed (10-yr ~4.00%, 2-yr ~3.50%), maintaining curve stability after last week’s auctions. The USD held steady, and gold hovered near $4,000 after its sharp correction.

Commodities:

Oil (~$61) remains subdued after last week’s spike, helping stabilize inflation optics. Energy equities traded mixed, but credit spreads in the sector remain firm.

Global tone:

Asian equities mixed following Japan’s milestone Nikkei 50,000 print; European data (IFO, M3) show steady if subdued growth. Trade-related headlines remain the key swing factor for cross-asset tone.

Mapping to IG

Base case: The 50–55 bp zone is still home base, fair value in a low-vol, liquidity-rich market.

Bias: Modestly tighter toward high-40s if trade momentum endures and earnings confirm macro resilience.

Financials:

Senior bank paper holds firm, aided by steady issuance absorption and confidence in regulatory flexibility.

Cyclicals (Energy, Materials, Industrials):

Credit impact muted; oil stability keeps Energy carry intact, while tariff headlines drive only marginal idiosyncratic movement.

Defensives (Staples, Health Care, REITs):

Still rich but well-supported by flows, duration stability keeps these sleeves attractive.

Tech/Comms:

Earnings in focus this week (MSFT, GOOGL, META, AMZN, AAPL). Balance sheets remain fortress-like; minimal spread beta to equity volatility.

Risk Markers to Watch

Trade tone: Any concrete progress from the Trump–Xi track anchors the risk tone through month-end.

Oil path: Sustained >$60 brings marginal widening pressure in cyclicals but little systemic impact.

Equity follow-through: A melt-up without credit confirmation would flag late-cycle exuberance, but we’re not there yet.

Systemic tell: Watch 60 bp OAS, only a decisive break above signals a regime shift, still a low-probability tail.

Credit remains calm, carry-focused, and orderly. With equities setting records and macro risks contained, US IG spreads remain comfortably rangebound, a picture of stability amid optimism. Until the trade narrative breaks or oil reawakens inflation fears, expect OAS to hover near 50 bp and grind tighter on dips.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

All of the interest rate sensitivity models are now reserved exclusively for paid subscribers. If you would like to do a free trial, you can with this LINK.

Launch video for these models is here: LINK

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.