Macro Regime Tracker: The Set Up Into CPI

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

Macro Regime Context

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

AI and Machine Learning Strategies - Macro Regime and Positioning Premiums Strategies: S&P 500, 2-Year Interest Rates, Gold, and Bitcoin

Macro Regime Context:

I published the alpha report earlier today with a video breakdown:

And then I recorded a video specifically breaking down levels moving into CPI.

I also wrote a thread on Bitcoin here: LINK

And short squeeze views here:

Main Developments In Macro

*BOWMAN’S TERM AS VICE CHAIR FOR SUPERVISION TO END JUNE 9, 2029

*FED: BOWMAN TOOK OATH AS VICE CHAIR FOR SUPERVISION ON MONDAY

*TRUMP: IRAN SEEKS ENRICHMENT, WE CAN'T HAVE IT

*TRUMP: IRAN ASKING FOR THINGS YOU CAN'T DO

*TRUMP: MEETING ON THURSDAY WITH IRAN

*TRUMP: NOT GOING TO GET RID OF TESLA, STARLINK AT WHITE HOUSE

*TRUMP: WE'RE GOING TO SEE ABOUT EXPORT CONTROLS WITH CHINA

*TRUMP REITERATES DESIRE TO 'OPEN UP CHINA'

*TRUMP: CHINA TALKS ARE ONGOING, THEY'LL BE CALLING IN SOON

*TRUMP: WE ARE DOING WELL WITH CHINA, IT'S NOT EASY

*LUTNICK SAYS US-CHINA TALKS WERE 'FRUITFUL'

*BESSENT ON US-CHINA TALKS: 'GOOD MEETING'

*TREASURY SECRETARY BESSENT SPEAKS TO REPORTERS IN LONDON

*TRUMP: WOULD BRING IN MORE NATIONAL GUARD IF NEEDED IN LA

*TRUMP: DISCUSSED IRAN, GAZA WAR WITH NETANYAHU

*TRUMP: THINK BUDGET BILL WILL PASS PRETTY QUICKLY

*JOHNSON: HOPE WE CAN MEET JULY 4 DEADLINE ON TAX BILL

*US TO HIT DEBT LIMIT DEADLINE BETWEEN MID-AUG, END OF SEPT: CBO

*TRUMP:IF BUDGET BILL TAKES A LITTLE LONGER THAN TARGET, IT'S OK

*US-CHINA TALKS IN LONDON WILL CONTINUE TOMORROW: OFFICIAL

*TRUMP SAYS WILL PICK INDEX FUND FOR TRUMP KID ACCOUNTS

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

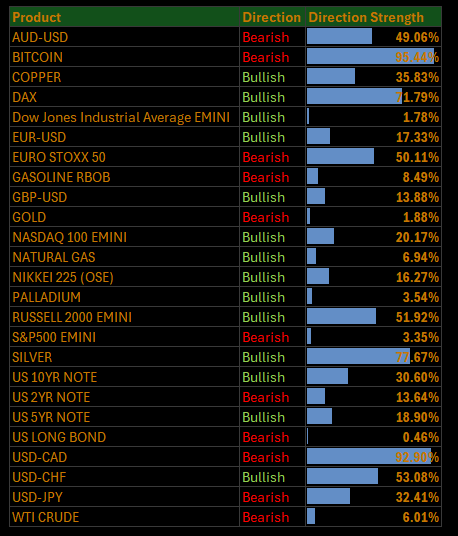

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income and Currencies

You can find the educational primer and video explanation of these models here: LINK

Here is a summary of all models and their directional strengths:

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

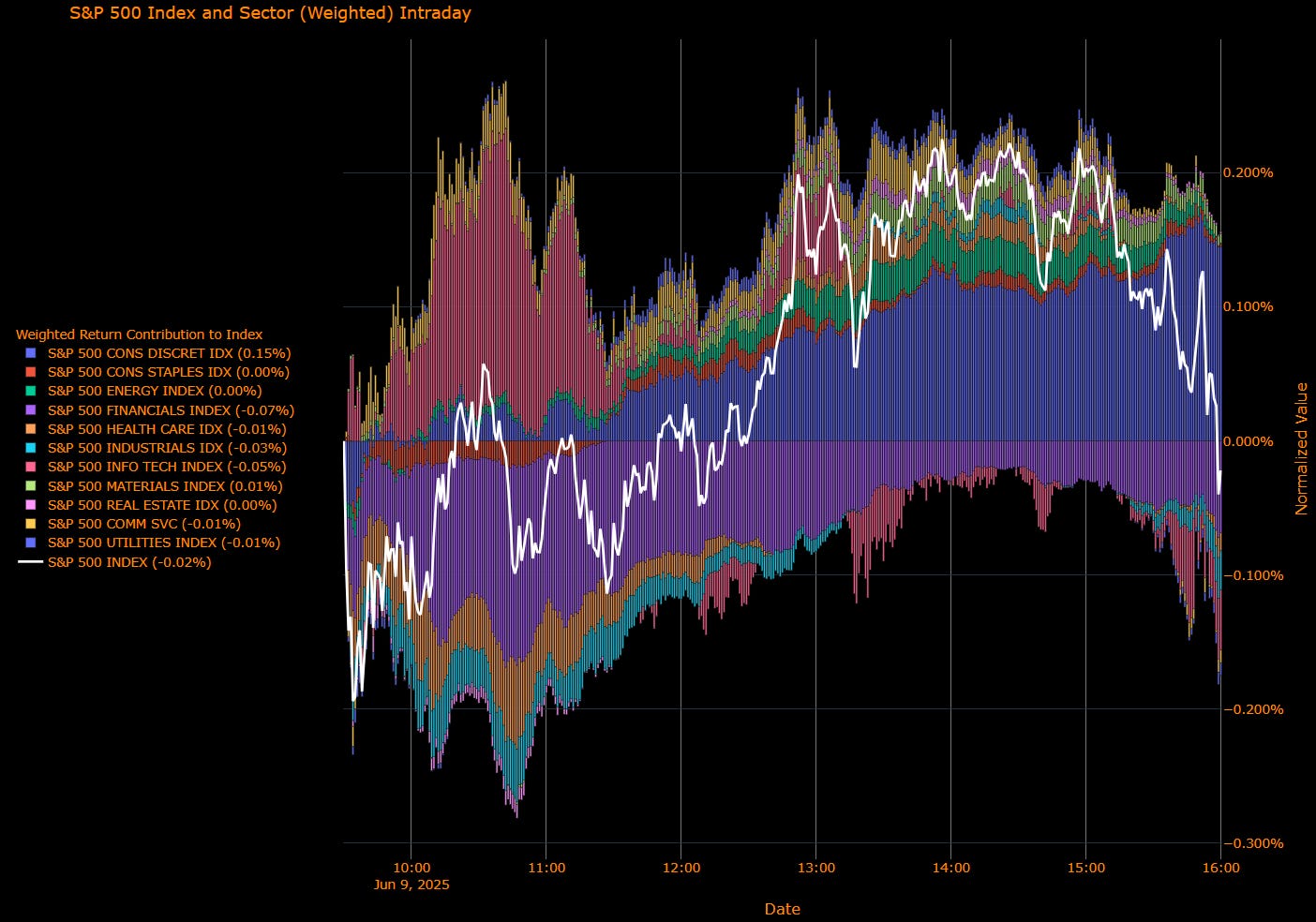

S&P 500 Edges Down 0.02%, Weighed by Technology Despite Strength in Consumer Discretionary

Sector-by-Sector Contribution Snapshot (Weighted Impact)

Consumer Discretionary (+0.15 pp) – Top positive contributor, driven by improved consumer sentiment and selective risk-taking as trade tensions showed modest easing signs.

Materials (+0.01 pp) – Slight positive contribution, reflecting cautious optimism amid ongoing trade discussions.

Consumer Staples (0.00 pp) – Neutral contribution, showcasing defensive stability.

Energy (0.00 pp) – Flat contribution, as commodity markets awaited further clarity from US-China trade negotiations.

Real Estate (0.00 pp) – Neutral impact, balanced between yield attraction and interest rate caution.

Utilities (-0.01 pp) – Slight negative impact, indicating mild investor rotation away from defensive sectors.

Health Care (-0.01 pp) – Modestly negative as investors cautiously positioned amid uncertainties in economic outlook.

Communication Services (-0.01 pp) – Mild negative contribution, reflecting cautious sentiment.

Financials (-0.07 pp) – Notably negative, weighed down by persistent concerns about economic growth and interest rate trajectories.

Industrials (-0.03 pp) – Negative contribution amid continued tariff-induced uncertainty in manufacturing sectors.

Information Technology (-0.05 pp) – Significant drag, impacted by persistent investor caution around technology exports and tariff implications.

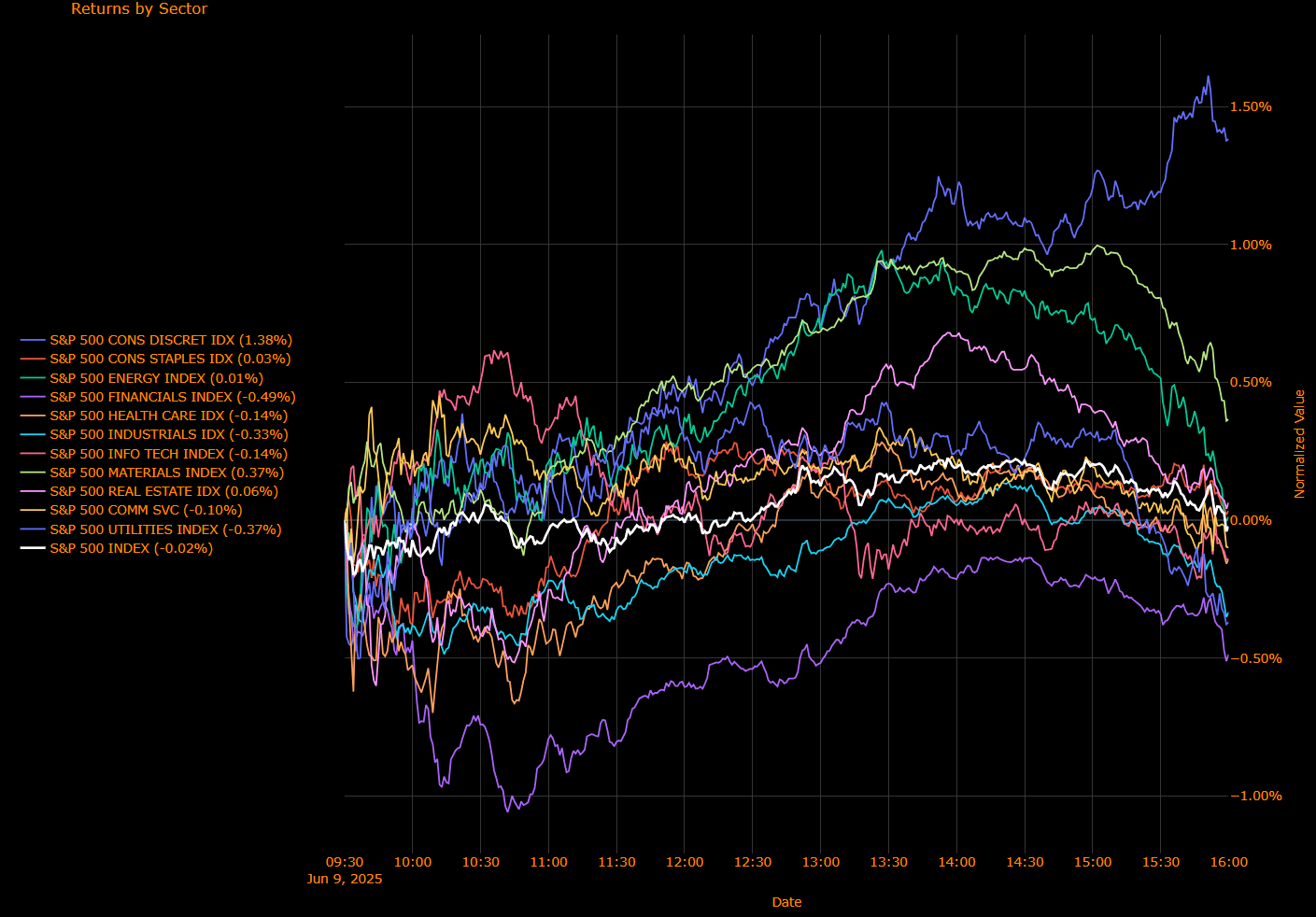

Sector-by-Sector Performance Snapshot (Unweighted Returns)

Consumer Discretionary (+1.38%) – Strongest performer, benefitting from optimism in consumer sentiment amid easing trade tensions.

Materials (+0.37%) – Solid positive performance as investors sought selective opportunities amid trade negotiation optimism.

Consumer Staples (+0.03%) – Slight positive performance, indicating defensive stability.

Energy (+0.01%) – Marginally positive, with investors awaiting clearer direction on trade impacts.

Real Estate (-0.06%) – Minor negative, reflecting cautious sentiment regarding interest rates.

Communication Services (-0.10%) – Slightly weaker, indicative of cautious investor positioning.

Information Technology (-0.14%) – Weak performance, influenced by sustained caution amid trade negotiations and export restrictions.

Health Care (-0.14%) – Underperformed modestly due to cautious investor sentiment and economic uncertainty.

Utilities (-0.37%) – Noticeably weaker, indicating rotation away from defensive sectors amid selective risk appetite.

Industrials (-0.33%) – Significant underperformance, impacted by ongoing tariff and trade uncertainties.

Financials (-0.49%) – Weakest sector, driven by concerns over economic growth and interest rate uncertainties.

Macro Overlay

The S&P 500 dipped slightly by 0.02%, primarily weighed down by continued weakness in Information Technology and Financials despite notable strength in Consumer Discretionary. Investors cautiously monitored ongoing US-China trade talks aimed at easing tensions around tech exports and rare earth materials. Inflation expectations moderated further, easing slightly across all horizons according to the latest New York Fed survey, but economic uncertainties continued to weigh on market sentiment. Additionally, improved labor market sentiment partially offset concerns, with consumer confidence in job prospects modestly improving despite broader caution.

Bottom Line

The market closed marginally lower, highlighting caution amid persistent trade uncertainties, sectoral divergences, and evolving economic outlook. Continued vigilance remains essential, particularly around technology and financial sectors, as market participants seek clarity from ongoing trade discussions and upcoming economic data releases.

US IG Credit Wrap — Spreads Tighten Slightly to 53.91 bp Amid Cautious Optimism Despite Trade Concerns

Current Spread: 53.91 bp (▼ ~1.6 bp d/d), indicating a modest narrowing of spreads. The current level remains below the 5-year historical average (~63 bp), suggesting cautious investor optimism despite persistent macroeconomic uncertainties.

Credit Context

< 60 bp: Stable, duration-friendly range supporting insurance and liability-driven investment (LDI) strategies.

60–70 bp: Neutral-to-cautious positioning recommended amid tariff uncertainties and macroeconomic volatility.

> 90 bp: Significant market distress—currently unlikely without a major escalation in geopolitical or macroeconomic shocks.

Macro Overlay:

The slight tightening in IG credit spreads to 53.91 bp reflects cautiously improved investor sentiment amid selective stabilization in economic indicators, tempered by ongoing concerns about trade tensions. Treasury yields displayed mixed responses, reflecting tempered expectations of potential Federal Reserve rate cuts later this year.

Remain attentive to ongoing US-China trade discussions, assessing implications from potential agreements or escalations in tariffs following recent constructive but cautious talks between Presidents Trump and Xi Jinping.

Bottom Line:

US IG credit spreads modestly tightened to 53.91 bp, illustrating caution alongside tentative optimism. It is wise to maintain vigilance regarding upcoming economic releases, Federal Reserve communication, and developments in trade negotiations to effectively manage risk exposure.

Mag7 Model:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.