Macro Regime Tracker: Understanding The Cycle

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

The live stream recording from today can be found here, where I explain the big picture logic for WHERE we are and HOW it’s developing.

The key pieces to read are the most recent one on the consumer. News flash, the consumer is doing just fine.

And an important word of caution, as we have another massive green candle for the ES close today:

Main Developments In Macro

US AI, Technology, and Industrial Policy

TRUMP SIGNS ACTION ON US AI EXPORTS

TRUMP SIGNS ACTION ON FEDERAL PERMITTING FOR DATA CENTERS

TRUMP: AI PLAN INCLUDES GLOBAL RELIANCE ON US TECHNOLOGY

TRUMP: WILL SIGN ORDER TO FAST-TRACK AI INFRASTRUCTURE PERMITS

TRUMP: US WON'T ALLOW A FOREIGN NATION TO BEAT US AT AI

TRUMP: DECLARING AMERICA WILL WIN THE AI RACE

TRUMP PRAISES NVIDIA'S HUANG FOR THE JOB HE HAS DONE

TRUMP SAYS HE THOUGHT ABOUT BREAKING UP CHIP INDUSTRY

WHITE HOUSE RELEASES STATEMENT ON UNVEILING OF AI ACTION PLAN

US TO REMOVE 'ONEROUS' AI DEVELOPMENT REGULATIONS: WHITE HOUSE

TRUMP TO PROMOTE RAPID BUILDOUT OF DATA CENTERS FOR AI

ALPHABET: AI IS POSITIVELY IMPACTING EVERY PART OF BUSINESS

ALPHABET CEO SAYS COMPANY HAS BEEN ABLE TO RETAIN TOP AI TALENT

US Fiscal, Fed, and Rate Policy Commentary

TRUMP: FED BOARD SHOULD ACT

TRUMP: OUR RATE SHOULD BE THREE POINTS LOWER THAN THEY ARE

TRUMP: HOUSING LAGGING BECAUSE POWELL REFUSES TO LOWER RATES

TRUMP SAYS FED BOARD 'DOESN'T HAVE THE COURAGE' TO 'ACT'

JOHNSON: OPEN TO REFORMING FED, BUT DEPENDS ON DETAILS

JOHNSON SAYS LEGAL AUTHORITY AROUND FIRING FED CHIEF UNCLEAR

SPEAKER JOHNSON SAYS HE IS 'DISENCHANTED' WITH FED CHAIR POWELL

JOHNSON STARTS WORK ON FOLLOW-UP TAX BILL, SEEKING FALL PASSAGE

BESSENT: TRUMP HAS SAID HE'S NOT GOING TO FIRE POWELL

BESSENT: 'WE'RE NOT IN A RUSH' ON FED CHAIR NOMINATION

BESSENT ON RATE DECISIONS: NOT SURE WHAT FED IS LOOKING AT

BESSENT: FED TARIFF ANALYSIS 'IS A BIT OFF'

Trade, Tariffs, and Geopolitics

TRUMP: JAPAN PAID $550B FOR 'PRIVILEGE' OF NEGOTIATING WITH US

TRUMP: IN SERIOUS NEGOTIATIONS WITH EU

TRUMP: LOWER TARIFF FOR EU IF THEY AGREE TO OPEN UP

TRUMP: VERY SIMPLE TARIFF OF 15% TO 50% FOR SOME COUNTRIES

TRUMP: WILL ONLY LOWER TARIFFS IF COUNTRY OPENS ITS MARKET

TRUMP: WANT MAJOR COUNTRIES TO OPEN MARKETS TO THE US

TRUMP: ALWAYS, ZERO TARIFFS TO AMERICA

TRUMP: WILL ALWAYS GIVE UP TARIFF POINTS FOR OPENING MARKETS

TRUMP: JAPAN AGREED TO BUY BILLIONS WORTH OF MILITARY EQUIPMENT

TRUMP: OUR BUSINESSES WILL MAKE A 'FORTUNE' FROM INDONESIA DEAL

TRUMP: MAKING ALASKA ENERGY DEALS WITH VARIOUS ASIAN COUNTRIES

TRUMP: MAKING SOME INCREDIBLE DEALS WITH ASIA ON ENERGY

BESSENT: TALKS WITH EU ARE GOING BETTER THAN THEY HAD BEEN

BESSENT ON WHETHER EU CAN GET 15%: JAPAN WAS INNOVATIVE

US AND EU CLOSE IN ON 15% TARIFF DEAL: FT

US, EU WOULD WAIVE AIRCRAFT, SPIRITS, MEDICAL DEVICE TARIFFS: FT

MACRON: WILL COORDINATE EU RESPONSE TO US TARIFFS

EU TO MERGE LISTS OF US TRADE COUNTERMEASURES: SPOKESPERSON

US Economy – Housing & Consumer

BESSENT: AMAZON CEO TOLD ME LAST WEEK HE SEES NO PRICE HIKES

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Here is a summary of all models and their directional strengths:

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

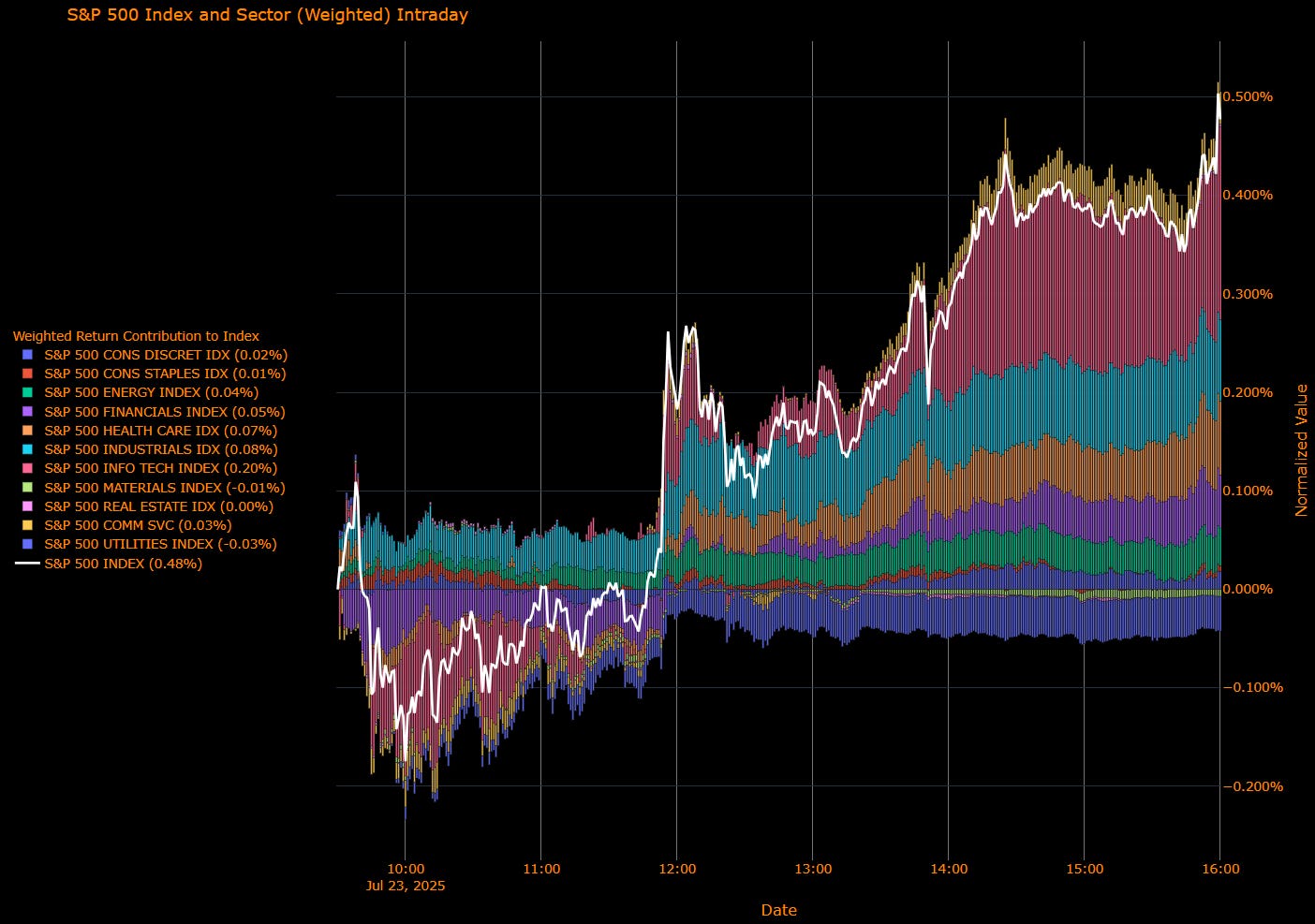

US Market Wrap: S&P 500 Pushes Higher on Trade Tailwinds, Despite Rotation Under the Surface

The S&P 500 climbed another 0.48% Wednesday, notching a third consecutive record close as optimism around US trade talks with Japan and the EU firmed global risk sentiment. Under the hood, the index masked notable rotation: cyclical strength drove the headline gain, but pockets of defensiveness held firm and Utilities slid sharply. Sector breadth was constructive, if uneven, and the latest tariff developments appear to be reshaping positioning flows ahead of key economic prints and the looming August 1 deadline.

Sector Contribution Breakdown

(Weighted Return Contribution to S&P 500)

Info Tech (+0.20 pp) – The largest contributor. AI-linked names and semis rebounded post-Tesla and Alphabet results, helping recover prior session’s drag.

Industrials (+0.08 pp) – Tailwinds from tariff repricing and a pickup in global PMIs supported capital goods and transports.

Health Care (+0.07 pp) – Continued leadership from managed care and big pharma. The bid for defensive growth persisted.

Financials (+0.05 pp) – Banks edged higher amid a slight backup in yields and fading Fed-pivot noise.

Energy (+0.04 pp) – Supported by stable oil and macro clarity. Marginally positive flow as crude inventories declined.

Comm Services (+0.03 pp) – Helped by select mega-cap gains in media and ad-tech.

Consumer Discretionary & Staples (0.02 & 0.01 pp) – Modest gains. Discretionary lifted by autos; Staples held up despite rotation.

Utilities (–0.03 pp) – The lone material drag. Higher rates and fading yield-seeking demand weighed.

Materials (–0.01 pp) – Soft performance despite trade optimism; precious metals mixed.

Sector Performance Breakdown

(Unweighted Daily Returns)

Energy (+1.29%) – Top gainer. Oil-linked equities surged on drawdowns in crude inventories and diminished geopolitical tension.

Industrials (+0.95%) – Trade optimism lit up transports and machinery. Export-exposed names gained on Japan-EU deal headlines.

Health Care (+0.82%) – Managed care and pharma extended gains, underpinned by defensive allocation and pre-earnings stability.

Info Tech (+0.59%) – Recovered partially after recent pullback. AI names stabilized, boosted by Alphabet’s beat.

Consumer Discretionary (+0.17%) / Staples (+0.11%) – Retail and household names held ground. Auto-led gains offset by weaker housing-linked names.

Financials (+0.39%) / Comm Services (+0.34%) – Solid performers, buoyed by macro clarity and some tech spillover.

Real Estate (+0.11%) – Mixed. Some REITs firmed, but rising yields limited duration sensitivity.

Materials (–0.38%) – Lagged despite trade tailwinds. Commodities were choppy, with base metals under pressure.

Utilities (–1.45%) – Sharp underperformance. The rate backup hit long-duration equity proxies hardest.

Macro Overlay: Trade Relief Meets Rate Headwind

Tariff Progress Boosts Cyclicals

Markets welcomed the US-Japan 15% tariff framework and promising signals from EU talks. The Japan deal, underpinned by a $550 billion investment pledge, offers a potential model for broader global trade recalibration. Commerce Secretary Lutnick floated similar equity-linked deals with the EU, while President Trump reiterated his willingness to impose 15–50% tariffs on non-compliant nations. That clarity buoyed Industrials and Energy, where export leverage is high.

Megacaps Stabilize, But Rotation Takes Hold

Info Tech rebounded modestly after Alphabet’s revenue beat, but the rotation narrative is intensifying. Flows continue to shift into cyclicals and real economy segments a function of both improving trade visibility and growing exhaustion around megacap outperformance. Still, the AI infrastructure theme remains dominant, undergirding longer-term support for semis and cloud-linked software.

Rates Climb, Utilities Crack

Treasury yields snapped a five-day rally, with the 10-year climbing four basis points to 4.38%. The move came despite strong demand in the 20-year auction, signaling that real money flows may be turning cautious on duration. Utilities bore the brunt, sliding nearly 1.5% in their worst single-day showing in weeks.

Fragile Leadership, Braced for Policy Tests

The S&P’s advance masks fragility: while sector breadth improved, leadership remains reactive to headline risk. With the Fed remaining mum on near-term policy clarity and the August 1 trade deadline fast approaching, traders are now weighing whether tariff relief can truly offset stretched valuations in megacaps and high-duration equity proxies.

A Tariff Truce, or Just the Eye of the Storm?

The tape remains resilient, but vulnerable. The US market is clearly pricing in a benign resolution to trade negotiations and some combination of policy pragmatism and AI momentum to carry equities higher. Yet the rotation underway particularly the sharp unwind in Utilities and selective bid into cyclicals suggests there is positioning for a less dovish Fed and a more reflationary macro regime.

US IG Credit Wrap: Spreads Slip to 50.11 bp as Tariff Relief Buoys Risk Sentiment

Current IG Spread: 50.11 bp | 5-Year Average: 62.75 bp | COVID High (Mar 2020): 151.80 bp | Cycle Low (Feb 2020): 43.75 bp

Investment-grade credit edged tighter Wednesday, with spreads narrowing to 50.11 bp a new local low and the tightest since late 2021. The move reflects growing investor conviction that tariff risks will be defused in the near term, as the US finalizes trade deals with Japan and approaches a compromise with the EU. Yet while the tape looks clean, the broader macro setup remains highly conditional a “priced-for-perfect-peace” regime that’s light on cushion if headlines go awry.

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

Macro Overlay: Trade Deals Fuel Optimism, but the Floor Is Thin

Tariff De-escalation Pushes Risk Higher

IG investors welcomed news of a 15% US-Japan tariff agreement and strong momentum toward a similar framework with the EU. Commerce Secretary Lutnick and Treasury Secretary Bessent painted the Japan deal as a blueprint — a 15% rate in exchange for $550 billion in investment pledges with the EU next in line.

While this helped compress spreads, the underlying structure remains fragile. Talks with China resume in Stockholm next week, and any deviation from the softening tone could quickly reprice global-facing credit particularly in autos, tech hardware, and industrials.

Fed Noise Ignored… For Now

Despite Powell's tenure increasingly becoming a political football, credit markets remain dismissive. Trump’s remarks (“he’s out in eight months”) and Bessent’s assurance of “no rush” to name a successor barely registered. That indifference suggests the market is pricing institutional continuity but history shows Fed credibility erosion doesn’t show up in spreads until it’s too late.

Rates Pause, Spreads Keep Grinding

The 10-year yield rose four basis points to 4.38%, snapping a five-day rally. Unlike earlier this month, IG spreads didn’t widen in response. That’s notable. Carry demand appears intact, and the brief rate backup has yet to derail the slow march tighter. But with real yields near cycle highs and duration risk skewing longer, this could quickly reverse.

Tighter, But Not Safer

This market isn’t ignoring risk — it’s pricing in the resolution of all of it. Between geopolitical thawing, Fed continuity, and a soft landing, the narrative feels priced to perfection. Credit is grinding tighter not because risk is gone, but because participants expect it to stay managed.

That may hold... but if it doesn’t, the unwind will be fast. There’s no technical floor here. Just trust in diplomacy and policy restraint.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

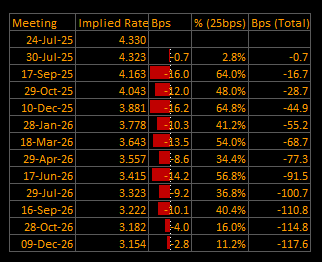

Short-End Rates Wrap: Easing Path Narrows to –117.6 bp as Tariff Euphoria Meets Fed Reality

Cumulative Implied Easing (to Dec 2026): –117.6 bp | Terminal Rate: 3.154%

Markets remain confident in the easing cycle, but that confidence is getting a little less comfortable. The OIS curve trimmed back its peak dovishness Wednesday, with cumulative cuts priced through end-2026 now totaling –117.6 basis points down from –122.8 bp the day prior. Traders still anticipate a steady glidepath to a sub-3.2% terminal rate, but the front end is flickering with uncertainty, and the back end may be starting to resist the "just right" narrative.

OIS-Implied Policy Path

Macro Overlay: Trade Clarity vs. Policy Drift

Tariff Truce Boosts Sentiment… But Doesn’t Shift Policy Path

Traders welcomed the US-Japan 15% tariff deal and signs of EU convergence, validating bets that global trade stress won’t derail the Fed’s plan. But notably, the easing path didn’t steepen. That reflects belief in a macro backdrop that’s already "discounting resolution" and suggests there's limited room for more upside without hard data validation.

September Cut: A Probabilistic Pivot, Not a Commitment

At 4.16%, the September meeting is now pricing a 64% chance of a cut. That's firmer than last week, but hardly locked in. With core services inflation sticky and Powell remaining publicly non-committal, markets want confirmation via July PCE or Jackson Hole before conviction solidifies. Until then, the front-end curve will wobble around the 4.15–4.20% pivot rate.

Fed Independence: The Silent Risk Markets Keep Ignoring

Despite louder political noise around Powell’s future, OIS pricing suggests traders see no scenario where his potential departure changes the Fed’s easing trajectory. That assumption is a risk. A change in chair — or even an unclear succession could destabilize the Fed's policy credibility, especially if paired with inflation surprises or geopolitical setbacks.

Back End: Smooth, Fragile, and Priced to Glide

Every meeting from March 2026 onward is now pricing an implied 13–16 bp of cuts. The curve has clearly locked in a "measured glide" assumption one where the Fed trims methodically, inflation stays tame, and the labor market cools but doesn’t crack.

That’s a beautiful base case. But it’s also fragile.

One sticky inflation print, or a fiscal/tariff shock that revives goods inflation, and this part of the curve could easily reprice 25–50 bp wider in a week.

Final Word: The Illusion of Control

The market is still trading the soft landing fantasy and maybe that fantasy proves right. The Powell Fed glides into 2026, Trump’s tariff machine gets defanged via reciprocal deals, and the dollar slips just enough to support risk without importing inflation.

But that’s a tightrope.

The cuts are still coming. But they're coming with more hesitation and less margin for disappointment. Jackson Hole looms as the next true test. Until then, the curve floats higher… but more from hope than from hard confirmation.

Tactical Portfolio

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.