Macro Regime Tracker: Week Ahead

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

Macro Regime Context

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

AI and Machine Learning Strategies - Macro Regime and Positioning Premiums Strategies: S&P 500, 2-Year Interest Rates, Gold, and Bitcoin

Macro Regime Context:

See part two of the macro report here:

We are heading into a consequential week because we have both the weekend risk and FOMC hedges to unwind as we progress to Friday. These are likely to move in lockstep with the logic I have been laying out for paid subscribers in the geopolitical video (link). I will be updating this further with geopolitical redundancy plans for crude and other assets.

Main Developments In Macro

*TRUMP ADMIN BRIEFED LAWMAKERS BEFORE ISRAELI STRIKES: AXIOS

*TRUMP, NETANYAHU SPOKE BY PHONE: FOX NEWS

*US USING GROUND-BASED AIR DEFENSE SYSTEMS TO AID ISRAEL: AP

*US HELPED ISRAEL DOWN IRAN MISSILES, US OFFICIALS TELL REUTERS

*IRAN FIRED MISSILES AT ISRAEL FROM A SUBMARINE: IRAN FARS NEWS

*IRAN: RESPONSE TO ISRAEL WILL BE FIRM AND DECISIVE

*US FORCES HELPING INTERCEPT IRANIAN MISSILES: ISRAELI OFFICIAL

*AT LEAST TWO ISRAELI FIGHTER JETS SHOT DOWN OVER IRAN: IRNA

*IRAN HAS LAUNCHED SECOND WAVE OF MISSILES AT ISRAEL: IRNA

*IDF: DOZENS OF ADDITIONAL MISSILES LAUNCHED TOWARD ISRAEL

*IDF: IRANIAN ATTACK ONGOING

*IRAN'S KHAMENEI: WON'T IGNORE THE VIOLATION OF IRANIAN AIRSPACE

*IRAN'S KHAMENEI: ISRAEL STARTED A WAR, IT WON'T GO UNSCATHED

*IDF: 'ALL OF ISRAEL' UNDER FIRE AS IRAN FIRES PROJECTILES

*IDF SAYS IT IDENTIFIED MISSILES LAUNCHED FROM IRAN TO ISRAEL

*IDF: SYSTEMS OPERATING TO INTERCEPT THE THREAT

*MACRON: IRAN NUCLEAR PROGRAM CLOSE TO CRITICAL THRESHOLD

*PUTIN SPOKE WITH ISRAEL AND IRAN LEADERS: KREMLIN

*TRUMP SAYS US-IRAN MEETING IN OMAN SUNDAY STILL PLANNED: RTRS

*TRUMP SAYS NOT SURE US-IRAN MEETING WILL TAKE PLACE: REUTERS

*NETANYAHU: ISRAEL UPDATED US BEFORE THE STRIKE

*TRUMP SAYS IRAN OFFICIALS CALLING HIM TO DISCUSS SITUATION: NBC

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income and Currencies

You can find the educational primer and video explanation of these models here: LINK

Here is a summary of all models and their directional strengths:

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

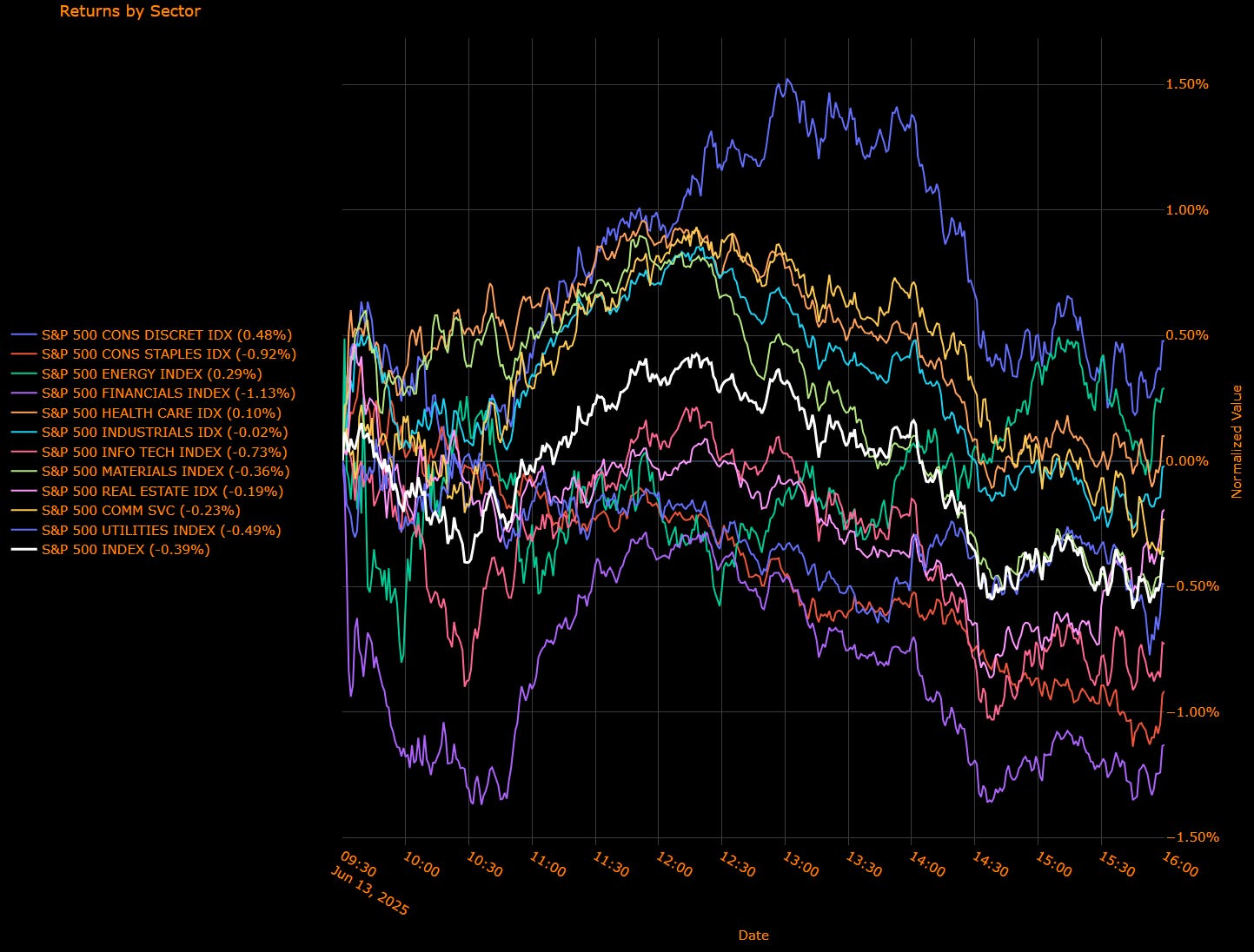

S&P 500 Falls 0.39%, Led Lower by Tech and Financials as Defensive Sectors Cushion the Blow

Sector-by-Sector Contribution Snapshot (Weighted Impact to Index)

Information Technology (–0.23 pp) – Biggest drag on the index, driven by profit-taking and AI-related fatigue after a strong run.

Financials (–0.16 pp) – Declined as long-end yields rose and the rate-sensitive trade reversed with geopolitics in focus.

Consumer Staples (–0.05 pp) – Defensive sector lagged as risk aversion narrowed to specific sectors.

Communication Services (–0.02 pp) – Continued underperformance, led by weakness in media and telco names.

Utilities (–0.01 pp) – Small drag despite usual safe-haven behavior.

Materials (–0.01 pp) – Flattened out amid mixed signals on global growth.

Consumer Discretionary (+0.05 pp) – Surprisingly resilient, led by rotation into domestic retail.

Energy (+0.01 pp) – Marginal positive as oil held firm after initial spike.

Health Care (+0.01 pp) – Mild support with sector rotation toward stability.

Industrials (–0.00 pp) – Essentially flat, caught between rising capex hopes and geopolitical headwinds.

Real Estate (–0.00 pp) – Little impact as bond volatility whipsawed duration-exposed sectors.

Sector-by-Sector Performance Snapshot (Unweighted Returns)

Consumer Discretionary (+0.48%) – Sector leader, benefiting from a shift back toward cyclical names as oil shock fears faded late in the session.

Energy (+0.29%) – Supported by renewed Middle East tensions and higher crude volatility.

Health Care (+0.10%) – Held up on defensive appeal and better managed care sentiment.

Industrials (–0.02%) – Weakness in transports and machinery offset capex-driven optimism.

Information Technology (–0.73%) – Heaviest underperformer as semis and software sold off on valuation concerns.

Consumer Staples (–0.92%) – Declined despite risk-off tone, signaling profit-taking in defensive positioning.

Financials (–1.13%) – Broadly weaker on rising yields, curve steepening, and geopolitical jitters.

Materials (–0.36%) – Slid as growth-sensitive names adjusted to demand worries.

Real Estate (–0.19%) – Fell with yield back-up pressuring rate-exposed sectors.

Communication Services (–0.23%) – Soft performance from streaming/media as risk appetite faltered.

Utilities (–0.49%) – Surprisingly lower despite haven flows, signaling positioning fatigue.

Macro Overlay

The S&P 500 declined 0.39%, snapping a multi-day rally as the market absorbed a fresh wave of geopolitical stress. The Israeli strike on Iranian nuclear facilities, followed by Iran’s direct missile retaliation, jolted investors. Oil surged more than 7% intraday before settling up 5.6%, and bond yields rose, particularly in the long end, with the 10-year climbing 6 bps to 4.42%.

Despite the initial panic, the index clawed back from losses of over 1% intraday, underscoring the market's reluctance to fully price in a broad escalation – for now.

Key drivers today:

Geopolitical tension escalated dramatically with Iran firing hundreds of missiles at Israel. While US and Israeli defense systems intercepted many, the sheer scale shocked markets. Energy and defense stocks caught bids, but broad sentiment remained fragile.

Gold hovered near record highs as haven demand persisted.

Fed expectations remain cautious after soft PPI data, but the energy shock complicates the inflation outlook.

US IG Credit Wrap — Spreads Tighten to 55.89 bp Amid Soft Inflation and Strong Treasury Demand

Current Spread: 55.89 bp (▼ modest tightening), below the 5-year average of ~62.96 bp. Levels remain within a historically stable zone, signaling continued investor comfort despite persistent macro and geopolitical noise.

Credit Context

< 60 bp: Stable, duration-friendly range supporting insurance and liability-driven investment (LDI) strategies.

60–70 bp: Neutral-to-cautious positioning recommended amid tariff uncertainties and macroeconomic volatility.

> 90 bp: Significant market distress—currently unlikely without a major escalation in geopolitical or macroeconomic shocks.

Macro Overlay

Treasury strength: A strong $22B long-bond auction eased concerns about fiscal crowding out. Yields at the long end declined sharply, reinforcing the duration bid.

Fed policy inertia: With both CPI and PPI prints coming in below forecast, markets are increasingly pricing in at least one rate cut later this year. This has provided a backstop to duration-heavy credit.

Geopolitical risk: Middle East tensions remain elevated, with Iran firing hundreds of ballistic missiles at Israel in response to Israeli strikes on nuclear facilities. Despite the headlines, credit markets remain largely insulated. Investor focus is on the upcoming US–Iran nuclear talks in Oman.

Bottom Line

Credit markets continue to lean cautiously optimistic, with IG spreads tightening to 55.89 bp—hovering near the lowest levels since early April and well below the post-COVID average. The move reflects a benign inflation backdrop, resilient equity sentiment, and strong Treasury demand. While geopolitical risks are high and insider equity selling is elevated, credit remains well-behaved,

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

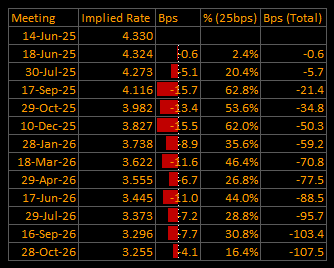

Short-End Rates Wrap — Cumulative Easing Deepens to ≈ –107.5 bp; Market Now Sees First Cut by September

Key Takeaways (Latest OIS-Implied Pricing)

First-Cut Timing:

14-Jun-25: All but ruled out (–0.6 bp), suggesting policy on hold for now.

18-Jun-25: Just 0.4% probability of a cut — functionally off the table.

30-Jul-25: Market pricing a 20.4% probability for a 25 bp cut (–5.1 bp) — still cautious, not yet a base case.

17-Sep-25: Clear shift in expectations — now 62.8% chance of a cut (–21.4 bp), increasingly seen as the likely inflection point.

Front-Loaded Easing Path (2025)

10-Dec-25: Implied rate of 3.827%, reflecting a total of –50.3 bp in cumulative cuts (~2 full cuts).

Full-Year 2025: Markets are pricing in just over 2 cuts between July and December, indicating a preference for gradual easing once the Fed begins.

Longer-Term Easing Expectations (2026)

28-Oct-26: Terminal implied rate sits at 3.255%, representing a cumulative drop of –107.5 bp from the current effective Fed Funds rate of 4.33%.

The forward curve now embeds roughly 4 full 25 bp cuts through the end of 2026, with the bulk of those coming across H1 2026.

Macro Context

Soft Inflation Prints: May PPI came in at +0.1% m/m, following soft CPI earlier in the week. This gives the Fed room to wait — or cut — without pressure from headline inflation.

Treasury Demand: A well-bid $22B 30-year auction reinforced market confidence in the long end, easing volatility and helping anchor short-end pricing.

Geopolitical Volatility: Tensions between Israel and Iran are now at a high, with missiles fired and oil spiking. Still, rate markets remain resilient, with the front-end largely ignoring geopolitical premiums — for now.

Fed Optics: Trump’s rhetoric on rates continues to pressure the Fed narrative, but he confirmed Chair Powell’s job is safe. Meanwhile, the market sees ~50–55 bp of easing by year-end, and >100 bp through 2026.

Bottom Line

Markets are converging on September as the likely start of the easing cycle, with just over 2 full cuts priced by December and a total of 107.5 bp of cuts expected by the end of next year. The backdrop of benign inflation, solid Treasury demand, and subdued front-end volatility keeps policy normalization orderly — even as geopolitical risks flare.

Unless oil-induced inflation surprises, the Fed appears in no rush to act — but when it does, it will likely move in measured 25 bp steps over multiple meetings.

Tactical Portfolio

Morning Trade(s) and Market thread

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.