Macro Regime Tracker: What Stage?

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

All of the macro views for WHERE we are can be found here:

As always, all the systematic models and strategies are laid out below.

Main Developments In Macro

US Macro, Policy, and Market Developments

TRUMP EXCLUDES GENERICS FROM BIG PHARMA TARIFF PLAN: WSJ

TRUMP CONSIDERING SHIFTING FUNDS TO PAY TROOPS: POLITICO

TRUMP: CHICAGO CAN BE SAVED, OTHER CITIES ARE GONE

TRUMP: FINAL NEGOTIATION IS WITH HAMAS, WE MAY LEAVE SATURDAY

TRUMP: TALKS WITH HAMAS SEEM TO BE GOING WELL

TRUMP: NEGOTIATION WITH HAMAS GOING WELL

TRUMP: IN DEEP DISCUSSIONS ON MIDDLE EAST

TRUMP: GOOD CHANCE OF SUCCESS IN MIDDLE EAST

TRUMP: MOST FED WORKERS WILL GET BACKPAY

TRUMP: SOME FEDERAL WORKERS WON’T QUALIFY FOR BACKPAY

TRUMP: WOULD CONSIDER GOING TO GAZA

TRUMP: I’LL BE MAKING THE ROUNDS IN THE MIDEAST

TRUMP SPEAKS AT THE WHITE HOUSE

JOHNSON: WORRIED ABOUT ALL SORTS OF ADVERSE EFFECTS OF SHUTDOWN

JOHNSON: HAVE NOT SPOKEN TO SCHUMER SINCE OVAL OFFICE MEETING

JOHNSON: DON’T HAVE ANYTHING TO NEGOTIATE ON STOPGAP BILL

JOHNSON: ONGOING TALKS ABOUT REFORMING ACA SUBSIDIES

SCHUMER SAYS POSITION ON HEALTH CARE SUBSIDIES REMAINS THE SAME

MINORITY LEADER CHUCK SCHUMER SPEAKS ON SENATE FLOOR

CARNEY: EXPECT BILATERAL DEALS ALONGSIDE USMCA

US ADDS 26 ENTITIES, INCLUDING CHINESE FIRMS, TO ENTITY LIST

HUANG: US IS OVERALL ‘NOT FAR AHEAD’ OF CHINA ON AI

SEC PROBES ACCOUNTING PRACTICES AT MASSMUTUAL: WSJ

Federal Reserve Commentary & Policy Outlook

FED RELEASES MINUTES OF SEPT. 16-17 MEETING IN WASHINGTON

FED: MOST SAID LIKELY APPROPRIATE TO EASE POLICY MORE THIS YR

FED: A FEW OFFICIALS COULD HAVE SUPPORTED NO RATE CUT IN SEPT.

FED: MAJORITY EMPHASIZED UPSIDE RISKS TO INFLATION OUTLOOK

FED: COUPLE SAID INF. WOULD BE CLOSE TO GOAL EXCLUDING TARIFFS

FED: LABOR MKT LIKELY TO CHANGE LITTLE OR MODESTLY SOFTEN

FED: DOWNSIDE RISKS TO EMPLOYMENT ELEVATED AND HAVE RISEN

FED: IMPORTANT TO MONITOR HOW CLOSE RESERVES ARE TO AMPLE

FED: SEVERAL REMARKED ON ISSUES RELATED TO FED BALANCE SHEET

FED: SOME NOTED POLICY MAY NOT BE PARTICULARLY RESTRICTIVE

FED STAFF SEES UPSIDE INF. RISKS, COULD PROVE MORE PERSISTENT

BARR SEES BIG BANK DEREGULATION AS THREAT TO COMMUNITY BANKS

BARR: RECENT CAPITAL PROPOSALS THREATEN TO ERODE PROTECTIONS

FED’S BARR TO SPEAK AT COMMUNITY BANKING RESEARCH CONFERENCE

Global Developments

US, MIDEAST OFFICIALS VIEW GAZA DEAL WITHIN REACH THIS WEEK: AXS

TURKEY’S FIDAN: TODAY’S GAZA TALK MAY RESULT IN CEASEFIRE

FIDAN: GAZA TALKS TODAY FOCUSING ON HOSTAGES, PRISONERS, AID

HAMAS SEES OPTIMISM AMONG PARTIES TO REACH CEASEFIRE

ISRAEL SAYS THWARTED SMUGGLING OF IRANIAN WEAPONS TO WEST BANK

IMF’S GEORGIEVA SAYS UNCERTAINTY IS THE NEW NORMAL

GEORGIEVA: VALUATIONS HEADING TOWARD DOT-COM HEIGHTS OF 2000

GEORGIEVA: EASY FINANCIAL CONDITIONS ‘MASKING’ GROWTH SOFTENING

GEORGIEVA SAYS WORLD AVOIDED TRADE WAR RETALIATION ‘SO FAR’

GEORGIEVA URGES NATIONS TO PRESERVE TRADE AS ENGINE OF GROWTH

GEORGIEVA: WORLD ECONOMY ‘GENERALLY WITHSTOOD’ ACUTE STRAINS

IMF CHIEF EXPECTS DECISIONS SOON ON ARGENTINA AID PACKAGE: RTRS

IMF CHIEF GEORGIEVA DELIVERS SPEECH IN WASHINGTON

SAUDI GOVERNMENT SAID IN TALKS WITH BANKS FOR $10 BILLION LOAN

NOVAK: RUSSIA’S SEPTEMBER OUTPUT WAS CLOSE TO OPEC+ QUOTA: IFX

BOE: THREAT TO FED CREDIBILITY COULD TRIGGER SHARP REPRICING

BOE: EQUITY VALUATIONS APPEAR STRETCHED, NOTABLY FOR AI FIRMS

BOE’S PILL: UK SEEING STRUCTURAL CHANGE IN PRICE, WAGE-SETTING

BOE’S PILL: INFLATION EXPECTATIONS MAY HAVE SHIFTED

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

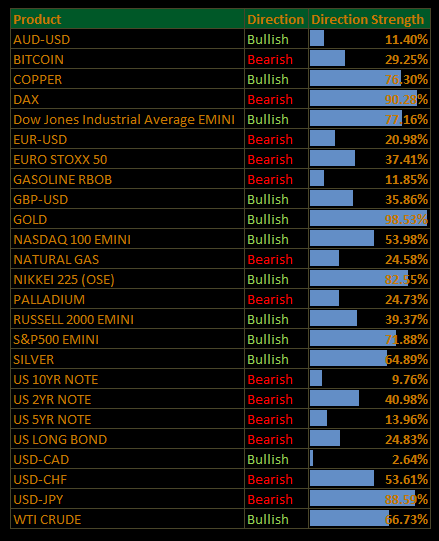

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

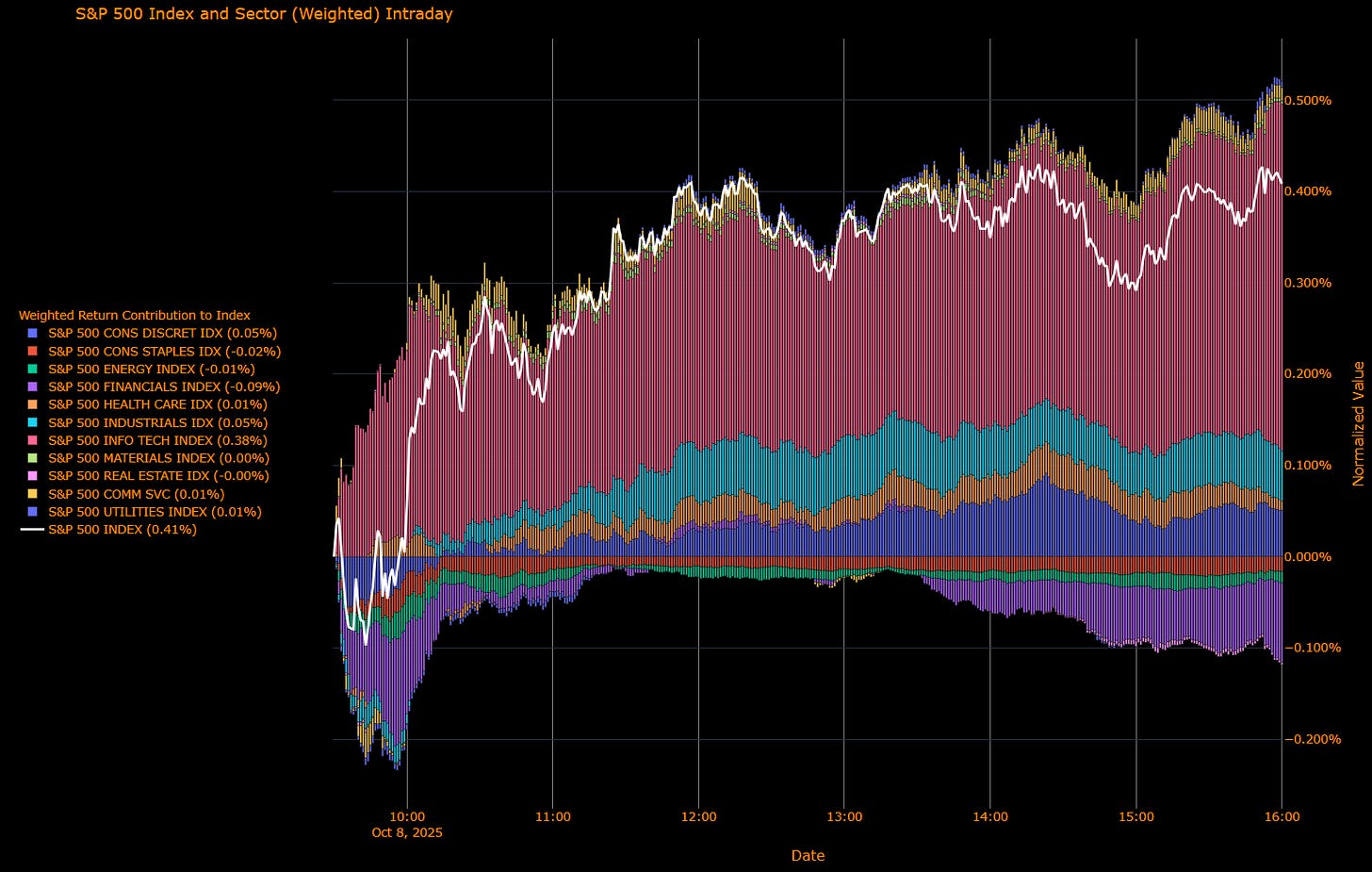

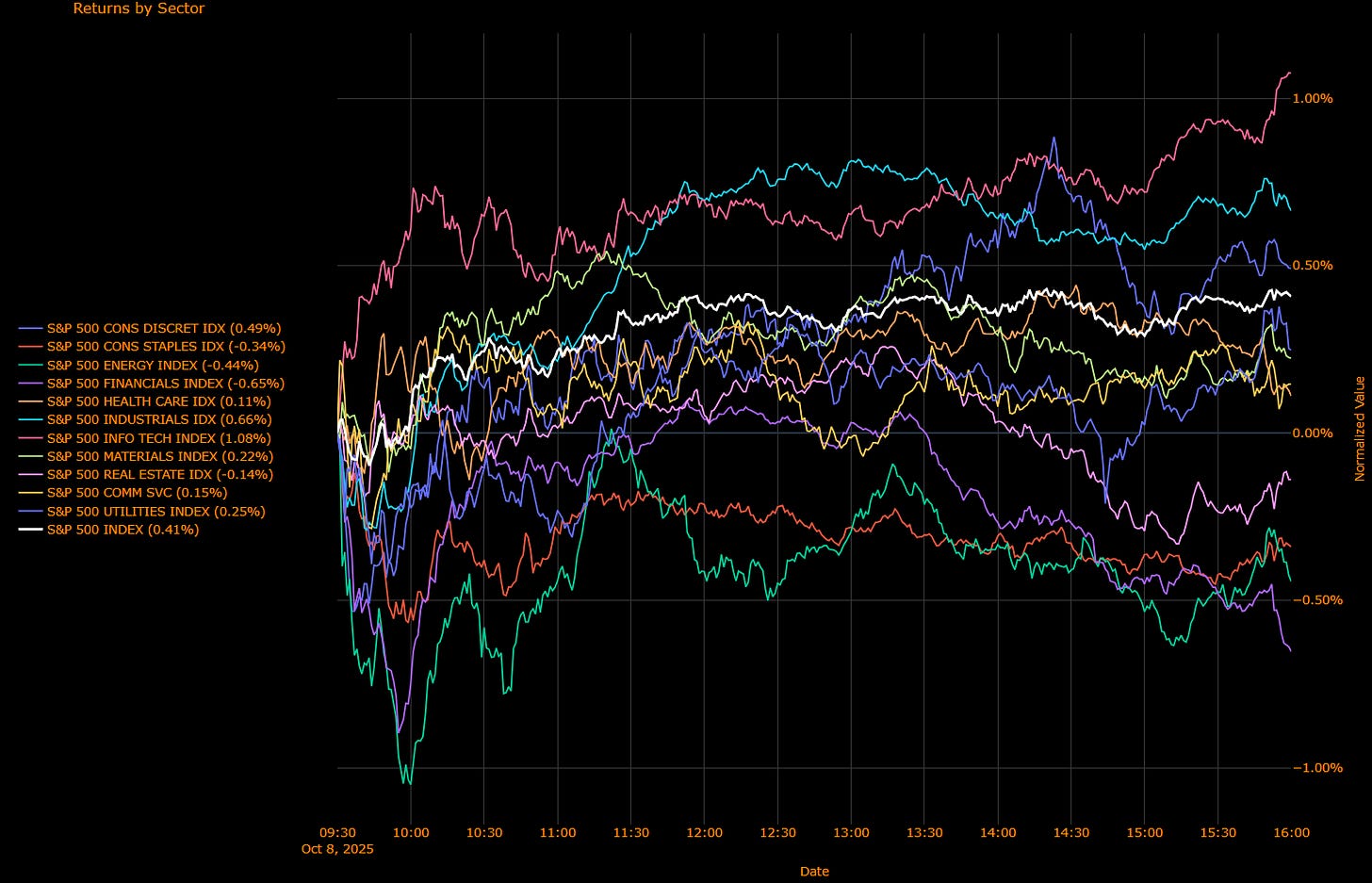

US Market Wrap: Tech Drives Fresh Highs as AI Fever Returns (S&P +0.41%)

The S&P 500 resumed its charge higher (+0.41%), led almost entirely by a renewed surge in mega-cap tech. Nvidia extended gains after CEO Jensen Huang said Blackwell chip demand is “really, really” strong, igniting another wave of AI optimism. The Nasdaq 100 added 1.2%, and the broader S&P’s advance was once again narrow dominated by Info Tech (+0.38 weighted return, +1.08% unweighted) and supported by Discretionary (+0.05 / +0.49%) and Industrials (+0.05 / +0.66%).

Sector Attribution

Weighted Return Contribution

Leaders – Info Tech (+0.38%), Discretionary (+0.05%), Industrials (+0.05%)

Laggards – Financials (–0.09%), Staples (–0.02%), Energy (–0.01%)

Net: S&P 500 +0.41%

Unweighted Performance (Breadth)

Leaders – Info Tech (+1.08%), Discretionary (+0.49%), Industrials (+0.66%), Utilities (+0.25%)

Laggards – Financials (–0.65%), Energy (–0.44%), Staples (–0.34%), Real Estate (–0.14%)

Breadth: Positive but narrow—four sectors driving nearly the entire index gain.

Macro Overlay

AI Still in the Driver’s Seat

The AI-driven rally continues to defy gravity, with investors looking through bubble warnings toward earnings resilience and the Fed’s steady easing path. With the S&P nearly doubling from its 2022 lows, comparisons to the dot-com era are surfacing, but strategists note multiples remain far below 2000 peaks. Nvidia’s upbeat tone and fresh capital expenditure signals from Cisco and Broadcom extended the “AI infrastructure” trade, overshadowing stretched sentiment readings.

Fed Minutes: Hawkish Tint, Dovish Reality

Minutes from the Sept 16-17 FOMC meeting showed “almost all” officials backed the 25 bp cut, though “a few” favored holding. The tone skewed hawkish, emphasizing upside inflation risks and the uncertainty around tariffs. Still, “most” participants expect further easing later this year. Market pricing remains firm for an October cut as the shutdown dampens confidence and data visibility.

Cross-Asset Moves

The 10-year Treasury held near 4.13% after a $39 billion auction drew mixed demand. The Bloomberg Dollar Index touched its strongest since August; yen hovered near 152.7 per dollar amid intervention watch. Gold surged 1.4% to $4,042/oz and oil edged higher (+0.6%) as inventories fell. Bitcoin (+0.3%) and Ether (+0.3%) tracked mild risk-on sentiment.

The Read-Through

Breadth remains razor-thin Tech’s 1 point move carried nearly the entire S&P gain but there’s no sign of exhaustion yet. The combination of contained yields, robust AI momentum, and a measured Fed keeps the macro backdrop supportive. Still, concentration risk is high: if leadership falters, the S&P’s lofty levels could wobble quickly.

Takeaway: The AI trade remains the market’s heartbeat. As long as yields stay anchored and earnings validate the hype, dips will likely keep finding buyers. The next real test arrives with October’s Fed meeting and the shutdown’s impact on data visibility.

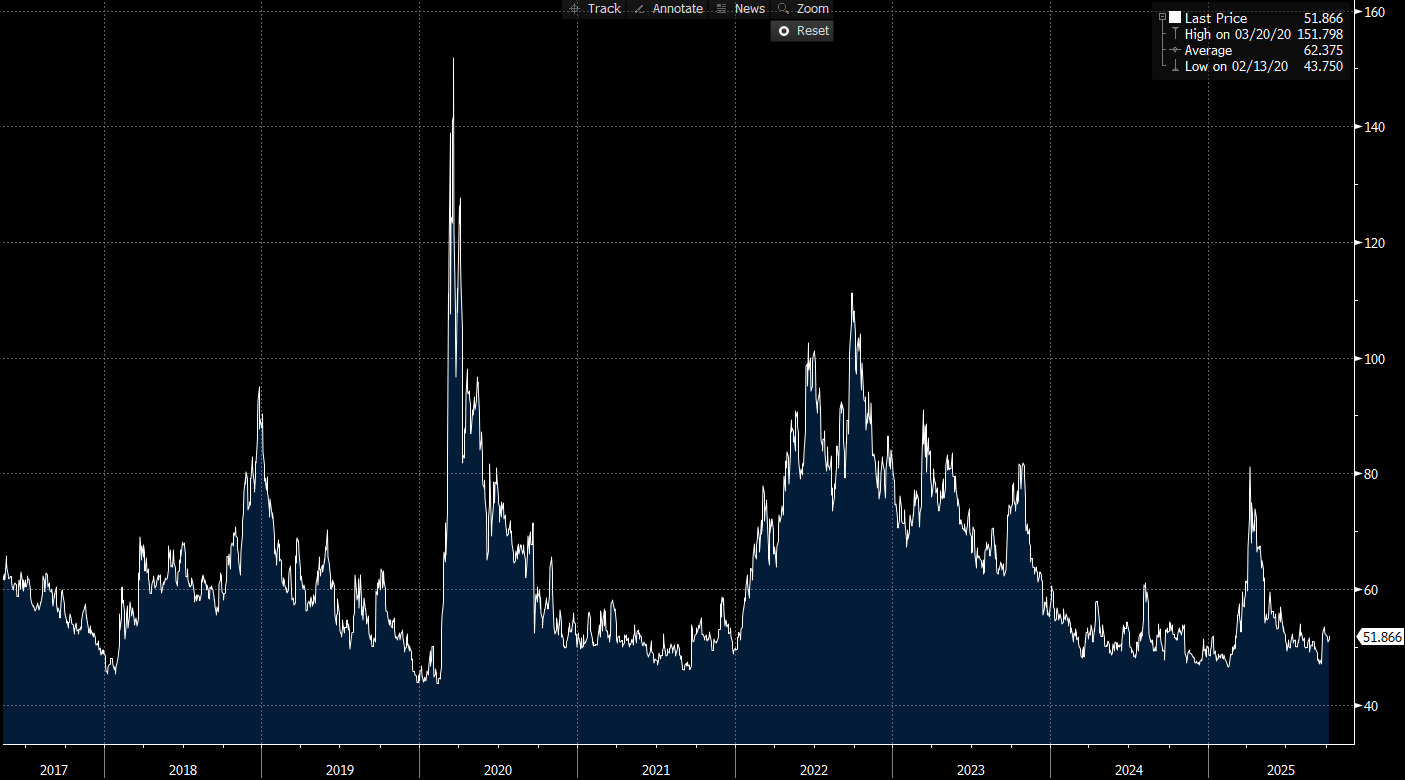

US IG Credit Wrap: Low-50s Grind Persists as AI Risk Bid Returns (IG OAS ~51.9 bp)

IG spreads hugged the carry channel despite a higher-beta equity pop led by AI. The Bloomberg US IG OAS closed around 51.9 bp, essentially flat on the day, with duration support offsetting mixed Treasury auction tone and a firmer dollar. Credit beta remains well-anchored; dispersion, not direction, is where the action is.

Where we sit (from the chart)

IG OAS: ~51.9 bp (chart last: 51.866)

5-yr avg: ~62.4 bp → ~10.5 bp inside

Cycle tights: 43.8 bp → ~8.1 bp off

Pandemic wides: 151.8 bp → ~100 bp tighter

(Chart stats: Last 51.866 | High 151.798 on 03/20/20 | Avg 62.375 | Low 43.750 on 02/13/20.)

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

Macro overlay

Equities: US benchmarks set fresh highs; AI complex (Nvidia commentary; DC/AI capex chatter) powered leadership; breadth still narrow.

Rates: UST 10y around 4.13% after a $39bn 10y auction with demand a touch soft; curves steady.

USD/Commods: Dollar at the strongest since Aug; gold >$4,000; oil firmer on inventory mix.

Fed minutes: Hawkish tint (inflation risks, tariffs) but “most” still see further easing later this year; shutdown adds to data-visibility risk rather than a growth shock.

Mapping to IG

Carry > convexity: Low-50s OAS keeps IG in “clip the coupon” mode; equities up + contained yields = no impulse to reprice wider.

Duration cushion: Long-end stability continues to support A/AA long-duration demand.

Quality skew / dispersion: Index flat masks BBB cyclicals sensitivity to any backup in reals or earnings wobble; idiosyncratic headlines (M&A, capex, guidance) driving single-name moves.

Correlation check: Stronger USD + tech leadership would usually lean mildly wider; duration and benign macro kept spreads pinned.

The read-through

Base case remains a sideways grind in the low-50s: supportive rates, measured Fed easing bias, and AI-led risk appetite, but with concentration risk if leadership stumbles.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

All of the interest rate sensitivity models are now reserved exclusively for paid subscribers. If you would like to do a free trial, you can with this LINK.

Launch video for these models is here: LINK

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.