Are We In A Bubble? AI and Macro Liquidity: Setting the Stage

How the dollar, AI, and macro liquidity have all converged into the endgame

Are We In A Bubble? AI and Macro Liquidity: Setting the Stage

There is no accepted definition of a “bubble.” No formal rulebook exists to declare when an asset class has detached from fundamentals or when collective belief has crossed into “mania.” That is why every cycle produces disagreement, because calling something a “bubble” is often an admission that one cannot model or measure it. The real task is not to label the market but to dissect the causal mechanics driving it. A well-formed hypothesis must be both quantifiable and testable; otherwise, it is narrative, not analysis. Those who default to calling the market a bubble often do so to avoid the harder work of identifying the underlying flows, constraints, and feedback loops that actually determine whether to get long or short.

In this report, the focus is on deconstructing the structure of the current equity rally and quantifying how it connects to the broader credit cycle I have outlined. By establishing this framework, we can move beyond vague narratives and begin identifying specific, quantifiable opportunities grounded in the mechanics of capital flows and credit dynamics.

First, please review ALL the reports I have written thus far, explaining the mechanics of the credit cycle and macro regime:

Additionally, you can find all of the educational primers, book recommendations, and cycle playbooks here:

How Equities Work:

Fundamentally, every risk asset has a credit risk component and a duration component. In the S&P500, we quantify this by looking at earnings and valuations. Earnings are driven by nominal growth in the economy, and valuations are driven by liquidity (in all its various sources). You can see the S&P500 playbook here:

This is an important starting point because every dollar that exists originates from somewhere. Money can be created, but it always operates within an asset–liability relationship that links the real economy to financial markets, both in nominal and real terms.

The problem with saying “it’s a bubble” is that the statement has no quantifiability or testability. What exactly defines a bubble? Is it excessive valuations? Rapid price acceleration? Extreme sentiment or speculative positioning? Is it when retail participation surges, or when institutional allocation peaks? And if any of these are true, have they historically provided predictive value? Without measurable parameters, “bubble” becomes a label for reductionism rather than a framework for understanding.

WHAT is actually happening?

If you understand how earnings and valuations function across equity markets and within their individual components, you can begin to frame why the rally is occurring in the first place.

So let’s break these down:

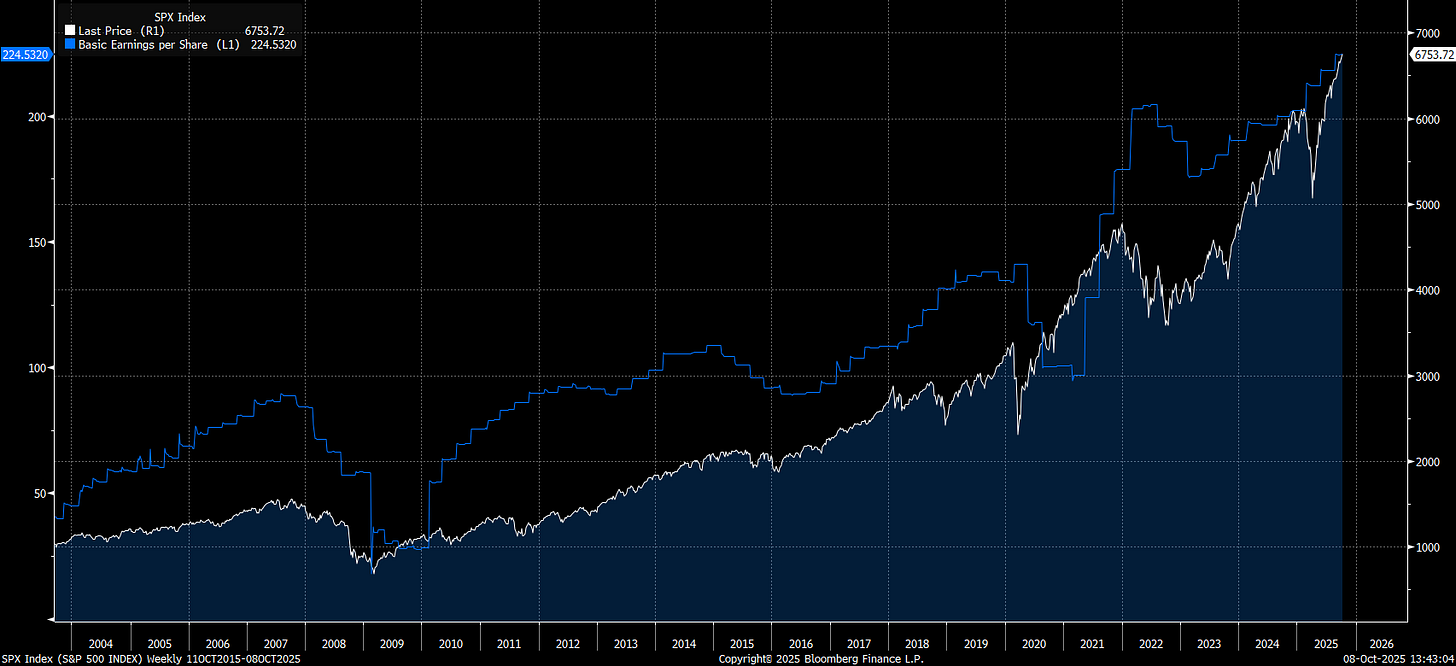

Earnings in the S&P500 continue to rise on a consistent basis as nominal and real growth accelerate:

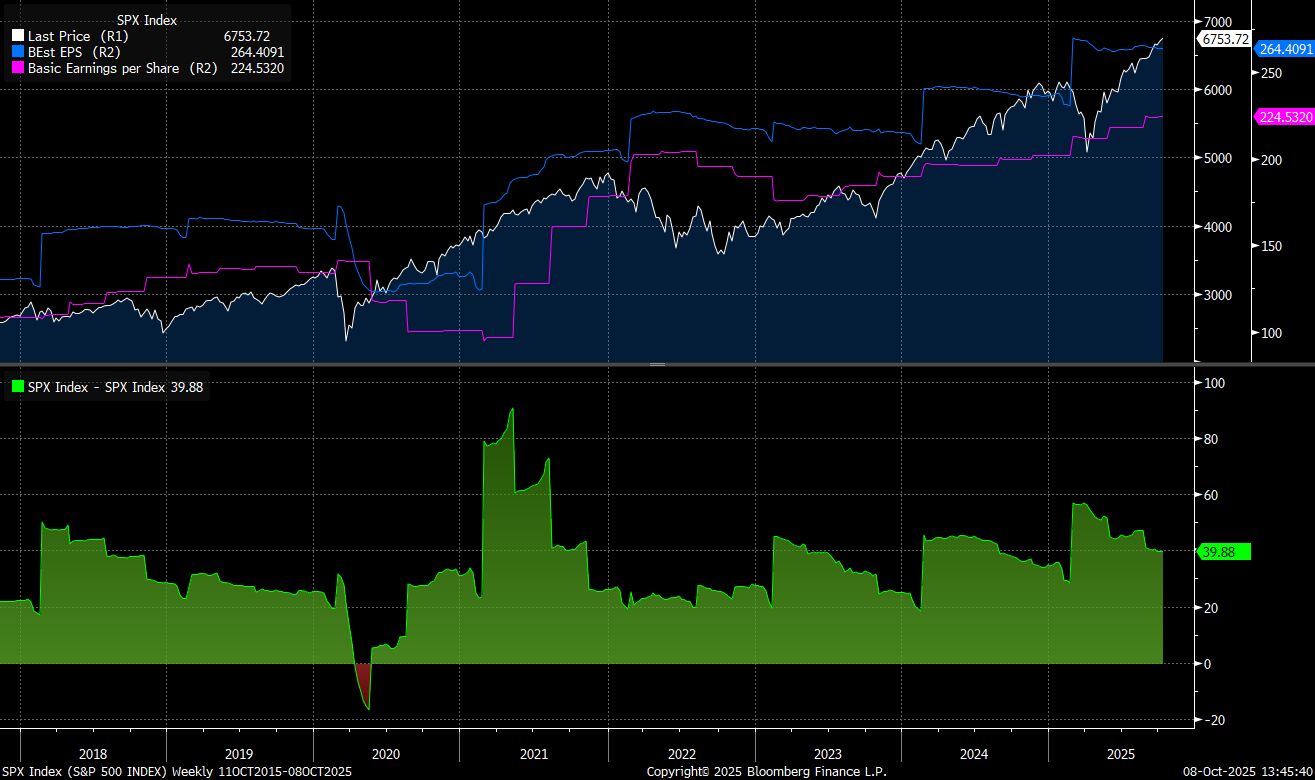

Earnings expectations remain ABOVE realized earnings, but we are seeing a consistent expansion in both:

As long as growth continues to rise, it supports the earnings function of equities. Given current conditions in interest rates, growth, and inflation, the probability of a recession by year-end that would materially erode corporate cash flows is LOW.

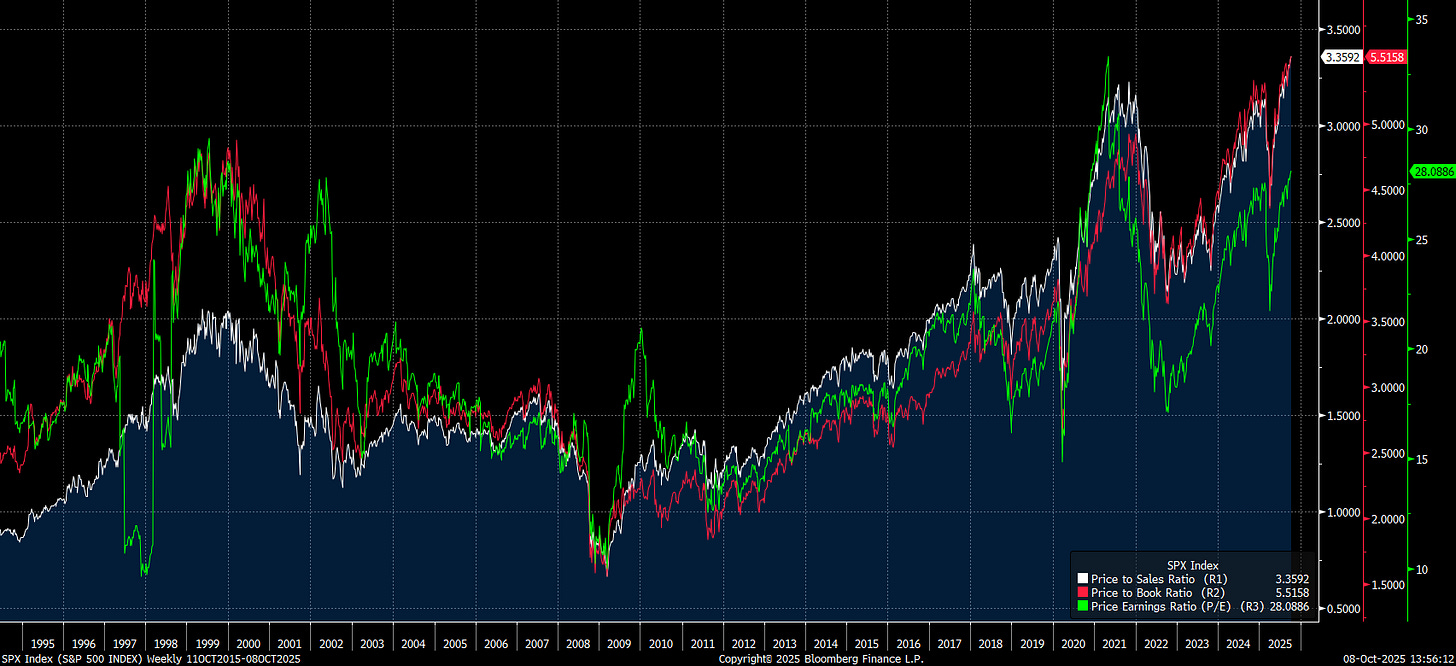

The question from here is WHERE are valuations? If cash flows remain constant through the end of the year, the primary factor that would cause valuations to expand and push the index UP would be macro liquidity. Right now, valuations on every metric are at historic levels due to the unprecedented convergence of liquidity factors all aligned in the same direction (I laid out all of the liquidity factors in the reports linked above).

A Side Note:

When I analyze macro flows, I start by running an attribution analysis on each asset to understand what truly drives its performance. From there, I break the process into scenario analysis. In practical terms, my view on the S&P 500 is a function of my outlook on nominal growth—whether it is rising or falling—and liquidity—whether it is expanding or contracting.

On top of this, each attribution for the S&P500 can have varying degrees of strength (represented by stdv σ below), which results in varying degrees of performance in the index:

Growth Rising / Liquidity Expanding

−3σ −2σ −1σ 0σ +1σ +2σ +3σ

Growth Rising / Liquidity Contracting

−3σ −2σ −1σ 0σ +1σ +2σ +3σ

Growth Falling / Liquidity Expanding

−3σ −2σ −1σ 0σ +1σ +2σ +3σ

Growth Falling / Liquidity Contracting

−3σ −2σ −1σ 0σ +1σ +2σ +3σ

When we pull these fundamental principles together, we can begin to understand WHERE we are going in the S&P500 in both the parts and whole. What I want to do in the remainder of this report is explain the specific factors we are seeing driving earnings and valuations to properly understand the risk-reward and probable outcome of the S&P500 into the end of the year.

Macro Liquidity, AI, and The Coming Cliff:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.

![[FREE] Educational Primers On Every Aspect Of Macro & Markets](https://substackcdn.com/image/fetch/$s_!tfas!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F69c49472-3d63-47f0-9b8c-2a682fa625f1_1024x1024.jpeg)