Macro Report/Insights: Nominal Cash Flows

Nominal Growth, Rates and Capturing Alpha

I have long spoken about the fundamental change in the environment we have entered. We continue to see managers and retail investors hold to biases from 2008 and not update their views. When you study financial history holistically then you recognize there are a lot of different left-tail and right-tail risks besides a 2008 scenario.

The nominal growth environment remains above the last 30 years:

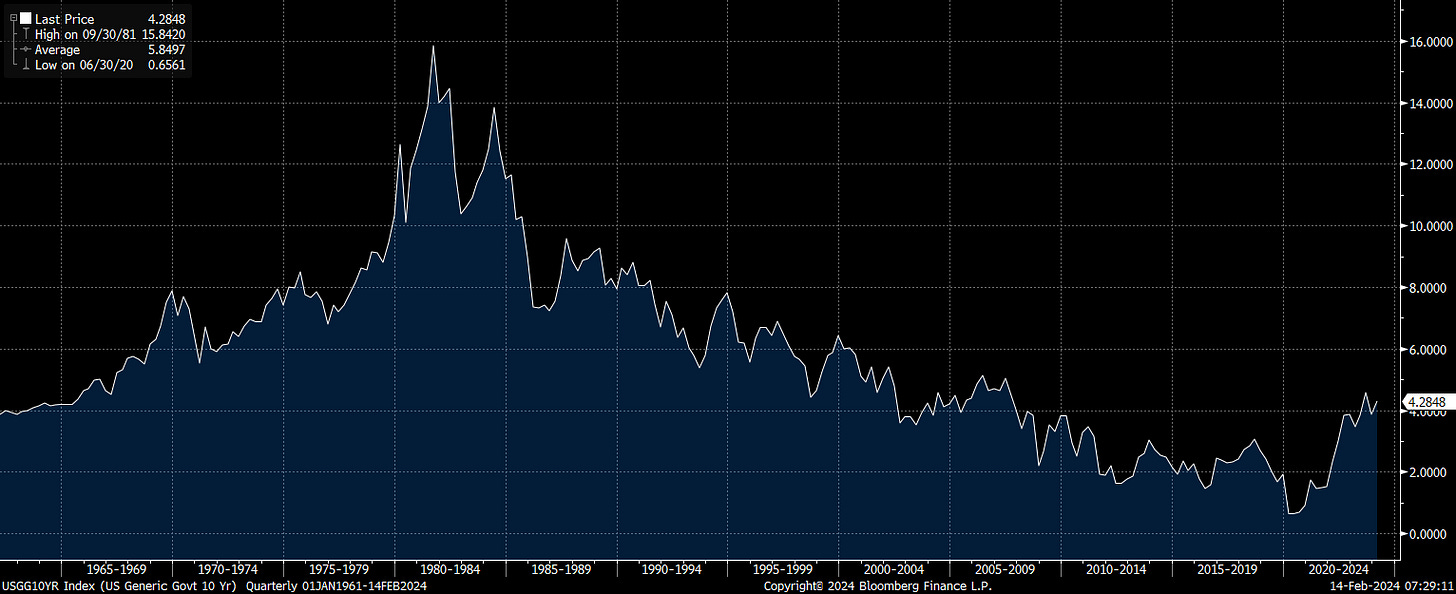

When nominal growth is elevated like this then it directly feeds into the specific sectors whose top-line revenue has the highest sensitivity to nominal growth. However, the additional variable is that financing costs have risen considerably:

So we have this situation where nominal growth is elevated and financing costs are higher. The way to manage this environment is by identifying the assets that take advantage of the higher nominal environment without being crushed by the higher financing costs.

There is a reason that the Materials to Utilities ratio (in white) is moving in lockstep with inflation expectations:

However, investors with a 2008 deflationary bias continue to buy Utilities because they seem “safe.” The problem is that you need to manage the right and left tail risks for growth, inflation, and liquidity.

Markets have clearly moved back to a low volatility environment within this new structural regime as liquidity is accommodative in a higher nominal growth environment.

When you have incredibly low implied volatility at the same time macro risks are compressing in the system then it sets the preconditions for a nonlinear move.

We are almost back to the Fed’s dot plot projections but equities keep rallying:

There are clear reasons for this dynamic:

First, passive flows continue to push capital into the Mag7 names:

I wrote about my views on this here:

Second, the nominal growth environment + positive liquidity provide incredibly accommodative conditions for equities to rally.

GDP nowcasts are running above 3%

And we continue to surprise growth expectations:

Third, as we entering a cutting cycle, capital is going to move out the risk curve. I made my views very clear about this in the article below. Resilient growth + cutting cycle = melt up in equities. This has played out exactly as I laid out:

Just look at NQ price action. We are very bullish:

And the bullish BTC view I shared over and over continues to pay in a huge way:

Sometimes you need to know when to be “Long and Dumb.”

If you want to dig into the macro tensions and connected trades then check out the macro report and macro webinar:

Conclusion:

I am running macro models and strategies that monitor WHEN the next inflection point is likely to take place. As I shared, macro volatility is THE main thing you need to be on the right side of in the economic cycle. Everyone panicked during 2022 AFTER they were in a drawdown. If you want to be resilient then you need to prepare NOW for the next move.