Macro Report/Insights: What is the probability of a recession?

A long term view

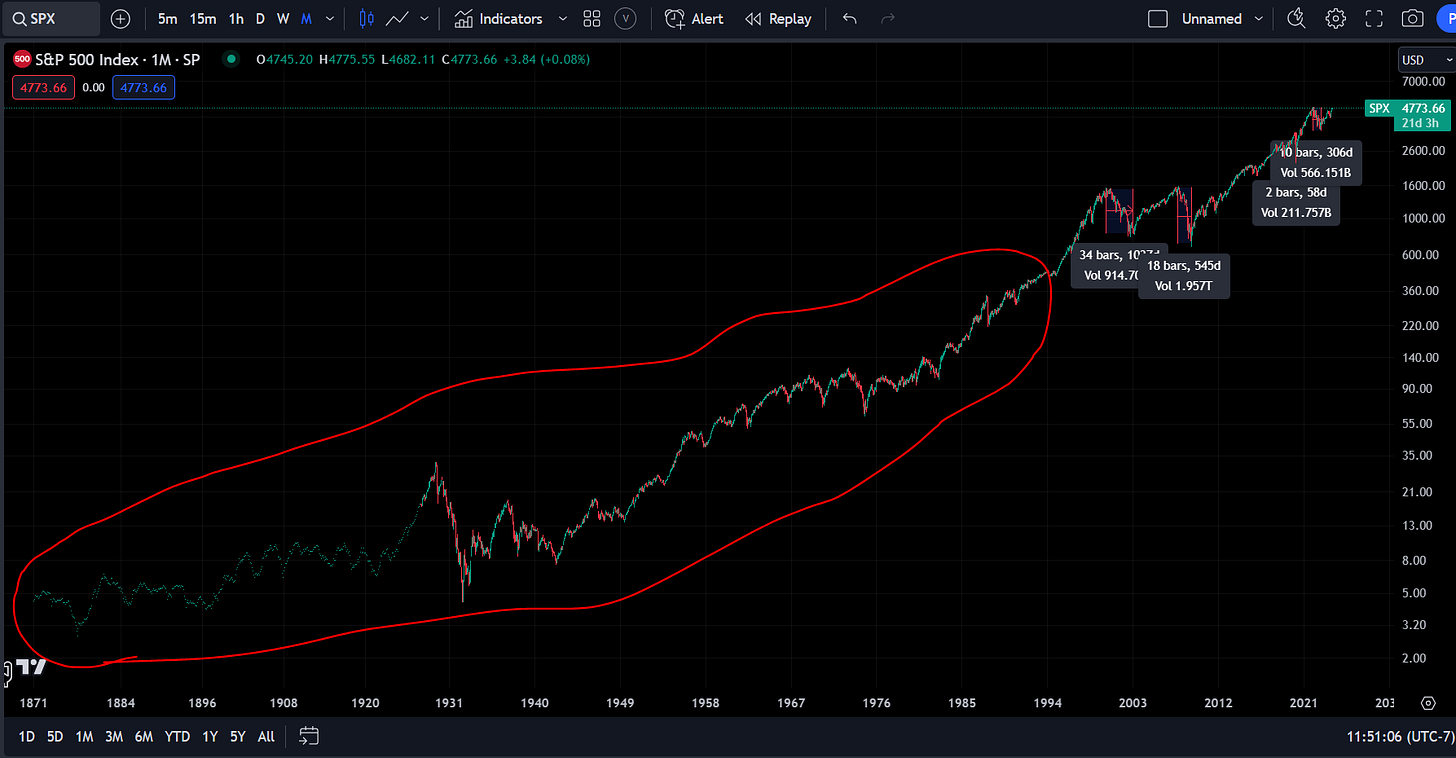

Over the years, time and time again the S&P500 has continued to make all-time highs. There have been bear markets but it has always rebounded. 80% of the time, the S&P500 goes up.

The long-term logarithmic chart illustrates this:

The % change chart makes the history of the market look even more dramatic:

How To Think About It:

The question is, will it continue? Let me explain HOW I think about this:

I don’t like the reasoning that since the S&P500 has always gone up in the past that it will continue doing so in the future. While that might be correct in retrospect, it is flawed logic for operating in forsite.

The more important question should be, what are the structural drivers of S&P500 returns, and will they continue? This gets to the root of the issue. It is not about retrospective bias or flawed logic but seeks to identify the causal factors you need to know to operate under uncertainty.

Let’s start with several big-picture things:

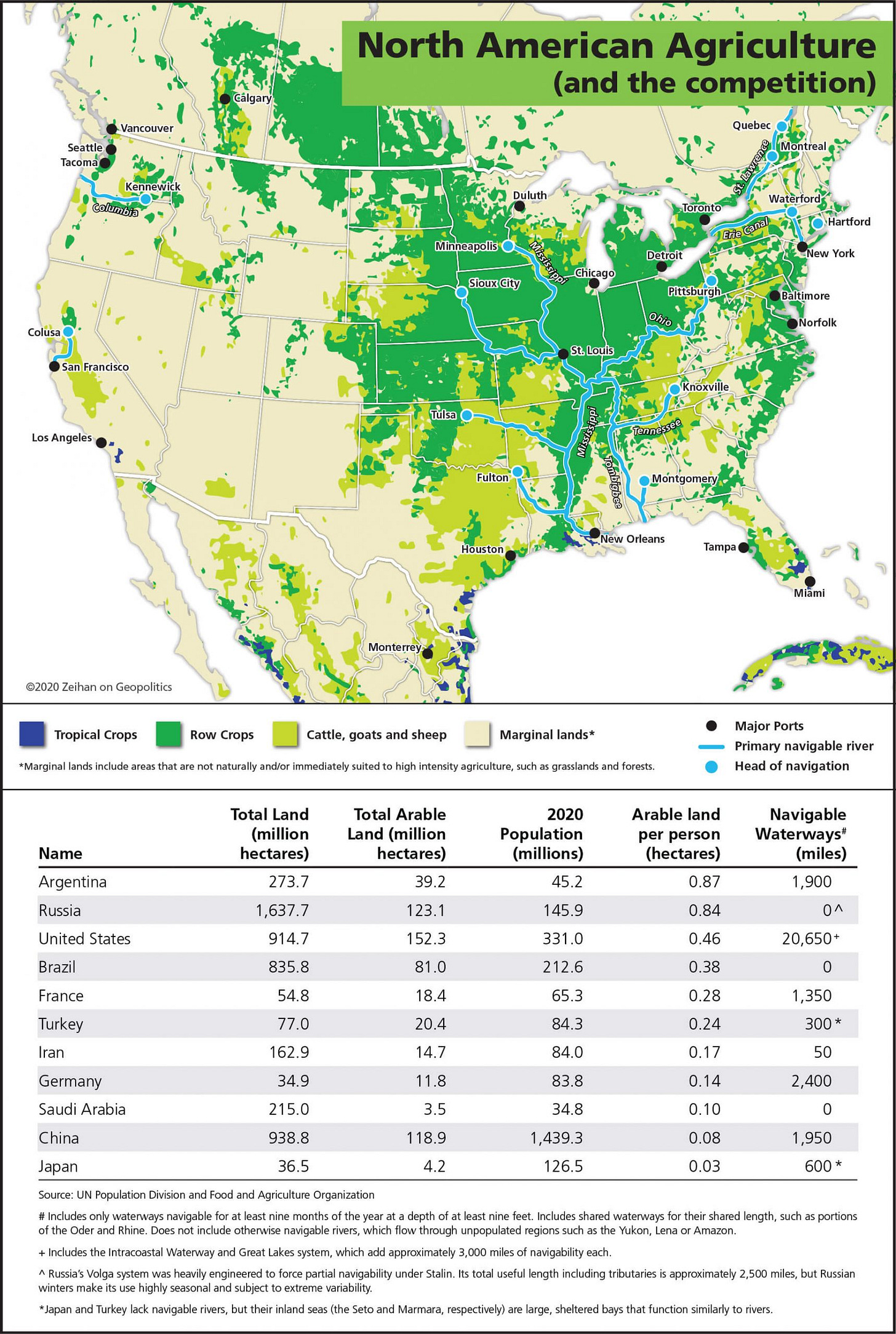

1) The geographic situation of the US is functionally the best in the world. There is no other country that has such an advantage from a militaristic, transportation, energy, and agriculture standpoint. Maybe there are supply chain issues here or there but there isn’t going to be a famine.

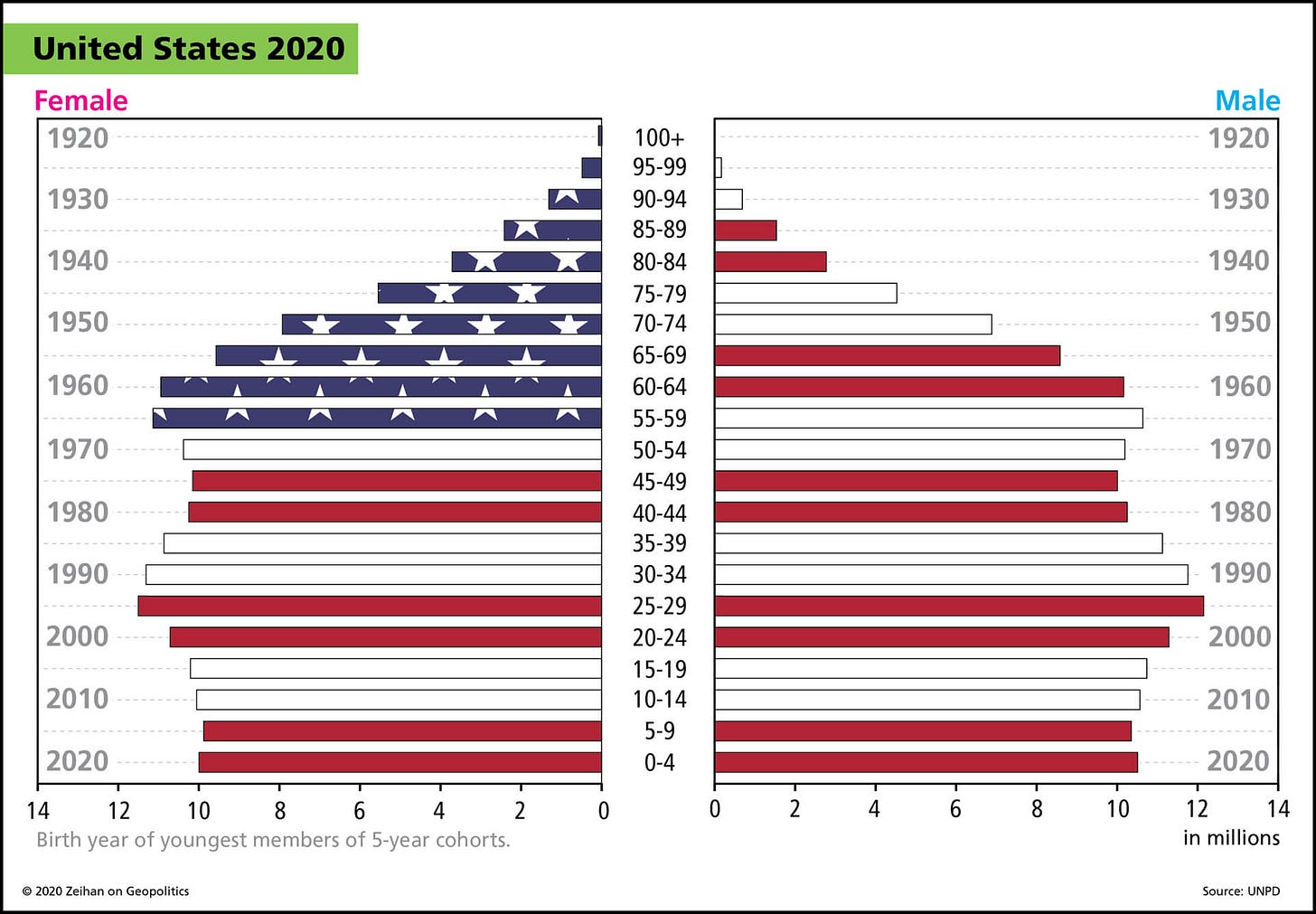

2) Second, the demographics of the US are some of the best in the world for a fully industrialized economy. Is there some weakening? Sure. Is America going to collapse? Unlikely from a demographic perspective.

3) The S&P500 index functionally has monopolies as its largest weightings. Do you really think Apple, Amazon, Google, and Microsoft are going to go under? Maybe they won’t grow as fast in the future but they are literally integrated with the entire US the way a utility company is. Many components of the companies provide the government with infrastructure for national security.

4) The dollar continues to hold reserve currency status which is a net liquidity impulse to all US financial assets. Cross-border flows are a huge component of the price action of any US financial asset. People speculate about the US losing its reserve currency status but it is not currently happening.

5) The final thing I will say is that the US is the most financialized country in the world. It is a self-reinforcing mechanism. Because there is liquidity, people get credit and because people get credit, liquidity providers keep coming. This trickles down all the way to small businesses and start-ups. There is a reason that so many successful start-ups are in the US. A lot of it has to do with the degree of financialization.

All of these are structural reasons for WHY the S&P500 continues to make new highs. There are other causal drivers but these are the main ones. You can quantify every single one of these factors and have an informed view of the persistence of S&P500 returns. This would be the proper way to take well-informed views on an asset and operate under uncertainty.

What if multiple drivers began to deteriorate? Well, then you should definitely begin questioning the validity of returns.

There are structural changes happening on the margin but we haven’t seen a pronounced and pervasive change that would cause us to question if the S&P500 could make new highs.

What about a recession?

The inevitable question comes up though, what about a recession? In recent history, we have had several recessions causing significant bear markets. The 2022 bear market was less of a recession and more about a repricing of assets due to inflation.

However, don’t forget, you have this entire period of time that also occurred.

It is easy to have the most dramatic experience of our lives shape how we act moving forward. This can be good or bad. The people who lived through 2008 are likely scarred from that experience and are always biased toward that type of outcome. The opposite is likely true of younger people who were just finishing college at the time.

The important thing is to remember that MANY different outcomes can occur. This is why I wrote an entire article on contingency planning:

If you are an exceptional contingency planner with a blank slate, you are likely in a better spot than most people. If your default mode is one of adaptation to a multiplicity of future scenarios as opposed to waiting for a recapitulation of a previous experience, you will be incredibly successful in any domain of life.

So will there be a recession in 2024? My current view is that it is unlikely (I laid out my views on this in the macro report: Link) . Could this view change? 100%. However, I hold this view just as lightly as I hold my bullish view. Always ready to flip on a dim and adapt to the outcome with the highest expected returns.

This is the goal! Adapt or die!