Monetary Policy And The Sins Of Central Bankers

Exposing Policy Failures, Incentive Misalignments, and the Cost of Hubris in Modern Central Banking

The Delusion That Has Become Normalized:

One of my favorite scenes in any movie is from Inception. Why? Because it captures the superpower of planting an idea in someone’s mind, an idea so deeply rooted that it becomes nearly impossible to erase.

This happens when we undergo an extreme experience, either euphoric or terrifying, that fundamentally alters how we think. When repeated over time, that experience becomes indistinguishable from reality, even if it is a delusion.

I bring this up because we now live in an era where a single centralized entity sets the price of money. This feels natural and normal, even democratic. After all, it was implemented through the legislative process, so it must be our collective choice, right?

But it goes deeper. In the United States, the Federal Reserve does not just set the price of money for domestic policy. It sets it for global trade because of the dollar’s reserve currency status. Other central banks are no longer optimizing policy for their own economies. They are managing their relationship with the Fed.

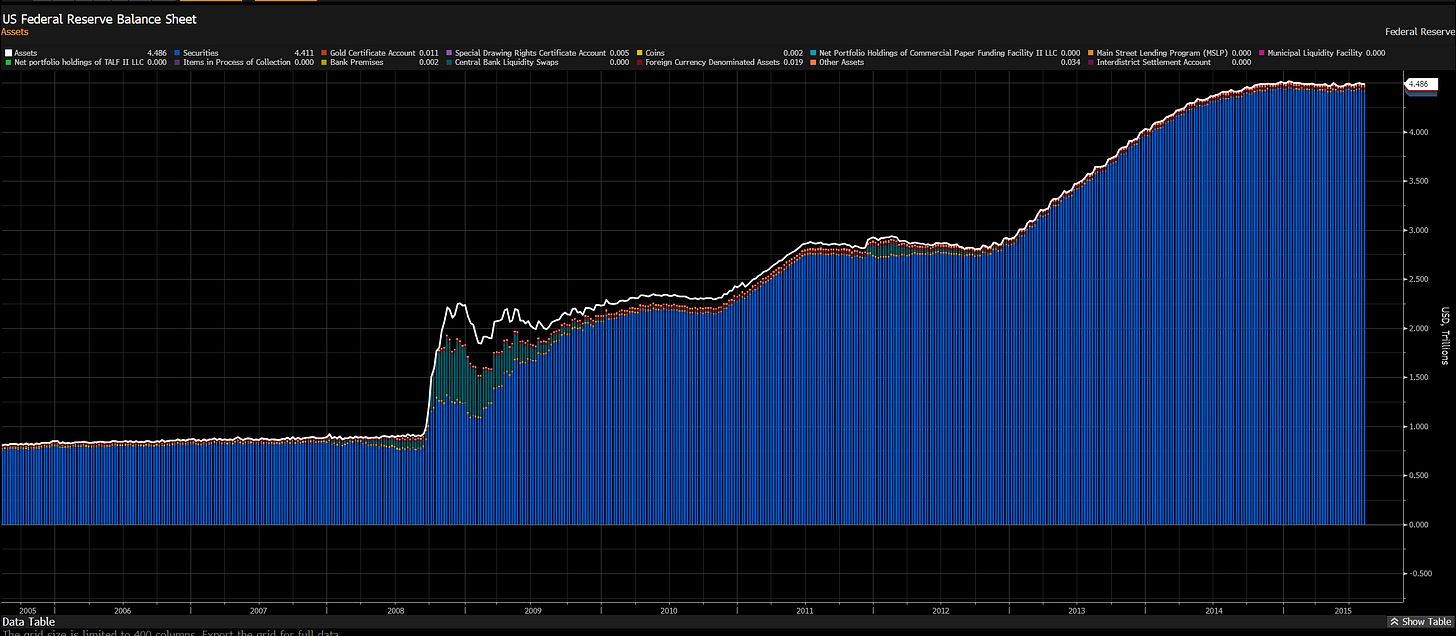

After the Global Financial Crisis, everyone became a Fed watcher. When the Fed’s balance sheet expansion marked the bottom in equities during the GFC, the market’s attention turned fully toward its every move.

We have professionalized Fed watching to the point where entire careers—strategists, media figures, and talking heads—are now built around “interpreting” Fed signals. Yet most of these interpretations offer no monetizable value. It is commentary without consequence.

Today, we have reached a point where people believe whether the Fed hikes or cuts in September is the defining factor in the U.S. housing market and the fate of the broader economy.

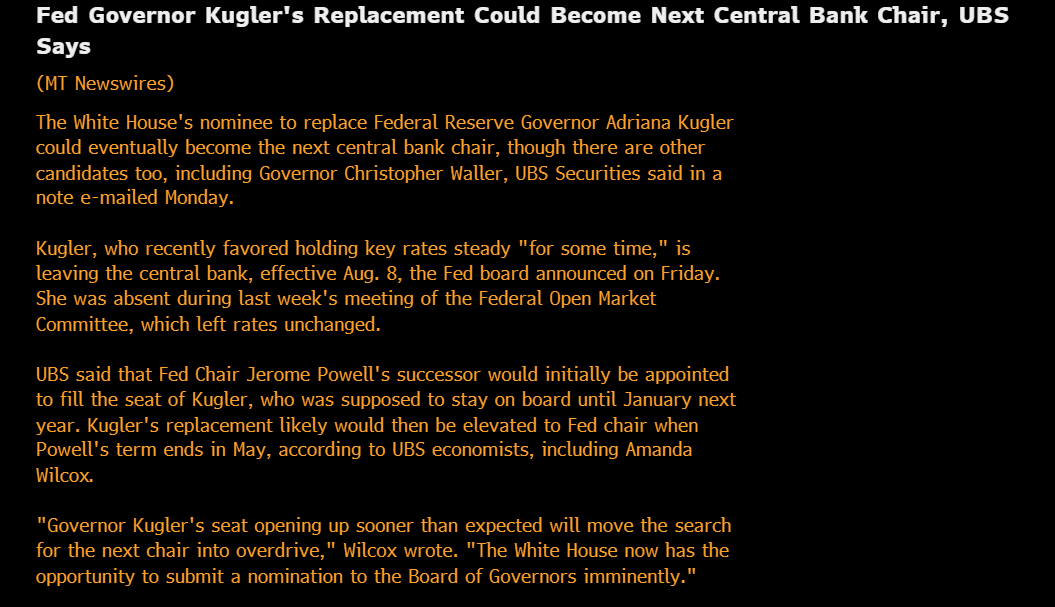

On top of this, the President is putting pressure on the Fed, which only typically matters when reappointment is at stake. Then we see events like a Fed governor stepping down, as happened this past Friday.

There are major shifts underway, both in how the Fed is perceived and in the structure of the underlying economy. These shifts will rattle people because they challenge the deepest assumption: “It’s always been this way.”

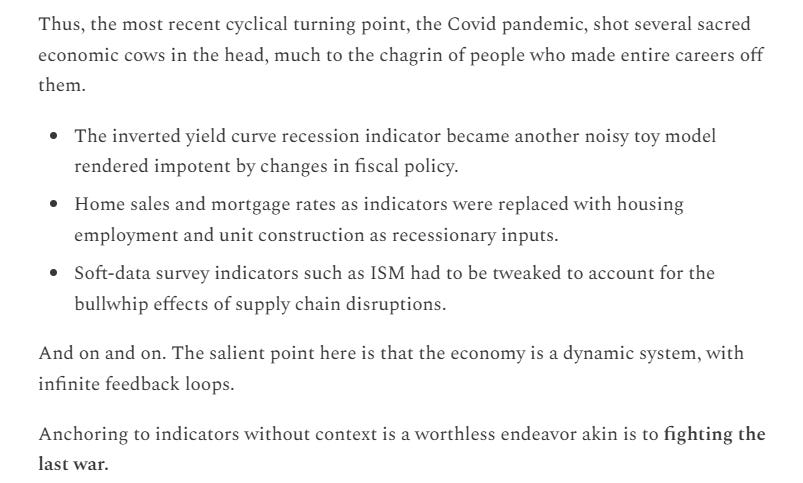

David Cervantes (truly sharp macro thinker whom I enjoy reading) Just touched on this with how the most valued “leading indicators” of a recession have consistently failed:

Shifting ideas and rising volatility move together. But this volatility is no longer confined to financial markets or physical systems. It now plays out across the digital sphere and cascades through the attention economy.

It is in the midst of this volatility that clear thinking commands its highest premium.

Constraints and Clear Thinking:

The Federal Reserve has only just begun to make the mistakes that will mark its history for decades to come. What is more important is this: what are all the constraints the Federal Reserve faces?

When I approach markets, I always start by asking what the constraints are and allowing those to frame the distribution of probable outcomes. Even if those constraints are temporal (“I don’t think a recession will occur for the next month”), they still shape how you take action.

When we come to the realm of interest rates, there is a single critical idea that is drastically underappreciated by almost everyone right now:

“It doesn’t matter who the Fed Chair is. It can be Powell, Volcker, or Trump. Every action has an opposite and often nonlinear impact that is always priced by markets. If the Fed cuts rates to zero, it will be reflected in the long end of the curve. If they implement yield curve control to suppress the long end, the currency will fall.”

This idea was illustrated perfectly—almost like a test run—in 2024, when the Fed began cutting rates into resilient growth. The result: 30-year long-end rates (blue) and 30-year mortgage rates rose.

Your Biggest Risk:

The infinite number of competing ideas is only going to increase as AI generates content cycles that appeal to the specific cognitive biases of our search history and attention span.

The only way to maintain any semblance of hope in a world with this much noise is to implement EXTREME intentionality in your personal thinking and education. This will be the differentiating quality that separates the winners from the losers, because the biggest danger to people today is not a lion in the wilderness but distraction and noise.

This is WHY I place so much emphasis on the personal education journey we all need to go through, and I cite Good Will Hunting:

“You wasted $150,000 on an education you coulda got for $1.50 in late fees at the public library.”

If you want to take the first step in understanding interest rates, all of the educational primers are here:

And the interest rate primer that gives you a comprehensive list of every book, paper, and article you could ever read about interest rates is here:

You can also review the video I did explaining the global significance of interest rates in today’s world:

As always, a Pepe for the culture:

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

bro always thanks for your education.

can i ask you something?

Are you ex-Goldman or something? or just retail trader?

How did you study macro analysis framework?

It is always amazing.