Special Announcement! New Bitcoin Strategy, ES Strategy, Gold Strategy, and 2 Year Strategy

Macro regime and risk assets qualified clearly

Special Announcements

Hello everyone,

I have several special announcements for you today, so let me start with the big picture. Last year, it became very clear to me that AI was becoming THE defining trend of the decade (see the articles I wrote here and here). I didn’t want to just be long the picks and shovels in markets (Semi’s or NVDA); I wanted to actively build the future that is yet to be seen by the market. I decided to take a concentrated bet on the Capital Flows Substack and hire an individual who has extensive experience trading at some of the largest banks and one of the largest hedge fund’s in the world. This individual also has extensive experience in the AI and machine learning side of finance, which is very rare in today’s world. I also heavily invested in multiple AI projects that are truly unparalleled in the financial market space (these projects will be launched in the coming months).

We have been relentlessly building extensive models and strategies that quantitatively map every single aspect of the global economy and financial markets. Today, we are rolling out the first iteration of these strategies, and they are coming at the perfect time, given the volatility we have seen in markets YTD.

Today, we are launching quantitative strategies that map BOTH the macro drivers and positioning in Equities (ES), the 2-Year Interest Rate, Gold, and Bitcoin (THESE ARE ALL BELOW). The greatest difficulty in markets is that things are ALWAYS changing, and you need a process that dynamically adapts to how the underlying drivers are shifting. The new strategies take every macro driver (growth, inflation, and liquidity) as well as positioning signals (the premium you pay to be long or short) and uses AI and machine learning to dynamically adapt in real time.

If you understand HOW the underlying drivers are dynamically shifting and WHERE their net effect is skewing the price, then you can know the exact risk reward of an asset. This doesn’t mean we will always know the future, but it does mean we will have the highest quality in our decision making for the present. The strategies accomplish this exact goal. They are broken down into the following:

The directional skew of the asset (bullish or bearish)

The total strength of macro and positioning factors that show you the level of alignment and thereby inform discretionary conviction.

The underlying attribution of each driver so that you can always know the WHY behind a specific skew.

When we understand the skew of an asset, the total strength of drivers, and underlying attribution, we can begin to have a high degree of accuracy in identifying short-term levels that display the probable distribution of these changes. Each strategy will have a display of the short-term levels that flow directly from the strategy as opposed to being arbitrarily based on subjective biases.

In addition to the launch of all of these new strategies, we are launching a tactical trade portfolio that is specifically designed to focus on short-term trades that flow from the strategies above AND other internal strategies we are running. We will also be publishing the short internal memos that we use to inform daily decisions. The tactical trade portfolio and internal memos will be published and updated daily in the Chat function: Here. The Trade Write-Ups (link) will continue to focus on the large-leverage bets that have asymmetric opportunity for home runs, while the tactical trade portfolio will focus on all of the incremental opportunities that present themselves on a shorter-term basis.

If you want to see the current tactical portfolio tracker, then it will always be available in the Chat function, and you will see Capital Flows Admin facilitating this process (This will start in the next 24 hours, so keep an eye out for it).

If you are here, then we think about the world in the same manner. You don’t need an Ivy League degree or letters behind your name to succeed in today’s world. What you need is a mindset that continually learns and NEVER quits. The foundational quote of Capital Flows has never been more true in light of the new wave of AI.

“You wasted $150,000 on an education you coulda got for $1.50 in late fees at the public library.”

I will say this: outsized returns in life come from highly concentrated bets. The Capital Flows Substack has been and will continue to relentlessly invest in the highest quality talent and projects in public and private markets. If you are long as a paid subscriber, then you know the upside is only going to increase.

And YES, we are keeping the Pepe because it represents the unconventional path that pays the highest returns in life.

Macro Regime Tracker:

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

Macro Regime Context

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

AI and Machine Learning Strategies - Macro Regime and Positioning Premiums Strategies: S&P 500, 2-Year Interest Rates, Gold, and Bitcoin

Macro Regime Context:

We saw the tariff catalyst today function as a short-term clearing event, and additional cuts get priced in 2026 SOFR as the Trade Write-Up laid out. As we progress and some underlying drivers change, I will be reassessing and reupdating macro views in an additional Trade Write-Up.

Main Developments In Macro

*ADP US MARCH PRIVATE EMPLOYMENT RISES 155,000; EST. +120K

*US TO SET BASELINE TARIFF RATE OF 10% FOR ALL COUNTRIES

*CANADA, MEXICO NOT SUBJECT TO RECIPROCAL TARIFFS FOR NOW

*WHITE HOUSE SAYS HIGHER TARIFFS TAKE EFFECT ON APRIL 9

*BESSENT: US ON WARNING TRACK FOR DEBT CEILING IN MAY OR JUNE

*OIL DECLINES AT OPEN AFTER TRUMP ANNOUNCES WIDE-RANGING TARIFFS

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

The analysis, focusing on economic data, the yield curve, and equities, will be formatted in a PDF moving forward. We will have a more extensive version tomorrow, but here is the initial one.

Macro Regime and Positioning Premiums - Strategies:

Equities (ES)

5848: unlikely to close above on a weekly basis without a significant shift in macro drivers

5733: reasonable probability post tariff

5575: Gap down from futures open

5463: likely to test level

5417: reasonable probability if macro tracker skew is realized

5307: Unlikely to close below on a weekly basis

In the top panel, the total impulse of macro drivers and positioning is illustrated in its strength. The greater the strength in the move, the higher the probability and amplitude of the move that is likely to take place. The bottom panel illustrates if the skew is either bullish or bearish probability. Right now, the ES strategy is skewed bearish.

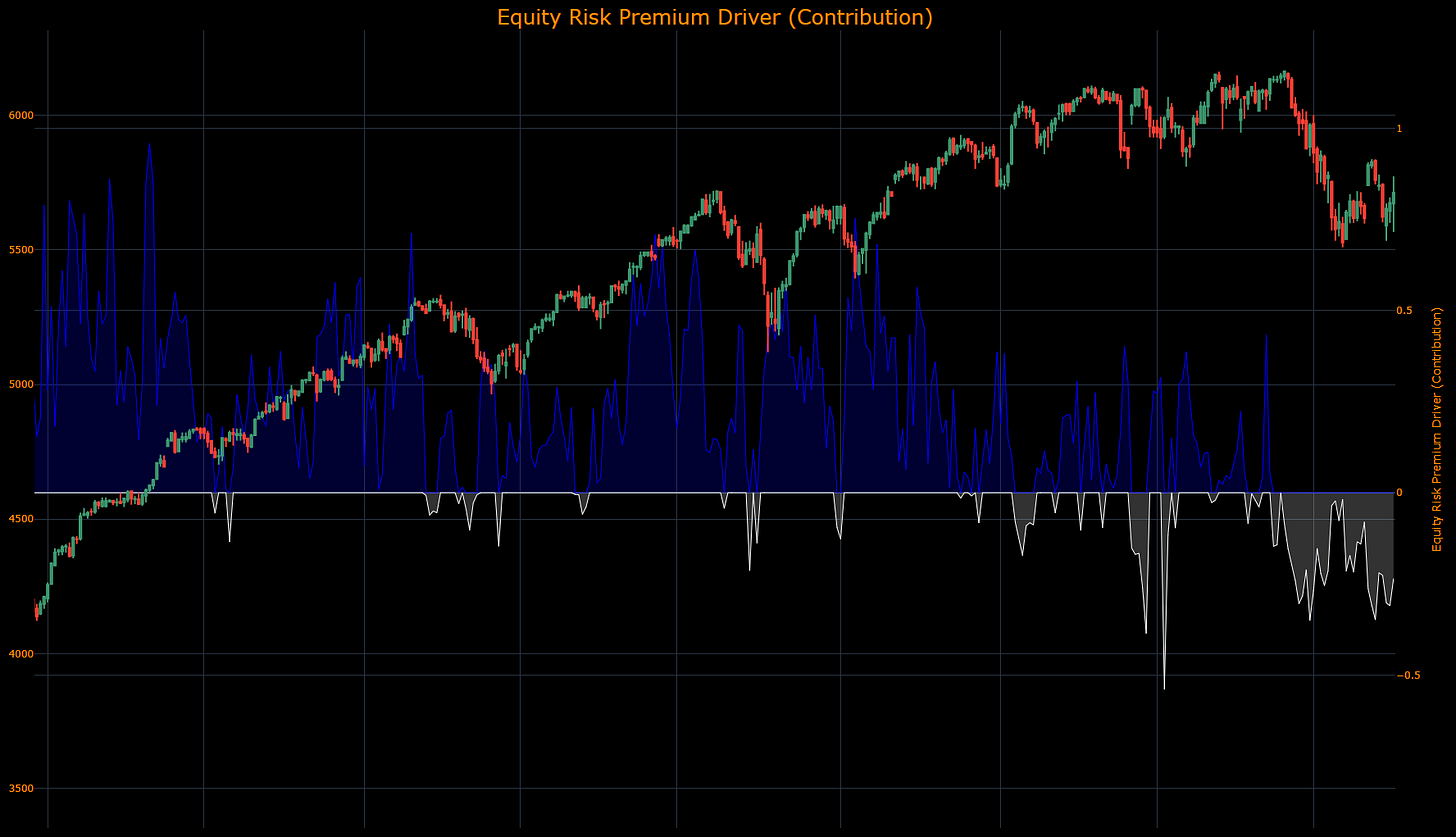

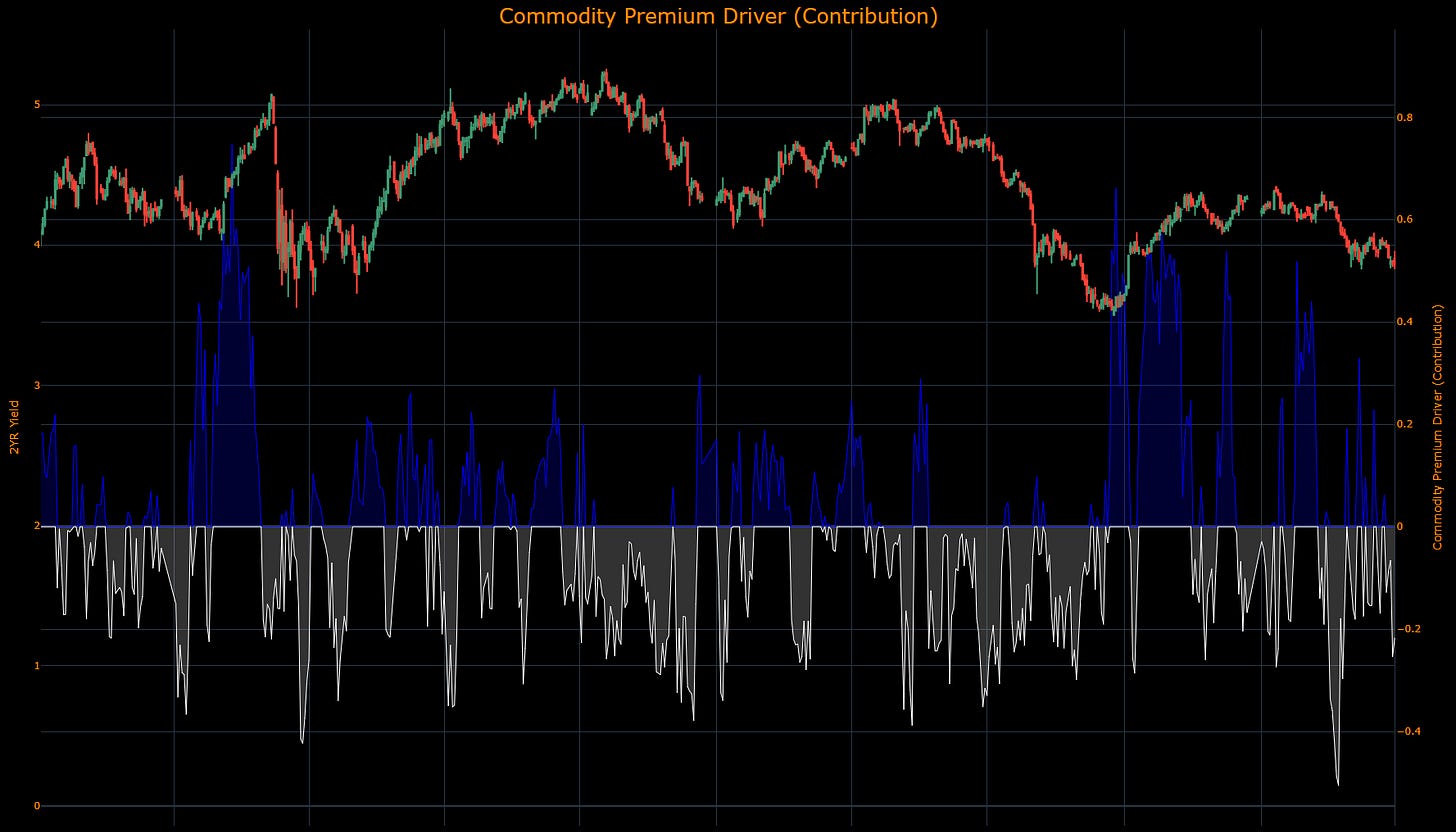

The next three charts show the underlying contribution for the Total Macro and Positioning Drivers in the chart above. These allow you to see the WHY behind moves.

The Equity Risk Premium contribution aggregates major macro factors and the strength of factors driving equity risk premiums. In the same manner, the higher the contribution moves, the more strength the drivers have in pushing the index in a specific direction.

The Positioning Premium Driver contribution identifies HOW the drivers of positioning are contributing to equity returns. In the same manner, the higher the contribution moves, the more strength the drivers have in pushing the index in a specific direction.

The Growth Risk Premium Driver contribution identifies HOW the drivers of growth are contributing to equity returns. In the same manner, the higher the contribution moves, the more strength the drivers have in pushing the index in a specific direction.

2-Year Interest Rate

4.00%: unlikely to close above on a weekly basis without a significant shift in macro drivers

3.88%: reasonable probability post tariff

3.84%: Gap down from futures open

3.82%: likely to test level

3.76%: reasonable probability if macro tracker skew is realized

3.71%: Unlikely to close below on a weekly basis

In the top panel, the total impulse of macro drivers and positioning is illustrated in its strength. The greater the strength in the move, the higher the probability and amplitude of the move that is likely to take place. The bottom panel illustrates if the skew is either bullish or bearish probability. Right now, the 2-year strategy is skewed bearish.

The Inflation Risk Premium Driver contribution identifies HOW the drivers of inflation expectations are contributing to 2-year returns. In the same manner, the higher the contribution moves, the more strength the drivers have in pushing rates in a specific direction.

The Commodity Premium Driver contribution identifies HOW the drivers of commodities are contributing to 2-year returns. In the same manner, the higher the contribution moves, the more strength the drivers have in pushing rates in a specific direction.

The Growth Risk Premium Driver contribution identifies HOW the drivers of growth are contributing to 2-year returns. In the same manner, the higher the contribution moves, the more strength the drivers have in pushing rates in a specific direction.

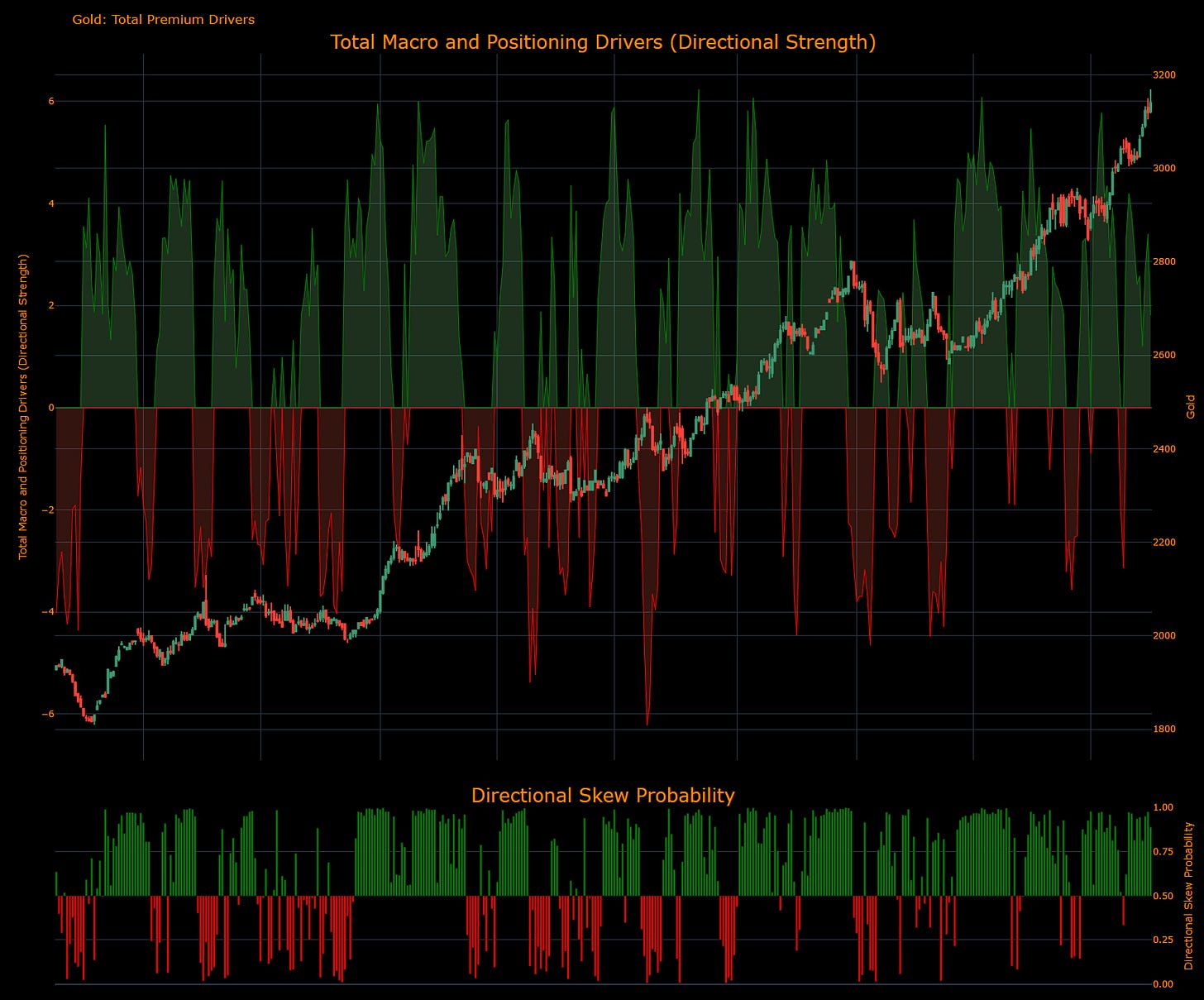

Gold

3275: unlikely to close above on a weekly basis

3218: reasonable probability if skew is realized

3192: Gap down from futures open

3096: Unlikely to close below on a weekly basis

In the top panel, the total impulse of macro drivers and positioning is illustrated in its strength. The greater the strength in the move, the higher the probability and amplitude of the move that is likely to take place. The bottom panel illustrates if the skew is either bullish or bearish probability. Right now, the Gold strategy is skewed bullish.

Gold is fundamentally about macro liquidity which means the drivers are marginally different than ES and the 2-year.

The US Macro Liquidity Driver contribution identifies HOW the drivers of US liquidity are contributing to the returns of Gold. In the same manner, the higher the contribution moves, the more strength the drivers have in pushing gold in a specific direction.

The Gold Risk Premium Driver contribution identifies HOW the risk premium of gold is contributing to returns. In the same manner, the higher the contribution moves, the more strength the drivers have in pushing gold in a specific direction.

The Dollar Liquidity Driver contribution identifies HOW the drivers of dollar liquidity are contributing to the returns of Gold. In the same manner, the higher the contribution moves, the more strength the drivers have in pushing gold in a specific direction.

The Global Liquidity Driver contribution identifies HOW the drivers of global liquidity are contributing to the returns of Gold. In the same manner, the higher the contribution moves, the more strength the drivers have in pushing gold in a specific direction.

Bitcoin

$89,320: unlikely to close above on a weekly basis

$85,560: reasonable probability if skew is realized

85,154: Reversal and selling pressure

$79,554: Unlikely to close below on a weekly basis

In the top panel, the total impulse of macro drivers and positioning is illustrated in its strength. The greater the strength in the move, the higher the probability and amplitude of the move that is likely to take place. The bottom panel illustrates if the skew is either bullish or bearish probability. Right now, the Bitcoin strategy is skewed marginally bullish.

The US Macro Liquidity Driver contribution identifies HOW the drivers of US liquidity are contributing to the returns of Bitcoin. In the same manner, the higher the contribution moves, the more strength the drivers have in pushing Bitcoin in a specific direction.

The Bitcoin Risk Premium Driver contribution identifies HOW the risk premium of Bitcoin is contributing to returns. In the same manner, the higher the contribution moves, the more strength the drivers have in pushing the Bitcoin in a specific direction.

The Dollar Liquidity Driver contribution identifies HOW the drivers of dollar liquidity are contributing to the returns of Bitcoin. In the same manner, the higher the contribution moves, the more strength the drivers have in pushing Bitcoin in a specific direction.

The Global Liquidity Driver contribution identifies HOW the drivers of global liquidity are contributing to the returns of Bitcoin. In the same manner, the higher the contribution moves, the more strength the drivers have in pushing Bitcoin in a specific direction.

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

Hey Cap, quick couple of questions:

1) Have the 2D and 5D ES models been removed, or will they be included in tomorrow’s extended version of the Macro Tracker?

2) Does the Tactical Trade Portfolio come with any additional costs? Just asking because the Capital Flows Admin page is showing a pledge/subscription screen.

how's risk premium of bitcoin calculated?