The Credit Cycle, Money, and Monetary Correlations

The misconceptions about the flow of money and how we are setting the stage for the macro end game

The Credit Cycle:

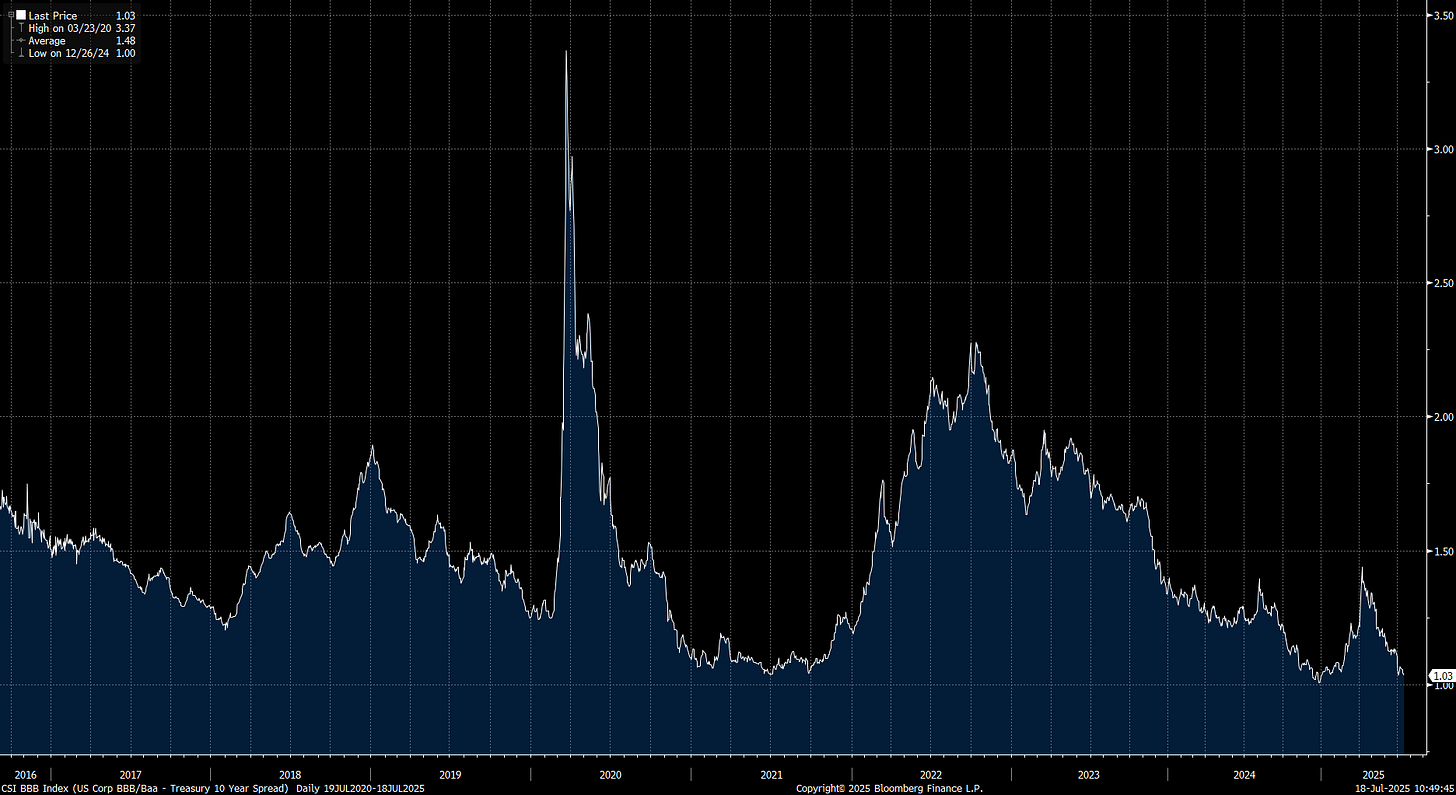

Credit spreads are functionally back at cycle lows, which is allowing corporations and businesses to easily take out debt to fuel future growth. When credit spreads are falling like this and GDPnowcasts are running above 2%, it is incredibly accommodative for the future outlook.

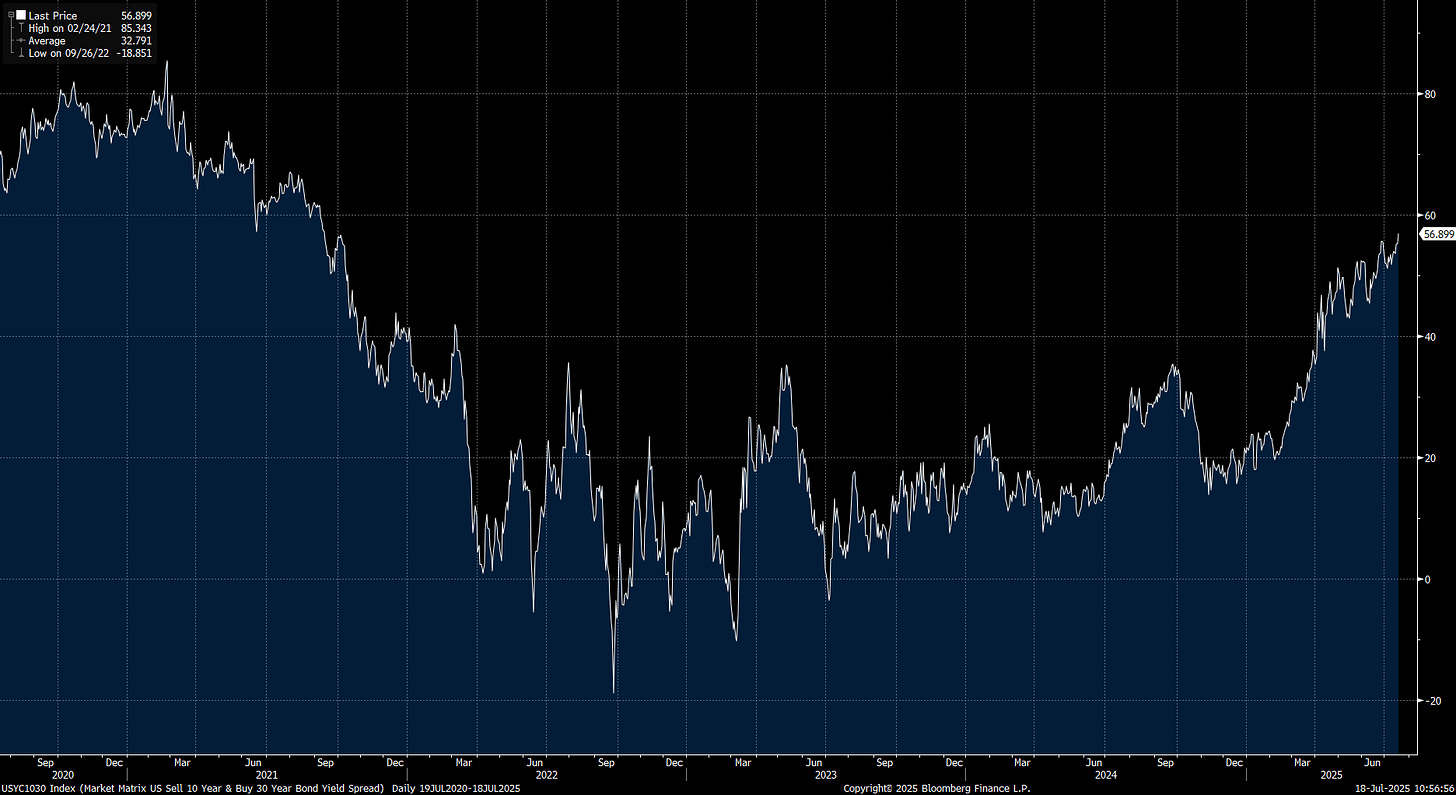

This is exactly why we continue to see 10s30s steepen to price in HIGHER nominal GDP expectations. Understanding the relationship of credit spreads with the yield curve frames EVERYTHING in macro for capital flows.

You can find the video I recorded on this idea here: (Attached charts: LINK)

Additionally, the educational playbooks for WHERE we are can be found here:

A Technical Scenario Analysis Of The End Game:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.