The Research HUB: How Crypto Fits Into Macro Flows

BTC, Crypto Majors and Memecoins

Crypto is one of the most interesting assets from a psychological and societal perspective because it is so polarizing. On one end of the spectrum, some people love crypto and have significant portions of their net worth in it. On the other end of the spectrum, some people absolutely hate crypto and have even made it their mission to speak ill of it and attempt to discredit it.

These polarizing extremes amplify when crypto makes a large move to the upside OR downside. For example, this past week BONK made a huge rally as it was added to the Coinbase platform:

This price action reverbted across headlines and the polarization amplified.

In this article, I am going to break down the following:

Why does this polarization in crypto exist?

How does crypto fit into macro flows?

Principles for trading crypto

Why does this polarization in crypto exist?

There are several reasons there is such polarization in crypto:

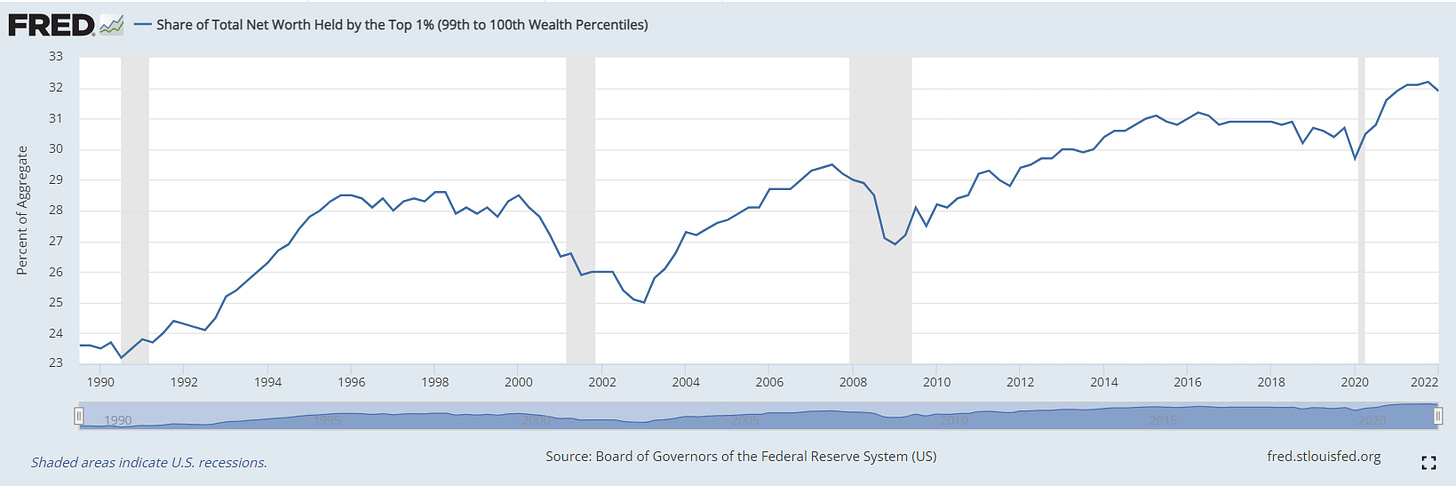

First, a lot has to do with where we are macroeconomically. Inequality is incredibly high which directly connects to the populism and outrage we see politically. Fundamentally, the financial state of a country is always connected to its politics (check out this book on it if you want to dig in more: Link). When inequality is high, people look for an exit out of the system.

Second, anything new and disruptive always creates a divide because it is a beneficiary to some and a threat to others. When people don’t understand something, they typically resort to criticizing it rather than saying “I don’t know.”

Third, many parts of crypto have been filled with fraud due to the lack of regulation. Many people will try to pump up the price of their low-float coins to dump their position on unsuspecting traders. However, this is true of regular financial markets as well.

At the end of the day, crypto is cloaked in a narrative that it is trying to take down the current establishment. When the government spends trillions of dollars at the same time the FED does trillions in QE, people want a way out.

How does crypto fit into macro flows?

With all of that being said, I am going to break down how crypto fits into the current macro flows of the system and its underlying drivers. It doesn’t matter if you love crypto or hate it. There are ALWAYS causal drivers that can be identified.

Fundamentally, crypto is a liquidity release valve in the economic system. What do I mean by liquidity release valve? When liquidity expands, capital moves out the risk curve causing valuations to expand. We see the expression of this risk curve in corporate bonds or equities. For example, companies with more debt on their balance sheet have a higher chance of default than a company with large cash reserves. This is typically reflected in the risk premia. However, if more capital is injected into the system, capital ALWAYS searches for a return and it moves out the risk curve to accomplish this.

This is why crypto correlates with specific risk assets. Correlations aren’t random, they are specific signals that reflect the underlying mechanics of the system.

For example, there is a reason that BTC has a high correlation between ARKK 0.00%↑ IPO 0.00%↑ and stocks like CVNA 0.00%↑:

These sectors are on the farthest end of the risk curve and have the best performance when money is the cheapest. People will complain that these assets “shouldn’t be trading this way” but then won’t complain about the fact that they locked in their mortgage at sub 3%. Both of these are a result of the same liquidity. They just ARE. There are always effects for every cause but there is no “right” or “wrong” in markets. Markets are meant to reflect what IS. Policy is meant to set what “should be” based on ethics, morals, and wisdom.

This is where understanding macro liquidity is instrumental. If you want an exceptional breakdown for thinking about liquidity, check out this article by Prometheus Research: https://prometheus-research.com/monitoring-liquidity-dynamics/

I would also encourage everyone to Subscribe to their ETF portfolio. It is the single best systematic macro research product out there right now (I don’t benefit financially from saying that, I am a Subscriber and simply love their product): https://prometheus-research.com/category/prometheus-etf-portfolio/

Concoda also has some amazing content on the plumbing of the system and how it connects to macro liquidity. Be sure to follow his work!

Pivoting back to crypto, since Bitcoin specifically has a limited supply, this impacts the overall float of the asset. It might not have underlying cash flows but that doesn’t mean it doesn’t provide utility as a digital commodity-like asset. Regardless of the asset you are trading, you always connect it to the underlying float of the asset.

When I say that crypto is a “liquidity release valve”, this is very clear when you look at simple liquidity metrics such as central bank reserves:

Real rates (chart is of real rates inverted and BTC):

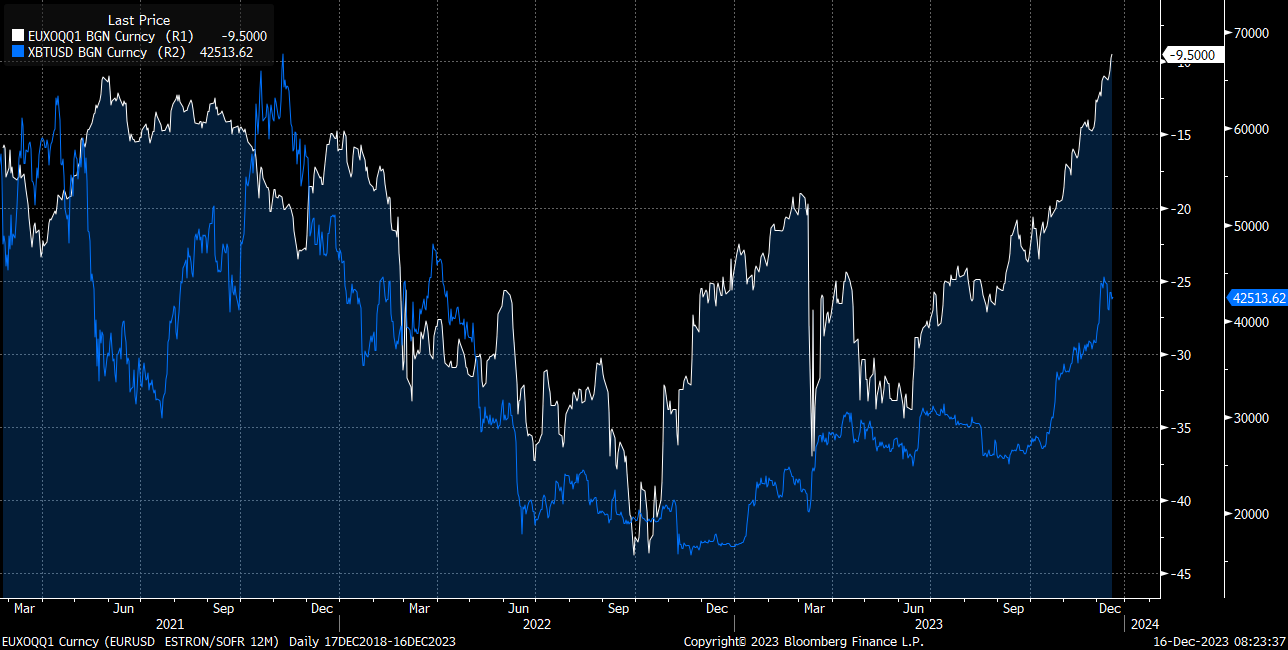

And cross-currency basis swaps:

It is especially a beneficiary when we are in a Goldilocks regime where liquidity is increasing as growth is resilient. See my notes here on the current Goldilocks regime:

The final thing I will say is that crypto is a global asset so technically you need to be watching how ALL central banks are influencing liquidity dynamics. For example, Japan and Asia were really important for BTC flows during 2021.

Ever since the BITO ETF was launched, BTC volume began to move in lockstep with major financial assets. If the spot ETF is launched sometime in January then BTC will be even more integrated into the financial system.

Principles for trading crypto:

I’ve spent a lot of time trading the majors in crypto on an outright basis as well as long/short. If you want to run a very simple process for analyzing or trading crypto, create regimes based on the following logic:

Macro Liquidity Expanding or Contracting? Y/N

Majors in Crypto (top 10 largest by market cap) showing positive or negative momentum? Positive/Negative

Minors in Crypto showing positive or negative momentum? Positive/Negative

Minors in Crypto Underperforming or Outperforming Majors? Underperforming/Outperforming

If you use these questions as logic for determining bullish or bearish positions then you will have a reasonable system. After you establish a bullish or bearish view, you could simply use an ATR or moving average crossover to further refine execution.

For example, here is an ATR strategy in Tradingview:

And here is a moving average crossover strategy from Tradingview:

These are very simplistic ways to trade but they begin to provide you with a framework of HOW to think. If you want to dig into this idea of “creating regimes” then check out this article:

As you know, all the educational articles are synthesized in a single place. I will be adding to these over the holiday season so stay tuned!

Conclusion:

If you are trading memecoins like Bonk or simply trying to maintain a holistic view of liquidity and its impact on assets across the risk curve, understanding these fundamental principles are crucial.

Right now I am bullish due to the macro regime we are in. See tweet here:

https://twitter.com/Globalflows/status/1735036832684068903

Additionally, here is an older tweet I did on BTC:

https://twitter.com/Globalflows/status/1662236458621587462

If you want to follow several accounts that provide a lot of value in the crypto space, I suggest you check out. They are all really good guys who share a ton of value:

Enjoy the weekend!

In the information age, you simply need to be at the right place, at the right time, with the right information to succeed

Keep up the 🔥notes 🫡👍🏻

Good write up, CF