Geopolitical Risk and FOMC:

We are entering a week where two major factors are going to interact with the macro regime: 1) Geopolitical risk and 2) FOMC. These factors are going to interact with the positive growth regime (See Macro Reports on the macro regime: LINK and LINK) we are in which means understanding these catalysts within the proper context will inform the risk reward of all major assets.

We will start with redundancy planning and proper analysis and them move into specific trade ideas.

Redundancy planning and scenario analysis:

First, the context and scenario analysis for crude is here: (if there are issues with downloading, it is available here as well: LINK)

I expect gap risk at the open given how elevated vol is and the developments in news of the conflict. Outright volatility is very elevated and implied volatility premiums (second panel) are elevated along with the term structure (third panel) and call skew (bottom panel). In other words, people are clearly aware and betting on further upside. This doesn’t mean we can’t have CL rally because as long as physical things are taking place in the oil market, CL can keep rallying. There will be a time to short crude but we are not there yet. We need to see a clearer rejection. If the geopolitical risk accelerates, I expect significant rallies higher. $100 crude is not out of the question but its all about how crude begins to consolidate and how domestic and other international players begin to increase production to meet demand.

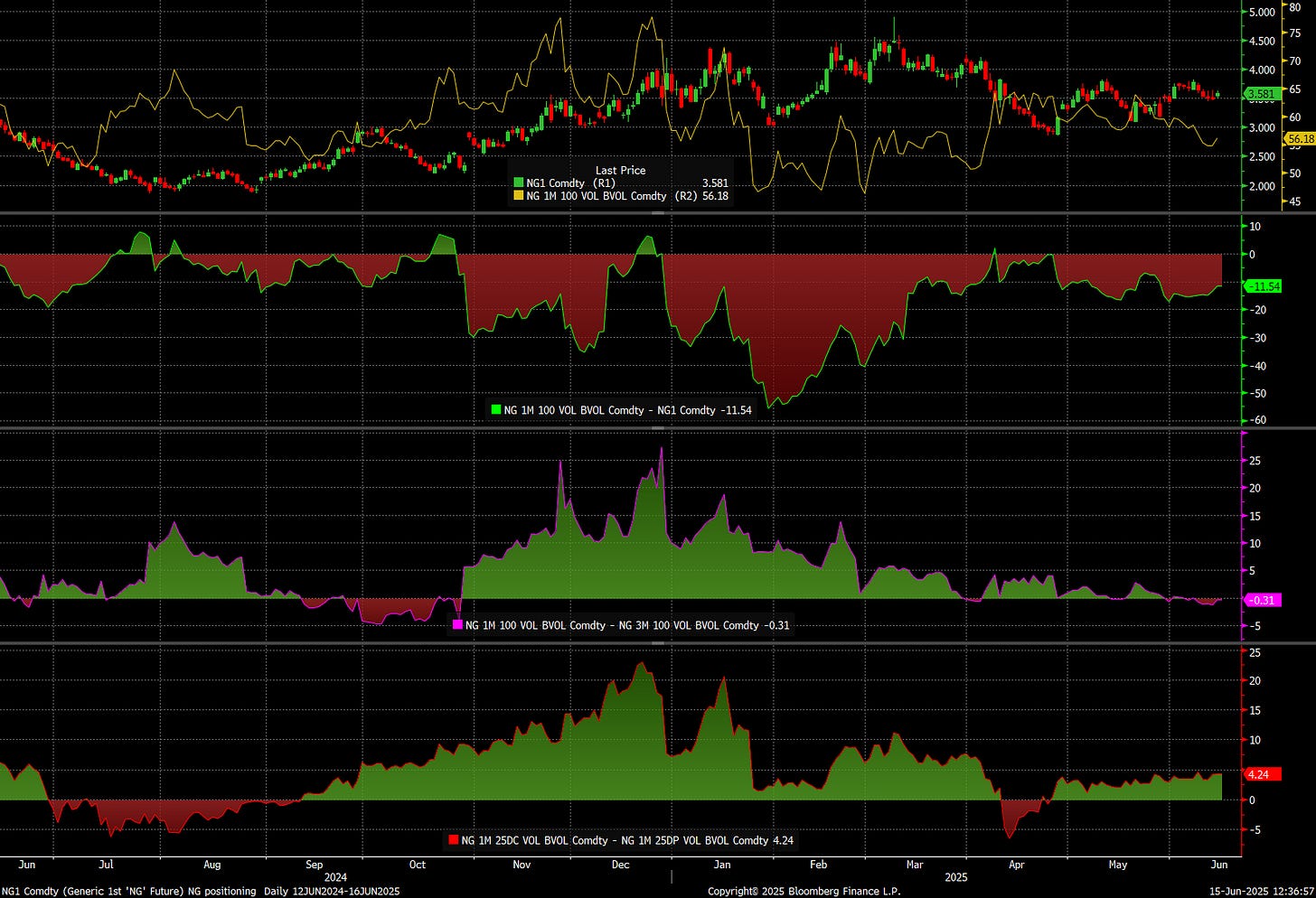

Second, the changes in the Strait of Hormuz Statu could begin impacting the Nat Gas market as well. Around 20% of LNG trade passes through the Strait of Hormuz near Iran. The context and scenario analysis for Nat Gas is here: (if there are any issues downloading, here is a link as well: LINK)

We have not seen any type of significant bid in NG yet so if there is complacency, it is likely here. I will be watching it incredibly closely and looking for potential longs.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.