Trapped by Trade: Central Banks and the Impossible Trinity

Global trade exposure and capital mobility are eroding central banks’ ability to independently control monetary policy

Central Banks and Trade:

Central banks do not operate in a vacuum; they are increasingly constrained by the structural realities of global trade and capital mobility. At the heart of this is the impossible trinity, or trilemma: the principle that a country cannot simultaneously maintain a fixed exchange rate, free capital movement, and an independent monetary policy. In a world where trade linkages and cross-border flows are deep and accelerating, central banks in export-heavy economies are often forced to subordinate monetary sovereignty to exchange rate management, lest currency misalignments crush their trade competitiveness. Conversely, nations dependent on imports become exposed to the pass-through effects of foreign exchange volatility on domestic inflation, limiting policy flexibility. In both cases, the domestic economy becomes implicitly leveraged to global trade flows and foreign exchange dynamics, turning the central bank from a policy setter into a reactive agent in a tightly constrained system.

The divergence between the United States and China sits at the core of global market dynamics in 2025. The U.S., with its persistent current account deficit and reserve currency status, opts for monetary independence and free capital movement, allowing its exchange rate to float. In contrast, China maintains a managed exchange rate and strict capital controls to support its export-driven economy, effectively sacrificing full monetary autonomy. This structural split along the lines of the impossible trinity defines their strategic behavior: the U.S. uses rate policy as a domestic tool, while China targets external competitiveness and financial stability. This foundational asymmetry underpins the tariff escalations seen YTD, as the U.S. seeks to counterbalance its structural trade disadvantage and reassert control over supply chains. The result is a reordering of global trade flows and FX pressures that ripple across all asset classes.

Macro Context:

The structural dynamics noted above contextualize what is going to take place next in the macro regime. If there is one chart that is completely outside of the consensus narrative, it is about global services inflation. The reason WHY no one is focusing on it is because central banks have already begun cutting, and trend followers assume the coast is clear.

The chart below shows Services Inflation for each major country. You will notice we are nowhere near 2019 levels. We are still very elevated, and the BoE and ECB have already begun cutting rates!

I laid out the initial framework for how to connect these ideas to the tangible price action in markets in yesterday’s report:

The recession callers will say that US services inflation is still trending down and growth is about to collapse. While core services decelerated in the last print, it is unclear how much of this was a short term move due to tariffs and how much is actually reflected of the structural macro regime.

Here is the problem: if the growth situation is really that bad, why are interest rates back at the same level they were on April 4th when the last CPI print came out lower?

Why has the Atlanta Fed GDPnowcast rebounded and is now positive?

Why is the trend in the labor market clearly showing more and more jobs being added to the economy?

Why is all of the real-time alternative data indicating an expansion in growth?

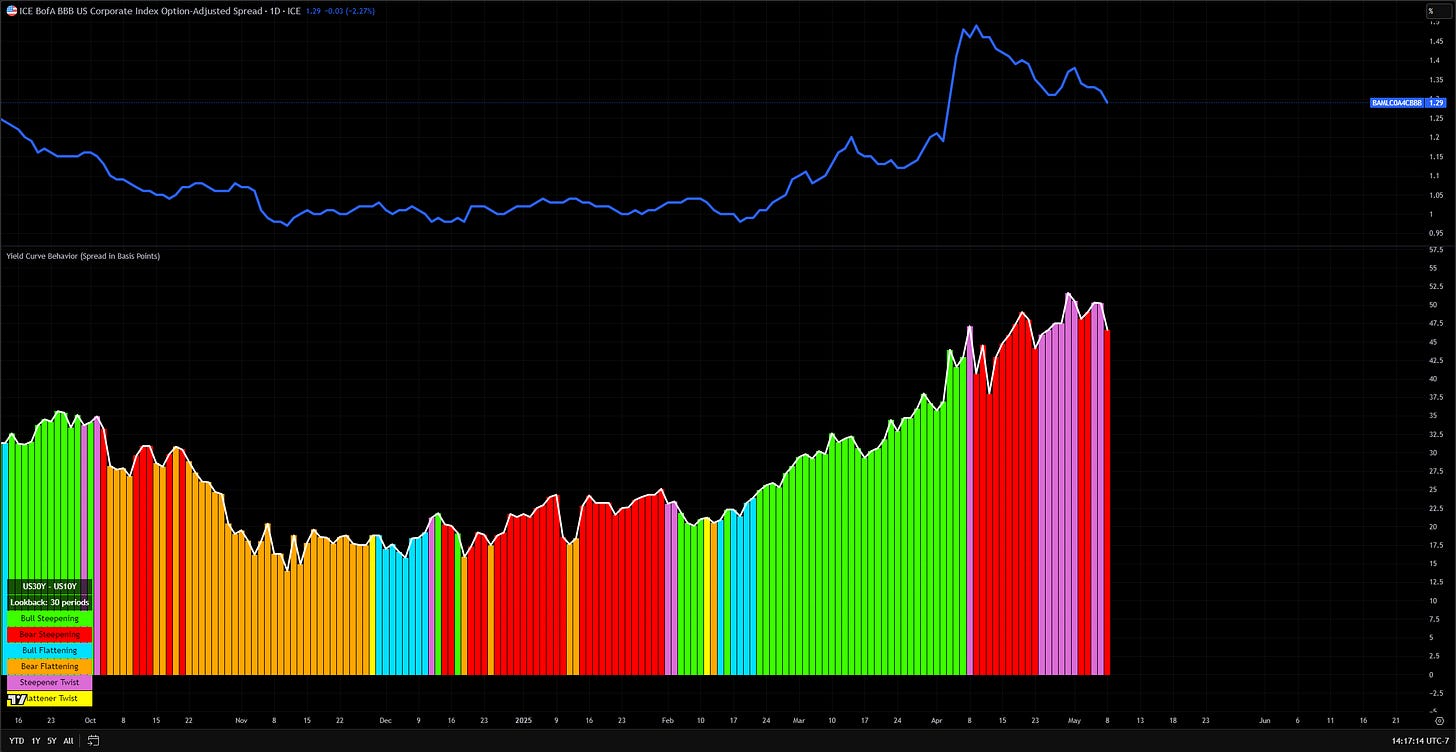

All of these questions are pointing to what the yield curve has been screaming for months: higher nominal GDP. When credit spreads are falling and the 10s30s curve is bear steepening, this is the exact OPPOSITE of what you see during recessions.

These forces will inform the next macro bet in the trade write-up section (I am working on this right now). You can see the first idea laid out here, which plays right into the TYPE of curve move we are seeing in 10s30s.

If these ideas are new to you, all of the educational primers are here, and you can feed all of the papers and books into ChatGPT.

As a reminder, there are now 7 days left to lock in the early adopter’s rate on the Substack. All of the links and details are in the article below:

The best is yet to come

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

Owner's equivalent rent accounts for roughly 33-35% of services CPI. From what I can see, all live rent measures aren't showing any upside pressure; if anything, the construction boom that started in 2021 is adding supply gradually. On the demand side, the u-turn in total immigration (legal and illegal) should keep demand tepid. Shouldn't we be looking at leading indicators? What do you think I'm missing? Furthermore, equities have rebounded above April 2nd levels, even though we still don't know what the impact of tariffs will be on the real economy. Fiscal impulse probably won't amount to much given that it's mostly in the form of extending existing tax cuts. With back-end rates flirting with 5%, and next 2y deficit @ 7-8% of GDP, I have a tough time seeing how this won't be the last deficit increase. Lastly, we might have seen some frontloading ahead of the tariffs on consumption data.

Regarding Europe, apart from Germany, no other major economy has the balance sheet and income statement to add more stimulus (France, Spain, and Italy). Populism is on the rise worldwide, but the system has actual constraints. For now non-German 10y EU sovereign yields are well contained, but they would quickly rise to 4.5-5% in the case of a significant fiscal overhaul, and crowd out much-needed private sector investment to boost productivity. What do you think of these points? We're potentially looking at different time-frames.

So reading across your recent posts, it seems like we are more likely to see inflation reaccelerate or remain flat than disinflate. Rule of thumb that disinflation follows a growth slowdown would support that. Even a modest slow down or recession might not drop inflation low enough for the fed to cut a ton if employment doesn’t fall much. All this makes the next risk to equities maybe another liquidity drain to much higher long end yields ala 2022? Is that on your radar or you expecting a growth grind up with steady inflation? How do you see this playing forward 1-2 moves?