Alpha Report: Asymmetrical Information

What knowledge gaps reveal about financial markets

AI, The Information Age, and Financial Markets:

I want to start today’s piece on an educational note about asymmetrical information. There are two quotes that I have consistently shared on this Substack.

In the information age, you simply need to be at the right place, at the right time, with the right information to succeed

And

“You wasted $150,000 on an education you coulda got for $1.50 in late fees at the public library.”

Why are these important? Because if you understand how to interact in the TYPE of world we live in then you will recognize that the bridge to success is self-education. We have entered a period of time where the barriers to entry is so low due to online education and AI tools. There are things I didn’t have the capacity to do a few years ago that I can now have hundreds of bots do for me every day. I quite literally have AI bots up and running next to my Bloomberg Terminal all day long doing processes for information flow or searching the internet for resources.

The barriers to entry have never been so low BUT the competition has never been so fierce. Fundamentally, technology concentrates wealth and amplifies outcomes. This means that those who are disciplined autodidactics will be able to achieve a much larger spread than those who aren’t. However, the competition is only getting more fierce as the entire world becomes your competitive playing field. In the same way that global value chains opened opportunity for companies to sell their goods/services internationally, they now have competition that is international as opposed to just local.

I share all of this because THE most competitive market in the entire world is the US market. US equities, rates, and currencies against the dollar have the best people in the world trading them. I will say on a personal level, so many people in markets are chasing trades instead of building systems that allow trades to come to you: (From Advances In Financial Machine Learning)

This Substack is meant to be the place where I show the full spectrum of all of the building, research, and trades connected to macro. No one is forcing you to show up every day and the success rate is astronomically low. If you are the type of person who operates at their best when things are at their worst then welcome to global macro.

The Big Picture:

The primary tension to understand in this macro regime is that valuations are high across all major indices BUT we are not seeing an imminent driver to cause a contraction in either the cash flow component or valuation component on a macro basis.

This big-picture theme and its connection to interest rates was laid out in the recent macro report

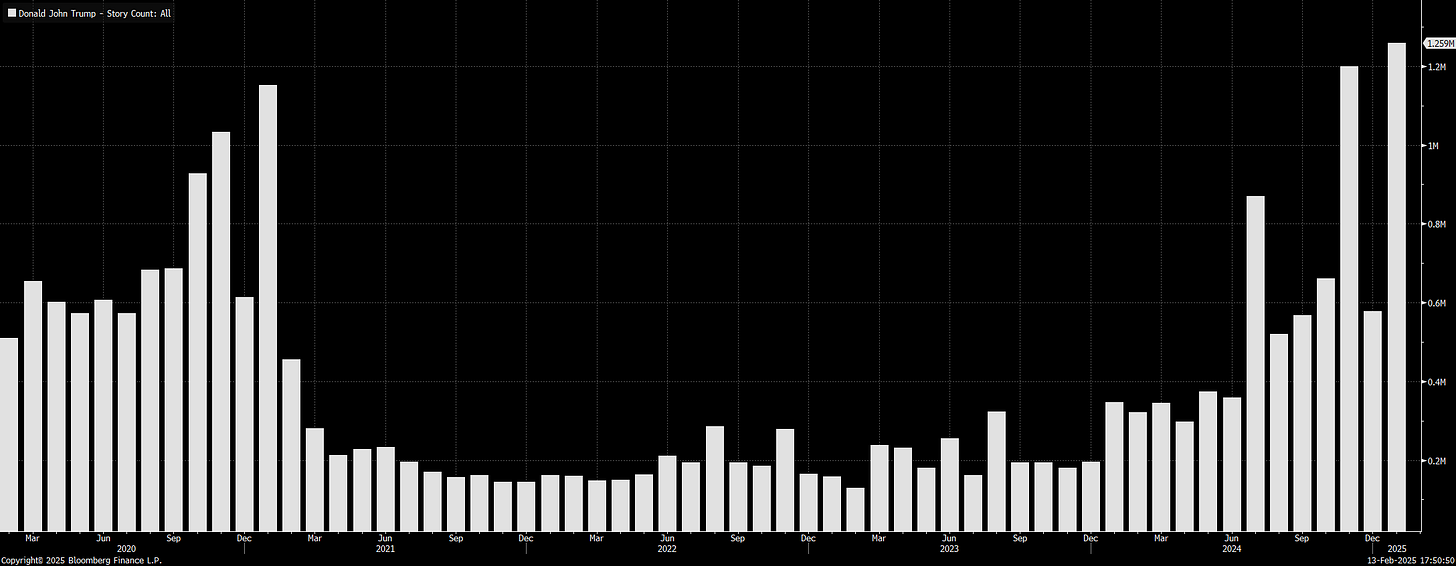

This rally in equities has been overlapping with a focus on the new administration and positioning remains incredibly strong:

This is why the long equity trade was published for paid subscribers BEFORE the CPI clearing event:

The more important question now is zooming into the underlying mechanics of the rally and how it connects to broad risk flows.

Zooming In:

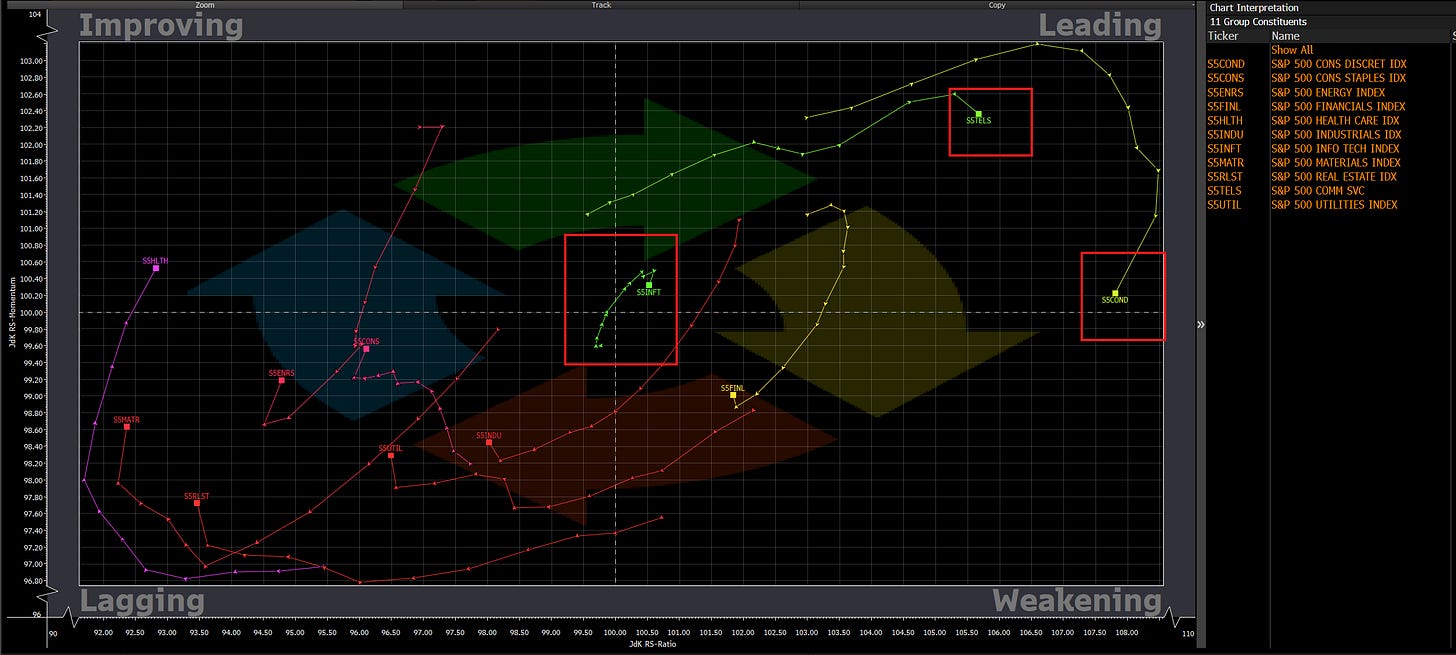

As we have shifted to begin pushing up to all-time highs, tech, telecommunications and consumer discretionary have begun leading the way:

You will notice that the Nasdaq has begun rallying and diverging from Bitcoin since the initial positioning unwinds and now CPI print.

Why is this divergence taking place? Part of the reason is that we are still seeing the Russell underperform as capital allocates toward quality. Watching the RTY/YM ratio in connection with Bitcoin will be a helpful signal here:

The momentum trade continues to have a ton of capital allocated to it. Even NVDA has shaken off its tariff shock and is pushing back to all-time highs. The risk premia yield of NVDA 0.00%↑ even went above the sector yield for a moment.

We are not seeing imminent signs of deterioration in equities that are driven by macro factors. In fact, we are seeing resilience to the macro regime after the positioning shocks that took place. As a result, we are unlikely to make a weekly close BELOW the 6050 level where CPI hedges were unwound.

Pulling Things Together:

On the inflation front, the PPI print came in above expectations similar to the CPI print.

Why this does matter? Because the services line item of PPI remains range-bound as the goods portions accelerated. Difficult to have bull steepening (there period where you get leverage long TLT) when this is taking place.

This is connected to the tariff risk as I laid out here:

However, you will notice that even with the inflation print coming in above expectation, the market was not interested in pricing LESS than 25bps of cuts for 2025 as a whole. In other words, the market isn’t convinced that we are moving into an outright reacceleration with inflation:

This is actually a reasonable stance by the market since Fed funds still sit around 100bps above CPI:

If inflation swaps move any higher than this though, the Fed will likely be constrained to make some hawkish statements that get credit spreads higher in order to actually be restrictive on financial conditions. For the time being though, the Fed is in a pausing stance and equities are skewed to the upside.

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

Your point about competition is not just conjecture, it is quantifiable. The Equity Risk Premium and PE of the major indices all being extended to 20+ year extremes without some exogenous outlier event, both say that more hands are grasping for the same dollar, as well, without a clear explanation that those earnings are going radically higher any time soon.

Great insights! Technology makes it easier to start but harder to win. Self-education and smart systems are key. Looking forward to more!