Bitcoin and Its Emerging Market Structure

How macro liquidity is being transmitted

Macro View:

Anytime I approach an asset, it always starts by asking what the drivers are. If you don’t know WHY an asset is moving, then you are functionally just using momentum as a signal for action. The limitation of using momentum is that there are ALWAYS pieces of information in a time series that are not inherently reflected in the price.

When we think about this principle in relationship to Bitcoin, there are significant insights that directly relate to predicting the price and trading it. The goal of this report is to explain HOW macro liquidity is directly tied to Bitcoin and WHY the evolving market structure is fundamentally changing how you should trade Bitcoin.

One of my main goals in markets is to identify HOW the rules of the game are changing BEFORE everyone else realizes it. Over the last 5 years we have seen some dramatic changes in the flows for Bitcoin and how positioning adapts to have the best exposure.

Macro Liquidity:

Every asset ALWAYS functions in the context of macro constraints. Bitcoin has many people buying and selling it from many countries. Regardless of what popular narratives say, every single person has their Bitcoin cross-collateralized with something else. If a person is running a portfolio with leverage and begin to have a drawdown, they typically pull back exposure across all assets by selling to raise cash. This is one of the reasons correlations take place because managers put up and take down exposure across everything all at once.

The other way Bitcoin can be cross-collateralized is simply if an individual begins to experience financial difficulty in their income, they will sell assets to be able to survive. So every single asset is directly linked with the incomes of consumers in the economy. At the end of the day, if someone truly needs cash to pay rent or buy food, they will sell their Bitcoin (or any asset they hold). When you have mass adoption of the asset, this is what happens.

This is why understanding money in the system is fundamental for understanding any asset. We know that ALL MONEY THAT IS ANYWHERE HAS TO COME FROM SOMEWHERE. When we think about this from an economic and financial markets perspective, there are two key ideas to keep in mind:

Economy: We know that the amount of money relative to output (total goods and services) is reflected in inflation. This is ALWAYS a relative relationship. There are no true price controls in any system, only a transfer of risk reflected in capital flows.

Financial markets: We know that in modern financial markets with central banks and fractional reserve banking, both interest rates and the quantity of money in the system determine the AMOUNT of macro liquidity/money.

I have written comprehensive primers on these two ideas as well as Bitcoin that are laid out here:

Macro and Microstructure:

So we know Bitcoin falls directly into the macroeconomic framework for money because it is 1) priced in dollars, and 2) cross-collateralized with other assets because it is held by people operating in the economy and financial markets.

The question we need to ask from here is HOW is the transmission mechanism between dollars and Bitcoin evolving over time? If we can understand the answer to this question then we can begin to know WHAT signals to watch for determining WHEN to buy and sell.

When you have financial products created around Bitcoin, it creates NEW avenues for market participants to express risk. Anyone who actively trades and is monitoring the calendar for these financial products is actively front running these types of events which is way the majority of them have created short term tops in the price of Bitcoin.

Progression of Financialization:

May 13 2016 – BitMEX launches the perpetual swap

Creates the benchmark instrument for leveraged retail flow, setting a precedent for high-volume 24-hour derivatives trading.December 10 & 18 2017 – CBOE and CME list USD cash-settled Bitcoin futures

Opens a regulated on-ramp for U.S. institutions and hedge-fund basis trades, integrating Bitcoin into mainstream derivative markets.January 2018 – June 2019 – Post-launch volatility spike then decay

Academic studies show that futures initially boost, then dampen, realised volatility—evidence of growing market efficiency as liquidity deepens.September 23 2019 – Bakkt introduces physically-settled Bitcoin futures

Tests demand for deliverable contracts; although uptake is modest, it proves the feasibility of physical settlement in crypto derivatives.January 13 2020 – CME lists options on Bitcoin futures

Adds convexity and enables miners, treasurers, and institutional desks to run structured-product and hedging strategies.May 3 2021 – CME launches Micro Bitcoin futures (0.1 BTC)

Lowers contract size, attracting active retail traders and enhancing arbitrage links between CME and offshore perpetual-swap markets.October 19 2021 – ProShares BITO futures-based ETF begins trading

Becomes the first U.S. Bitcoin ETF, proving investor appetite and creating a precedent for exchange-traded exposure through futures.January 11 2024 – SEC approves spot Bitcoin ETFs (e.g., IBIT, FBTC, GBTC conversion)

Triggers a sustained institutional inflow wave; ETFs now hold close to one million BTC and anchor weekday liquidity.March 2025 – Derivative open interest hits all-time highs

CME Bitcoin futures OI tops USD 11 billion and Deribit options OI exceeds USD 42 billion, confirming derivatives as primary price-discovery venues.

The main idea that you should take away from Bitcoin is that it is HIGHLY financialized and is moving in lockstep with traditional equity factor flows. The additional factor is that you have all of these new companies like MicroStrategy that are using their publically traded status and leveraging their capital stack to acquire Bitcoin. This is an additional way traders are getting exposure to Bitcoin and it’s very important to monitor. You can find a full list of these companies here: https://bitcointreasuries.net/

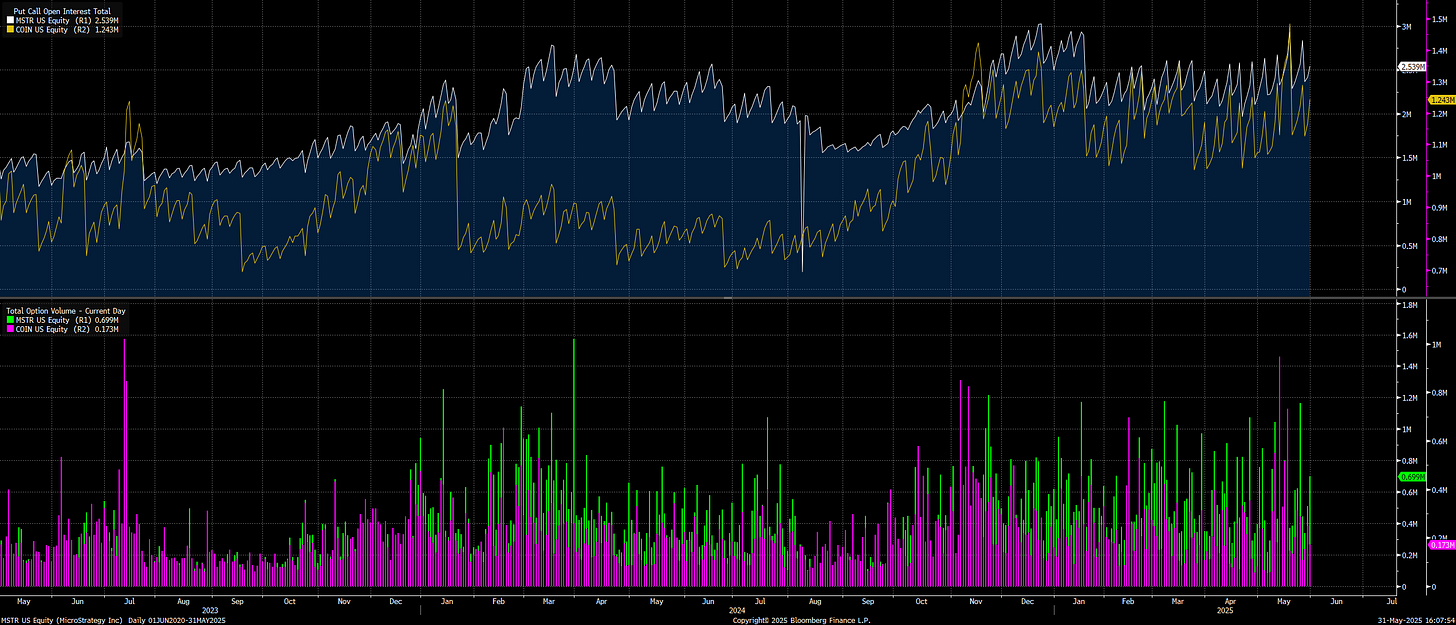

The interesting thing for these Bitcoin proxies like MicroStrategy or Coinbase is that they have very liquid options on them that traders are using to bet on the price of Bitcoin. Here is a chart of total open interest for the main BTC proxies as well as the ETFs.

Now here is the thing, I laid out in the Bitcoin Strategy primer how you need to watch Bitcoin’s correlation to equities and factor flows. There are additional things to keep in mind now.

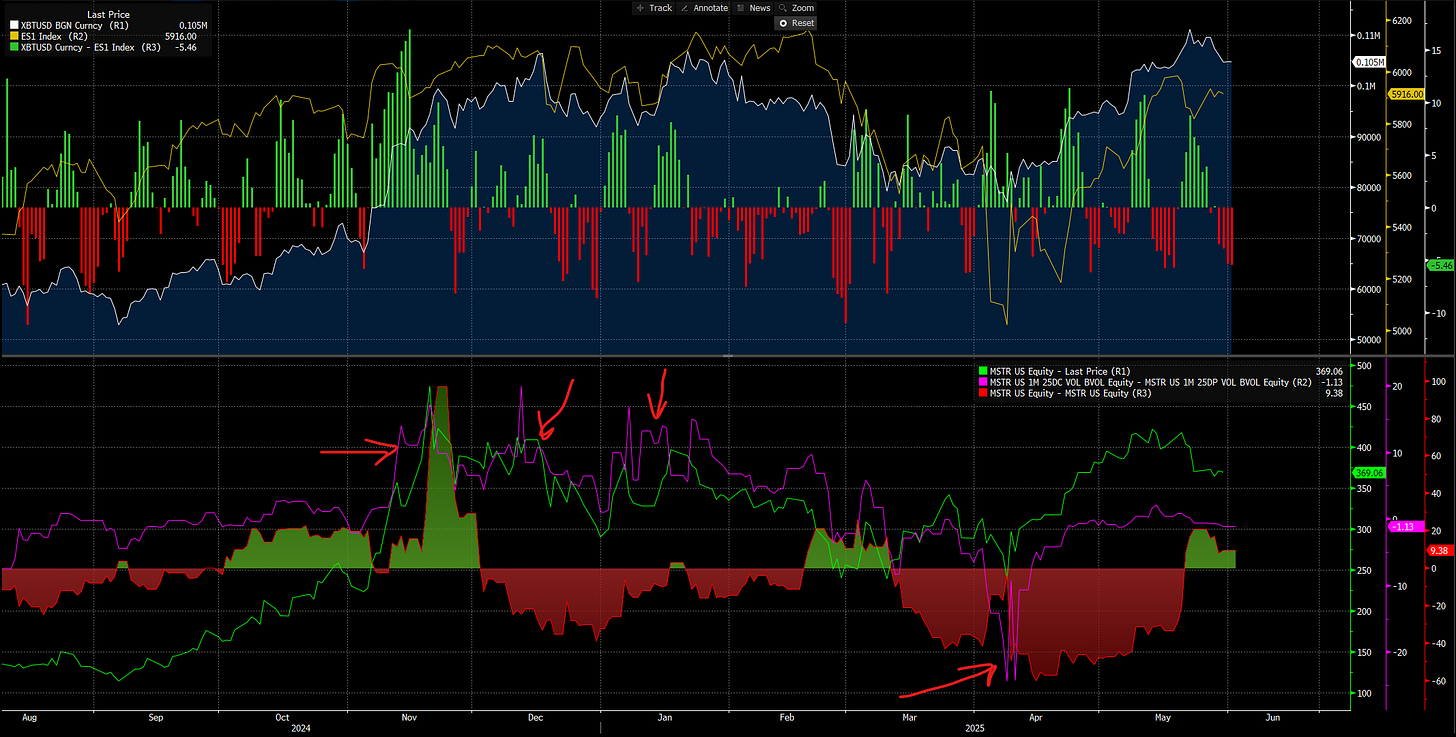

What I am going to do is use MSTR as an example of what is beginning to happen across all the Bitcoin proxies: In the top panel I have the green and red bars as 5D rolling returns of BTC minus 5-day rolling returns of ES so it is showing Bitcoin outperforming (green) and underperforming (red) the S&P500. The bottom panel shows MSTR price (green), the 25 delta call minus the 25 delta put (vol skew) to show WHICH DIRECTION traders are paying a premium for options (Read this primer if you don’t understand this: LINK), and then implied volatility minus realized (green and red shaded).

Now, I want you to notice how call skew (purple line in the bottom panel where I drew red arrows on it) blew out on MSTR at the end of 2024 and into the beginning of 2025. This showed traders paying a massive premium for upside on MSTR. You will notice that as soon as this happened, you began to see the periods of underperformance in ES move to a range-bound market and eventually lower as opposed to establishing a higher low for continued uptrend.

The main idea to take away from this is that the positioning on MSTR is critical to watch in connection with Bitcoin outperforming or underperforming ES. You will notice that many people on twitter or youtube will talk about the lead/lag relationship between Bitcoin and equities. This correlation was being traded and taken advantage of a long time ago. Knowing this lead-lag relationship provides very little value. However, if you can know WHY this lead/lag relationship is taking place, then you can know if the leading/lagging is a directional signal about Bitcoin going in a new direction or playing catch-up to where ES actually is.

Simply put, if Bitcoin underperforms ES, does this mean it needs to rally more to “catch up” or is this a signal that ES is going to begin to move lower? This is the fundamental problem with lead/lag flows. To solve this problem, we need to know the WHY behind the move and HOW positioning is paying a premium or discount for volatility.

There’s a Catch:

Now there is a bit of a dilemma that we face. Let’s say an institutional trader or retail trader wants to get exposure to Bitcoin. Both have the same problem, HOW do I get exposure? Is it going to be through futures, a BTC proxy, options on a proxy, ETFs, spot market, or even on-chain protocols like Hyperliquid?

If you had the majority of capital trading in a single place then you could map WHERE positioning is taking place in a much easier manner. The problem is that open interest and the flows of capital around Bitcoin are ALWAYS changing.

Let's keep things super simple and say we are watching skew on MSTR and COIN in connection with the Bitcoin price to begin to map extremes in price action for trading a range. The more open interest and volume in the stock as a percentage of the overall Bitcoin flow in the entire system, the greater the signal it has. The chart below shows the total option open interest (top panel) and volume (bottom panel). You can see the amount of open interest is always changing. Also, an important clarification is that this is just regular open interest and isn’t adjusted for the notional value. So since the stock price of MSTR is technically higher than COIN, you need MORE capital notionally to buy the same option.

The entire idea I am trying to communicate here is that the capital that is chasing alpha is always morphing to where the returns are the highest. This means you need to constantly monitor open interest across all of these financial products for Bitcoin AND correctly connect it to factor flows, equities, and the macro regime. This is how to understand positioning in Bitcoin. Positioning in Bitcoin operates within the constraints of the macro regime. Read these if this is new:

Macro Alpha Primers:

Macro Alpha Primer: Credit Risk and Duration Risk and Macro Podcast: Macro Alpha Primer

Macro Alpha Primer: Correlations and Macro Podcast: Macro Alpha Primer

Macro Alpha Primer: Macro Catalysts, Hedging Pressure, and Positioning and Macro Podcast: Macro Alpha Primer

Macro Alpha Primer: Positioning Premiums and Macro Podcast: Macro Alpha Primer

The reason why it sounds complicated is because it is and the traders who are actually doing this are very good at extracting returns from the market. I will also say there are always things I see that I prefer not to discuss publically because the things that worked in the last cycle won’t work this cycle. Capital always flows in a different manner and the microstructure of the market is always changing.

Final Point:

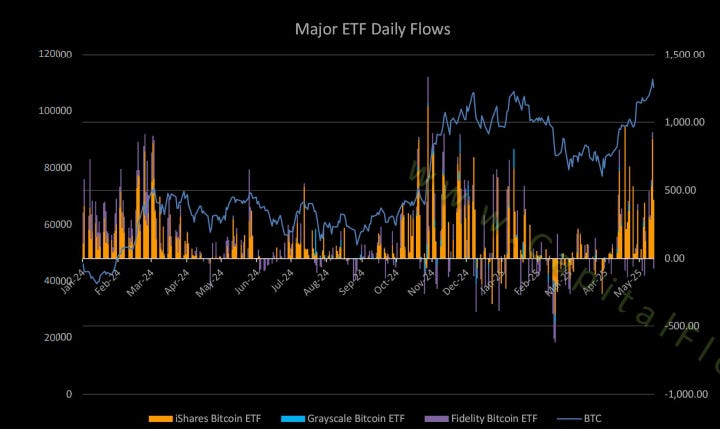

I publish all the ETF flow data daily in the Macro Regime Tracker in the Crypto Tear Sheet (this is always free link). What I will say is that the narrative around these ETF flows is that they are highly sticky. I don’t really buy this. The more financialized an asset becomes, the more weak hands trade it and get washed out.

If there was one thing I would challenge you to do is ALWAYS look for an informational edge. These markets are changing incredibly fast. Since 2020, the speed at which traders recognize things has become way faster. Part of this is due to AI and Machine learning which I obviously use as well but I will say things get priced so fast now.

In the long term, I view Bitcoin as a release valve for macro liquidity. This is the only thing that explains the full distribution of price action. There are so many positioning insights I didn’t even cover in this report such as how it connects to flows around gold, FX, and long-end bond volatility. If you are a paid subscriber, you will be seeing more on this topic as we progress through June because I do believe the amount of money that will be made and lost on Bitcoin will only increase as the options market on these products rises. Just remember, we don’t have 24/7 0dte options on Bitcoin yet so we are still early in the financialization process. Financialization doesn’t necessarily have a directional implication for Bitcoin though so don’t view this as a bullish statement.

As always, a Pepe for the culture:

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

i have a few illiquid crypto options exchanges offering 7 day per week 0dte on bitcoin but it's a serious liquidity concern. i think you're correct with asserting that we're not at the point of full options reach on crypto.

once again nothing better to do but to dig deeper

Question is if equities could break from liquidity cycle? Imagine the scenario where a global trade war creates uncertainty in forward earnings, while fanning flames of stagflation. Now we have treasuries, equities, and commodities entering free-fall. Where can we find safety other than precious metals? Anything else that has no earnings driven demand? Enters …bitcoin! Suddenly a rotation of liquidity from yield bearing assets to pure liquidity plays. The lead-lag relationship breaks and many are on the wrong side of the trade.

By the time liquidity dries up, crypto at highs, and the US Sovereign Wealth Fund chasing a $200k bitcoin… markets rotate into treasuries via “flight to safety trade” and yield bearing stable coin mania.

Can the relationship break between crypto and equities?