Brainstorm: Simple and Intuitive

Let's zoom out a little

Hey everyone,

I hope all of you are having a good weekend!

Over the past two weeks, I have covered some pretty technical and in-depth topics. As of this week, there are now primers on the S&P500 (link), Bonds (link), and FX (link). Today I want to take a little bit of a step back from the technical side to look at the big picture.

While it is easy to be overwhelmed by the technical side of markets, I always like coming back to what is simple and intuitive. In my mind, you can have a very technical process to quantify ideas but the ideas in themselves should be very simple and intuitive.

If something doesn’t make intuitive sense, it’s probably because there is something about it that is misleading or taking advantage of you. Every great trade or investment I ever made immediately made intuitive sense. I still had to spend time conducting my own due diligence but clear things click.

It’s actually funny, if you have ever read the book, The Art of Short Selling, one of the things that the author says is a signal for identifying shorts is that it makes no sense. And the author isn’t talking about it not making sense because you don’t understand the field or something like that. It doesn’t make sense because you have no idea how value is being generated or money is flowing.

I remember reviewing a real estate deal a while back. The numbers and explanation for the numbers made zero sense. When I talked to the wholesaler pitching the deal I literally asked, how can you complicate real estate?! I have done due diligence on a lot of the major REITs in the real estate space and even the largest ones weren’t as complicated and confusing as this deal. Turns out, the deal went under about a year later because of accounting shenanigans. Not surprising!

Simplify:

So let’s simplify a little with what is going on in the market and overall economy. There are all these complex explanations about what “should” be happening but the market continues to defy expectations.

We have spent a decent amount of time covering growth, inflation, and liquidity in the economy. What I always find confusing is how people try to make such precise predictions and bets on where the economy will be in a couple of years. In my mind, I try to maintain as much optionality to multiple outcomes instead of trying to bet on a single outcome.

Inflation is still super high compared to history:

The one thing I think about is where is the pain trade? I can’t tell you how many managers I talk to in their 40s-50s who lived through 2008 and they are literally scared forever to always expect deflationary credit events. The idea of shorting bonds is “dangerous” to them. Then inflation comes along in 2022 and all their deflationary credit hedges don’t work at all. In fact, almost no hedges work at all since it was an inflationary bear market.

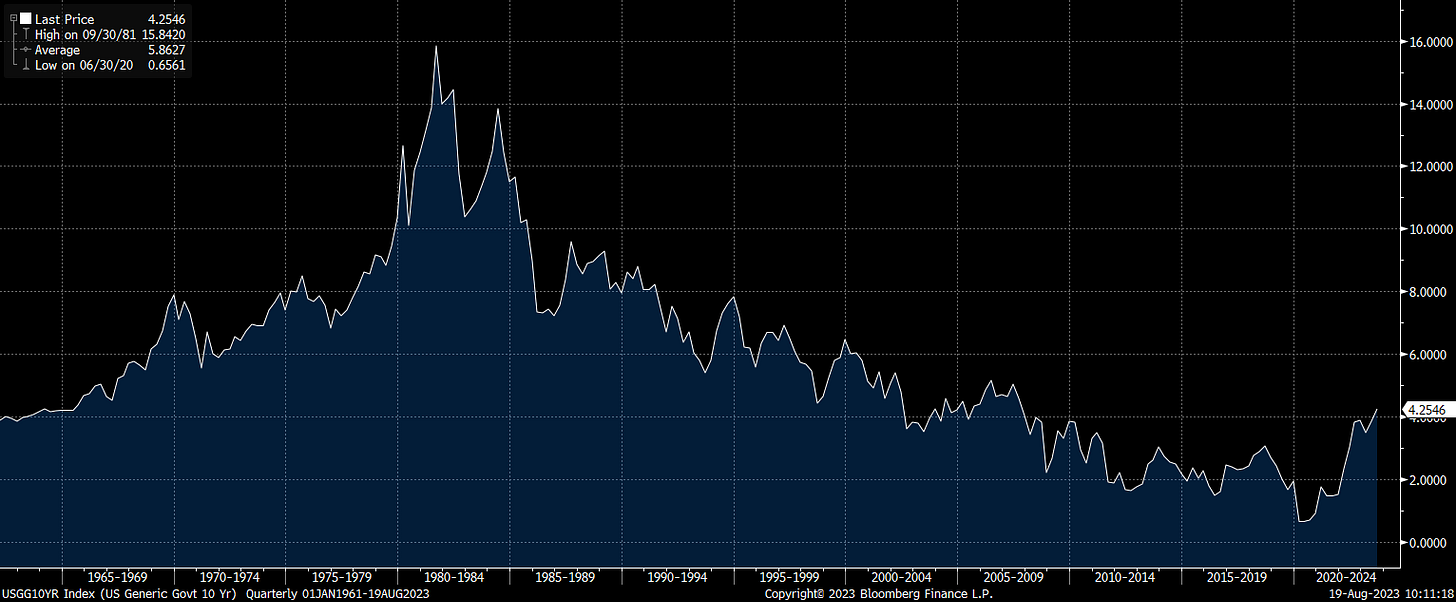

There is a tension in life of being simplistic without being reductionistic. When I look at the chart of the 10-year interest rate, I just think, something is changing:

As someone who spends the majority of their time reading academic literature, books and modeling economic data around rates and inflation, sometimes just zooming out and looking at this chart is more helpful than all the “sophisticated explanations.”

Here is the thing, I don’t know where rates will be in 5-10 years. I do know that I don’t want to be long bonds yet. You can go back through the macro report I wrote breaking down the logic behind this:

Prometheus and I actually did two Twitter spaces on the situation we are seeing with bonds right now.

First Spaces: https://twitter.com/Globalflows/status/1690048533226041344

Second Spaces: https://twitter.com/Globalflows/status/1692574349985824980

The bottom line: Why would I take duration risk when I can get paid over 5% to put my capital in a money market fund?

When I think about making decisions in markets, I think it’s the same as the uncertainty you experience when you’re dating someone. You might say, listen I have no clue if I would marry this person but I do know that I want to hang out with them again. You don’t need to know what things look like 5 years out to make the decision about taking someone out. Same thing with a portfolio, I don’t know where rates will be in 5 years but I know what I should be doing right now.

Pretty intuitive right?

Final thought:

I will end with my broad thoughts on stocks. Ever since the yield curve steepened from its low, stocks have sold off. Why is this? Well basically the bond downside is now impacting stocks.

Do we know how much downside there is for stocks? Let me just tell you now that no one knows even if they give you a target. What I will be looking for is a divergence in the correlation between stocks and yields on the long end. If I compare that correlation with the growth situation, I will have a much clearer direction for making a decision. For the time being though there is downside for stocks in my view. Active management in this period of time will be critical!

I will be writing an article tomorrow for Paid Subscribers focusing on the flows that are likely to take place next week and how I view risk-reward across major assets.

Thanks for reading!

This man works so hard, i’m still read part 4 of the FX primer 😭😭also would you recommend that book mentioned ( The art of short selling)?

When you say, "a divergence in the correlation between stocks and yields on the long end". Do you mean stocks down, duration yields down... Thank you.