Correlation Analysis: Macro Flows

Correlation scenario analysis for CPI tomorrow

I have laid out HOW to think about correlations in the Macro Alpha Primers.

Macro Alpha Primer: Credit Risk and Duration Risk and Macro Podcast: Macro Alpha Primer

Macro Alpha Primer: Correlations and Macro Podcast: Macro Alpha Primer

Macro Alpha Primer: Macro Catalysts, Hedging Pressure, and Positioning and Macro Podcast: Macro Alpha Primer

Macro Alpha Primer: Positioning Premiums and Macro Podcast: Macro Alpha Primer

I want to go through some tangible examples of correlations as they connect to scenario analysis and the hedging pressure we are going to experience tomorrow through CPI.

If you didn’t catch the Macro Podcast and connected report I published yesterday, check it out here:

Big Picture:

We are in a regime where growth is positive and inflation is clearly decelerating at an increasing speed. When you see Crude going off a cliff and breaking key levels, you know headline CPI is going to get dragged down in consecutive prints:

This is why we are seeing the negative correlation between crude and bonds increase in its strength:

The Crude / Gold ratio is making new lows at an increasing speed:

Index Connection:

In this context, financial conditions remain incredibly accommodative:

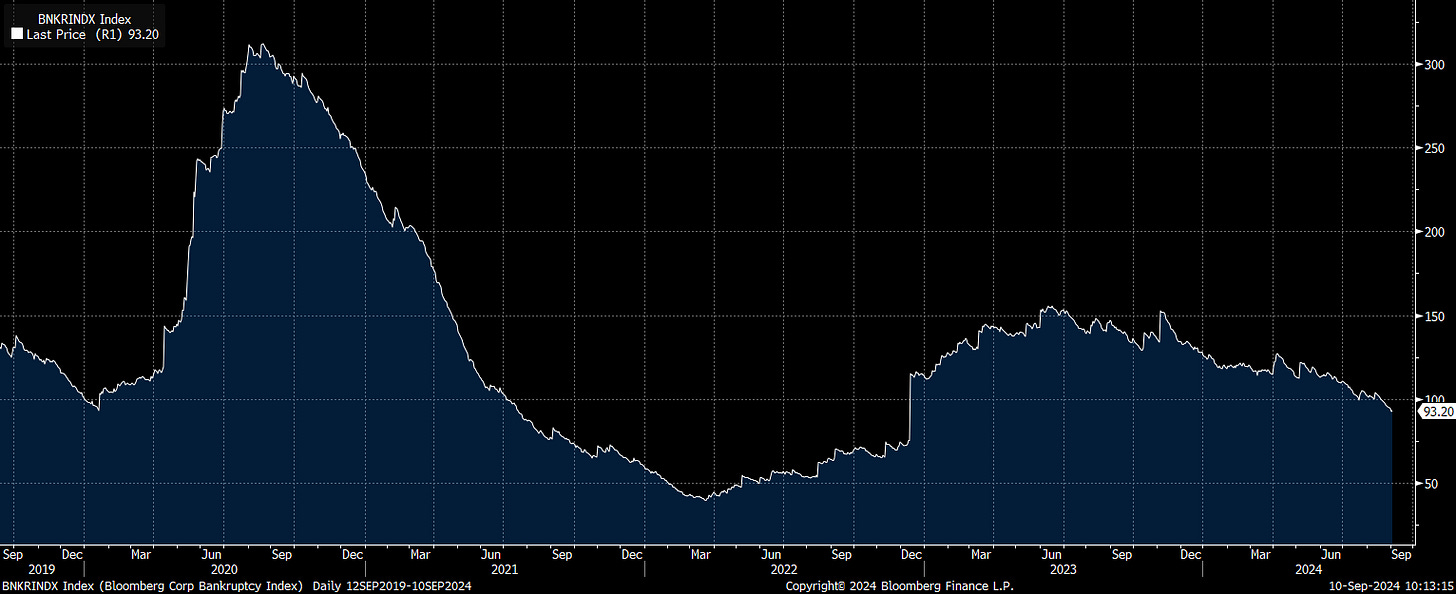

The Bloomberg Bankruptcy index continues to decelerate:

When you have an environment where financial conditions (index represented by the white line) remain accommodative and inflation expectations are falling (blue) this causes Goldilocks. (you can also see this reflected in the personal income and outlays data)

Within this regime, we clearly have positioning be constrained by implied correlations (white) in the index and the speed of rate cuts (blue).

We are coming back to vwap in ES and it’s at these levels we will have an increase in transactions tomorrow as hedges are monetized on the CPI event.

Both the inflation print, stock-bond correlation, and relative performance of indices will be important to watch tomorrow on the CPI print and as we move into the US open. Scenarios:

1. CPI Above Expectations

Stocks Down, Bonds Down (Positive Correlation)

Stocks Down, Bonds Up (Inverse Correlation)

2. CPI Below Expectations

Stocks Up, Bonds Up (Positive Correlation)

Stocks Up, Bonds Down (Inverse Correlation)

3. CPI In Line with Expectations

Stocks Neutral/Up, Bonds Up (Positive Correlation)

Stocks Neutral/Up, Bonds Down (Inverse Correlation)

Tomorrow will be interesting because the market has priced such an aggressive action by the Fed without a collapse in growth. Financial conditions remain accommodative and there isn’t a constraint on the Fed to make “emergency cuts.”

The scenarios I noted above don’t include how we have the initial print and any potential mean reversion into the higher volume US equity open. This will be important to note because traders are going to begin adjusting for FOMC next week. Traders hedging their macro risk are in a constant state of moving from catalyst to catalyst.

I will update you on my views tomorrow after the open.

Pulling Things Together:

As I noted in the report from yesterday (link), we are at some key levels. I am waiting patiently right now for a larger swing in ES, bonds, Bitcoin and gold. We are highly likely to have flip-flops in correlations as we move through CPI and FOMC that will confuse people. Just remember the difference between the Goldilocks correlation and the growth scare correlation. These contextualize the outright moves in financial assets and their standard deviation ranges.

A Pepe for the culture

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

You know sometimes i read and one thing I'm always looking forward to is the pepe cause I know it's going to be dope 🤣. And it goes without saying best macro take on the internet my guy