Equity / ES Update: Positioning Unwind

Understand the collocation of signals

The signals in the equity market are incredibly multifaceted and more complicated than OHLC levels in ES. For example, watching the correlation of assets to equities or watching the TYPE of sectors that are rallying will tell you what technical levels can’t.

If you are trying to think in a first principles mindset, outright signals and relative signals BOTH provide value. For example, an outright signal of time series momentum (see this paper: Link) can be very valuable when combined with cross-sectional momentum or correlation analysis. This might seem simple and obvious to some but structuring these signals hierarchically is critical.

If all of this is just going over your head, check out all the educational primers here:

I am going to use the price action of ES today as an opportunity to further explain the principles above. You can reference the equity report and update I wrote here:

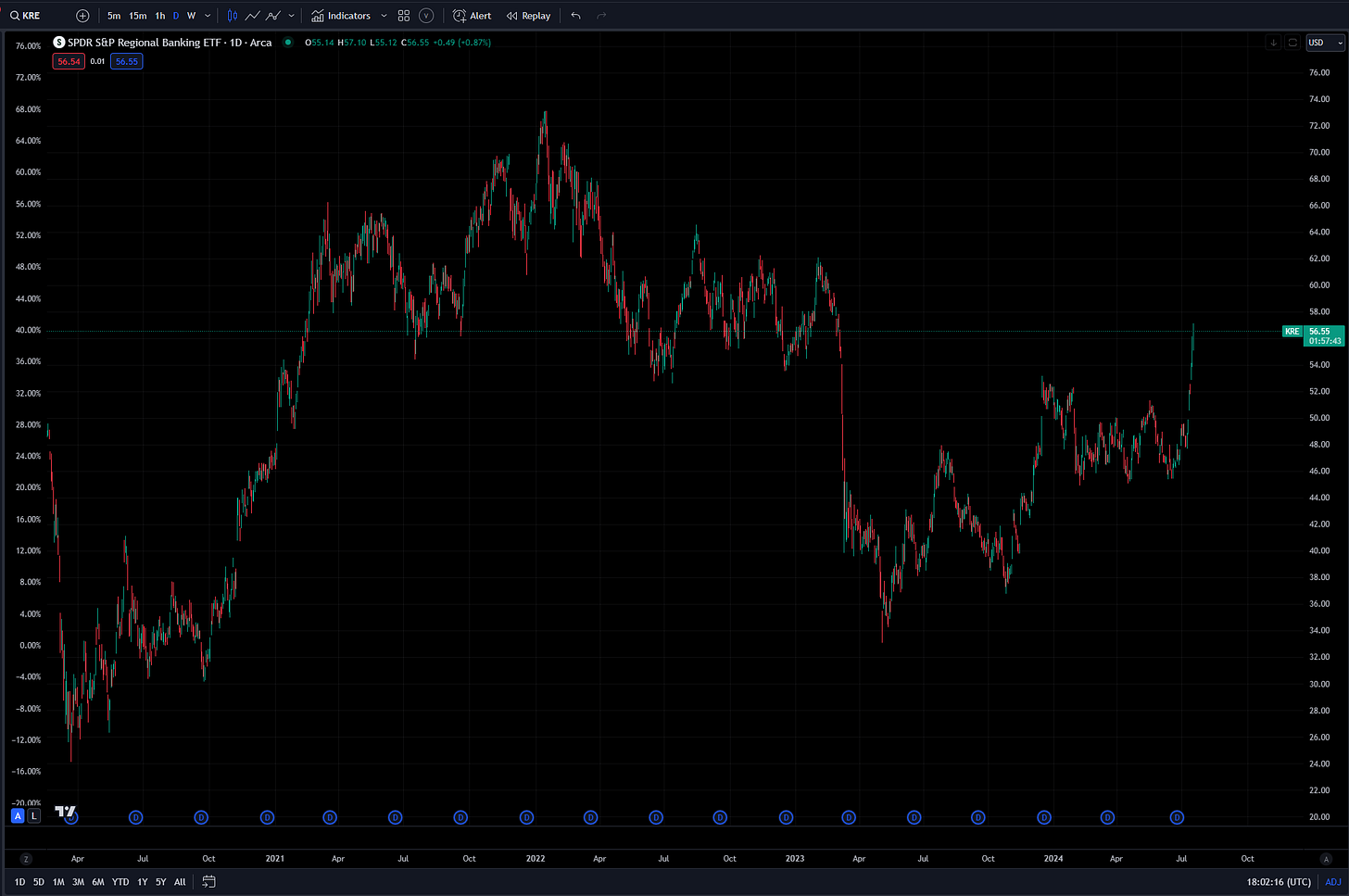

The one thing I will say is, do you really think we are moving into a recessionary bear market with regional banks skyrocketing like this?

Clearly delinquencies are not pervasive enough to begin dragging on personal consumption and impact bank balance sheets:

Let’s get into the specifics of price action today and the implications for our view in equities.

ES Levels and Drivers:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.