Equity Red Day: Why Flows Are Moving

The framework for why assets are functioning the way that they are

Hello everyone,

The whipsaws we have seen in equities over the past 48 hours have been considerable and require some updated analysis. I decided to make this entire write-up public for everyone because we are at a critical juncture in equities and interest rates.

I will be writing an updated comprehensive macro report for paid subscribers that will be released over the weekend. As I noted in the Announcement Article, there will be a price increase on Monday, August 5th. If you Subscribe BEFORE then, you will lock in the current price and it will never change. You can also do a free trial to check out the macro report when it’s published.

Let’s start big picture……..

Big Picture Regime:

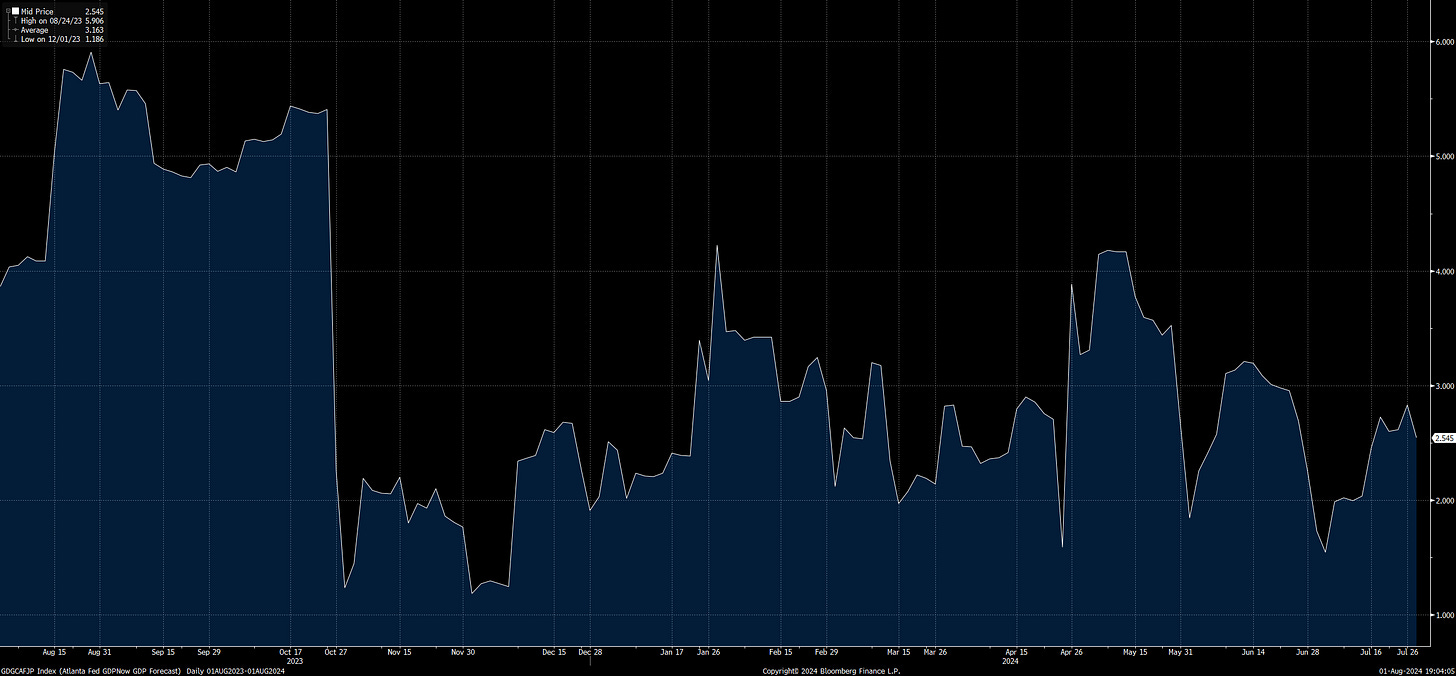

We already know that growth isn’t completely collapsing. Sure there is some underlying softening from the 2023 extreme but overall real GDP remains positive. The Atlanta GDPnowcast remains positive:

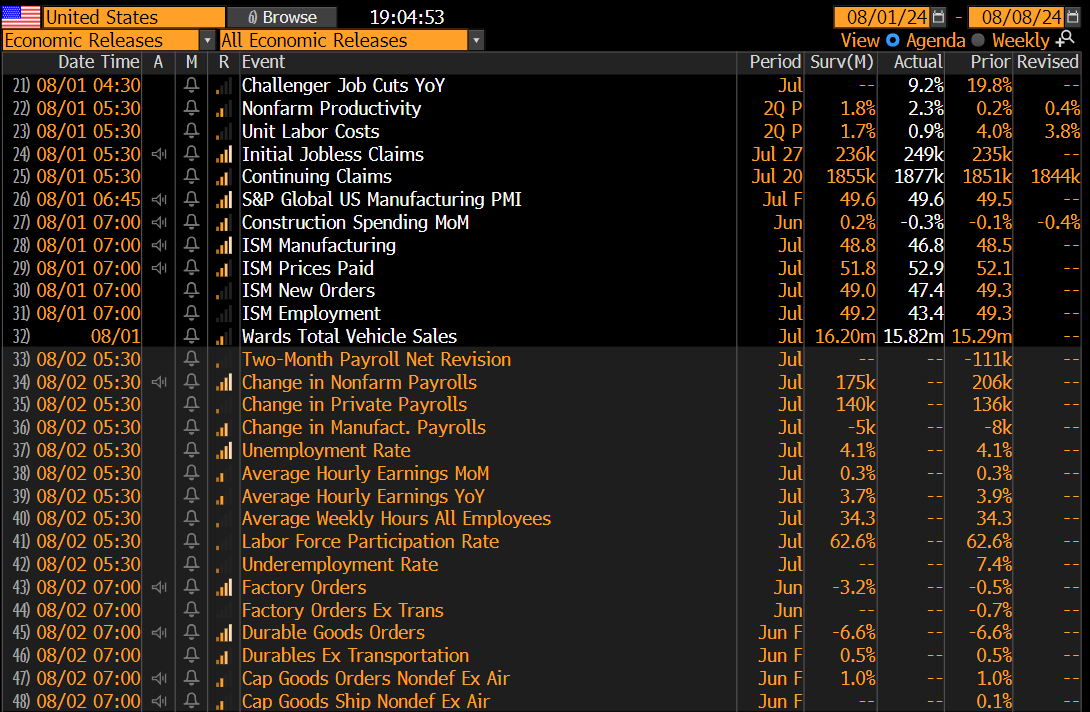

While the ISM print came in below expectations, the real focus will be on NFP tomorrow:

Just remember that NFP is still incredibly elevated. This means that even if we are heading straight into a recession, the time it will take for us to move into a contraction will be reasonable:

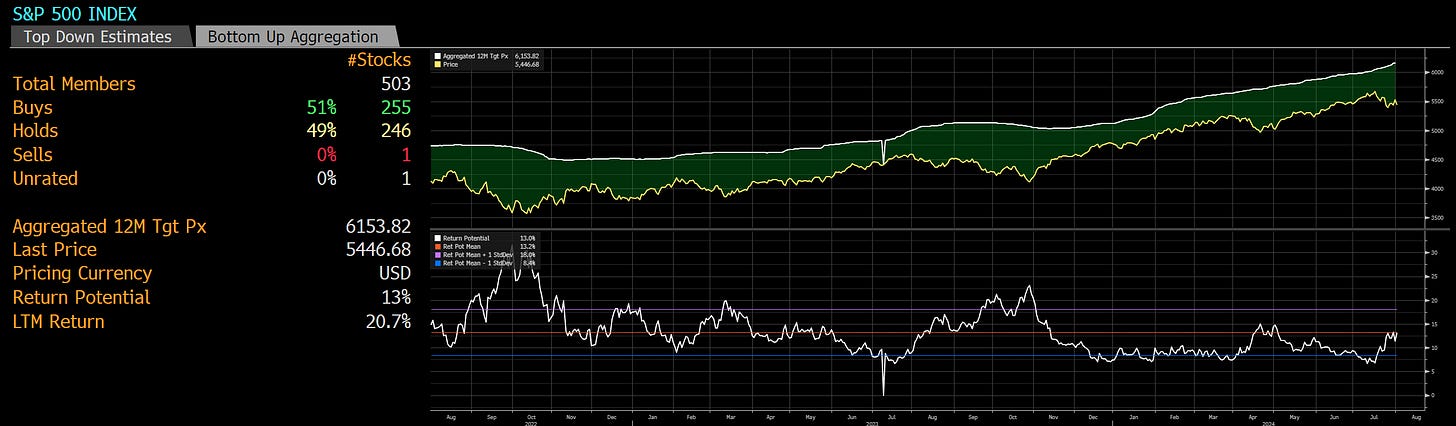

We have seen a reasonable deviation from price expectations in the S&P500:

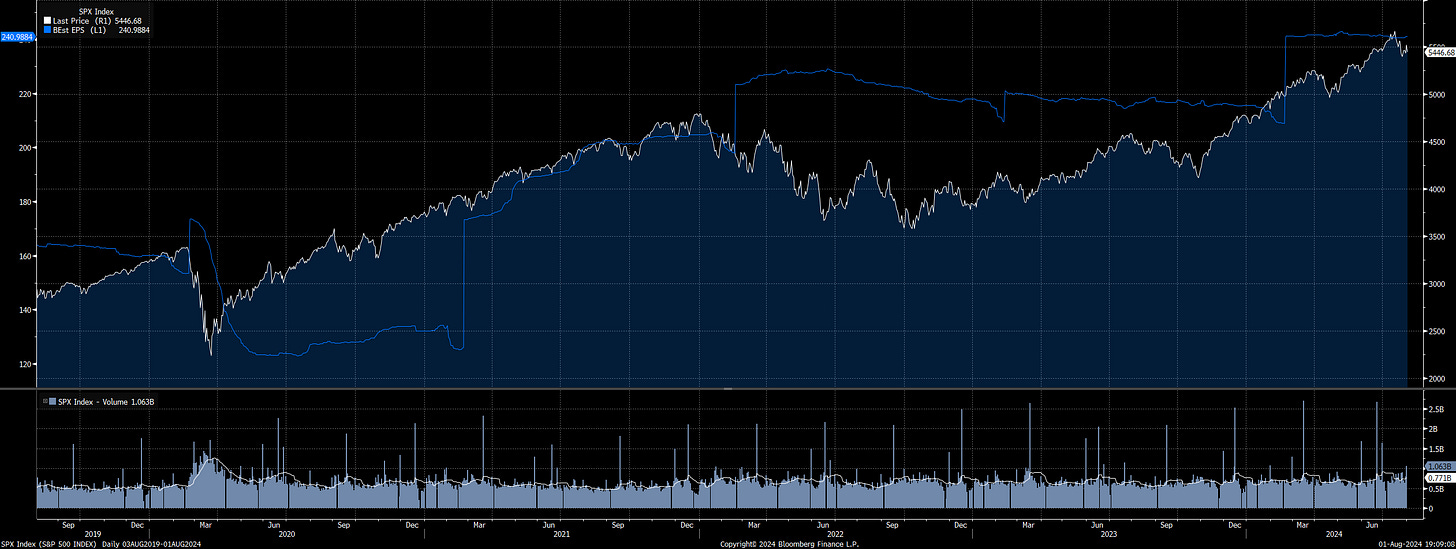

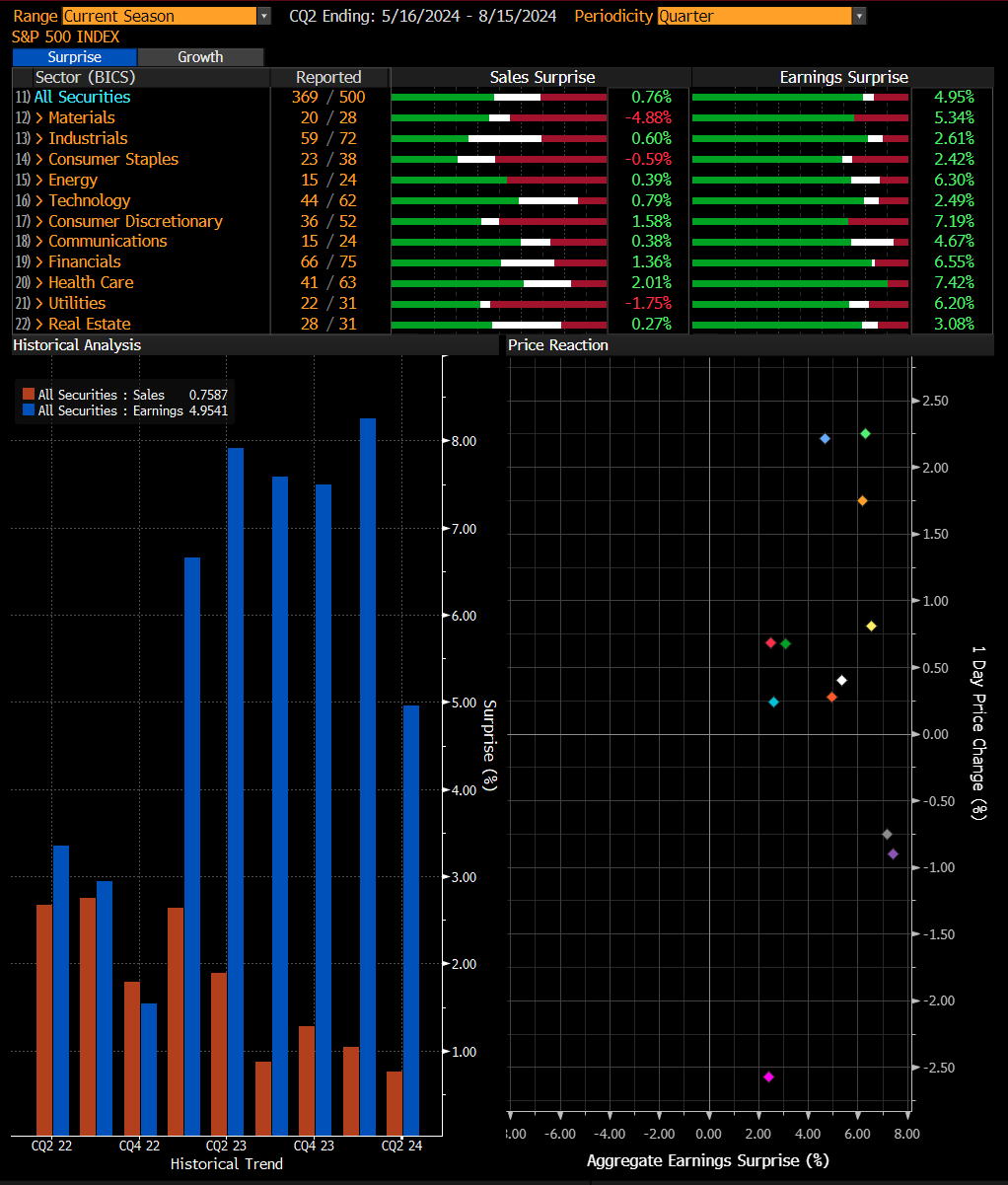

But earnings expectations remain positive:

We continue to see earnings surprise expectations:

Big picture, the macro regime continues to be one of positive growth with earnings showing positive signals. This contextualizes the price action for this past week.

Positioning and Price Action:

I already laid out how positioning is functioning in this most recent ES pullback here:

And here:

We need to remember that ES was up almost 16% YTD at the highs. This is considerable! The unwind we have seen was primarily based on implied correlation, the rotation out of large caps, and hedging into FOMC.

Now this is where it’s important to have a different time horizon and risk tolerance than the market. I opened the ES long here noted by the yellow arrow (link)

As I noted, we held these levels because it was unlikely that we would move lower as everyone was hedged into FOMC. See my note here on this:

We rallied into FOMC and then the Russell retraced its bid completely as ES and NQ held their bid.

Today, we moved down across all major indices as bonds bid considerably. This indicated a negative stock-bond correlation and one of the main reasons I have been long BOTH stocks and bonds. See all current trades in this article:

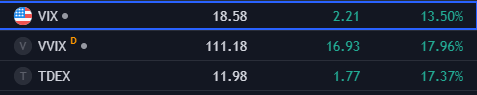

As of market close today, all major implied vol indices are at short term highs:

We are seeing a massive implied vol premium:

When you have an implied vol premium in a macro regime that is supportive for equities, you want to look for buying opportunities.

When we approach assets and are trading them on a weekly time horizon, we need to remember that there will be intraday oscillations that consistently take place throughout the Globex session and information catalysts. If we can’t see some type of buying support tomorrow through NFP and the intraday session, it is very likely that we are going to unwind positioning even more. As a result, the equity longs would be taken off.

Weekly OHLC levels as they connect with intraday mean reversion through the Globex session and information catalysts are critical to monitor for confirming or falsifying a view. If you want to dig into this idea more, check out the intraday trading primer I wrote here:

Bottom line, we need to see some type of marginal support through NFP and the US session tomorrow. When you have extreme price moves that close on temporal points in time like information catalysts or changes on a daily/weekly turnover, many times these set short-term inflection points in confluence with macro views. In other words, the turn of the week or NFP catalyst can function as a short-term inflection point if equities don’t continue making significant standard deviation moves down.

While I know I am explaining a lot, it is the real-time synthesis that is difficult. Bottom line, equities remain skewed to the upside on a cyclical basis but it is critical that we manage the positioning risk. If the trade gets taken off, my strategy will be looking for clearer confirmation of a reversal within the implied vol premium that presents an opportunity for another long. I will keep you updated on these dynamics and let you know how the flows are shifting.

The bond, gold, and silver trades noted here have been offsetting a lot of the negative returns in equities which is one of the reasons you want to execute across multiple assets when expressing a global macro view.

Keep a close eye out and I will update you on the trades I am running in confluence with the macro regime. We will move forward together!

Reading this to get into the mood for markets after I get off my terrible job. But we keep grinding until we get where we want to be!! Great article can’t wait for the one this weekend!

Have you read Weston N’s recent analysis re NQ JPY/USD correlations. If so any thoughts on his observations?