Macro Regime Tracker: Credit Cycle Trades

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

I have updated and laid out all of the macro views here:

The HYPD 0.00%↑ trade I shared with paid subscribers is now up 130%. I will be providing an update on this tomorrow.

HYPD 0.00%↑ Analysis:

As always, all of the models are updated below. Thanks

Main Developments In Macro

US Macro & Fed

BESSENT HAS INTERVIEWED FOUR OF AT LEAST 11 FED CHAIR OPTIONS

BESSENT INTERVIEWED RIEDER FOR CENTRAL BANK JOB ON FRIDAY

BLACKROCK’S RICK RIEDER CLIMBS RANKS OF FED CHAIR CONTENDERS

DEUTSCHE BANK ADDS OCTOBER FED RATE CUT TO 2025 FORECAST

UMICH 1-YR INFLATION EXPECTATIONS UNCHANGED AT 4.8%

UMICH PRELIM SEPT. CONSUMER SENTIMENT FALLS TO 55.4; EST. 58

MICHIGAN SEPT. CURRENT CONDITIONS FALLS TO 61.2 VS 61.7

MICHIGAN 5-10 YR INFLATION EXPECTATIONS RISE TO 3.9% VS 3.5%

MICHIGAN PRELIM. SEPT. EXPECTATIONS INDEX FALLS TO 51.8 VS 55.9

TRUMP ON FED: ALWAYS LATE ON INTEREST RATES

US Politics & Fiscal

TRUMP ON GOVERNMENT FUNDING: WILL LIKELY DO A STOPGAP

SCHUMER WARNS SHUTDOWN IF GOP NOT ACCEPT HEALTHCARE DEMANDS: AP

US Energy & Economy

US OIL RIG COUNT UP 2 TO 416 , BAKER HUGHES SAYS

US TOTAL RIG COUNT 539 , BAKER HUGHES SAYS

US Foreign Policy & Security

ZELENSKIY URGES US TO PROVIDE MORE AIR DEFENCE FOR UKRAINE

US PROPOSES BROAD G-7 SANCTIONS ON RUSSIAN ENERGY TO END WAR

US OFFICIALS MEET SYRIAN PRESIDENT IN DAMASCUS

CENTCOM, SYRIA LEADERS PLEDGE FUTURE MEETINGS TO COUNTER ISIS

US CENTRAL COMMAND LEADER MEETS SYRIAN LEADER IN DAMASCUS: AP

TRUMP SUGGESTS VERY HARD SANCTIONS ON RUSSIA

TRUMP: PATIENCE WITH PUTIN RUNNING OUT FAST

GUNSHOTS HEARD AT US NAVAL ACADEMY: FOX

US NAVAL ACADEMY ON LOCKDOWN: FOX

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

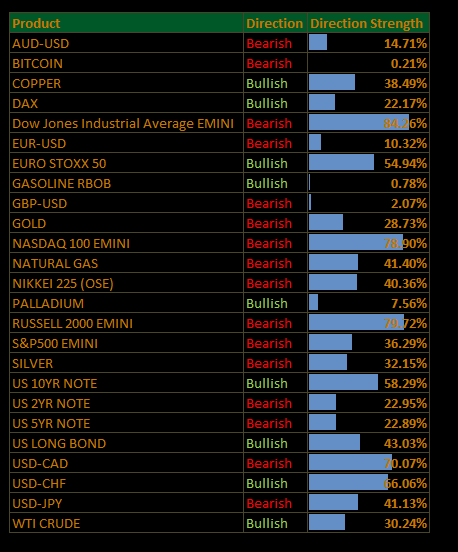

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

US Market Wrap: Sentiment Softens, Cuts Still on Deck; Breadth Mixed as Defensives Shine (S&P –0.00%)

A strong week for equities ended on a quieter note, with the S&P 500 essentially flat as bonds sold off modestly and consumer sentiment fell to the lowest since May. The University of Michigan survey showed long-term inflation expectations rising to 3.9%, keeping the Fed’s balancing act between sticky inflation and softening labor firmly in focus. Markets remain positioned for a September cut, the tone of guidance will matter as Powell seeks to avoid overcommitting to a dovish path.

Flows continue to show caution: BofA flagged $266b moving into cash over the past four weeks, offsetting equity gains and highlighting latent demand for yield. The dollar capped its worst weekly slide in a month, but relative US resilience still provides a floor until labor deterioration accelerates.

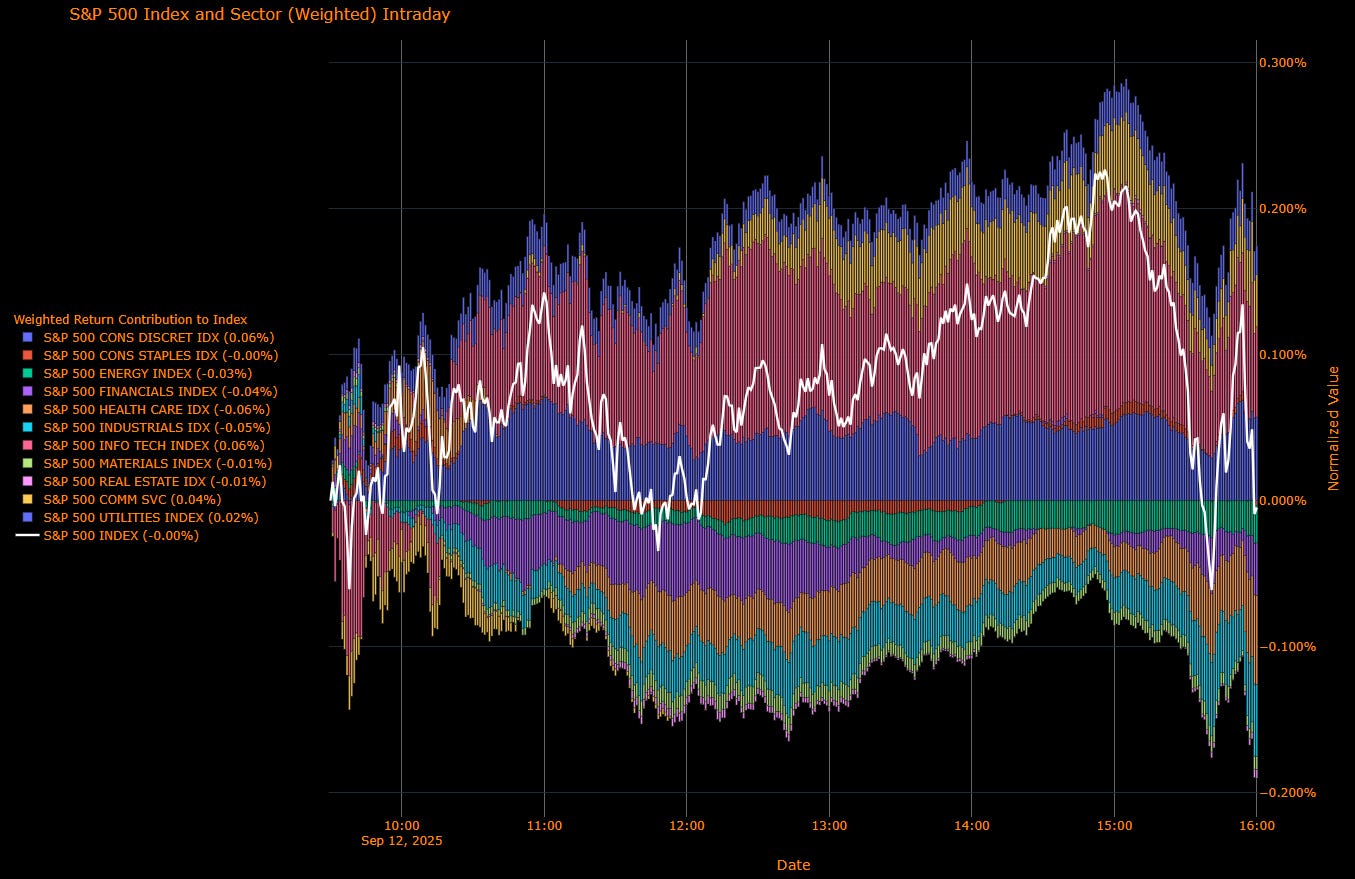

Sector Attribution

Weighted Return Contribution to Index

Information Technology (+0.06%), Consumer Discretionary (+0.06%) – modest positives offsetting weakness elsewhere.

Communication Services (+0.04%) and Utilities (+0.02%) added incremental support.

Financials (–0.04%), Health Care (–0.06%), Industrials (–0.05%), and Energy (–0.03%) were drags, leaving the index flat.

Sector Performance (Unweighted Breadth)

Utilities (+0.84%), Consumer Discretionary (+0.54%), and Communication Services (+0.35%) led the tape, a defensive tilt with selective consumer strength.

Tech (+0.18%) gained narrowly, signaling some rotation back into growth.

Energy (–0.88%), Health Care (–0.68%), Industrials (–0.60%), and Materials (–0.48%) weighed heavily, dragging breadth negative.

S&P 500 Index: –0.00%

Macro Overlay

Consumer Sentiment & Inflation

UMich prelim September sentiment fell to 55.4, lowest since May, underscoring household anxiety over jobs and prices.

5–10yr inflation expectations rose to 3.9% from 3.5%, the second straight monthly rise, complicating the Fed’s message.

Combined with weakening payrolls momentum, the survey highlights the Fed’s dual risk: inflation not yet anchored, but labor cracks widening.

Policy Outlook

Economists lean toward two to three cuts by year-end, with Deutsche Bank and Morgan Stanley both shifting forecasts more dovish.

TD Securities expects a “lean dovish” tone but with Powell avoiding a hard commitment to a sequence.

The September SEP is likely to show two cuts in 2025 but with inflation projections nudging higher.

Flows & Positioning

Cash hoarding continues ($266b into money funds in four weeks), signaling skepticism about risk appetite despite record equity levels.

Still, defensive yield sectors like Utilities and Staples outperformed, suggesting investors are rotating rather than de-risking.

Rates & Commodities

Treasury yields pushed higher into the weekend, with 10s at 4.07% and the curve steepening.

Oil slid on the week, while gold rose near fresh highs consistent with a mix of easing expectations, geopolitical hedging, and disinflation bets.

Market Tone

The index masked undercurrents: defensives (Utilities, Staples) and consumer discretionary outperformed, while cyclicals (Energy, Industrials, Materials) lagged. Tech steadied, but leadership narrowed and mega-caps paused.

Investors are leaning into a “cuts without crisis” setup, but sentiment weakness and rising inflation expectations underline fragility. The market wants insurance cuts; the Fed wants to preserve credibility.

The Read-Through

Base Case: September 25 bp cut with Powell signaling flexibility, not a locked-in sequence.

Risks: Faster labor deterioration could force quicker cuts; persistent inflation expectations could cap pace.

Positioning Lens: Favor US defensives and selective rate-sensitives into the cut. Utilities and REITs fit the yield bid, while Financials may find support if cuts validate curve steepening. Tech breadth likely to remain narrow.

Final Word

The week closed with markets in balance: stocks at records, bonds soft, sentiment wobbling, and the Fed still in play. The near-term story is insurance easing amid labor cracks, but the deeper risk is that inflation expectations drift higher even as growth slows. Until clarity comes from next week’s Fed meeting, the market remains caught between optimism and fragility, rotating, not retreating.

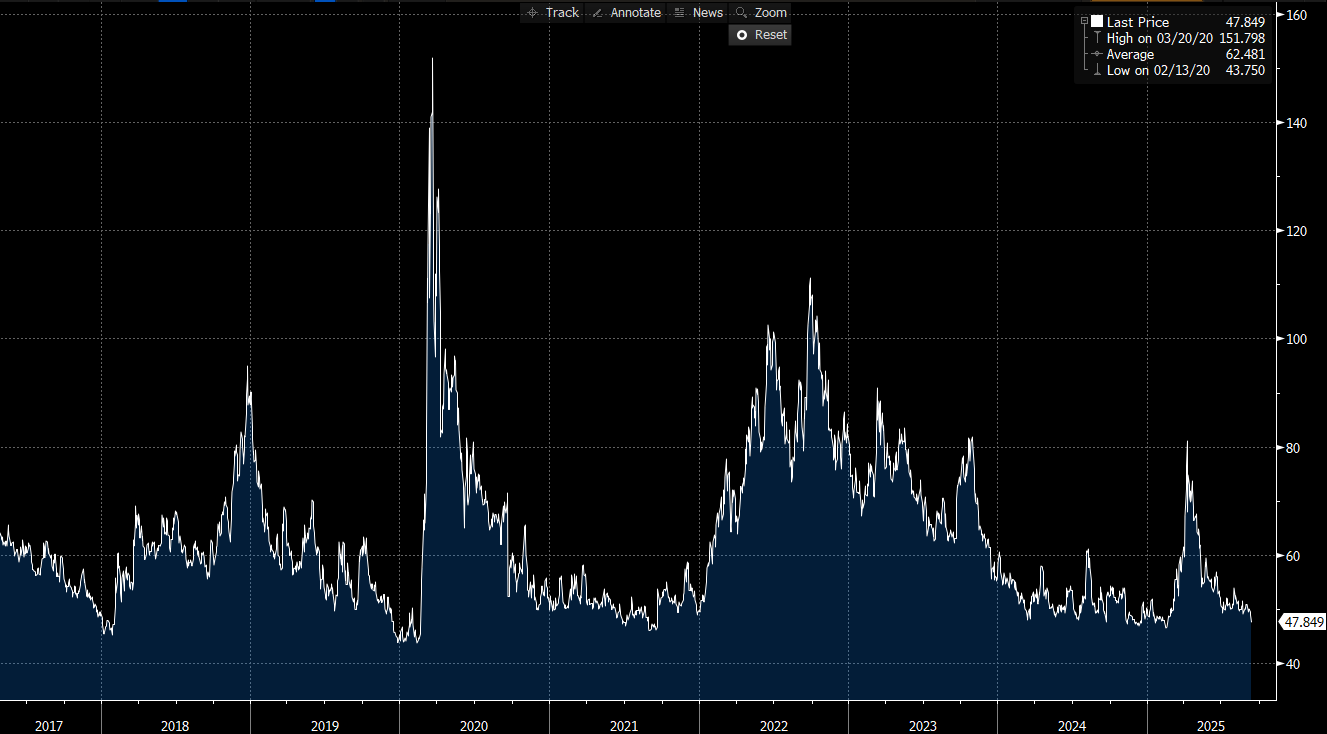

US IG Credit Wrap: Sentiment Slips, Cuts Still in Sight; IG Pinned Near Cycle Tights (IG OAS ~47.8 bp)

Investment-grade spreads remain exceptionally tight. Bloomberg IG OAS sits at ~47.8 bp, leaving credit ~14.6 bp inside the 5-yr average and ~4.1 bp off the cycle low. With equities near records and a modest bear-steepening in Treasuries, the message from credit is unchanged: carry first, volatility second.

Credit Context

IG OAS: 47.8 bp (chart last: 47.849)

5-yr average: 62.5 bp → ~14.7 bp inside

Cycle low: 43.8 bp → ~4 bp off tights

COVID peak: 151.8 bp → ~104 bp tighter

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

What Changed Today

Macro tape: UMich sentiment 55.4 (lowest since May) with 5–10y inflation expectations up to 3.9%. The mix reinforces cracks in labor and sticky expectations from your context.

Policy path: Markets still price a September 25 bp cut, with economists split between two–three cuts by year-end; guidance likely “lean dovish” but non-committal on sequencing.

Rates/backdrop: 10y UST around 4.07% into the weekend; curve modestly steeper. Risk assets held near highs, but tone was quiet/rotation-heavy.

Credit tone: Primary well-absorbed, concessions light; secondary two-way but ETFs/real-money demand keep OAS anchored in the high-40s.

Risks to Watch

Sticky expectations: another uptick in 5–10y inflation expectations would cap the pace of cuts → +2–4 bp to IG.

Labor deterioration: faster claims/payroll weakening could raise earnings worries and widen lower-tier IG disproportionately.

Rates vol/steepener: an aggressive growth-scare steepener is more problematic for spreads than a supply-led selloff.

Liquidity/primary: heavy calendars into thin liquidity windows can stall the grind.

Read-Through

IG is still pricing “cuts without crisis.” With OAS anchored near ~48 bp, the next 10 bp is about Fed communication and rates volatility, not credit fundamentals. Unless the labor cooldown accelerates or inflation expectations drift higher again, dips should be brief and bought but at these valuations, carry discipline and liquidity respect matter more than ever.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

All of the interest rate sensitivity models are now reserved exclusively for paid subscribers. If you would like to do a free trial, you can with this LINK.

Launch video for these models is here: LINK

Equity Indices:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.