Macro Regime Tracker: Crypto Set Up

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

I did a livestream today explaining macro views as they connect to crypto: LINK

Everything else is moving in lockstep with the framework I laid out in the recent interest rate report:

While we have moved around marginally, my view for BTC and MSTR remains the same as I laid out earlier this month:

As always, all the systematic models and strategies have been updated below.

Main Developments In Macro

Federal Reserve & US Monetary Policy

DALY: SEES EVIDENCE TARIFFS WILL HAVE ONE-TIME PRICE EFFECT

DALY: ECONOMY STILL NEEDS ‘MONETARY BRIDLING’ BUT NOT AS MUCH

DALY: RECESSION RISK IS VERY LOW RIGHT NOW

DALY: INFLATION EX-TARIFFS ROUGHLY 2.4% TO 2.5%

DALY: DON’T SEE STAGFLATION AROUND THE CORNER

DALY: PROJECTIONS FOR ADDITIONAL RATE CUTS ARE NOT PROMISES

DALY: FULLY SUPPORTED LAST WEEK’S QUARTER-POINT RATE CUT

FED’S DALY SAYS FURTHER POLICY ADJUSTMENTS LIKELY NEEDED

DALY: LABOR MARKET HAS SLOWED, INFLATION UP LESS THAN EXPECTED

GOOLSBEE SAYS STILL HAVE MOSTLY STEADY, SOLID JOBS MARKET: FT

GOOLSBEE SAYS NEW LABOR DATA SHOWS ONLY ‘MILD’ COOLING: FT

GOOLSBEE SAYS UNCOMFORTABLE OVERLY FRONTLOADING RATE CUTS: FT

BESSENT: POWELL SHOULD HAVE SIGNALLED 100-150 BPS CUT

US Politics & Trade

TRUMP: WILL SIGN EXECUTIVE ORDER ON DOMESTIC TERRORISM NETWORKS

TRUMP TO SIGN ORDER THURSDAY ON TIKTOK: US OFFICIAL

ALL PARTIES OF TIKTOK DEAL AGREED TO TERMS: NBC

CHINA AGREED TO TERMS OF TIKTOK DEAL: NBC

US FORMALIZES LOWER AUTO TARIFFS FOR EU EFFECTIVE AUG 1, 2025

SENATE PANEL TO HOLD TAXATION OF DIGITAL ASSETS HEARING OCT 1

WARREN CALLS FOR PROBE INTO TRUMP FAMILY FOREIGN CRYPTO DEALS

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

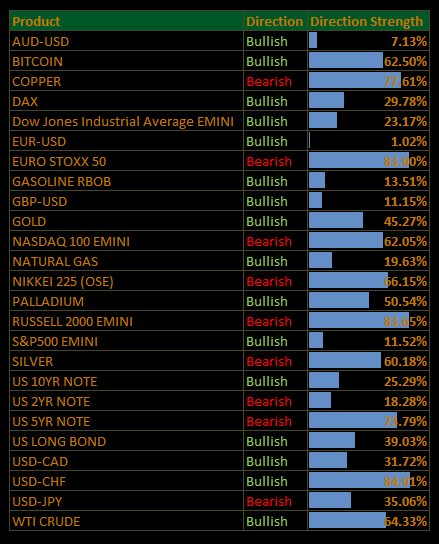

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

US Market Wrap: Rally Pauses, Defensives Cushion; Valuations Under the Microscope (S&P –0.45%)

The S&P 500 slipped 0.45%, extending a mild pullback from recent records as stretched valuations and Powell’s “fairly highly valued” comment stirred consolidation talk. The selling was concentrated in cyclicals and tech, while defensives and energy offered a cushion. With investors already near max exposure after a 35% rally off April’s lows, positioning risks are compounding into September’s seasonal weakness.

Treasury yields edged higher, with 10s up 4 bps to 4.14% and 30s to 4.75%, while the dollar firmed and gold pulled back 0.9%. Oil surged 2.2% on geopolitical headlines and inventory draws, underscoring a divergence between energy strength and broader equity fatigue. The market’s tone was one of digestion rather than reversal, but Wall Street’s “timeout” call is gaining traction.

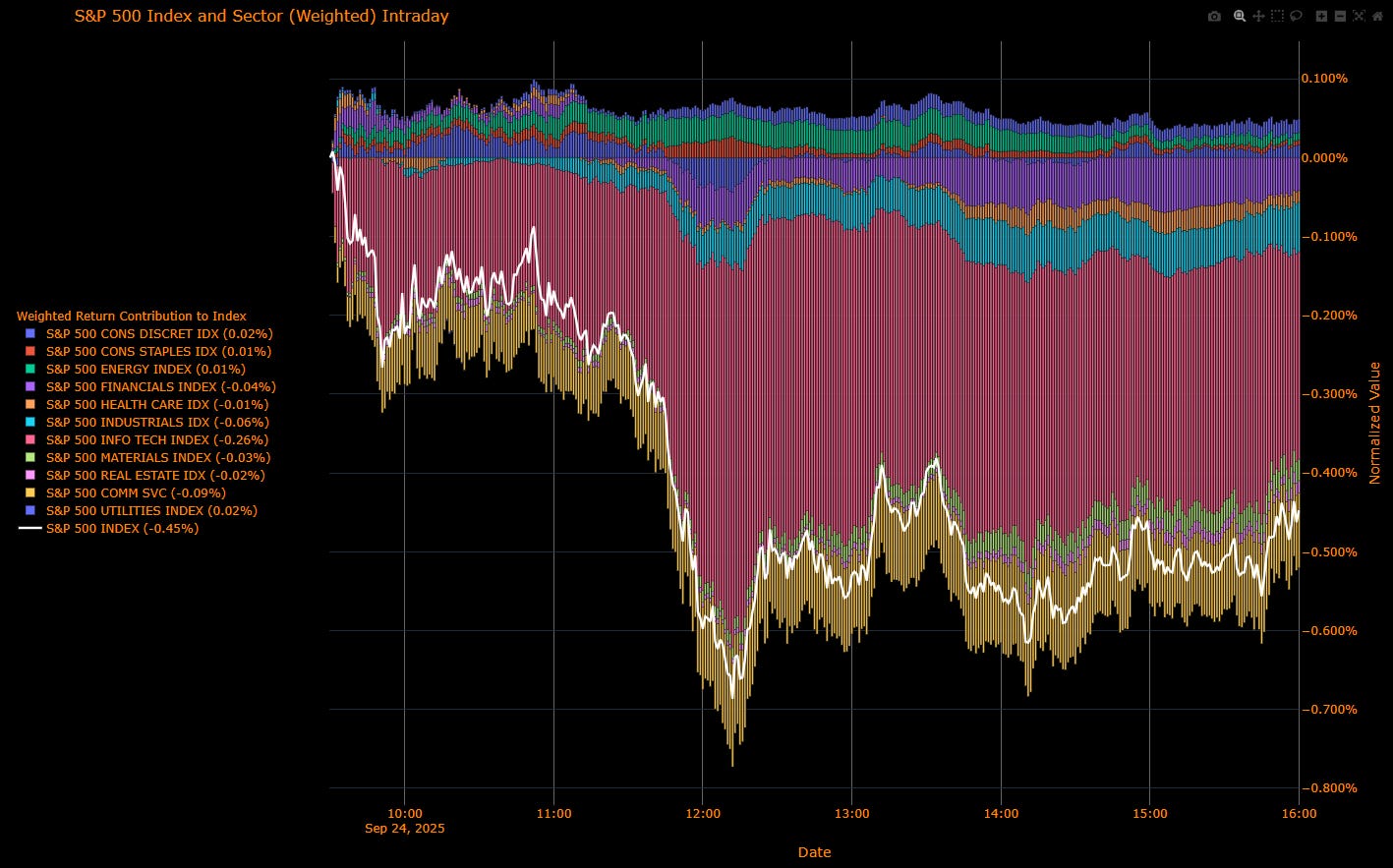

Sector Attribution

Weighted Return Contribution to Index

Biggest drag: Information Technology (–0.26%), as the AI trade lost momentum.

Other negatives: Communication Services (–0.09%), Industrials (–0.06%), Financials (–0.04%).

Offsets: Consumer Discretionary (+0.02%), Staples (+0.01%), Energy (+0.01%), Utilities (+0.02%).

Net impact: S&P 500 (–0.45%).

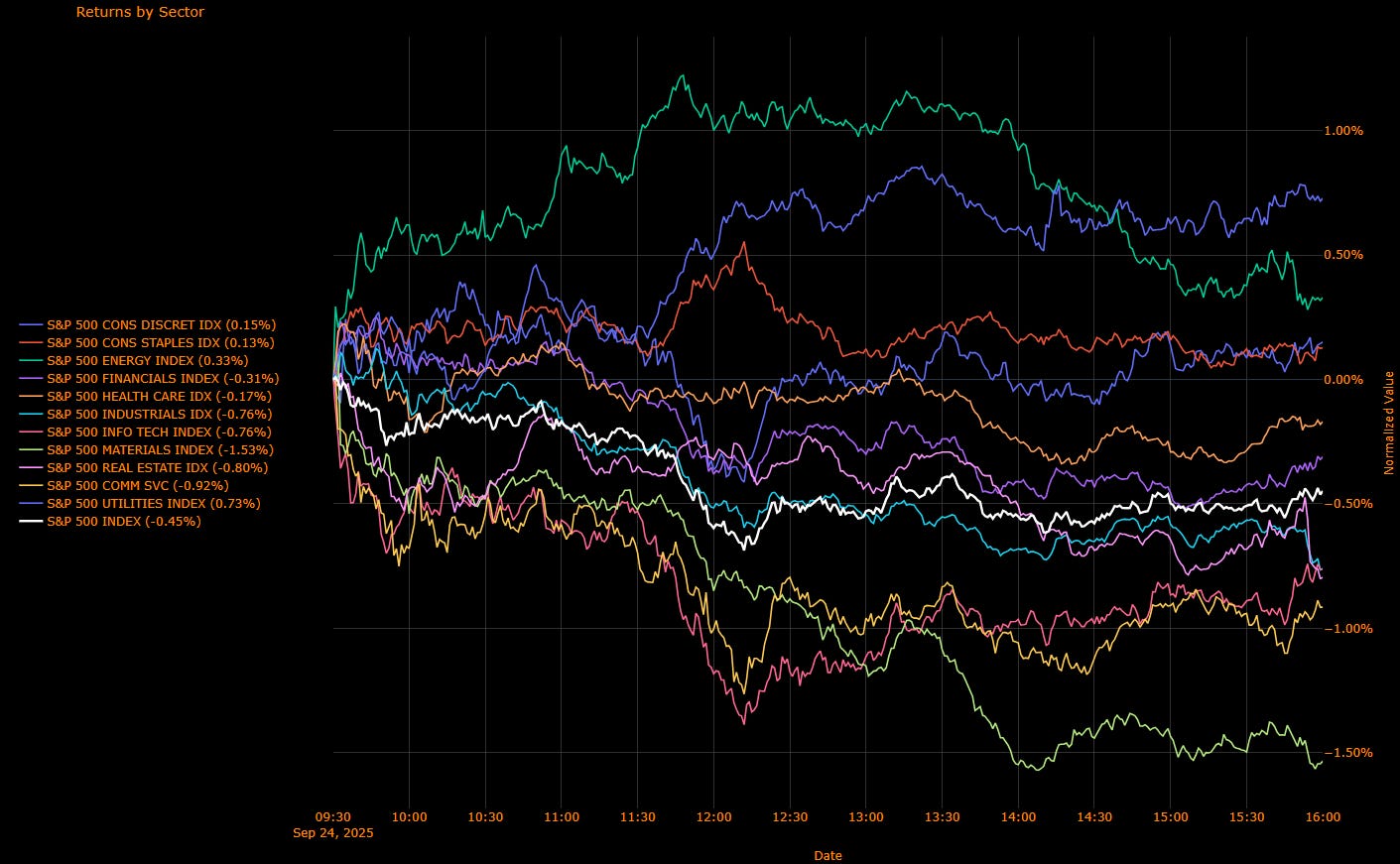

Sector Performance (Unweighted Breadth)

Heaviest losses: Materials (–1.53%), Info Tech (–0.76%), Industrials (–0.76%), Real Estate (–0.80%), Communication Services (–0.92%).

Defensives outperformed: Utilities (+0.73%), Energy (+0.33%), Staples (+0.13%), Discretionary (+0.15%).

The breadth confirmed a rotation away from cyclicals, with defensives absorbing flows.

Macro Overlay

Valuation Tension

The rally’s multiple stretched to 22.9x forward earnings, exceeding peaks seen only in the dot-com era and the 2020 pandemic stimulus. Fed Chair Powell’s “highly valued” remark was observational but sharpened the valuation debate.

Fed Dynamics

Daly stressed “further policy adjustments likely needed,” though she downplayed recession risks and flagged tariffs as a one-off inflation bump. Goolsbee cited a “steady, solid” jobs market but warned against frontloading cuts. Bessent countered, saying Powell should have signaled 100–150 bps. The policy spectrum remains fractured, but the base case is for two more cuts in 2025 if labor softens.

Market Positioning

The rally has turned skeptics into buyers at higher levels, raising concerns about crowding. Hedge funds and asset managers remain long, but hedging activity is increasing.

Market Dynamics

Rates: Yields higher across the curve (2s +2 bps to 3.60%, 10s +4 bps to 4.14%).

FX: Dollar rose 0.5%; EUR/USD dropped –0.6% to 1.174; JPY weakened to 148.9.

Commodities: WTI crude +2.2% ($64.8/bbl) on EIA drawdowns and supply concerns; Gold –0.9% ($3,730/oz).

Equities: Nasdaq 100 –0.3%; Russell 2000 –0.9%, underscoring broader weakness.

Market Tone

This was less about panic and more about digestion. Defensives and energy offered ballast as cyclicals and high-multiple tech bore the brunt. The “bubble” talk is rising, but strategists argue the bull market, now nearly three years old, still has room. The Fed’s easing cycle is seen as supportive, but September’s seasonal volatility and stretched positioning suggest more churn ahead.

The Read-Through

Base Case: Fed keeps October optionality; easing cycle continues but calibrated.

Risks: Sticky inflation from tariffs collides with labor softness.

Takeaway: The rally isn’t over, but the short-term risk/reward is compressed.

US IG Credit Wrap: Low-50s, Small Widen; Supply Headwind Meets “Timeout” Tape (IG OAS ~52.6 bp)

IG spreads nudged wider but stayed comfortably in the carry zone. Bloomberg US IG OAS printed ~52.6 bp (chart last: 52.631), up a hair from the low-52s and still far from stress. The move came alongside a consolidation in equities, a firmer dollar, higher Treasury yields, and chunky primary supply—enough friction to stall the recent grind tighter, not enough to re-price the asset class.

Credit Context (where we sit)

IG OAS: ~52.6 bp

5-yr avg: ~63.6 bp → ~11 bp inside

Cycle tights: ~46.1 bp → ~6–7 bp away

’22 wides: ~111 bp → ~58 bp tighter

Read: The low-50s regime remains carry-positive with two-way risk around data and supply windows.

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

What Changed Today

Macro tape: S&P –0.45% as leadership rotated; “timeout/consolidation” remains the street’s base case.

Rates: USTs bear-steepened (2s ~+2 bp to 3.60%, 10s ~+4 bp to 4.14%, 30s ~+3 bp to 4.75%). Modestly higher reals cheapen long duration at the margin.

Commodities/FX: WTI +2.2%; gold –0.9%; USD +0.5%.

Primary supply: High-grade calendar stayed active (e.g., Oracle $18bn multi-tranche), adding a near-term concession overhang

Risks to Watch

Data pulse: A hot core PCE/services print could cheapen duration and add +2–5 bp to OAS beta quickly.

Labor air-pocket: A sharper jobs slowdown = dispersion risk (cyclical BBBs/long maturities underperform).

Supply windows: Heavier calendars into thin liquidity widen tails; use concessions, avoid chasing post-break tighteners.

Curve dynamics: Growth-scare bull steepening is more credit-hostile than supply-led bear moves.

The Read-Through

Base case is unchanged: grind with noise.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

All of the interest rate sensitivity models are now reserved exclusively for paid subscribers. If you would like to do a free trial, you can with this LINK.

Launch video for these models is here: LINK

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.