Macro Regime Tracker: Global Liquidity

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

I have laid out all the macro views in the following reports:

As always, all the systematic models and strategies are updated below.

Main Developments In Macro

U.S. Policy & Fed Commentary

FED’S PAULSON: I SUSPECT BREAKEVEN JOB GROWTH IS LOWER THAN 75K

FED’S PAULSON SIGNALS SUPPORT FOR TWO MORE 25 BPS CUTS IN 2025

PAULSON: SEE NARROW BASE OF SUPPORT FOR GROWTH AND LABOR MARKET

PAULSON: DON’T SEE TARIFFS CAUSING SUSTAINED INFLATION

PAULSON: LABOR MARKET RISKS INCREASING, BUT ‘NOT OUTRAGEOUSLY’

PHILADELPHIA FED PRESIDENT ANNA PAULSON COMMENTS IN SPEECH

U.S.–China Relations & Trade Dynamics

STATE DEPARTMENT ISSUES STATEMENT ON CHINA, SCARBOROUGH REEF

US CONDEMNS CHINA’S TARGETING PHILIPPINE VESSEL IN S. CHINA SEA

US REAFFIRMS MUTUAL DEFENSE TREATY COMMITMENT TO PHILIPPINES

CHINA TO ADJUST SPECIAL PORT FEES ON US SHIPS AS NEEDED

CHINA EXEMPTS CHINA-MADE SHIPS OWNED BY US COS. FROM PORT FEES

CHINA SETS YUAN FIX AT STRONGEST SINCE NOV. AMID TRADE TENSIONS

BESSENT: WORKING-LEVEL TALKS WITH CHINA THIS WEEK

BESSENT: OPTIMISTIC THAT CAN DE-ESCALATE WITH CHINA

BESSENT: IDEA IS TO GIVE CHINA TIME TO MEET, TALK

BESSENT: WE WON’T LET CHINA EXPORT RESTRICTIONS GO ON

BESSENT: THIS IS CHINA VS WORLD

US SHOULD ENGAGE WITH CHINA IN DIALOG, LIN SAYS

CHINA SEPT. EXPORTS IN USD TERMS RISE 8.3% Y/Y; EST. +6.6%

CHINA SEPT. IMPORTS IN USD TERMS RISE 7.4% Y/Y; EST. +1.8%

CHINA SEPT. TRADE SURPLUS $90.45B; EST. +$98.05B

CHINA’S 30Y BOND FUTURES SURGE 0.5% ON RISKS OF TRADE TENSIONS

CHINESE PROPERTY STOCK GAUGE FALLS AS MUCH AS 3.5%

SPOT GOLD RISES TO RECORD ABOVE $4,060/OZ AMID US-CHINA SPAT

TREASURY FUTURES RETREAT AS TRUMP CHINA TONE SOFTENS

COPPER IN NEW YORK GAINS 2.2% AS TRUMP EASES TONE ON CHINA

BRENT CRUDE EXTENDS GAIN ABOVE 1% AS TRUMP EASES TONE ON CHINA

U.S. Politics & Global Diplomacy

PRESIDENT TRUMP SPEAKS AHEAD OF PEACE SUMMIT IN EGYPT

TRUMP SPEAKS AT SIGNING CEREMONY IN EGYPT

TRUMP: WOULD LOVE TO TAKE OFF IRAN SANCTIONS IF THEY TALK

TRUMP: IRAN WANTS TO MAKE A DEAL

TRUMP: THE HAND OF FRIENDSHIP, COOPERATION ALWAYS OPEN TO IRAN

TRUMP, ZELENSKIY TO TALK AIR DEFENSE, WEAPONS ON FRIDAY: RTRS

TRUMP PLANS TO WELCOME ZELENSKIY IN WASHINGTON ON FRIDAY: FT

ZELENSKIY PLANS TO DISCUSS WEAPONS, AIR DEFENSE IN US

TRUMP, ZELENSKIY TO ALSO TALK POSSIBLE RUSSIA NEGOTIATION: RTRS

EGYPT’S SISI: CONFIDENT TRUMP ONLY ONE ABLE TO ACHIEVE PEACE

TRUMP: GAZA NEEDS A LOT OF CLEANUP

TRUMP ON PHASE 2 OF GAZA DEAL: IT’S STARTED

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

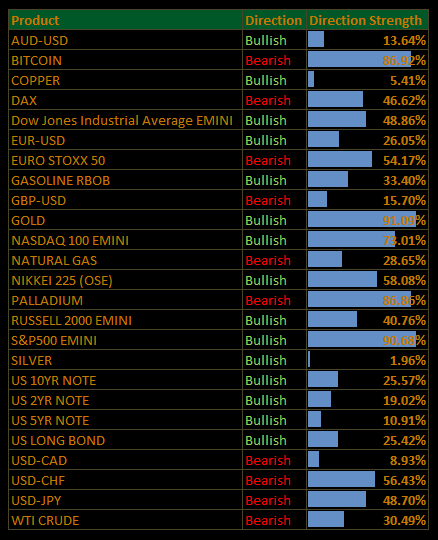

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

US Market Wrap: Relief Rally Reclaims Risk, AI Drives Recovery (S&P +1.6%)

Markets rebounded sharply as traders reversed Monday’s tariff-driven sell-off, embracing signs of renewed diplomacy between Washington and Beijing. President Trump’s administration hinted at “openness to a deal,” while China’s Commerce Ministry echoed calls for further talks, enough to unwind the prior session’s panic. The move was turbo-charged by an AI-led melt-up: Broadcom (+10%) soared after striking a multiyear chip-supply deal with OpenAI, reigniting the semiconductor complex (+5%) and restoring confidence in the bull market’s tech backbone.

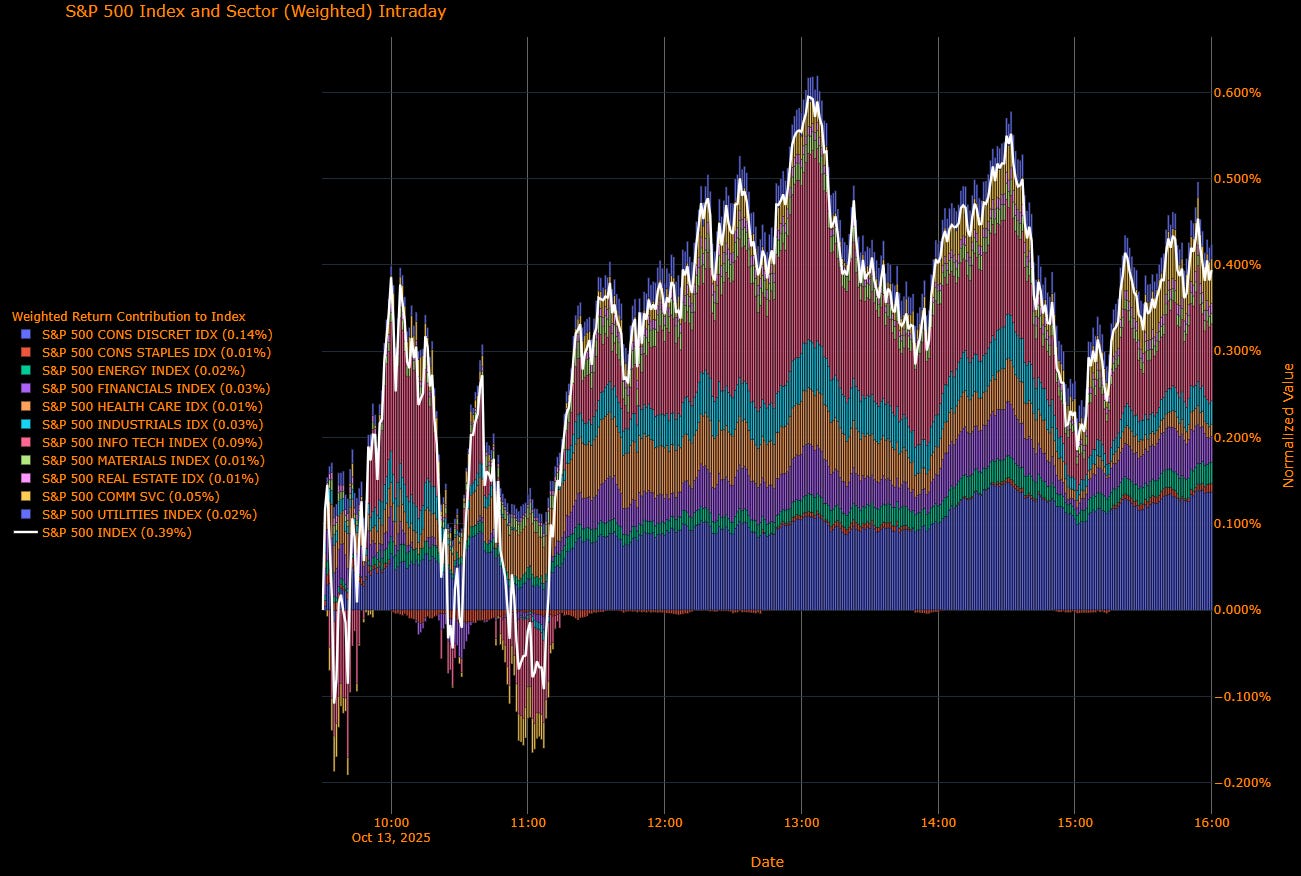

Sector Attribution

Weighted Contribution to Index (0.39%)

Leadership was concentrated in high-beta growth: Consumer Discretionary (+0.14%), Information Technology (+0.09%), and Communication Services (+0.05%) delivered over two-thirds of the S&P gain. Energy and Utilities chipped in (+0.02% each), while defensives such as Staples, Health Care, and Real Estate stayed marginally positive but irrelevant to performance breadth.

Unweighted Performance (Breadth)

Gains were broad but not euphoric. Consumer Discretionary (+1.32%), Energy (+0.87%), and Materials (+0.70%) led the charge as cyclical risk appetite returned. Utilities (+0.67%) and Real Estate (+0.61%) rounded out the gainers, reflecting a subtle bid for yield defensives even as growth rallied. Tech (+0.25%) lagged the headline narrative but dominated by weight. The S&P 500 rose 0.39% on a cap-weighted basis.

Macro Overlay

Catalyst & Tape:

The shift from confrontation to negotiation flipped sentiment on a dime. With Middle East tensions cooling and AI enthusiasm reignited, traders resumed chasing momentum. The “buy-the-dip” reflex, suppressed just one session ago returned in force.

Rates & FX:

Treasury futures were closed for Columbus Day, muting cross-asset signals. The dollar firmed (+0.2%) as risk appetite rebounded but not enough to pressure yields. Yen weakened (~0.8%) on renewed carry interest, while euro and sterling slipped modestly.

Commodities & Crypto:

WTI (+1.3%) and gold (+2.3% to $4,109/oz) both advanced, an unusual pairing that underscores how tariff relief coexists with persistent geopolitical hedging. Bitcoin (+0.7%) and Ether (+2.8%) added to the risk-on rotation.

Corporate & Credit:

JPMorgan’s pledge to direct $1.5 trillion toward U.S. security industries framed a domestic re-industrialization narrative aligned with Washington’s policy tone. AI infrastructure spend (Broadcom–OpenAI) reaffirmed the productivity-boom thesis that underpins equity valuations.

The Read-Through

The rebound illustrates how little conviction underpinned the prior sell-off. Markets remain liquidity-rich and headline-sensitive: remove the policy overhang, and risk demand snaps back instantly. Breadth and sector symmetry—cyclicals and defensives both green—suggest re-engagement rather than rotation. The macro mix (steady rates, easing trade tension, AI exuberance) keeps growth assets in control.

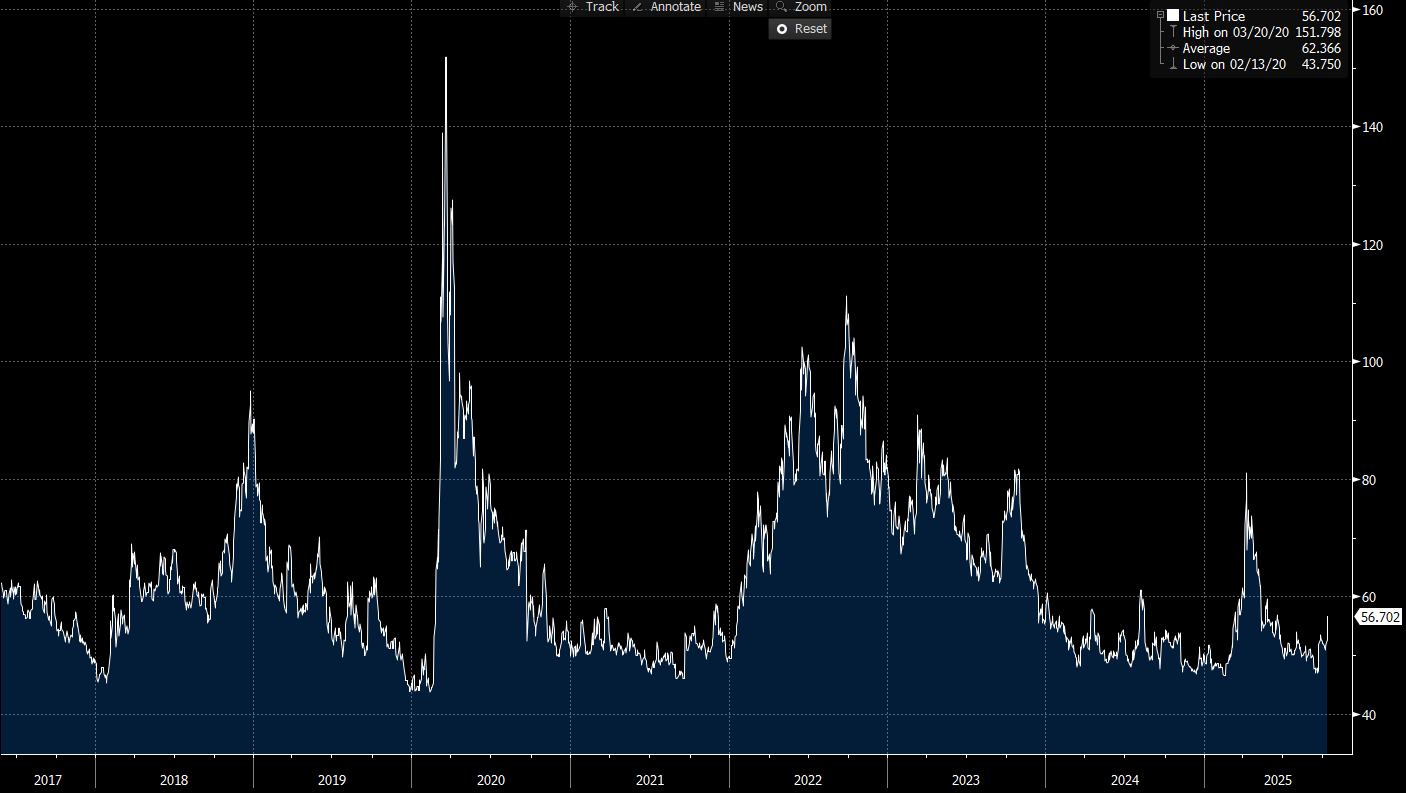

US IG Credit Wrap: Relief Bid Meets Holiday Lull; OAS Holds Mid-50s (IG OAS ~56.7 bp)

A risk-on reversal in equities (AI/semis leading) met a quiet rates backdrop with the US bond market shut, leaving IG spreads effectively unchanged on the day and still camped in the mid-50s. The tone improved, but without an active Treasury hedge and primary tape, there was little mechanical tightening to print. Base case: carry intact, two-way beta around headlines/earnings until cash reopens.

Where We Sit (from the chart)

IG OAS: ~56.7 bp

5-yr avg: ~62.4 bp → ~5.7 bp inside

Cycle tights: 43.8 bp → ~12.9 bp away

Pandemic wides: 151.8 bp → ~95 bp tighter

(Chart stats: Last ~56.7 | High 151.8 on 03/20/20 | Avg 62.37 | Low 43.75 on 02/13/20.)

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

Tape & Macro Overlay

Equities: Broad rebound as Washington/Beijing signaled talks; chips/AI re-accelerated.

Rates/FX: UST cash closed; dollar a touch firmer. With no duration impulse, spreads largely marked time.

Commodities/Crypto: WTI +1.3%, gold +2.3%, hedging bid persists even as risk re-engages.

Event path: Earnings kick-off (money center banks first) with tariff rhetoric still the key macro swing factor.

Mapping to IG

Carry > Convexity (still): Mid-50s is a carry-positive zone for A/AA duration buyers; yesterday’s widening hasn’t broken the channel.

Beta pockets: If the equity tone holds into a live rates market, look for 1–2 bp relief in cyclicals (Energy/Materials/Industrials) that bore the tariff shock; BBB remains dispersion-heavy around guidance.

The read-through

We shift from “wider on shock” to “mid-50s with upside if risk holds.” The relief rally alone doesn’t compress OAS without rate-complex participation, but the setup favors a grind-tighter bias into earnings, conditional on constructive guidance and no fresh tariff escalation.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

All of the interest rate sensitivity models are now reserved exclusively for paid subscribers. If you would like to do a free trial, you can with this LINK.

Launch video for these models is here: LINK

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.