Macro Regime Tracker: HYPD, credit cycle, and inflation

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

From a macro perspective, I remain bullish equities, bullish gold and bullish Bitcoin. The probability of a recession is dropping as the market over extrapolates short term labor data and prices significant cuts in the forward curve. Within this regime we are seeing specific expressions of capital moving out the risk curve.

The Bitcoin and MSTR view is laid out here:

The HYPD 0.00%↑ view and video breakdown connects to this (this is up almost 70% since when I first shared it with paid subscribers):

We then saw further news regarding Hyperliquid today:

I remain long ES in the risk reward I laid out here:

And I remain long gold:

The macro environment has aligned to have a lot of incredibly trends but managing risk remains paramount! After the CPI print tomorrow, I will be writing an updated report on how to think about inflation risk, recession risk and the Fed given the updates we are seeing. This would be a great time to become a paid subscriber because the challenges with the Fed, currency, and interest rate volatility will only increase from here on out.

I would strongly encourage everyone to review the interest rate guide here (I made it 100% free because it will set the foundation for the more in depth analysis I publish this week).

Finally, this was a really good short video on how to approach markets by my friend Skigod. I referenced some of our conversations and why having the proper approach to your daily life is critical for seeing asymmetrical opportunities. It’s well worth it.

As always, all the models and strategies are updated below. Thanks

Main Developments In Macro

US Macro & Policy

FOCUS WILL BE ON PPI, CPI COLLECTION AND EMPLOYMENT REVISIONS

OFFICE OF INSPECTOR GENERAL INITIATING REVIEW OF BLS CHALLENGES

US FINAL JULY WHOLESALE INVENTORIES RISE 0.1%; EST. +0.2%

US JULY WHOLESALE SALES RISE 1.4% M/M; EST. +0.2%

MIRAN'S NOMINATION FOR FED GOVERNOR CLEARS SENATE PANEL VOTE

TRUMP: POWELL MUST LOWER THE RATE, BIG, RIGHT NOW

US MULLS SEVERE RESTRICTIONS ON MEDICINES FROM CHINA: NYT

S&P 500 Faces Potential Pullback of Almost 8%, JPMorgan Warns

Barclays Strategists Lift S&P Targets on Solid Profits, AI Boost

US–China Relations

WANG CALLS ON US TO TACKLE GLOBAL CHALLENGES TOGETHER: XINHUA

XINHUA CITES FOREIGN MINISTER IN PHONE TALKS WITH US'S RUBIO

CHINA, US SHOULD WORK TOGETHER FOR WORLD PEACE: XINHUA

RUBIO SPOKE WITH CHINA'S WANG YI TODAY: STATE DEPARTMENT

NASA CUTS ACCESS FOR CHINESE CITIZENS IN US-BEIJING SPACE SALVO

HEGSETH: US DOES NOT SEEK CONFLICT WITH CHINA

Geopolitics (US Nexus)

TRUMP HELD HEATED CALL WITH NETANYAHU OVER QATAR STRIKE: WSJ

TRUMP SAYS ABOUT POLAND, RUSSIA: `HERE WE GO'

TRUMP POSTS ABOUT RUSSIA VIOLATING POLAND’S AIRSPACE

TRUMP ASKS WHAT’S WITH RUSSIA VIOLATING POLAND’S AIRSPACE

WHITE HOUSE OFFICIAL COMMENTS ON PLANNED US-POLAND CALL

TRUMP PLANS TO SPEAK TO POLAND'S NAWROCKI WEDNESDAY

POLAND'S NAWROCKI SAYS CALL WITH PRESIDENT TRUMP JUST ENDED

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

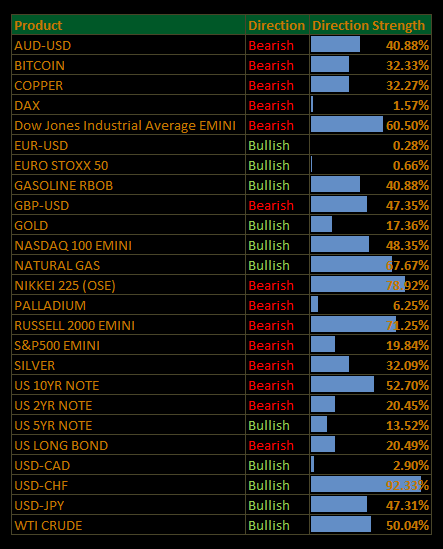

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.