Macro Regime Tracker: Interest Rate Risk

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

You can find all the macro views in the following reports:

Main Developments In Macro

US–RUSSIA–UKRAINE / POLICY

*TRUMP SAYS US WOULD COORDINATE WITH EUROPE ON UKRAINE SECURITY

*PUTIN, TRUMP BACK DIRECT RUSSIA, UKRAINE DELEGATION TALKS: IFX

*US MAY LEVERAGE INTEL SHARING TO PRESS FOR UKRAINE DEAL: WSJ

*US, UKRAINE WOULD STRIKE $50B DEAL ON DRONES IN PROPOSAL: FT

*UKRAINE WOULD BUY US WEAPONS FINANCED BY EUROPE: FT

*UKRAINE OFFERS $100B WEAPONS DEAL FOR SECURITY GUARANTEE: FT

*ZELENSKIY: SECURITY IN UKRAINE DEPENDS ON UNITED STATES

*RUTTE: 'BIG STEP' US WILLING TO BE PART OF SECURITY GUARANTEES

US MACRO DATA

*US AUG. HOMEBUILDER INDEX FALLS TO 32; EST. 34

*US AUG. NEW YORK FED BUSINESS ACTIVITY INDEX FALLS TO -11.7

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

US Market Wrap: Cyclicals Nudge Higher; Defensives Drag Into Jackson Hole

The S&P 500 eked out a +0.04% gain as traders squared up ahead of Jackson Hole and kept one eye on fast-moving diplomacy headlines around a potential Trump–Zelenskiy–Putin track. The 10-year Treasury yield rose 2 bp to ~4.34%, the Bloomberg dollar index added 0.2%, oil firmed, and gold was little changed. Pricing still leans toward a 25 bp September cut with roughly two moves penciled in by year-end, while Powell’s Friday speech is the week’s focal point.

Sector Contribution Breakdown

(Weighted contribution to the S&P 500’s daily return; what actually drove the +0.04%)

Leaders: Consumer Discretionary (+0.05%), Industrials (+0.04%), Financials (+0.03%), Information Technology (+0.01%).

Laggards: Health Care (−0.04%), Real Estate (−0.02%), Communication Services (−0.02%), Utilities (−0.01%), Materials (−0.01%).

Flat pockets: Consumer Staples (

0.00%), Energy (−0.00%).Index: S&P 500 (+0.04%).

Sector Performance Breakdown

(Unweighted sector moves; where breadth sat)

Leaders: Industrials (+0.46%), Consumer Discretionary (+0.43%), Financials (+0.26%), Consumer Staples (+0.05%), Information Technology (+0.03%).

Laggards: Real Estate (−1.00%), Utilities (−0.55%), Materials (−0.51%), Health Care (−0.40%), Communication Services (−0.22%), Energy (−0.03%).

S&P 500: (+0.04%).

Macro Overlay: Quiet Tape, Clear Focus

Policy watch: Powell’s Jackson Hole remarks are expected to frame the near-term path debate has shifted from “if” to “how much/how fast.” Swaps imply ~80% odds of a 25 bp September cut and two total by year-end.

Data pulse: Consumer sentiment softened and inflation expectations ticked up, highlighting a “do vs. say” split (retail sales still firm) and leaving markets sensitive to any hint that labor-market risk is overtaking inflation in the Fed’s calculus.

Geopolitics: The White House meetings with European leaders and President Zelenskiy, alongside chatter of potential trilateral talks with Russia, kept headline risk elevated but didn’t materially sway risk premia today.

Cross-asset: Mild bear-steepening (long end underperforms), dollar a touch stronger, oil up, gold steady.

Final Word

Today’s tape was a classic pre-event drift: cyclicals (Industrials/Discretionary) did the lifting, defensives (REITs/Utilities/Health Care) faded, and the index netted a rounding-error gain.

US IG Credit Wrap: OAS Holds ~50 bp; Pre–Jackson Hole Calm Keeps Carry in Charge

IG OAS: 50.04 bp • 5-yr avg 62.64 bp (≈ 12.61 bp inside) • Cycle low 43.75 bp (≈ 6.29 bp off tights) • COVID high 151.80 bp

Rates: 2y 3.77% (+2 bp) • 10y 4.34% (+2 bp) • 30y 4.94% (+2 bp) • Dollar +0.2% • WTI $63.34 (+0.9%) • Gold flat

IG spreads were effectively unchanged around the 50-handle as the rates move was a small parallel bear shift rather than a re-steepener. Into Jackson Hole, credit beta stayed quiet while duration did the P&L work. At ~6 bp off cycle tights and ~13 bp inside the 5-year average, IG remains squarely in the carry zone.

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

Macro Overlay for IG

Policy: Powell’s Jackson Hole remarks are the focal point. The debate has shifted from if to how much/how fast; pricing leans to a 25 bp September cut with roughly two moves by year-end.

Data pulse: Retail sales remain firm, but UMich sentiment fell and inflation expectations ticked higher—a classic “do vs. say” split that matters more for rates than for spreads at current carry-rich levels.

Geopolitics: Alaska diplomacy headlines (potential Trump–Zelenskiy–Putin track) kept headline risk elevated without a systemic credit impulse.

Rates Are the Risk

The path to a wider OAS regime likely runs through rate volatility: a sharp long-end selloff, a persistent dollar surge pressuring margins, or a meaningful tariff pass-through to input costs. Absent that, base case is range-trading around ~50 bp with carry doing the heavy lifting.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

US Short-End Rates Wrap: Sept 25 bp Still Base Case; Path Steady at –128 bp, Terminal ~3.05%

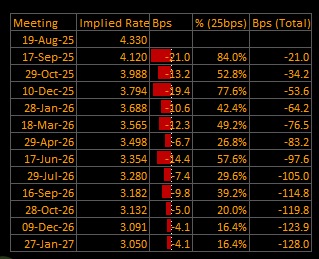

Cumulative Implied Easing (to Jan 2027): –128.0 bp

Terminal Rate (Jan 2027): 3.050%

September OIS Cut Probability: 84.0% — Implied Rate 4.120% | Implied Move: –21.0 bp (~0.84×25)

The front end remains locked on a “cautious cut” opener. Versus yesterday, the curve is essentially unchanged: a 25 bp September move is still the base case, the terminal sits ~3.05%, and the total path to Jan ’27 holds at ~–128 bp.

OIS-Implied Policy Path

Macro Overlay: Pre–Jackson Hole Drift, Rates > Path

Event risk: Powell’s Jackson Hole speech is the week’s fulcrum; debate has shifted from if to how much/how fast. Swaps lean to 25 bp in September with roughly two cuts total by year-end.

Data pulse: Retail sales remain firm, but UMich sentiment fell and inflation expectations ticked up—a mix that argues for a measured start rather than a shock-and-awe cut.

Cross-asset tone: 10-yr yields around 4.34% with a mild bear bias; dollar a touch stronger; equities cautious into the event.

Takeaway

The market’s message hasn’t changed: a gradual easing cycle starting with 25 bp in September, stepping down through 2026, and terminal near 3.0–3.1%. Near-term risk sits in rates volatility around Jackson Hole, not in a wholesale repricing of the cuts.

Tactical Portfolio

Morning Trade(s) and Market thread

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.