Macro Regime Tracker: Positioning Into Economic Prints

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

You can find the most recent reports breaking down all the macro views here:

As always, all the systematic models and strategies are laid out below.

Main Developments In Macro

US Politics & Government Shutdown

VANCE: WE HAVE TO KEEP CENTRAL SERVICES FUNCTIONING IN SHUTDOWN

VANCE: DEMOCRATS HAD A FEW IDEAS TRUMP AND I THOUGHT REASONABLE

VANCE: NOT REASONABLE FOR DEMS TO HOLD GOOD IDEAS AS LEVERAGE

THUNE: REPUBLICANS, TRUMP ARE UNITED BEHIND FUNDING BILL

VANCE: THINK WE’RE HEADED FOR SHUTDOWN BECAUSE OF DEMOCRATS

JOHNSON: TRUMP IS OPERATING IN GOOD FAITH IN SHUTDOWN TALKS

JEFFRIES: HAD A FRANK AND DIRECT TALK WITH TRUMP

SCHUMER: TRUMP CAN AVOID A SHUTDOWN, BUT DIFFERENCES REMAIN

SCHUMER: WE MADE PROPOSALS, ULTIMATELY TRUMP IS DECISION MAKER

SCHUMER: I THINK FOR THE FIRST TIME TRUMP HEARD OUR OBJECTIONS

SCHUMER: WE MET WITH TRUMP, WE HAVE LARGE DIFFERENCES

TRUMP, CONGRESSIONAL LEADERS MEETING UNDERWAY: US OFFICIAL

Liz Elkind: House GOP call: Mike Johnson says it’s a “good bet” that there will be a government shu

US LABOR DEPARTMENT ISSUES SHUTDOWN CONTINGENCY PLAN

BLS PLANS NOT TO RELEASE ECONOMIC DATA DURING GOVT SHUTDOWN

BLS TO SUSPEND ALL OPERATIONS IN CASE OF GOVERNMENT SHUTDOWN

Federal Reserve & Monetary Policy

FED’S MUSALEM: RESERVE BANKS ARE ‘CORNERSTONE’ OF INDEPENDENCE

FED’S MUSALEM: ECONOMIC DATA INTEGRITY IS CRITICAL

WILLIAMS: MY MODEL’S ESTIMATE FOR REAL NEUTRAL RATE IS 0.75%

FED’S MUSALEM: MOST INFLATION NOT TARIFF DRIVEN

MUSALEM: RATES ARE BETWEEN MODESTLY RESTRICTIVE AND NEUTRAL

MUSALEM: LABOR CONTINUES TO SOFTEN, BUT NEAR FULL EMPLOYMENT

WILLIAMS: VERY HARD TO KNOW EXACTLY HOW TARIFFS AFFECT PRICES

FED’S MUSALEM: LONG-TERM INFLATION EXPECTATIONS ANCHORED

FED’S MUSALEM: EXPECT INFLATION ABOVE TARGET FOR 2-3 QUARTERS

WILLIAMS: TARIFFS ASIDE, INFLATION HAS BEEN COMING DOWN

WILLIAMS: SOME OF THE UPSIDE RISK TO INFLATION HAS COME DOWN

WILLIAMS: RISKS TO EMPLOYMENT GOAL ARE GETTING A LITTLE HIGHER

WILLIAMS: LABOR MARKET HAS BEEN REMARKABLY RESILIENT

WILLIAMS: TARIFFS HAVE HAD MODEST OR MODERATE INFLATION IMPACT

WILLIAMS: I THINK UNDERLYING INFLATION CONTINUES TO MOVE DOWN

FED’S WILLIAMS: MONETARY POLICY CONTINUES TO BE RESTRICTIVE

HAMMACK: NEED TO MAINTAIN RESTRICTIVE POLICY

HAMMACK: INFLATION EXPECTATIONS CONCERN ME MOST NOW

HAMMACK: OTHER LABOR MARKET MEASURES REASONABLY STABLE

FED’S HAMMACK SAYS INFLATION TOO HIGH, TREND IN WRONG DIRECTION

NY FED’S REMACHE SAYS AMPLE RESERVES FRAMEWORK `SERVED US WELL’

MONEY MARKET VOLATILITY `NORMAL, NOT CONCERNING’: REMACHE

DEPUTY SOMA MANAGER REMACHE ADDRESSES PRIMARY DEALERS IN NY

Trade, Tariffs & Geopolitics

TRUMP POSTS ON TRUTH SOCIAL ABOUT NEW FURNITURE RELATED TARIFFS

TRUMP: NORTH CAROLINA HAS LOST FURNITURE BUSINESS TO CHINA

TRUMP: IMPOSING A 100% TARIFF ON MOVIES MADE OUTSIDE US

CHINA SAYS US UNDERMINES STABILITY OF GLOBAL INDUSTRIAL CHAIN

CHINA ISSUES STATEMENT ON US EXPORT CONTROL PENETRATIVE RULES

CHINA URGES JAPAN TO STOP PUT CHINA COS ON EXPORT CONTROL LIST

US, SWISS RECONFIRM NOT TARGETING FX RATE FOR COMPETITIVE GOALS

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

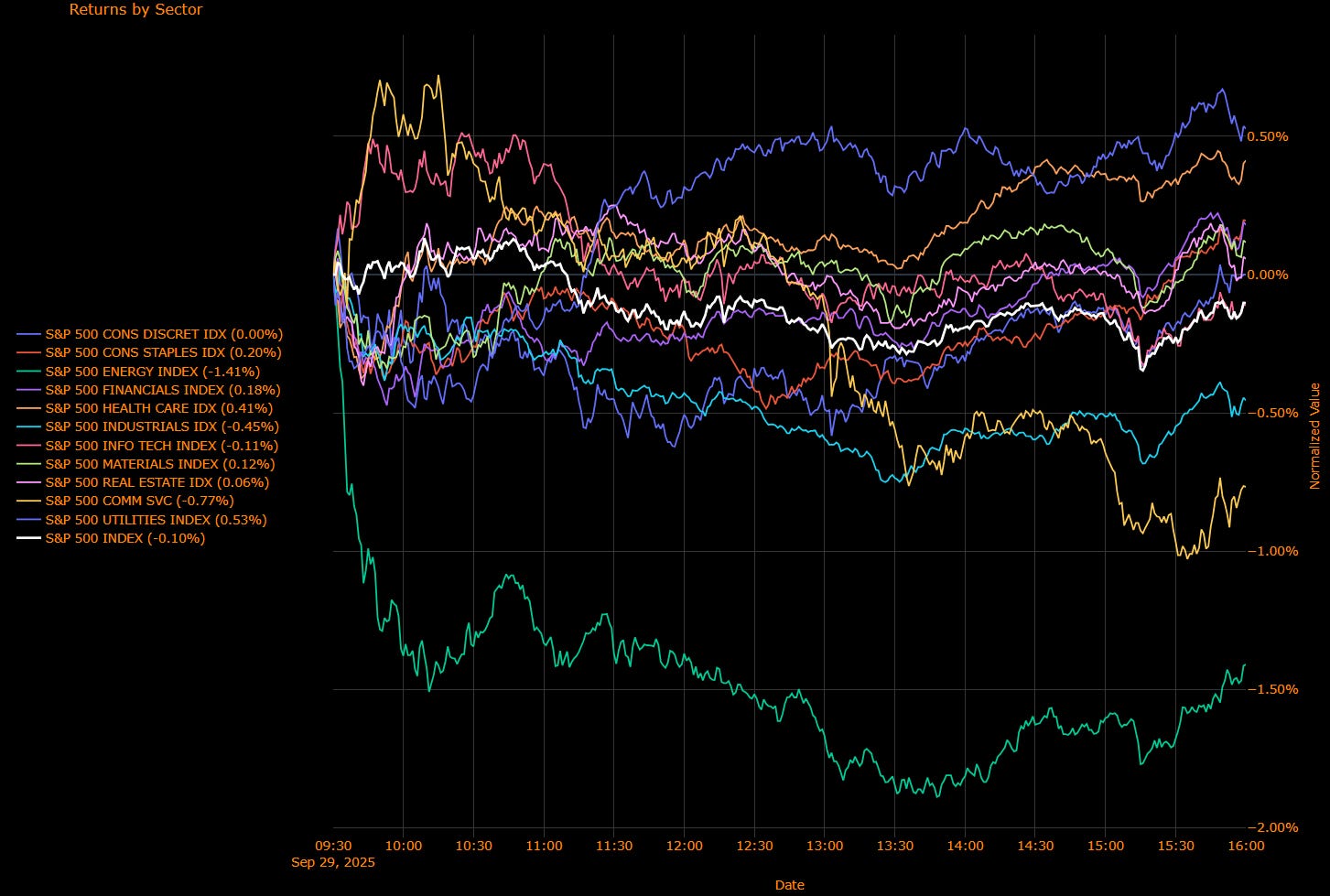

US Market Wrap: Defensive Tilt, Energy Lags; Shutdown Risk Clouds Data (S&P –0.10%)

The S&P 500 slipped 0.10% as sector leadership rotated toward defensives while cyclicals, especially Energy and Communications dragged. The tone was one of “wait-and-see” ahead of labor prints, with added uncertainty that a government shutdown could delay BLS releases. Treasury yields eased and gold hit a record as investors hedged policy and data-risk.

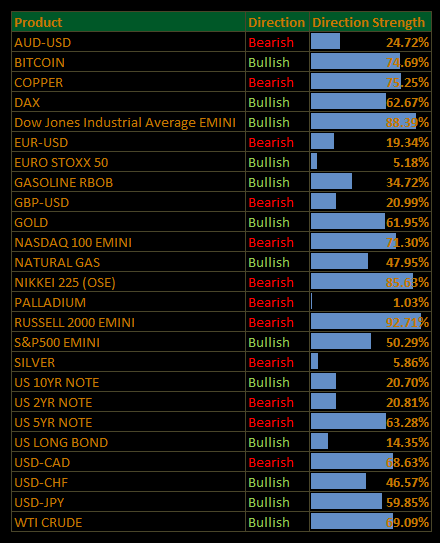

Sector Attribution

Weighted Return Contribution to Index

Biggest drags: Communication Services (–0.08%), Energy (–0.04%), Industrials (–0.04%), Info Tech (–0.04%).

Offsets: Health Care (+0.04%), Financials (+0.02%), Staples (+0.01%), Utilities (+0.01%).

Net: S&P 500 (–0.10%). (from image 1)

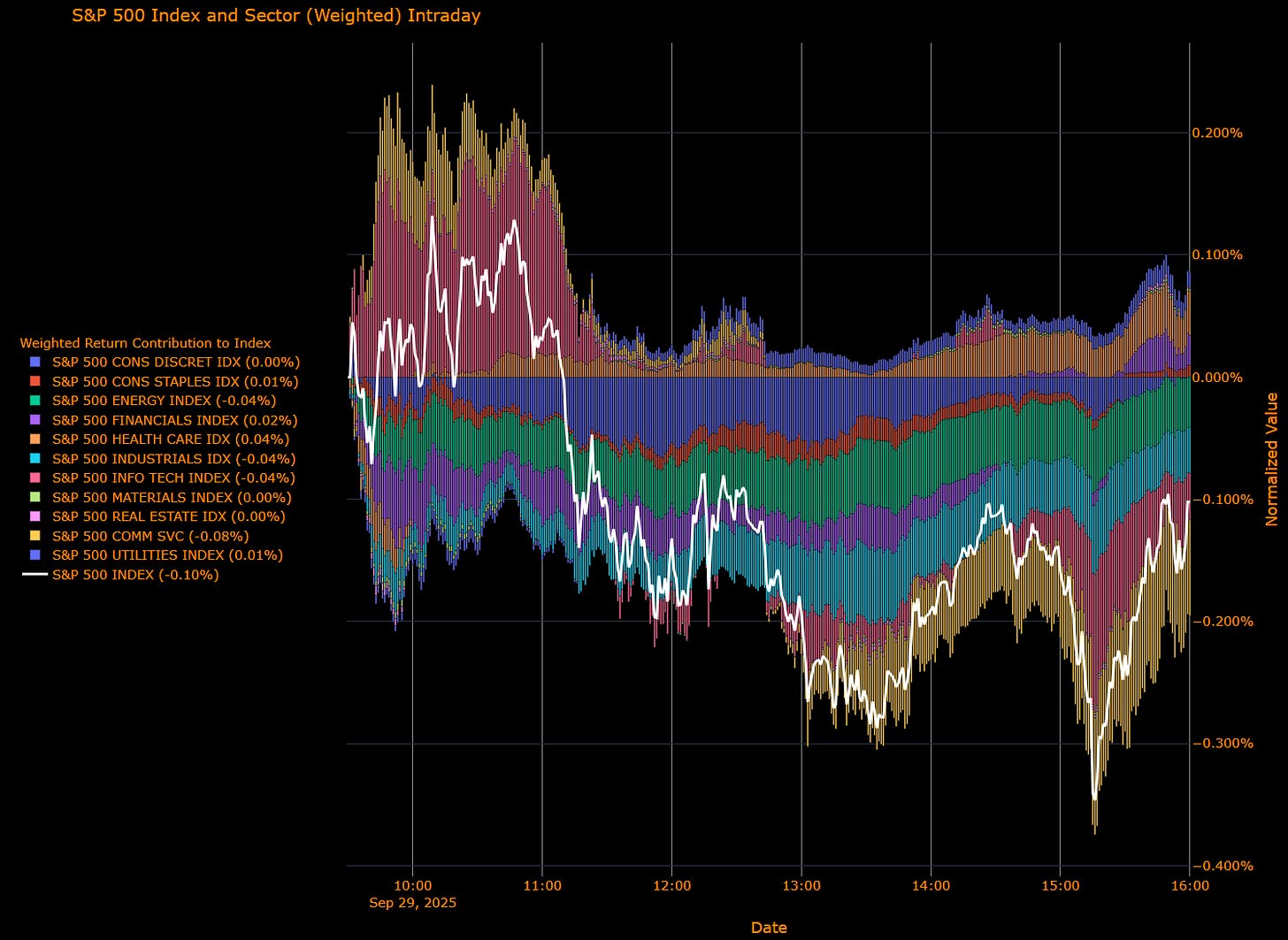

Sector Performance (Unweighted Breadth)

Losers: Energy (–1.41%), Communication Services (–0.77%), Industrials (–0.45%), Info Tech (–0.11%).

Winners: Utilities (+0.53%), Health Care (+0.41%), Staples (+0.20%), Financials (+0.18%), Materials (+0.12%), Real Estate (+0.06%); Discretionary (0.00%).

S&P 500: –0.10%. (from image 2)

Macro Overlay

Shutdown & Data Risk

Markets are bracing for a potential US government shutdown that could delay key releases (JOLTS, NFP) a notable source of policy uncertainty given the Fed’s data dependence.

Fed Speak

Williams (NY Fed): Inflation risks have receded while employment risks have risen; tariffs’ effects have been “modest to moderate.” Policy remains restrictive, with r* ~0.75% real, keeping rate-cut optionality alive but measured.

Remache (NY Fed SOMA): Quarter-end money-market volatility is “normal” within an ample-reserves framework; balance-sheet growth resumes once reserves approach the minimum ample level.

Net: The bar for aggressive easing remains high, but softer labor momentum keeps a gradual-cuts path plausible.

Policy Wildcards

Tariff headlines (incl. proposals targeting films/furniture) keep an inflation-pass-through tail risk in play even as most officials downplay broad tariff effects so far.

The Read-Through

Base case: Data-dependent Fed with October cut possible but not pre-signaled; gradual easing bias if labor cools.

Risks: Data blackout from a shutdown, tariff-related sticky prices, quarter-end funding volatility.

Takeaway: Rotation says quality/defensive still carries the near-term baton while Energy weakness and Comm Services drag cap index upside. With yields easing and gold at highs, the market is hedging policy/data uncertainty rather than abandoning risk.

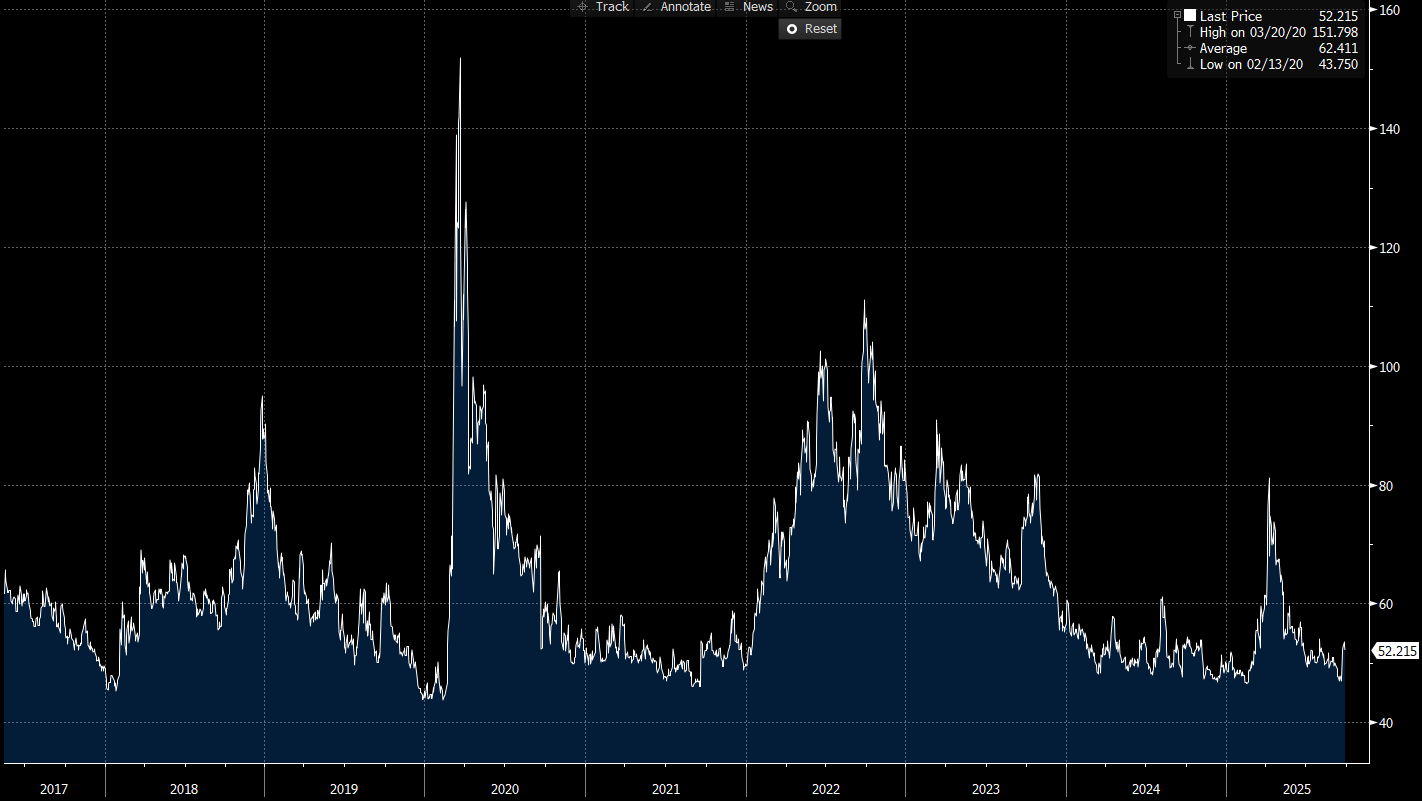

US IG Credit Wrap: Still in the Low-50s; Bonds Bid, Data/Shutdown Fog (IG OAS ~52.2 bp)

IG spreads held the carry lane as macro turned slightly risk-averse but rates rallied. Bloomberg US IG OAS printed ~52.2 bp (chart last: 52.215), a touch tighter vs yesterday’s ~52.6 and comfortably inside the 5-yr average. With Treasuries firmer, gold at a record, and shutdown risks threatening a temporary data blackout, credit traded steady-to-better rather than pro-cyclical.

Credit Context (where we sit)

IG OAS: ~52.2 bp

5-yr avg: ~62.4 bp → ~10 bp inside

Cycle tights: ~43.8 bp → ~8–9 bp away

’22 wides: ~111 bp → ~59 bp tighter

Read: Low-50s regime intact—carry-positive with two-way headline risk.

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

What Changed Today (macro tape)

Fed speak: Williams framed tariffs’ price impact as modest, risks re-balanced toward employment; Remache called quarter-end money-market volatility normal under an ample-reserves operating regime. Net: policy still restrictive, gradual-cuts bias alive but not pre-signaled.

Risks to Watch

Data blackout risk: A shutdown could delay JOLTS/NFP, dulling visibility and elevating event-gap risk when data resume.

Tariff pass-through: Headline noise persists; officials still see limited broad inflation impulse, but discrete sectors (goods importers) remain exposed.

Quarter-end funding: Transient prints in bills/repo; watch for knock-on to IG front-end pricing.

Curve dynamics: A growth-scare bull steepener is more credit-hostile than today’s rates-led grind.

The Read-Through

Base case: Grind-with-noise continues. Low-50s OAS is carry-friendly; dips toward high-40s likely fade without a clear macro inflection.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

All of the interest rate sensitivity models are now reserved exclusively for paid subscribers. If you would like to do a free trial, you can with this LINK.

Launch video for these models is here: LINK

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.