Macro Regime Tracker: PRE-FOMC

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

Macro Regime Context

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

AI and Machine Learning Strategies - Macro Regime and Positioning Premiums Strategies: S&P 500, 2-Year Interest Rates, Gold, and Bitcoin

Macro Regime Context:

We are about to enter FOMC and there is still a high degree of uncertainty. I laid out the redundancy plans for this week specifically focusing on how we are not at a point to short crude yet. We have seen NG rally though as the risk has remained elevated. (Report LINK)

I recorded several macro videos today explaining WHERE we are in the regime:

The first one covered the alpha report which I would strongly encourage you to review before tomorrow: LINK

The second video is a breakdown of stocks and bonds:

And finally a short market wrap video:

I will cover the risk reward of assets at the end of this report for paid subscribers.

Main Developments In Macro

*TRUMP'S MEETING W/ HIS NATIONAL SECURITY TEAM HAS ENDED: CNN

*IDF: IDENTIFIED MISSILES LAUNCHED FROM IRAN TOWARD ISRAEL

*MACRON SAYS WANTS TO FIX 'TARIFF ISSUE AS QUICKLY AS POSSIBLE'

*UAE, IRAN PRESIDENTS SPEAKS ON PHONE: WAM

*TRUMP SAYS 'WE' NOW HAVE 'TOTAL CONTROL' OF SKIES OVER IRAN

*TRUMP: IRAN HAD GOOD EQUIPMENT, DOESN'T COMPARE TO US

*BESSENT SERVING AS TRUMP STAND-IN AT G-7 AFTER PRESIDENT'S EXIT

*ECB'S VILLEROY: WE SHOULD ANALYZE EURO RATE IN POLICY DECISION

*ECB'S VILLEROY: WE SHOULD REACT QUICKLY IF NECESSARY

*ECB'S VILLEROY: WE SHOULD BE AGILE, PRAGMATIC

*ISRAEL: SIRENS SOUNDED IN SEVERAL AREAS ACROSS ISRAEL

*PUTIN, OPEC CHIEF TO DISCUSS OIL MARKET JUNE 20: IFX

*PUTIN TO DISCUSS MIDDLE EAST WITH XI THIS WEEK: IFX

*PUTIN TO HAVE A PHONE CALL WITH CHINA'S XI THIS WEEK: IFX

*TRUMP ADMINISTRATION SAID TO CONSIDER CRACKDOWN ON PHARMA ADS

*MUSK’S XAI IN TALKS TO RAISE $4.3 BILLION IN EQUITY FUNDING

*UK ISSUES 30 NEW SANCTIONS TARGETING RUSSIA

*XI SAYS UNILATERALISM, PROTECTIONISM HARM ALL: XINHUA

*XI SAYS THERE ARE NO WINNERS IN TARIFF WARS, TRADE WARS: XINHUA

*ISRAEL TO ATTACK SIGNIFICANT TARGETS IN TEHRAN TODAY: KATZ

*XI SAYS CHINA READY TO PLAY CONSTRUCTIVE ROLE FOR MIDEAST PEACE

*TRUMP: I HAVE NOT REACHED OUT TO IRAN FOR “PEACE TALKS”

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income and Currencies

You can find the educational primer and video explanation of these models here: LINK

Here is a summary of all models and their directional strengths:

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

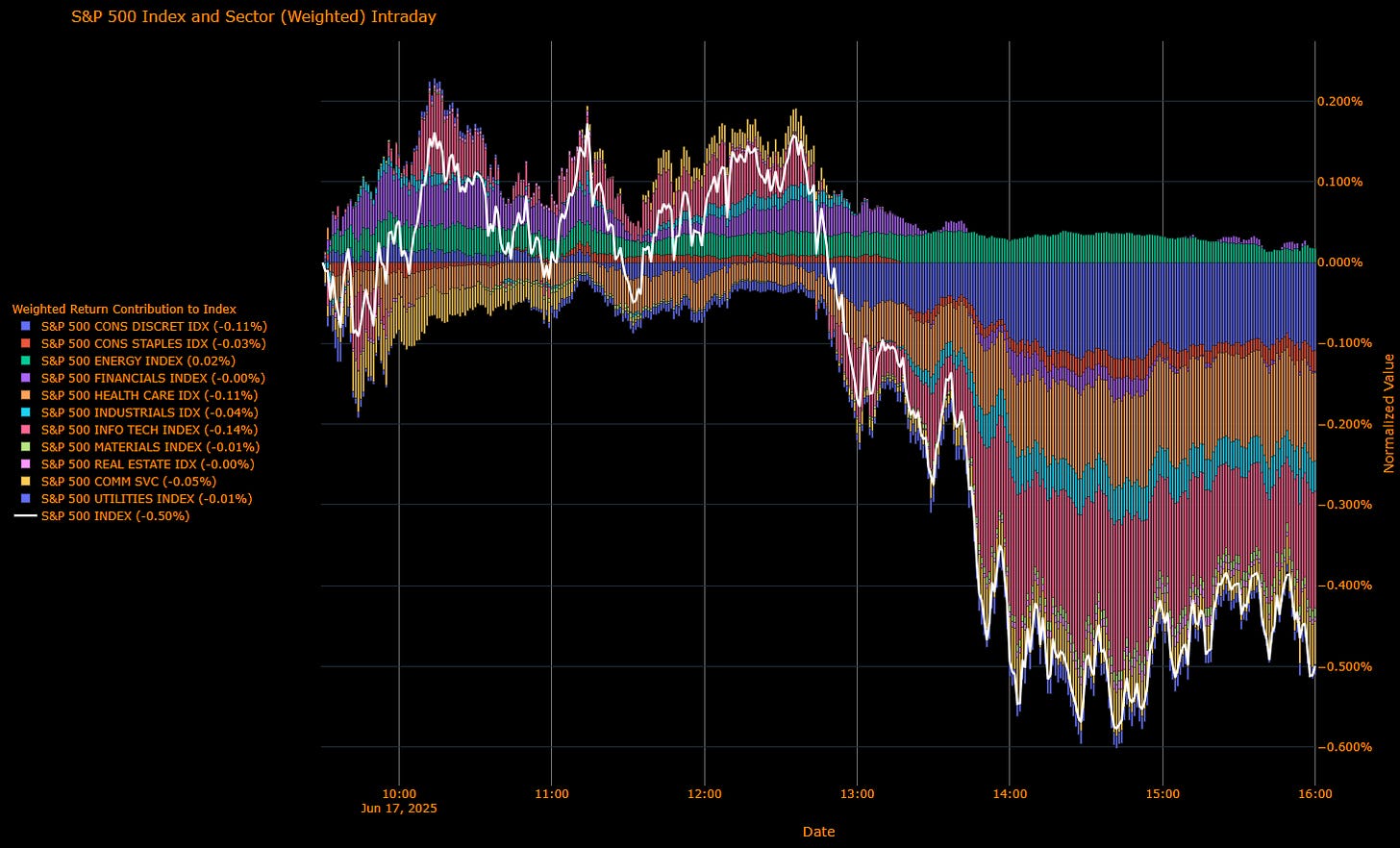

S&P 500 Falls 0.50%, Hit Broadly as Middle East Tensions Flare and Oil Surges

The S&P 500 gave back Monday’s gains, falling 0.50% as geopolitical risks escalated and traders grew more cautious ahead of this week’s central bank decisions. With oil spiking to fresh YTD highs and risk appetite fading resulting in unwounding of positions in growth and defensives alike. The move reflected a classic risk-off tilt, amplified by weak US retail sales, falling industrial production, and surging crude volatility.

Sector Contribution Breakdown (Weighted Impact to Index)

Information Technology (–0.14 pp) – The largest drag on the index, with chipmakers and software broadly weaker amid valuation pressure and geopolitical unease.

Health Care (–0.11 pp) – Defensive names failed to attract support, led lower by biotech and pharma under pressure from policy noise.

Consumer Discretionary (–0.11 pp) – Gave back leadership as retail names were hit by soft consumption data and shifting sentiment.

Communication Services (–0.05 pp) – Underperformed, as media and streaming names saw profit-taking.

Industrials (–0.04 pp) – Marginally weaker on macro growth concerns and fading defense sector momentum.

Consumer Staples (–0.03 pp) – Modest drag as investors rotated away from low-beta sectors.

Materials (–0.01 pp) – Marginally negative; metals and miners tracked weaker global demand signals.

Utilities (–0.01 pp) – Offered no refuge as yields stayed firm and traders exited haven trades.

Financials (–0.00 pp) – Flat on the day despite yield curve dynamics.

Real Estate (–0.00 pp) – Duration-sensitive names stayed heavy amid rate pressure.

Energy (+0.02 pp) – The lone positive contributor, with oil-linked names supported by the surge in crude.

Sector Performance Breakdown (Unweighted Returns)

Energy (+0.55%) – Strongest sector, driven by WTI rallying 4.4% as Middle East conflict escalated and traders hedged tail risks.

Information Technology (–0.45%) – Broad weakness in semiconductors and software after recent outperformance.

Health Care (–1.15%) – Worst performing sector, with a sharp rotation out of defensive names despite volatility.

Consumer Discretionary (–1.04%) – Hit by retail weakness and fading growth sentiment.

Communication Services (–0.55%) – Down as ad-based names and telcos slid.

Utilities (–0.53%) – Continued unwind of rate-sensitive defensives.

Materials (–0.59%) – Pulled lower by commodity weakness and global demand concerns.

Consumer Staples (–0.46%) – Followed the broad move out of defensives.

Industrials (–0.44%) – Struggled alongside soft IP data and geopolitics.

Financials (–0.01%) – Flat, with banks caught between rates and macro nerves.

Real Estate (–0.24%) – Slipped further on duration sensitivity and no sign of yield relief.

Macro Overlay: Risk-Off Returns Amid Middle East Escalation and Weak Data

Geopolitics

Markets recoiled as President Trump’s demands for Iran’s “unconditional surrender” stoked fears of broader US involvement in the Israel-Iran conflict. Despite earlier signs of containment, headlines around potential strikes on Tehran and heightened military activity reignited concern.

Oil

WTI crude surged 4.4%, closing near $75 a barrel, as traders positioned for potential disruptions around the Strait of Hormuz. Volatility in crude markets hit a three-year high, and options flow suggests traders are aggressively hedging for upside risk.

Fed Outlook

Retail sales fell 0.9% in May — the steepest drop this year — while industrial production declined again. The data underscored growing consumer strain and a fading manufacturing pulse. Yet with oil surging, the inflation picture remains clouded ahead of Wednesday’s FOMC. Markets still expect no change in June or July, but Powell’s tone and dot plot will be pivotal.

Bond Market

10Y Treasuries initially rallied but closed slightly weaker at 4.39%, pricing in both safe-haven demand and long-end fatigue. Meanwhile, the USD surged, with the Bloomberg Dollar Spot Index up 0.5% — its biggest jump in a month.

US IG Credit Wrap — Spreads Hold at 56.82 bp as Markets Absorb Geopolitical Risks and Eye Dovish Fed

Current Spread: 56.82 bp

5-Year Average: 62.89 bp

Status: Firmly within the pre-COVID stability range, marking a continued vote of confidence in macro containment and policy predictability despite rising global tension.

Credit Context

< 60 bp: Stable, duration-friendly range supporting insurance and liability-driven investment (LDI) strategies.

60–70 bp: Neutral-to-cautious positioning recommended amid tariff uncertainties and macroeconomic volatility.

> 90 bp: Significant market distress—currently unlikely without a major escalation in geopolitical or macroeconomic shocks.

Macro Overlay

Geopolitical Risk Not Yet Disruptive

Markets absorbed Israel’s intensified military actions and President Trump’s demand for Iran’s “unconditional surrender” with surprising calm. Spreads have not widened — a testament to confidence that the situation, while volatile, remains geographically contained and unlikely to impact global credit fundamentals or supply chains.Oil Rips, But Inflation Path Unchanged (So Far)

WTI jumped 4.4% to $74.92 — the highest since January — and crude volatility reached a 3-year high. Yet the market is distinguishing between transient commodity shocks and structural inflation. Unless oil sustains >$80, IG credit remains insulated. Energy IG issuers even benefit from the price action.Weak Economic Data Adds to Rate-Cut Bets

Retail sales fell 0.9% MoM and industrial production slipped for the second time in three months. Homebuilder confidence also hit the lowest since 2022. Despite a resilient control group reading (+0.4%), the softness in demand supports the case for Fed easing. Markets are now pricing in two cuts for 2025 — with the first fully priced by October.Fed Preview: Patience + Dovish Lean?

The FOMC is expected to hold this week, but the focus is on updated dot plots and Powell’s guidance. With inflation softening and real activity wobbling, even a marginal dovish tilt could drive inflows into IG as a carry-friendly alternative to volatile equity or HY.

Bottom Line

As shown in the attached chart, IG spreads are tracking inside their long-run average and remain far from the volatility of 2022 or the COVID spikes of 2020. At 56.82 bp, we are closer to 2017–2018 “Goldilocks” levels than any recent stress regime — and this despite rising oil, dollar strength, and ongoing global political frictions.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Short-End Rates Wrap — Cumulative Easing Deepens to –107.3 bp; September Cut Now Firmly in Play

Market Pricing Summary (Latest OIS-Implied Path):

Markets are sharpening their expectations for Fed cuts, pricing a full 107.3 bp of easing by the end of October 2026. The probability of a first cut by September 2025 has climbed further, while 2026 is now expected to deliver the bulk of the easing cycle — even as geopolitical stress and oil price volatility rise.

Key Takeaways (Implied OIS Pricing)

First-Cut Timing:

18-Jun-25: Functionally unchanged at 4.33% (–0.1 bp), with just a 0.4% chance of a cut — no live risk.

30-Jul-25: Pricing shifts slightly, with a 14.4% probability of a 25 bp cut (–3.6 bp). Still not a strong base case.

17-Sep-25: Conviction builds — markets now assign a 56.4% chance to a 25 bp cut (–17.8 bp), solidifying September as the expected liftoff point.

Front-Loaded Easing Path (2025):

10-Dec-25: Implied rate sits at 3.860%, pricing in a cumulative –47.0 bp of easing through year-end — just shy of two full cuts.

Longer-Term Easing Expectations (2026):

28-Oct-26: Terminal policy rate priced at 3.257%, reflecting total expected easing of –107.3 bp from the current 4.33%.

That implies four full 25 bp cuts, with the bulk expected to occur in H1 2026:

28-Jan-26 (–54.2 bp total)

29-Apr-26 (–74.7 bp total)

29-Jul-26 (–95.2 bp total)

Macro Context: Rate Traders Look Through Geopolitics, Focus on Deteriorating Data

Geopolitical Volatility High, but Contained

Despite direct missile exchanges between Iran and Israel, and President Trump’s aggressive stance ("UNCONDITIONAL SURRENDER"), markets are treating the conflict as contained.Oil Spike Not Derailing Easing Path

WTI crude closed at $74.92/bbl (+4.4%), yet the curve still leans heavily toward easing. Traders are betting that unless energy prices remain elevated into Q3, the inflation shock will remain transitory.Data Weakness Adds to the Cut Case

Retail sales fell 0.9% in May — the worst monthly reading of the year — with consumer demand softening under the weight of tariffs and inflation anxiety. Industrial production also dipped 0.2%, and homebuilder sentiment dropped to its lowest since December 2022. The macro tone has turned cautious, giving the Fed breathing room.Fed Outlook: No Move This Week, But Dovish Dots Likely

Markets expect no change at the June FOMC, but focus is squarely on Powell’s tone and the Summary of Economic Projections. With inflation easing and economic data rolling over, the Fed is in no rush. September is the logical starting point for cuts — and the market is confidently leaning that way.

Bottom Line: Market Locked Into a Gradual Path Lower

The short-end remains grounded in a base case of "September start, slow and steady thereafter."

Roughly two cuts priced for 2025

Total of –107.3 bp priced by October 2026

No front-loading, no panic — just a smooth, quarterly rhythm of easing unless oil or core inflation re-accelerates

Amid rising geopolitical stress and fragile consumer confidence, the STIR complex continues to look through the noise — leaning on soft data, Fed patience, and policy normalization by Q4.

The Fed may not pre-commit — but the market already has.

Tactical Portfolio

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.