Macro Regime Tracker: Systematic Breakdown

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

You can find the macro video breakdown I recorded here:

As we progress into FOMC, we are seeing confirmation of the views I laid out and the updated tensions around inflation risk from yesterday’s report:

As always, all the systematic models and strategies are updated below. I will be launching some new sections of research and trading for Capital Flows soon. I would appreciate it if you could provide feedback on how helpful you find the systematic macro regime tracker that is sent out daily:

Main Developments In Macro

US Macro, Trade & Policy

HASSETT ON US ECONOMY: RIGHT NOW, THE NUMBERS ARE GREAT

HASSETT: BESSENT IS GOING TO `LAND THIS PLANE’ ON CHINA

HASSETT: CHANCES FOR PROGRESS ON SHUTDOWN THIS WEEK

TRUMP: I WANT CHINA TO THRIVE, WE HAVE TO THRIVE TOGETHER

TRUMP: EXPECT WE’LL WORK OUT A FAIR DEAL WITH CHINA

TRUMP: CHINA MAY PAY 155% TARIFF IF NO DEAL BY NOV 1

TRUMP: CHINA PAYING A LOT OF MONEY TO US VIA TARIFFS

TRUMP: CHINA HAS BEEN VERY RESPECTFUL OF US

TRUMP: CAN THREATEN CHINA WITH AIRPLANES

TRUMP: WILL BE BIG PRICE IF NO DEAL ON ENDING WAR IN UKRAINE

TRUMP: UKRAINE COULD STILL WIN WAR

TRUMP: I THINK XI AND I WILL GET ALONG WITH REGARD TO TAIWAN

TRUMP: MEETING WITH XI IN SOUTH KOREA IN COUPLE OF WEEKS

TRUMP: CHINA PUNISHING OUR FARMERS BY NOT BUYING SOYBEANS

Europe: Monetary Policy & Geopolitics

ECB’S NAGEL: WE CAN STAY IN WAIT-AND-SEE MODE ON RATES

ECB GOVERNING COUNCIL MEMBER NAGEL SPEAKS IN NEW YORK

ECB EXECUTIVE BOARD MEMBER ISABEL SCHNABEL SPEAKS IN FRANKFURT

SCHNABEL: EURO’S GLOBAL POSITION STRONG, SHOULD BE STRENGTHENED

EU’S KALLAS: HOPE TO ADOPT RUSSIA SANCTIONS PACKAGE THIS WEEK

KALLAS: RUSSIA DOESN’T WANT PEACE, ONLY UNDERSTANDS STRENGTH

EU’S KALLAS: WE SEE TRUMP’S EFFORTS TO BRING PEACE TO UKRAINE

THUNE: RUSSIA SANCTIONS BILL POSTPONED UNTIL TRUMP-PUTIN TALKS

HUNGARY’S SZIJJARTO: WON’T BLOCK EU’S RUSSIA SANCTIONS PACKAGE

ITALY SIGNALS IT’S READY TO HELP UKRAINE BUY US WEAPONS

Japan Monetary & Political Developments

BOJ’S TAKATA: NEED TO ADJUST MONETARY EASING FURTHER

BOJ’S TAKATA: PRICE TARGET IS MORE OR LESS ACHIEVED

BOJ’S TAKATA: NOW IS PRIME OPPORTUNITY TO RAISE POLICY RATE

BOJ MAY `SLIGHTLY’ REVISE UP THIS YEAR’S GROWTH FORECAST: RTRS

JAPAN’S NIKKEI RISES 3% AS RULING LDP REACHES COALITION DEAL

JAPAN’S TOPIX INDEX RISES 2% TO 3,234.09 AT MORNING CLOSE

China & Emerging Markets

CITI NO LONGER EXPECTS CHINA TO CUT POLICY RATE OR RRR IN 4Q

CHINA’S 4TH PLENUM GOES UNDERWAY: XINHUA

XI BRIEFS PLENUM DRAFT OF NEXT FIVE-YEAR PLAN: XINHUA

US, CHINA SHOULD RESOLVE ISSUES ON BASIS OF EQUALITY: GUO

ETHIOPIA IN TALKS WITH CHINA ON CONVERTING DOLLAR LOANS TO YUAN

ARGENTINA CENTRAL BANK, US TREASURY SIGN $20 BILLION SWAP DEAL

JAMIE DIMON HEADS TO ARGENTINA BEFORE KEY TEST FOR MILEI

Global Trade & Supply Chain Themes

WHITE HOUSE: DOD TO INVEST IN GALLIUM REFINERY IN AUSTRALIA

WHITE HOUSE RELEASES US-AUSTRALIA CRITICAL MINERALS FRAMEWORK

US, AUSTRALIA SETTING UP CRITICAL MINERALS SUPPLY SECURITY UNIT

TRUMP: CHINA MAY PAY 155% TARIFF IF NO DEAL BY NOV 1

TRUMP: CHINA PAYING A LOT OF MONEY TO US VIA TARIFFS

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

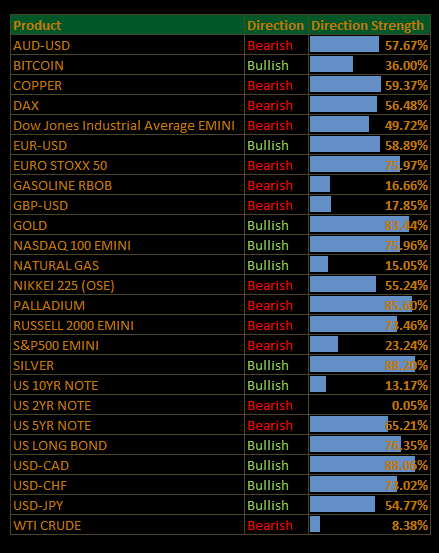

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

US Market Wrap: Earnings Beat Streak, Easing Trade Tension; Broad Risk-On With Defensives Lagging (S&P +0.47%)

The tone flipped as solid prints from Corporate America and a cooling US-China temperature steadied risk. About 85% of reporters have beaten estimates, helping the S&P 500 add +1.1% on the day at the close of cash trading and log its best two-day run since June, with 10-year yields easing to ~3.98 bps and small caps outpacing. The bid was earnings-led, not multiple-led, and breadth improved meaningfully.

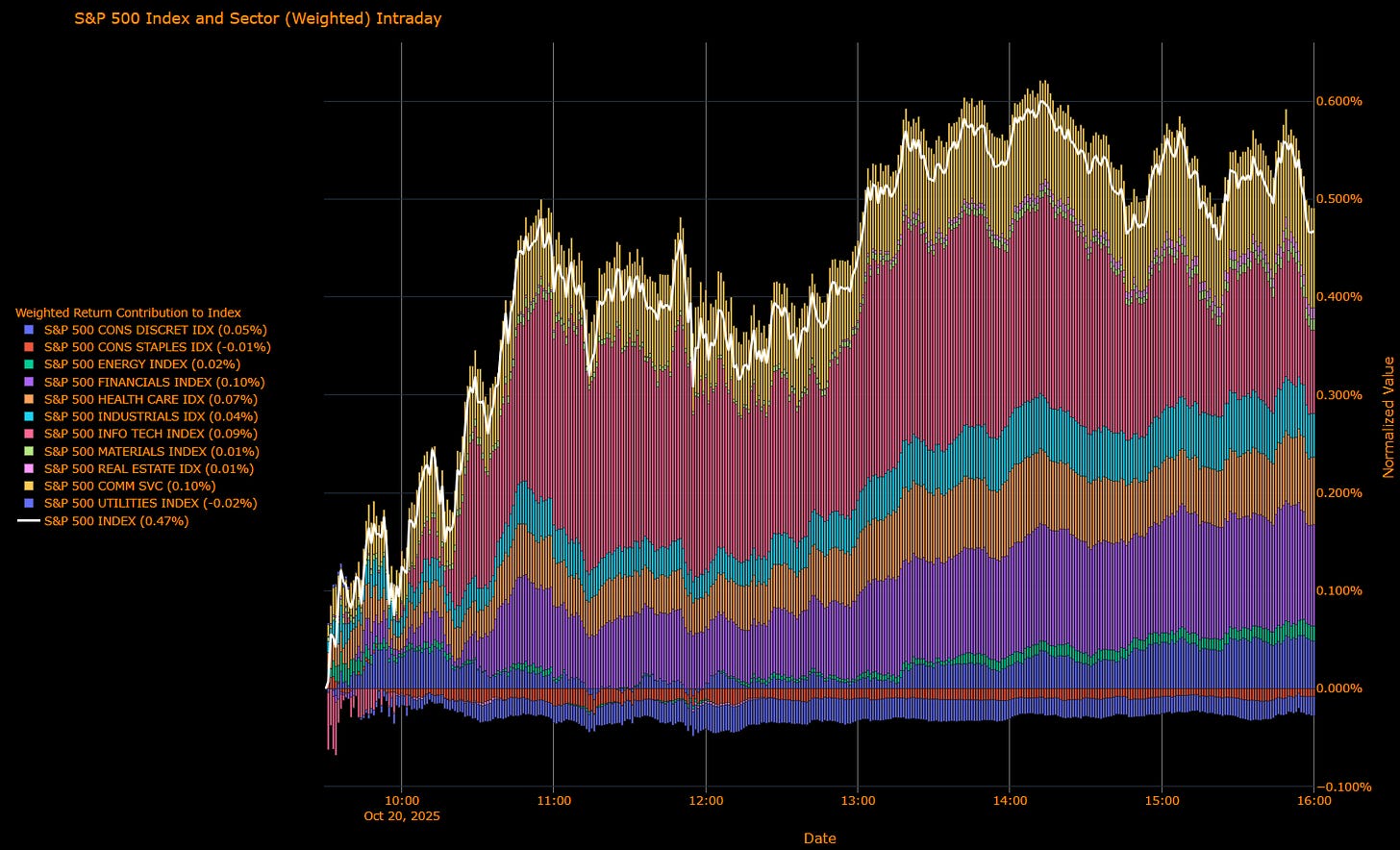

Sector Attribution

Weighted Return Contribution (S&P +0.47%)

Leaders: Financials (+0.10%), Communication Services (+0.10%), Information Tech (+0.09%), Health Care (+0.07%), Industrials (+0.04%), Discretionary (+0.05%).

Tails: Energy (+0.02%), Materials (+0.01%), Real Estate (+0.01%); Staples (−0.01%), Utilities (−0.02%).

Read: The index advance was broad and cyclically tilted, with classic defensives (Staples, Utilities) subtracting at the margin, consistent with easing growth angst and lower rates.

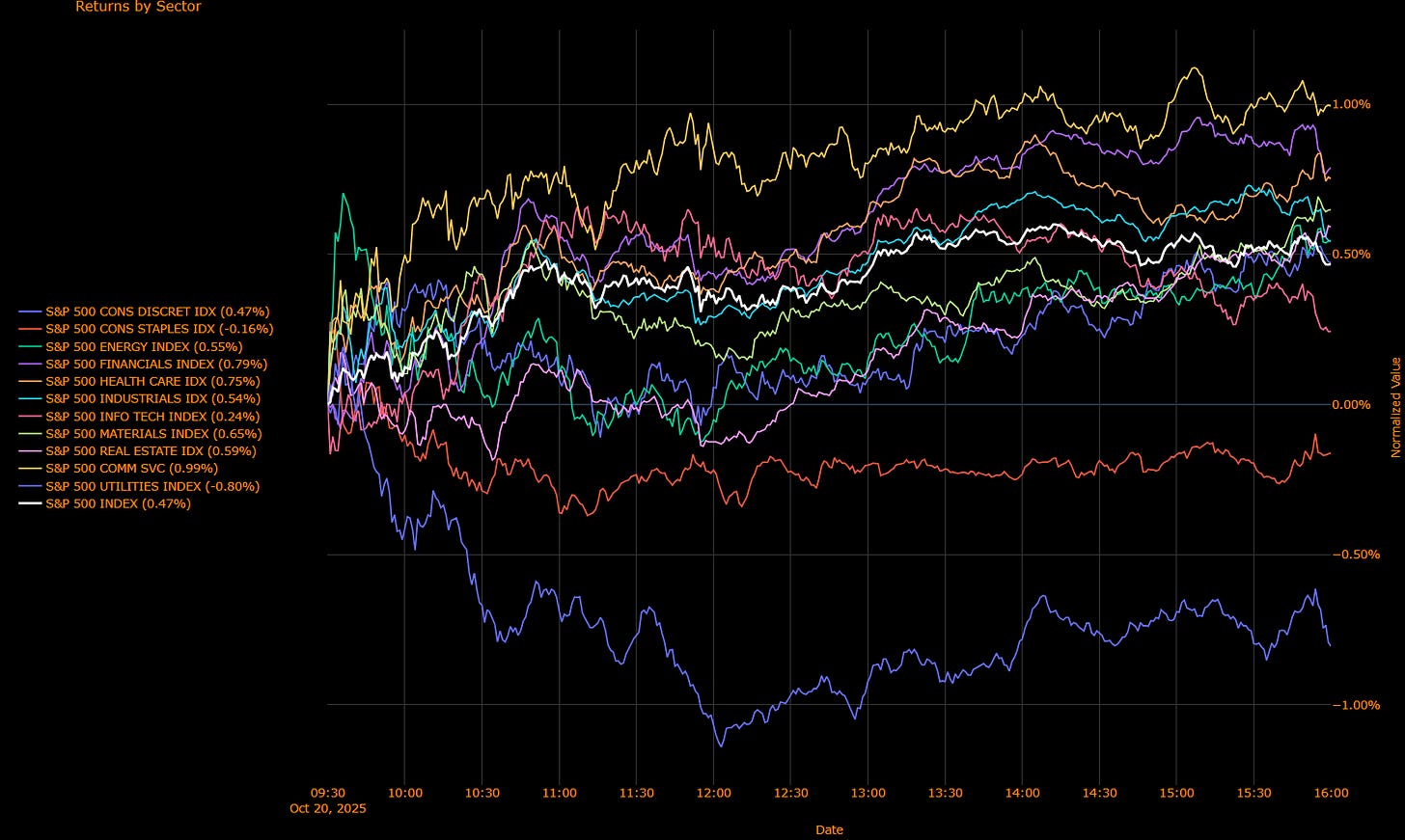

Unweighted Performance (Breadth)

Leaders: Communication Services (+0.99%), Financials (+0.79%), Health Care (+0.75%), Materials (+0.65%), Real Estate (+0.59%), Industrials (+0.54%), Energy (+0.55%), Discretionary (+0.47%); Tech (+0.24%).

Laggards: Utilities (−0.80%), Staples (−0.16%).

Read: Broad participation beyond megacap tech; beta and cyclicals outperformed while bond-proxies lagged despite softer yields, an earnings/animal-spirits day rather than a pure duration chase.

Macro Overlay

Catalysts:

Earnings season doing the heavy lifting (beat rate ~85%); Apple to fresh record on upgrade; small caps +1.9% as “profits-catch-up” narrative builds.

US–China tone a shade warmer (talks/meeting signals), even as tariff threats linger; traders faded worst-case escalation.

AWS outage headlines mostly idiosyncratic; didn’t dent the broader risk tone.

Policy/Rates/FX:

Front-to-back yields drifted lower (10y −3 bps to ~3.98%), easing the equity cost of capital; markets still lean to an October 25 bp cut with CPI (delayed by shutdown) now the week’s key macro print.

Dollar little changed; gold firmer on residual headline risk; crude flat.

The Read-Through

Earnings > Macro (for now): when beats are this broad, the market will fund risk even with tariff chatter in the background.

Cyclical breadth matters: leadership from Financials/Comm Services/Industrials/Materials/Real Estate alongside negative Utilities/Staples says this was growth/confidence, not merely lower-rates.

If US-China de-escalation holds and big-tech guidance confirms AI spend → profitability, the path into year-end tilts higher; watch CPI for any services stickiness that could cap duration support.

What to Watch Next

Megacap prints (AI monetization, capex efficiency).

CPI (Fri): a 0.3% core keeps the soft-landing glide path; hotter would re-tighten financial conditions.

Breadth follow-through: do Financials and Comm Services keep leading while defensives lag? That’s your tell that this rebound is earnings-driven and durable, not just a relief rally.

US IG Credit Wrap: Earnings Lift, Trade Chill; OAS Grinds Into Low-50s, Carry in Control (IG OAS ~52.2 bp)

IG tightened with the risk tone. As equities rebounded (S&P +1.1%, small caps +1.9%) on strong beats and a warmer US-China temperature, credit spreads ground into the low-50s and stayed orderly with yields a touch softer (10y ~3.98%). Tone = “earnings-led risk-on, carry still king.”

Where We Sit (from the chart)

IG OAS: ~52.2 bp (last 52.16)

5-yr avg: ~61.9 bp → ~10 bp inside

Cycle tights: ~46.1 bp → ~6 bp above

2022 wides: ~111.2 bp → ~59 bp tighter

Tape & Macro Overlay

Catalysts: Beat rate near ~85% has investors rewarding cyclicals and beta; tariff rhetoric persists but talks/meetings signal de-escalation risk.

Policy: Market still leans to an Oct 25 bp cut; CPI (Fri) is the swing print for dose and path.

Rates/FX/Commodities: Mild bull-steepening bias with 10y −3 bp; USD little changed; gold firmer on headline hedging; crude flat.

Mapping to IG

Base case: 50–60 bp range remains the center of gravity with a grind-tighter bias while earnings surprise positive and policy glides toward easing.

Banks: Equity nerves faded; senior IG stable on ample term funding and easier rates. Watch idiosyncratic names, not the beta.

Cyclicals (Energy/Materials/Industrials): Two-way to tariffs/oil, but the earnings tone helps quality BBB/A compress modestly.

Defensives (Staples/HC/REIT IG): Rich and steady; carry dominates unless duration rally accelerates.

Tech/Comms: Headlines (cloud outages, AI monetization) are idiosyncratic, no systemic read to IG; large-cap balance sheets still a support.

Risk Markers to Watch

CPI core (0.3% m/m consensus): hot print risks a brief rates tantrum → pause the grind; in-line keeps carry bid intact.

US-China tape: de-escalation keeps beta open; renewed tariff shock would cap spread tightening.

Regional-bank disclosures: breadth of charge-offs still the canary; systemic signal would be a clean break back above ~60 bp.

With earnings doing the heavy lifting and policy bias easing, IG OAS compresses toward cycle tights but respects the 50–60 bp corral. Absent a growth or funding shock, carry does the work; fade breaks wider without corroborating macro stress.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

All of the interest rate sensitivity models are now reserved exclusively for paid subscribers. If you would like to do a free trial, you can with this LINK.

Launch video for these models is here: LINK

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.