Macro Regime Tracker: The Credit Cycle Set Up

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

I have laid out the trade implications of the regime we are currently in here:

Post Jackson Hole, the credit cycle remains intact. When we are in periods of time like this, the liquidity we experience sows the seeds of its own demise.

When everything converges to the currency and interest rates like this, it is truly a risk because it can cause larger bear markets when it unwinds. We are NOT there yet, though! I remain bullish on risk assets on a cyclical basis. Understanding the signals around everything as we progress will be critical, though. If my strategies for risk assets turn bearish, then I will publish a report for paid subscribers on it immediately.

You can see the End Game Report I wrote here:

As always, all of the updated models and strategies are laid out below.

Main Developments In Macro

Fed, rates & governance (US)

*TRUMP WEIGHS QUICKLY ANNOUNCING REPLACEMENT FOR FED'S COOK: WSJ

*FEDERAL RESERVE: REMOVAL PROTECTIONS SERVE AS SAFEGUARD

*FEDERAL RESERVE REAFFIRMS COMMITMENT TO TRANSPARENCY: STATEMENT

*FEDERAL RESERVE WILL ABIDE BY ANY COURT DECISION: FED STATEMENT

*FEDERAL RESERVE: GOVERNORS MAY ONLY BE REMOVED 'FOR CAUSE'

*TRUMP: WE MIGHT SWITCH MIRAN TO ANOTHER LONGER TERM FED SPOT

*TRUMP ON FED'S COOK REPLACEMENTS: SOME VERY GOOD PEOPLE IN MIND

*TRUMP ON THE FED: NEED PEOPLE WHO ARE 100% ABOVE BOARD

*TRUMP: FED'S COOK SEEMS TO HAVE HAD AN INFRACTION

*TRUMP ON FED'S COOK: PREPARED FOR A LEGAL FIGHT

*LAWYER FOR FED'S COOK SAYS WILL FILE LAWSUIT CHALLENGING FIRING

*BRAINARD: TRUMP MOVES RISK HIGHER INFLATION, LONG-TERM RATES

*BARKIN: LONG-TERM INTEREST RATES ARE WITHIN HISTORIC NORMS

*FED'S BARKIN: MY FORECAST IS FOR A MODEST ADJUSTMENT IN RATES

*TRUMP ON THE FED: I ABIDE BY THE COURT

US policy, trade, tariffs, housing & regulation

*TRUMP ON TARIFF REBATE CHECK: THERE'S A POSSIBILITY

*TRUMP REITERATES FURNITURE TARIFF WILL BE 'VERY SUBSTANTIAL'

*TRUMP: NEW JOBS NUMBERS TO BE THROUGH THE ROOF FROM NEW HIRING

*TRUMP: GOVERNMENT JOBS ARE DOWN, PRIVATE JOBS ARE UP

*TRUMP: FOSSIL FUEL, NUCLEAR ENERGY IS WHAT WORKS

*TRUMP: WE DON'T WANT WINDMILLS OR SOLAR PANELS

*TRUMP SAYS HE THINKS OIL PRICES WILL BREAK $60/BARREL SOON

*TRUMP PRAISES OIL PRICES BEING CLOSE TO $60 PER BARREL

*LOEFFLER: SBA ORDERS LENDERS TO DOCUMENT DEBANKING PRACTICES

*LOEFFLER: SBA IN LETTER ORDERS 5000 LENDERS TO STOP DEBANKING

*LOEFFLER: SBA WILL ANNOUNCE A MAJOR INVESTIGATION ON DEBANKING

*VANCE ON ADDRESSING HOUSING COSTS: A LOT MORE WORK TO DO

*BESSENT: THINK WE'LL SEE TARIFF REVENUE JUMP IN SEPTEMBER

*BESSENT: TREASURY TAKING IN RECORD TARIFF REVENUES

*BESSENT: WE'LL SEE BIGGER CAPEX BOOM FROM HERE

*BESSENT: PUBLIC TRUST GIVES FEDERAL RESERVE ITS CREDIBILITY

*LUTNICK: INTEL DEAL IS NOT SOCIALISM, IT'S CAPITALISM

*LUTNICK: IF COMPANY NEEDS HELP, TRUMP WILL CONSIDER GOVT STAKE

*LUTNICK: THERE'S NO SOVEREIGN WEALTH FUND NOW

*LUTNICK: THERE'S MONSTROUS DISCUSSION ABOUT DEFENSE

*LUTNICK: GRANT PREVIOUSLY GIVEN TO INTEL ASKED FOR NOTHING

*LUTNICK: IRONING OUT THE DETAILS ON USING BLOCKCHAIN FOR GDP

*LUTNICK: ISSUING GDP ON THE BLOCKCHAIN

*LUTNICK: COMMERCE TO SOON ISSUE STATISTICS ON THE BLOCKCHAIN

Global macro (ex-US) with US-relevant spillovers

Central banks:

*MACKLEM: WE'RE NOT REVISITING OUR 2% INFLATION TARGET

*BANK OF CANADA RELEASES TEXT OF GOVERNOR'S MEXICO CITY SPEECH

*BANK OF CANADA EXAMINING BEST WAYS TO MEASURE CORE INFLATION

*BOC LOOKING AT HOW MONETARY POLICY AFFECTS HOUSING: MACKLEM

*BOE RATE-SETTER CATHERINE MANN SAYS IN TEXT OF SPEECH IN MEXICO

*MANN SAYS SHE'S READY FOR LARGER CUTS IF DOWNSIDE RISKS GROW

*MANN: MONETARY POLICY 'NOT TIGHT ENOUGH' IN BOE'S AUG RATE PATH

*MANN: WAGE-SETTING IS IMPORTANT SOURCE OF ELEVATED UK INFLATION

*MANN SAYS DOWNSIDE RISK TO DEMAND SCENARIO NOT HER CENTRAL CASE

*MANN: SHORT, LONG-TERM HOUSEHOLD INFLATION EXPECTATIONS RISING

*BOE'S MANN SAYS INFLATION PERSISTENCE IS HER CENTRAL CASE

China / Asia industrial policy & chip cycle:

*CHINA TO BOOST FINANCIAL, FISCAL SUPPORT FOR AI DEVELOPMENT

*CHINA TO SUPPORT AI CHIP INNOVATIONS: STATE COUNCIL

*CHINA TO SUPPORT AI CHIP, SOFTWARE ECOSYSTEM DEVELOPMENT:XINHUA

*CHINA TO BOOST INTELLIGENT CAR, ROBOT DEVELOPMENT

*JAPAN JULY CHIP-MAKING EQUIPMENT BILLINGS RISE 18.1% Y/Y: SEAJ

Europe data & markets:

*FRANCE AUG. CONSUMER CONFIDENCE FALLS TO 87; EST. 89

French Assets Lag Peers as Political Woes Persist: Macro Squawk

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

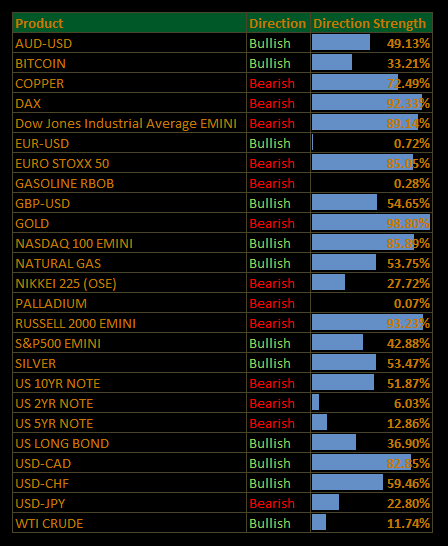

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

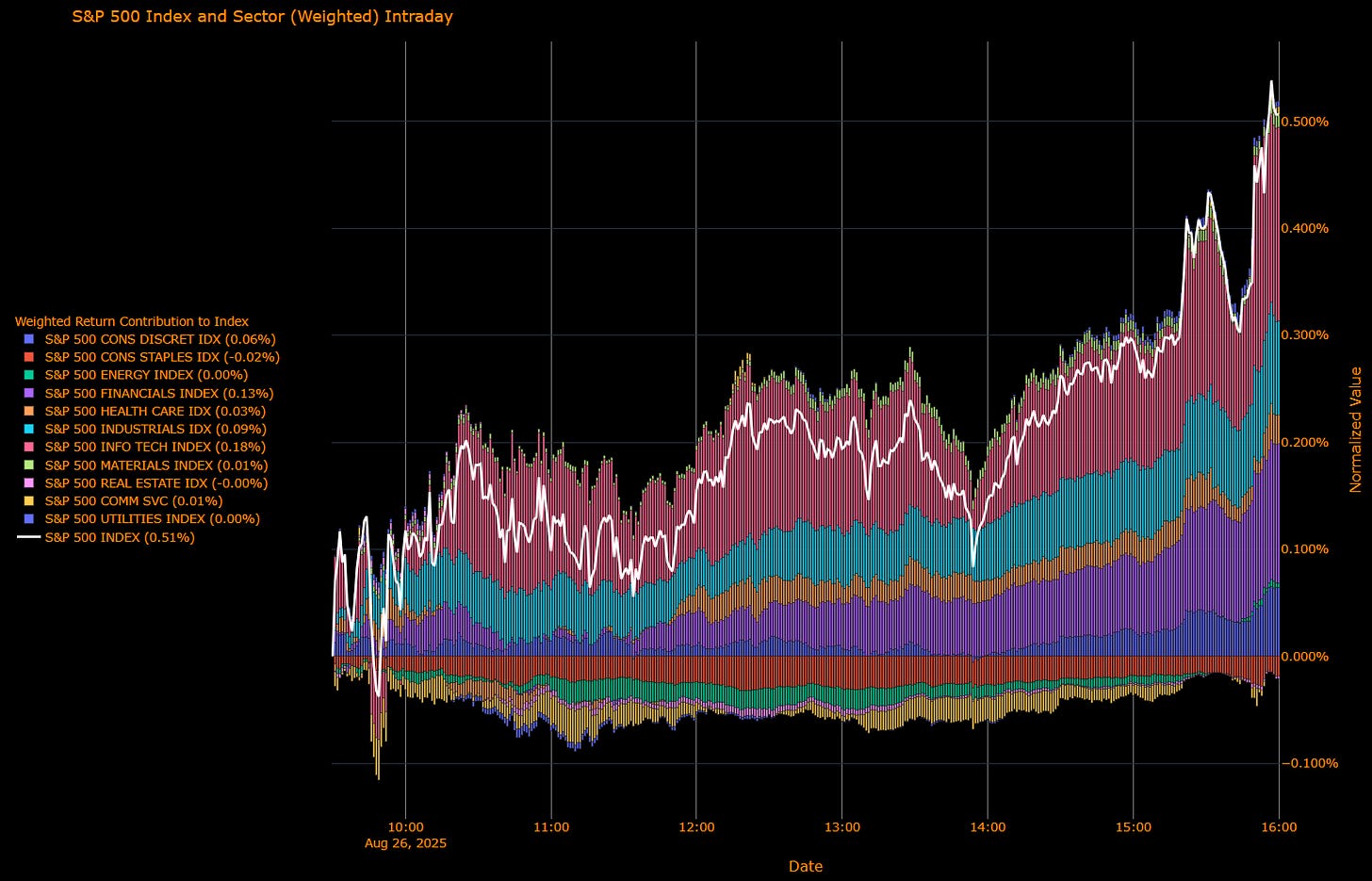

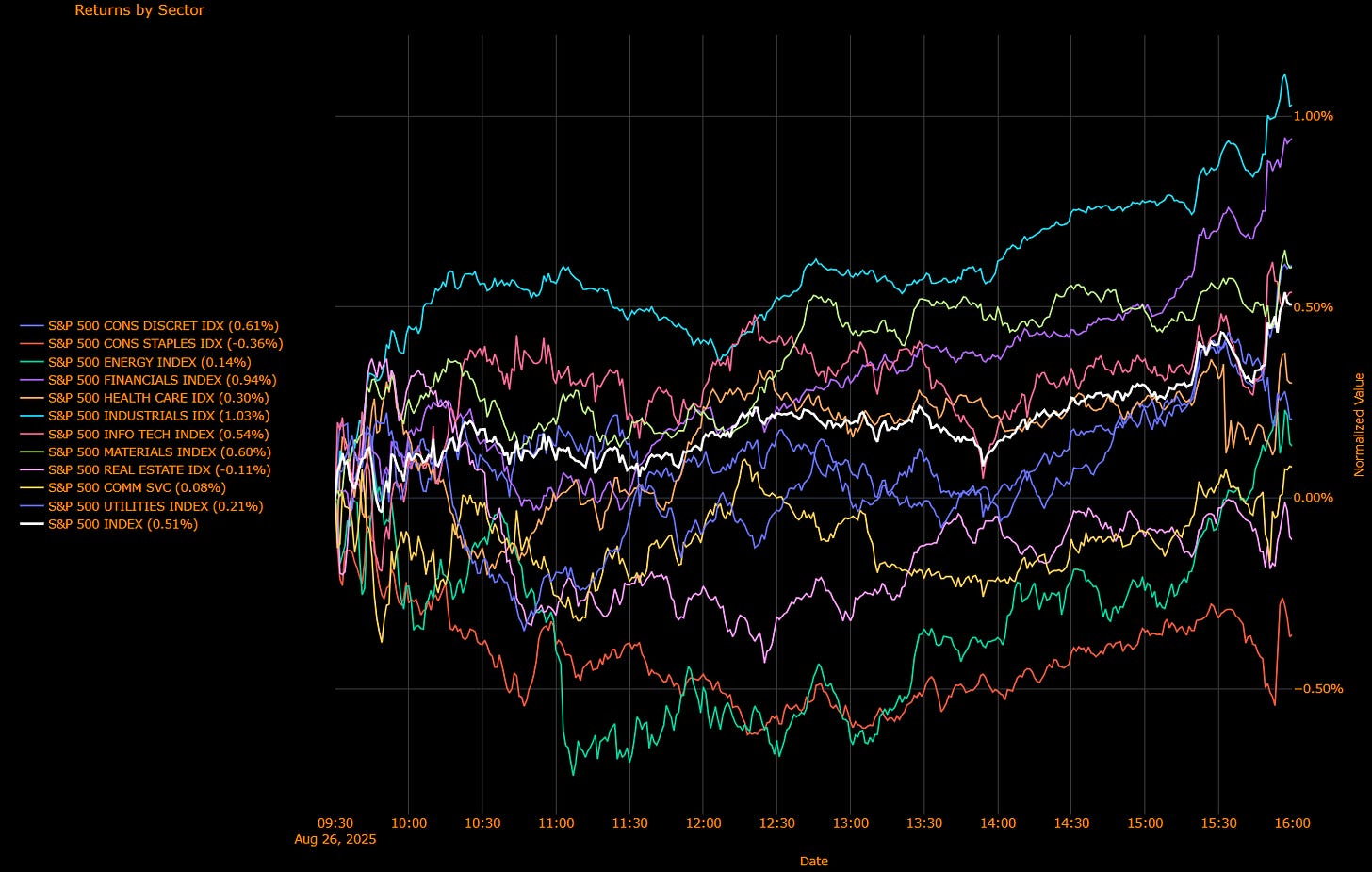

US Market Wrap: Nvidia Eve Bid; Curve Steepens, Cyclicals Lead (S&P +0.51%)

A calm, risk-on session into Nvidia’s print: the S&P rose +0.51% as Industrials/Financials/Tech did the heavy lifting. Long-end rates were choppy but the curve steepened (5s30s widest since ’21) amid renewed chatter about Fed independence after the move to oust Gov. Cook. A solid 2-yr sale (stop ~3.641%, bid/cover 2.69, strong indirects) underpinned the front end. Data were mixed-but-resilient: core capital goods orders beat (+1.1% m/m; shipments +0.7%) even as headline durables fell on aircraft. Dollar eased, crude inched up, and volatility remains pinned with funds heavily short VIX.

Sector Contribution (weighted to index move)

Offsets:

Information Technology (+0.18%), Financials (+0.13%), Industrials (+0.09%), Consumer Discretionary (+0.06%), Health Care (+0.03%), Materials (+0.01%), Communication Services (+0.01%).

Detractors/flat:Consumer Staples (−0.02%), Real Estate (~−0.00%), Energy (0.00%), Utilities (0.00%).

Index: S&P 500 (+0.51%).

Sector Performance (unweighted breadth)

Leaders:

Industrials (+1.03%), Financials (+0.94%), Consumer Discretionary (+0.61%), Materials (+0.60%), Information Technology (+0.54%), Health Care (+0.30%).

Laggards:Utilities (+0.21%), Energy (+0.14%), Communication Services (+0.08%), Real Estate (−0.11%), Consumer Staples (−0.36%).

Index: S&P 500 (+0.51%).

Macro Overlay: What mattered

Fed independence headline risk: Markets still assume an independent Fed, but any escalation argues for a steeper curve risk premium at the long end; watch 5s30s.

Growth pulse: Core capex beat and positive shipments signal ongoing AI/capex resilience even as headline durables sag on aircraft.

Funding & front end: Strong 2-yr auction keeps the September-cut debate “how dovish vs how hawkish,” not “if.”

Positioning/vol: Extreme net shorts in VIX leave a low-vol regime vulnerable to a headline or earnings shock (NVDA, core PCE next).

The tape favored cyclicals over defensives with a classic “growth-without-panic” tone. Base-case: a September 25 bp calibration cut remains in play, while politics nudges term-premium/steepening risk. Near-term pivot points: Nvidia’s guidance, core PCE, and any further signals on Fed governance.

US IG Credit Wrap: Sub-50 Steady; Curve Steepens, Capex Beat Keeps Risk Bid

IG OAS: 49.65 bp • 5-yr avg: 62.60 bp (~13 bp inside) • Cycle low: 43.75 bp (~5.9 bp off tights) • COVID high: 151.80 bp (~102 bp tighter)

Spreads held the “4-handle” again as the rates tape did more of the talking. The curve steepened (5s30s widest since ’21) while the 10y finished ~4.26% (-1 bp) and the USD eased. A solid 2-yr auction (clean stop, firm indirects) anchored the front end. Headlines around Fed governance nudged term-premium chatter higher, but IG beta stayed orderly, carry did the work and primary remains selective into data.

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

Macro Overlay for IG

Growth pulse: Core capex beat (+1.1% m/m; shipments +0.7%) supports the “AI/capex resilience” narrative even as headline durables sag on aircraft.

Rates & curve: Steeper long end = higher term-premium risk, but front-end anchoring plus cut odds keep the “hawkish vs dovish cut” debate intact rather than “if.”

Fed-independence noise: Markets still assume an independent Fed; escalation would pressure the long end first, not spreads, unless it dents equities/flows.

Vol & positioning: VIX shorts leave risk assets vulnerable to a headline shock (NVDA, core PCE), but in the absence of a surprise, carry grind favors IG.

Rates and Earnings in Focus

IG remains a duration-sensitive carry trade; watch core PCE, NVDA guidance, and any further signals on Fed governance. Base case: sub-50 holds near-term with spread moves smaller than rate moves.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

All of the Interest Rate Sensitivity Models will be free until Wednesday. After Wednesday, all of the models will be exclusively reserved for paid subscribers. This would be a great time to do a free trial so you can review everything. Free Trial LINK.

Launch video for these models is here: LINK

Equity Indices:

Equity Sectors:

Bitcoin:

Gold, Silver, and Crude:

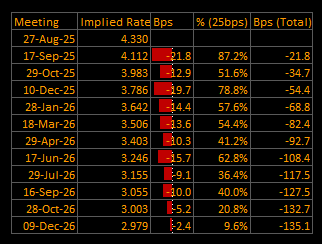

US Short-End Rates Wrap: Sept 25 bp Base Case (87.2%); Path Deepens to –135.1 bp, Terminal ~2.98%

Cumulative Implied Easing (to Dec 2026): –135.1 bp

Terminal Rate (Dec 2026): 2.979% (~2.98%)

September OIS Cut Probability: 87.2% — Implied Rate 4.112% | Implied Move –21.8 bp (~0.87×25)

Versus yesterday, the front end turned a touch more dovish: the total path deepens by ~5 bp (–135.1 bp vs –129.8 bp) and the terminal slips ~5 bp to ~2.98%. September remains a 25 bp base case with stronger odds (~87%).

OIS-Implied Policy Path

Macro overlay

Reaction function: Powell opened the door; markets are now pricing the pace. A steeper curve (5s30s widest since ’21) and a firm 2-yr auction anchor the front end, while Fed-independence headlines add a smidge of term-premium at the long end. The core capex beat (+1.1% m/m; shipments +0.7%) keeps the “AI/capex resilience” narrative alive even as headline durables fell on aircraft.

What it says: Base case is a calibration cut in September, then measured trims through mid-’26; today’s glidepath is a little deeper with the terminal nudged below 3%.

Risks to the path:

• Hot core PCE / sticky services → trims slow; terminal biased higher.

• Benign PCE + softer labor → path re-deepens toward the mid-40s (bp of additional easing) by late ’26.

• Governance noise → pressures the long end more than the front; watch funding into quarter-end.

Destination….

Destination remains lower; the speed is the variable. Into PCE/NVDA, front-end P&L is rates-led: hot prints shave cuts from 1H-’26; benign prints restore the step-down cadence with terminal just under 3%.

Tactical Portfolio

Morning Trade(s) and Market thread

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.