Macro Regime Tracker: Trading The Credit Cycle

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

I recorded a full livestream today explaining how I am trading the credit cycle here:

The most recent reports explaining all the views and trades are here:

As always, all the models are updated below.

Main Developments In Macro

US Macro / Fed

GOOLSBEE: SERVICES INFLATION IS AN AREA OF CONCERN AT THE LEAST

TRUMP POSTS ON TRUTH SOCIAL CALLING FED CHAIR AN OBSTRUCTIONIST

TRUMP: JEROME “TOO LATE” POWELL IS AN OBSTRUCTIONIST

SUPREME COURT TO HEAR ARGUMENTS IN JANUARY IN COOK FIRING CASE

SUPREME COURT REFUSES TO LET TRUMP IMMEDIATELY OUST FED’S COOK

US Policy / Government Shutdown

LEAVITT: GDP IMPACT DEPENDENT ON LENGTH OF SHUTDOWN

LEAVITT: LAYOFFS VERY LIKELY DUE TO SHUTDOWN

OMB CHIEF: LAYOFFS WILL HAPPEN IN THE NEXT ONE TO TWO DAYS: NBC

VANCE: IF SHUTDOWN DRAGS ON FOR DAYS, WEEKS, WILL DO LAYOFFS

VANCE: WILL HAVE TO LAY PEOPLE OFF IF SHUTDOWN CONTINUES

JOHNSON REFERS TO OFFICE OF MANAGEMENT AND BUDGET

JOHNSON: OMB HAS TO DECIDE ON ESSENTIAL GOVERNMENT SERVICES

SPEAKER JOHNSON: THERE’S NOTHING FOR ME TO GIVE, TO NEGOTIATE

JOHNSON: NOTHING WE CAN DO TO MAKE STOPGAP BILL BETTER FOR DEMS

JOHNSON: HOUSE WILL BE RETURNING NEXT WEEK

SPEAKER JOHNSON ON SHUTDOWN: HOPING FOR A BREAKTHROUGH TODAY

THUNE: SHUTDOWN ENDS WHEN DEMOCRATS BACK HOUSE-PASSED GOP BILL

US Trade / Foreign Policy

TRUMP DELAYING PHARMA TARIFFS TO NEGOTIATE DRUG PRICES:POLITICO

TRUMP: I’LL BE MEETING WITH PRESIDENT XI IN 4 WEEKS

TRUMP: I’LL BE MEETING WITH PRESIDENT XI

US IS IMPLEMENTING SNAPBACK SANCTIONS AGAINST IRAN: RUBIO

US SAID TO SEEK REPEAL OF BASEL RULE CHANGE THAT AIDED BNP

Global Macro (Non-US but Relevant)

ECB’S GUINDOS: CURRENT LEVEL OF RATES IS THE CORRECT ONE

BOE’S MANN: I PREFER A LONGER HOLD ON RATES

BOE’S MANN: INFLATION EXPECTATIONS HAVE DRIFTED

BOE’S MANN: RATES ON HOLD APPROPRIATE FOR CURRENT PERIOD

BOE’S MANN: HIGHER FOR LONGER INFLATION RISK PLAYING OUT

BOE’S MANN: HAVE TO BALANCE INFLATION AND ACTIVITY

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

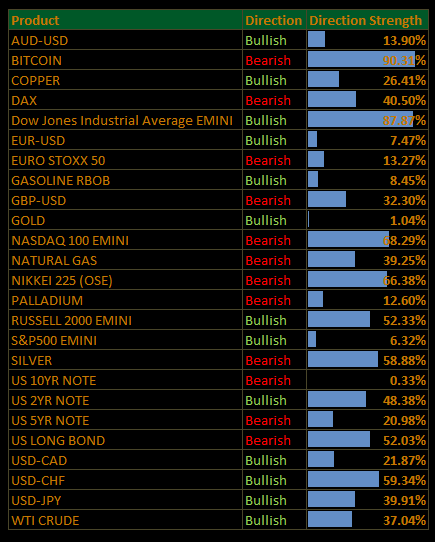

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

US Market Wrap: Health Care & Tech Carry Gains as Shutdown Clouds Data (S&P +0.79%)

The S&P 500 rose 0.79%, extending its rally to a fourth straight session and closing at a fresh record high. Strength came from defensives and rate-sensitive growth sectors, with Health Care and Info Tech providing the bulk of the lift, while Financials and Materials lagged. The backdrop remains defined by the government shutdown, which threatens to delay Friday’s payrolls release, leaving the Fed reliant on private data and proxies to gauge labor momentum.

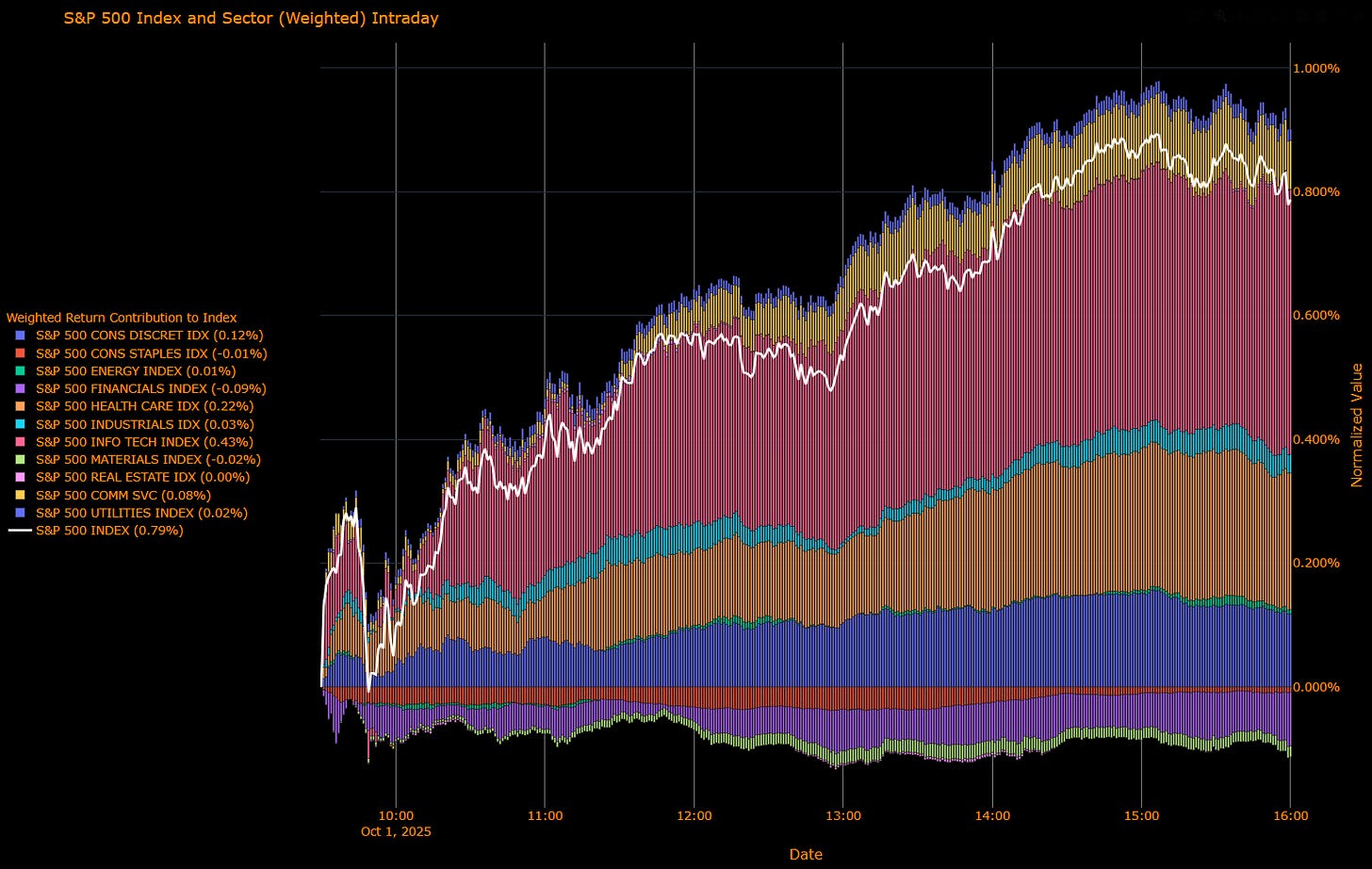

Sector Attribution

Weighted Return Contribution to Index

Leaders: Info Tech (+0.43%), Health Care (+0.22%), Consumer Discretionary (+0.12%).

Drags: Financials (–0.09%), Materials (–0.02%), Staples (–0.01%).

Net: S&P 500 +0.79%.

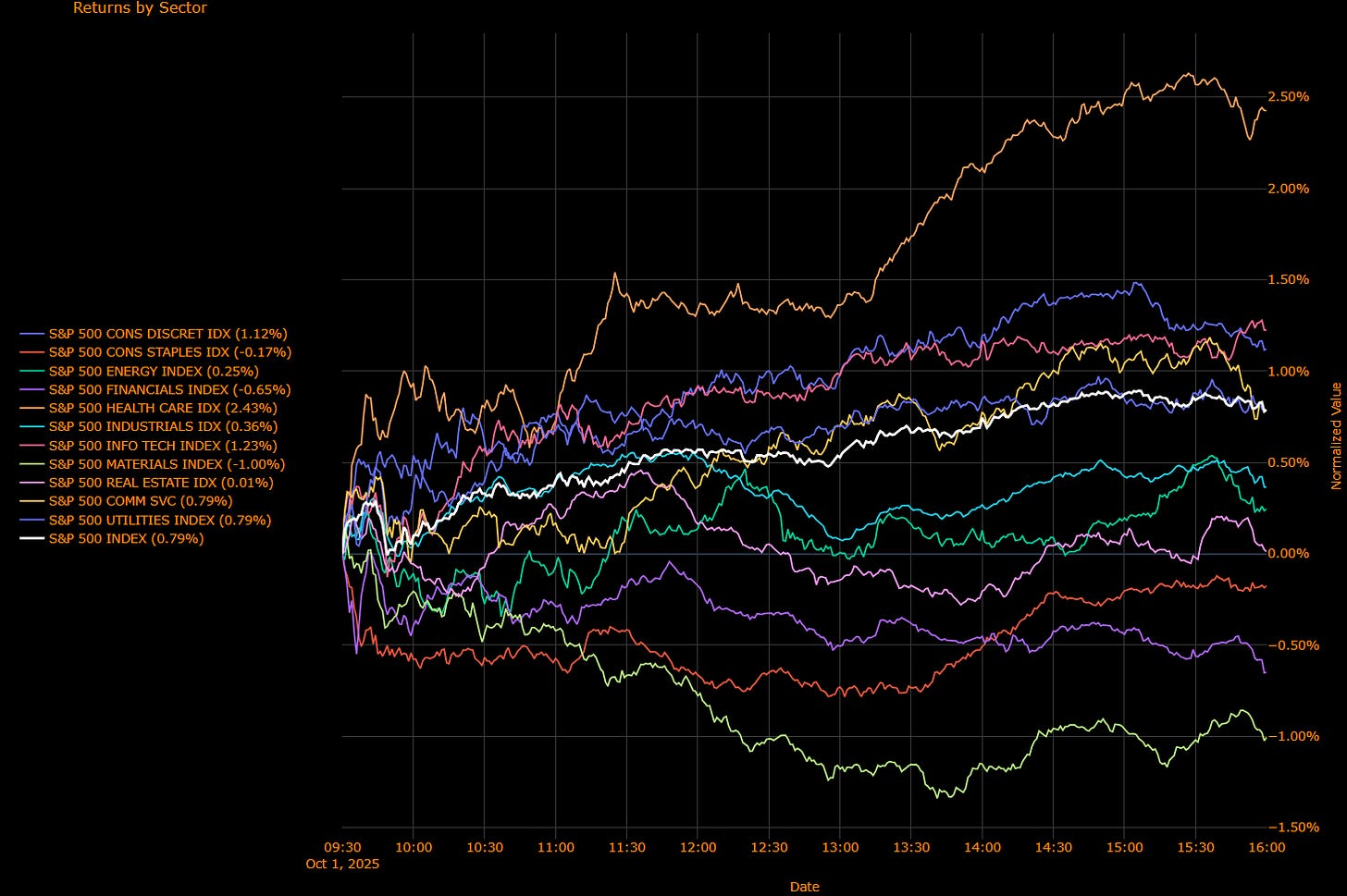

Sector Performance (Unweighted Breadth)

Winners: Health Care (+2.43%), Info Tech (+1.23%), Consumer Discretionary (+1.12%), Industrials (+0.36%).

Losers: Materials (–1.00%), Financials (–0.65%), Staples (–0.17%).

Net: S&P 500 +0.79%.

Macro Overlay

Shutdown & Data Void

Markets appear unfazed by the first US government shutdown in nearly seven years. Equities leaned on sector rotation rather than broad macro momentum, even as the looming data blackout could deprive the Fed of its most important high-frequency read on the labor market.

Labor Market Signals

ADP data showed private payrolls fell 32k in September, the second consecutive monthly decline and well below expectations. ISM manufacturing pointed to contraction for the seventh straight month, though employment and production improved slightly. Together, the reports reinforced the “low-hire, low-fire” labor environment, consistent with Fed easing expectations.

Rates & Commodities

Treasuries rallied, with the 10-year yield dipping toward 4.10%. Gold extended to fresh record highs as the dollar held steady. Oil inventories rose modestly, though Cushing stocks declined again, underscoring fragile balance in physical supply.

The Read-Through

The Fed’s October meeting remains live for another “insurance” cut, with investors leaning on the view that officials have enough evidence of labor market cooling even without the BLS payrolls print. Sector leadership Health Care, Tech, and Discretionary pulling ahead while Financials and Materials slump, reflects a market hedging toward policy-sensitive defensives and growth, not a broad embrace of cyclical recovery.

Takeaway: With shutdown politics muddying the data stream and ADP pointing to slower job growth, the market is relying on defensives and rate-sensitive growth leadership. The bias is toward caution, not capitulation, as investors hedge for a slower-growth, lower-rate path.

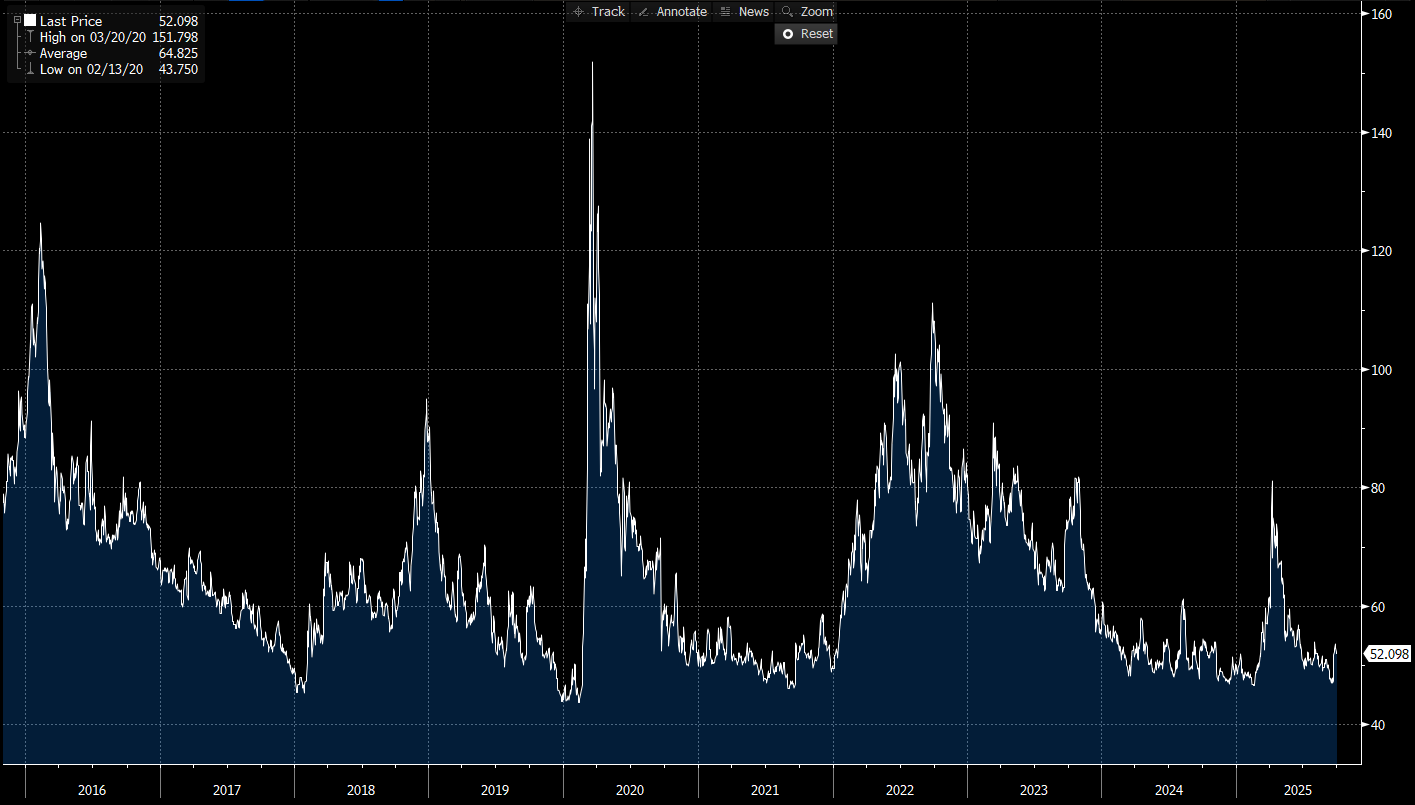

US IG Credit Wrap: Carry Holds in Low-50s; Shutdown Data Void, Softer Labor (IG OAS ~52.1 bp)

IG spreads remain pinned in the carry channel. Bloomberg US IG OAS prints ~52.1 bp (chart last: 52.098), essentially unchanged as equities grind higher and 10s rally toward ~4.10%. The market is treating the government shutdown as a visibility problem more than a growth shock; spreads are grinding, not breaking.

Credit context (where we sit) — from the chart

IG OAS: ~52.1 bp

5-yr avg: ~64.8 bp → ~13 bp inside

Cycle tights: ~43.8 bp → ~8 bp away

Pandemic wides: ~151.8 bp → ~100 bp tighter

(Chart stats: Last 52.098 | High 151.798 on 03/20/20 | Avg 64.825 | Low 43.750 on 02/13/20.)

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

What changed today (macro tape)

Risk backdrop: S&P at a fresh high; fourth up day. Gold to a record; dollar steady. 10-year ~4.10% after a small rally.

Shutdown: Data blackout likely delays BLS payrolls; Fed forced to lean on private proxies. Market still prices further easing.

Labor signal: ADP –32k (second monthly drop) and ISM manufacturing still in contraction, consistent with a “low-hire, low-fire” slowdown rather than a shock.

How this maps to credit

Primary market: Window stays open; no systemic concession creep. Idiosyncratic stories matter more than index direction.

Path to tighter: Needs a short shutdown, orderly labor cooling, and benign inflation prints that keep Fed cuts alive.

Path to wider: A prolonged data blackout with headline layoffs, or a growth scare/bull steepener that pressures cyclical cashflows.

The read-through

Base case is a sideways grind in the low-50s with carry doing the heavy lifting. Risk case pushes toward the high-50s if the shutdown lingers and labor softness meets policy noise. Until then, IG remains a carry market

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

All of the interest rate sensitivity models are now reserved exclusively for paid subscribers. If you would like to do a free trial, you can with this LINK.

Launch video for these models is here: LINK

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.