Macro Regime Tracker: Updated Macro Views and Models

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

We are coming off the price action from Jackson Hole, and I laid out the logic for HOW things are likely to develop here:

And recorded two videos today that can be found here:

And here:

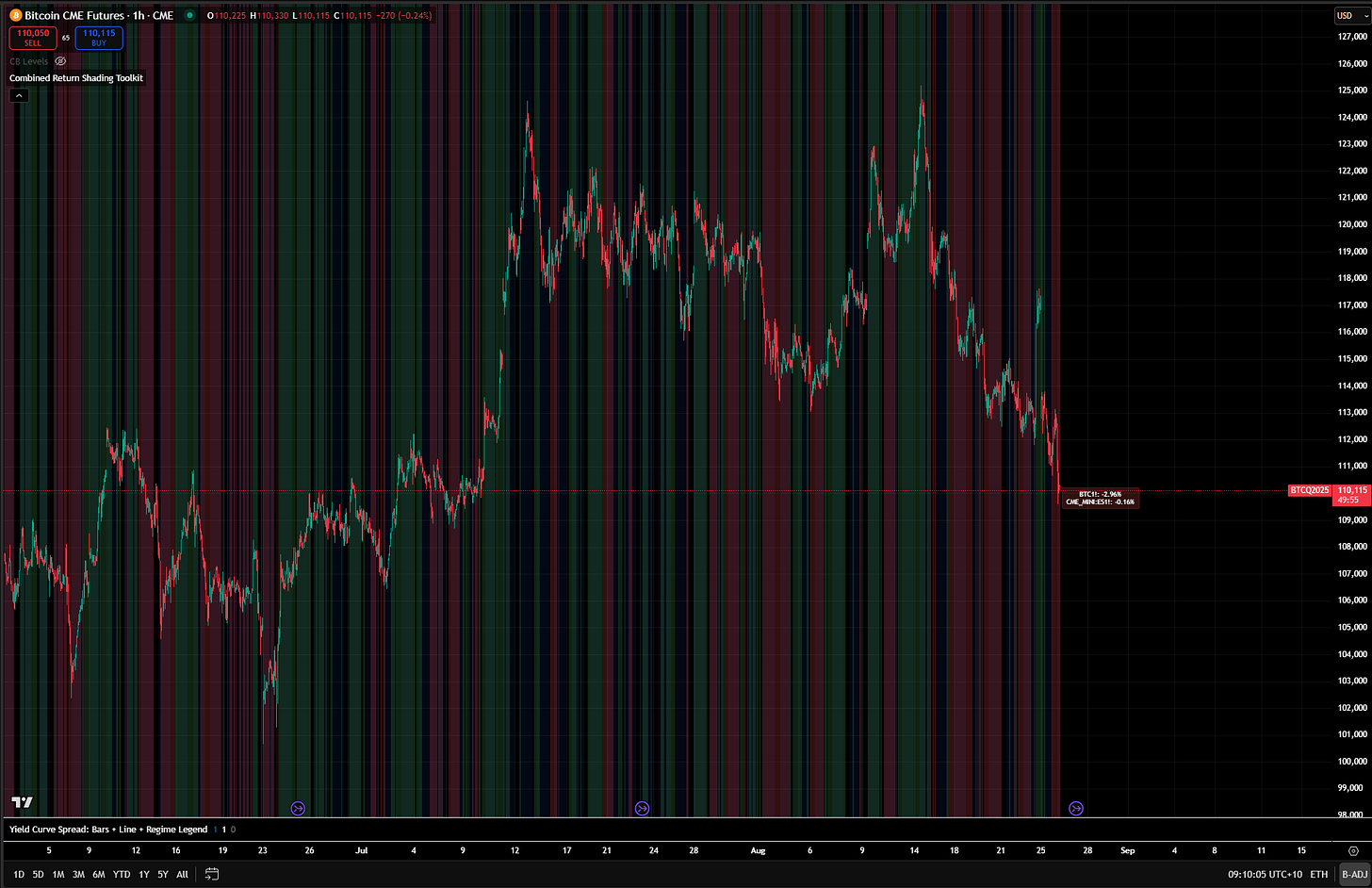

A short note on Bitcoin: we are still seeing underperformance of Bitcoin relative to ES. Until this shifts or we move through a macro catalyst that causes a significant reversal, Bitcoin is going to have difficulty rallying. I believe we are still skewed to the upside based on the credit cycle, but we need to see a reconvergence with broad beta flows.

We continue to operate in a world of global liquidity where short term changes in cross boarder flows can impact Bitcoin. See the report on the structural liquidity dynamics here:

The Bitcoin primer and Tradingview script can be found in this report:

As always, all of the systematic models and strategies are below. As a reminder, I just launched all of the new interest rate sensitivity models, and you can find the launch video here. These will be free until Wednesday, and then they will be reserved for paid subscribers AFTER that.

I will be recording a video later tonight breaking things down more for you guys.

Main Developments In Macro

Federal Reserve & Money Markets

*FED'S LOGAN: PERIODIC REVIEWS GIVE US SYSTEMATIC WAY TO LEARN

*LOGAN: ANTICIPATE USE OF FED'S RATE CEILING TOOLS IN SEPTEMBER

*LOGAN DOESN'T ADDRESS OUTLOOK FOR ECONOMY, RATES IN SPEECH TEXT

*FED'S LOGAN: REPO RATES SUGGEST WE HAVE ROOM TO REDUCE RESERVES

*LOGAN: COULD SEE SOME PRESSURE IN MONEY MARKETS AT QUARTER-END

US Policy / Industrial / Regulation

*TRUMP ADMINISTRATION PLANS TO HALT ANOTHER OFFSHORE WIND FARM

*EPIC CRUDE PIPELINE OWNERS EXPLORE $3B SALE: REUTERS

*HEDGE FUNDS WIN REVIEW OF SEC'S SHORT SALE DISCLOSURE RULE

*USGS PROPOSES POTASH AS CRITICAL MINERAL

*USGS PROPOSES INCLUDING COPPER AMONG CRITICAL MINERALS

*TRUMP ON INTEL STAKE: I WANT MANY MORE CASES LIKE IT

*TRUMP: ALL GOVT STAKE IN INTEL `GOES TO THE USA'

*HASSETT: POSSIBLE THAT GOVT TAKES MORE EQUITY STAKE FROM FIRMS

*HASSETT: INTEL WILL GET CHIPS ACT MONEY, GOVT WILL GET STAKE

*TRUMP: WILL PUT TARIFFS ON DRUGS RAPIDLY

Trade/Tariffs & US–China/EU

*TRUMP ADMIN. MULLS SANCTIONS OVER EU DIGITAL SERVICES ACT: RTRS

*TRUMP ADMIN. WEIGHS SANCTIONS ON EU OFFICIALS: REUTERS

*TRUMP SAYS CHINA, US HAVE 'TREMENDOUS POWER' OVER MAGNETS

*TRUMP: IT’LL TAKE US ABOUT A YEAR TO HAVE THE MAGNETS

*TRUMP FLOATS TARIFF THREAT ON CHINA IF MAGNETS NOT DELIVERED

*TRUMP: 200% TARIFF ON CHINA IF NO MAGNETS

*TRUMP: WILL ALLOW CHINESE STUDENTS TO COME TO US

US–Korea/Japan: Trade, Industry & Defense

*LEE: HOPES FOR US-SKOREA COOPERATION IN ECONOMY, TECHNOLOGY

*TRUMP: WILL HAVE VERY SERIOUS TALKS WITH LEE ABOUT TRADE

*TRUMP: S. KOREA WANTS OIL, GAS AND COAL FROM US THE MOST

*TRUMP: WILL MAKE JOINT VENTURE WITH S. KOREA, JAPAN IN ALASKA

*TRUMP: S. KOREA WILL HELP US GET BACK INTO SHIPBUILDING

*TRUMP: THINKING ABOUT CONTRACTING SOME SHIPS WITH S. KOREA

*TRUMP: WILL BE BUYING SHIPS FROM SOUTH KOREA

*TRUMP: WILL TALK ABOUT S. KOREA PURCHASING MILITARY EQUIPMENT

*KOREAN AIR TO ANNOUNCE ORDER FOR ABOUT 100 BOEING PLANES: RTRS

*JAPAN PREPARING JOINT COMMUNIQUE FOR ITS INVESTMENTS IN US: FNN

*JAPAN'S TRADE NEGOTIATOR AKAZAWA MAY VISIT US THIS WEEK: FNN

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

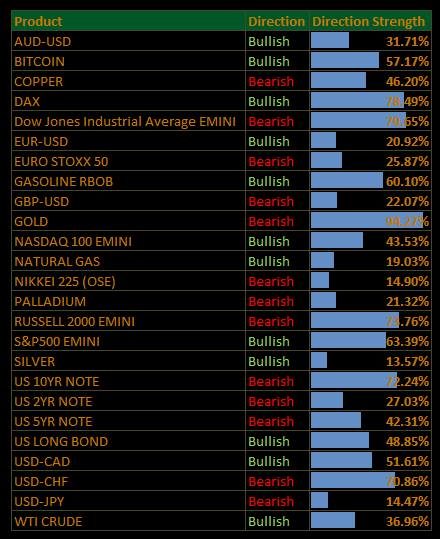

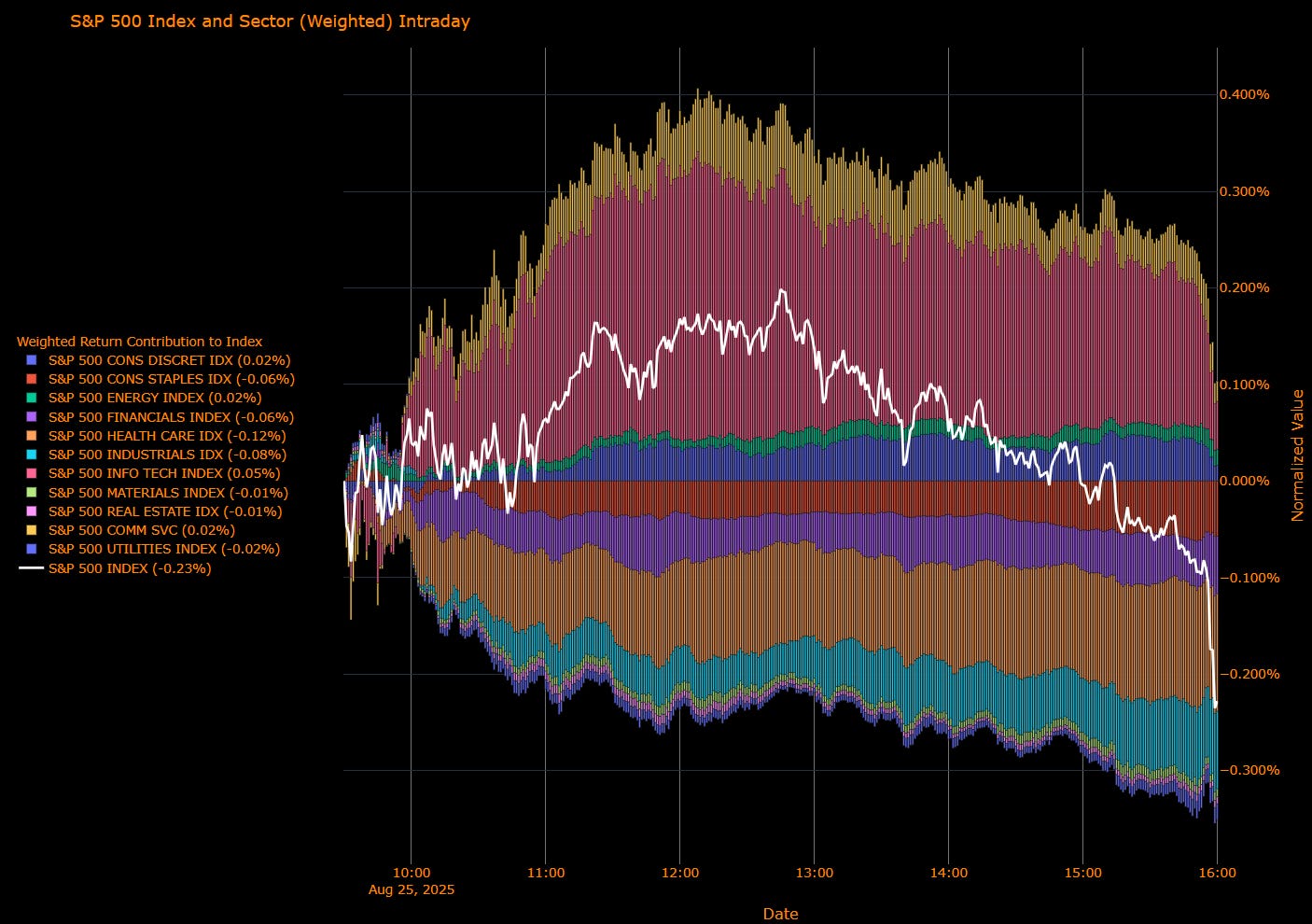

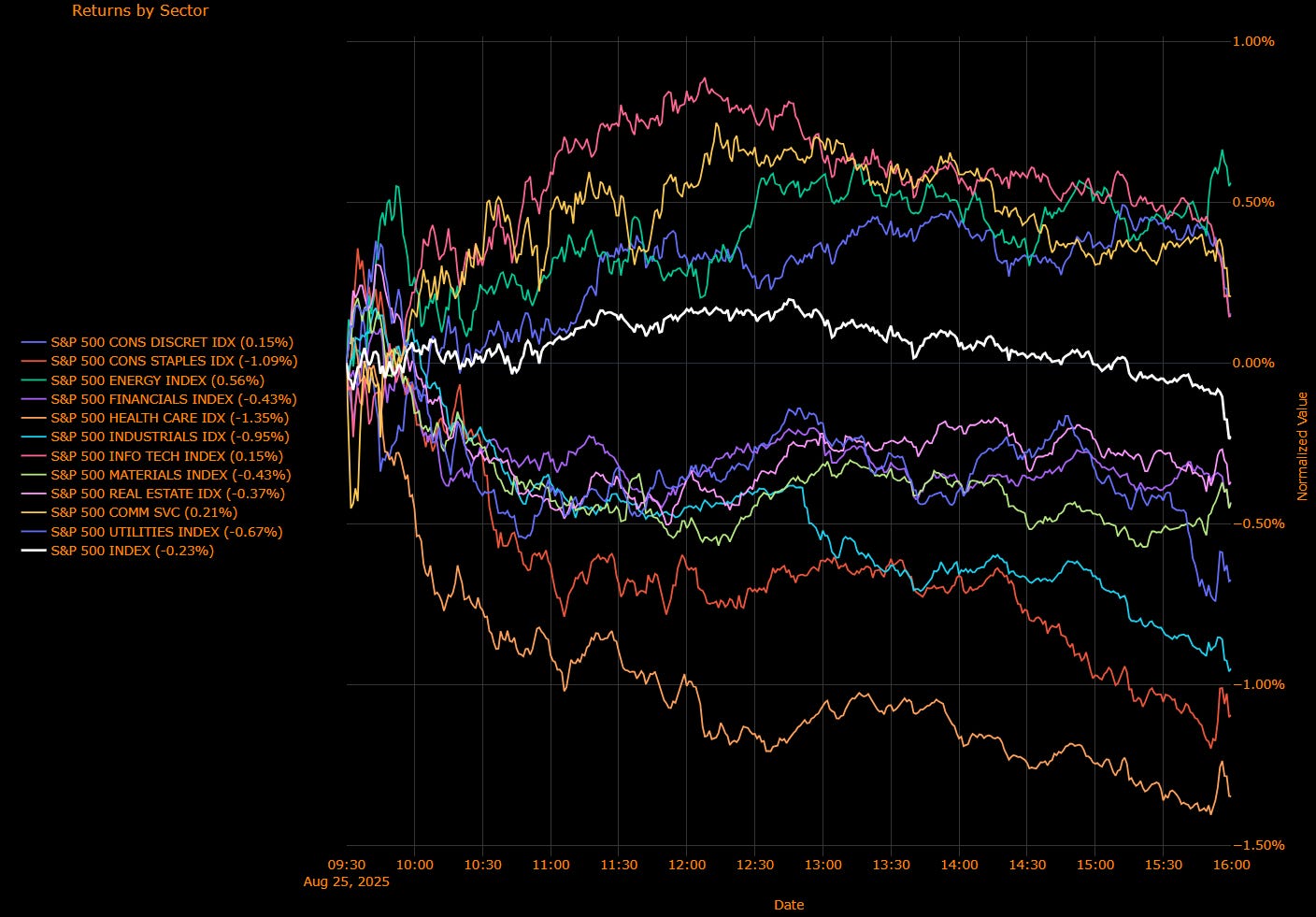

US Market Wrap: Post-Powell Euphoria Fades; Defensives Drag, Energy Leads (S&P −0.23%)

Powell’s “door-is-open” cut message is yesterday’s news; today the market re-priced the pace of easing. Yields firmed (10y ~4.28%,) equities softened (S&P −0.23%), and breadth was weak (~400 S&P names lower). Traders still lean ~80% to a September cut and ~two by year-end, but the focus has shifted to how hawkish/dovish that first move will be ahead of core PCE (consensus: a tick higher y/y) and more Fed speak (Waller Thu; Logan flagged quarter-end money-market pressures even as QT headroom remains).

Sector Contribution (weighted to index move)

Offsets: Information Technology (+0.05%), Consumer Discretionary (+0.02%), Energy (+0.02%), Communication Services (+0.02%).

Detractors: Health Care (−0.12%), Industrials (−0.08%), Consumer Staples (−0.06%), Financials (−0.06%), Utilities (−0.02%), Materials (−0.01%), Real Estate (−0.01%).

Index: S&P 500 (−0.23%).

Sector Performance (unweighted breadth)

Leaders: Energy (+0.56%), Communication Services (+0.21%), Consumer Discretionary (+0.15%), Information Technology (+0.15%).

Laggards: Health Care (−1.35%), Consumer Staples (−1.09%), Industrials (−0.95%), Utilities (−0.67%), Financials (−0.43%), Materials (−0.43%), Real Estate (−0.37%).

Index: S&P 500 (−0.23%).

Macro Overlay: What mattered

Rates path vs growth: The debate is now “dovish cut” vs “hawkish cut.” A firmer dollar and higher real yields weighed on defensives (Staples/HC/Utilities) while Energy outperformed with crude firmer.

Positioning & leadership: Mega-cap growth held up modestly (Tech/Comm Svcs small positives), but cyclicals outside Energy struggled as higher yields pinched Industrials/Financials.

Event risk ahead: Core PCE likely edges up; any upside surprise plus a stable labor print argues for a cautious, one-and-done September framing. Logan noted potential quarter-end funding pressure even as reserves remain ample—watch front-end funding and GC repo.

Final Word

Powell’s pivot stays intact, but today’s tape says the market won’t pay up for defensives with yields backing up. Into PCE/Waller, base-case is a September 25 bp “calibration” cut, not an easing cycle endorsement.

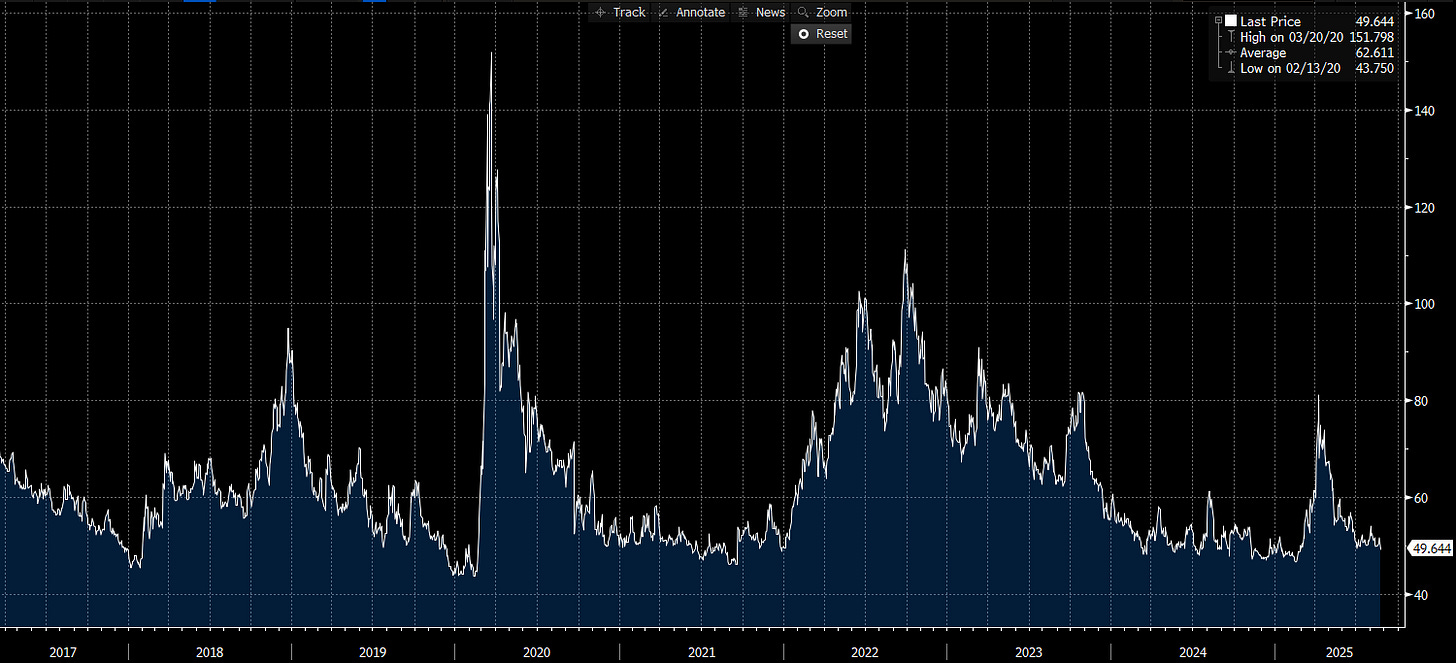

US IG Credit Wrap: Sub-50 Holds as Euphoria Fades; PCE Next

IG OAS: 49.64 bp • 5-yr avg: 62.61 bp (~13 bp inside) • Cycle low: 43.75 bp (~5.9 bp off tights) • COVID high: 151.80 bp (~102 bp tighter)

Spreads kept the “4-handle” even as the post-Powell sugar high cooled. Rates backed up modestly (10y ~4.28%, 2y ~3.73), the dollar firmed, equities softened, and breadth was poor yet IG beta stayed orderly and carry did the work. Money markets still lean ~80% to a September cut, but the debate has shifted to how dovish vs hawkish that first trim will be. Logan flagged potential quarter-end funding pressure even as QT headroom remains.

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

Macro Overlay for IG

Powell opened the door; the tape is now pricing the pace. With OAS ~49.6, fair-value chatter clusters low/mid-50s. Into core PCE (consensus: a small y/y uptick), risk to total return is rates first, spreads second. A persistent yield back-up plus firmer USD could nudge OAS toward 52–55; a benign PCE/labor run would let carry grind toward the mid-40s (cycle-tights zone) before supply season re-sets valuations.

Rates Are the Risk

IG remains a duration-sensitive carry trade. Watch: core PCE, Waller later in the week, and quarter-end money markets.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Interest Rate Sensitivity Model

Launch video for these models is here: LINK

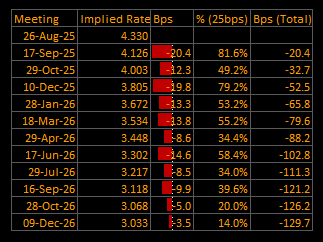

US Short-End Rates Wrap: Sept 25 bp Base Case (81.6%); Path Narrows to –129.8 bp, Terminal ~3.03%

Cumulative Implied Easing (to Dec 2026): –129.8 bp

Terminal Rate (Dec 2026): 3.032% (~3.03%)

September OIS Cut Probability: 81.6% — Implied Rate 4.126% | Implied Move –20.4 bp (~0.82×25)

Versus yesterday, the front end is shallower: the total path eases ~8½ bp less (–129.8 bp vs –138.5 bp) and the terminal is ~8–9 bp higher (~3.03% vs ~2.95%). September remains a 25 bp base case with solid odds (~82%), but the curve now sketches a steadier step-down rather than an acceleration.

OIS-Implied Policy Path

Macro overlay

Reaction function: Powell opened the door; markets are now pricing the pace. A modest back-up in yields and firmer USD nudged the terminal higher even as September odds held up.

What it says: The base case is a calibration cut in September, then measured trims into mid-’26; no hurry to race toward sub-3% unless data break softer.

Risks to the path: A hotter core PCE or stickier services inflation would cap September’s follow-through and bias the terminal higher; benign PCE + softer labor data re-deepens the path toward the mid-40s (bp of total easing) by early ’27.

Glidepath

Destination still lower, but the glidepath tightened: September ~25 bp, roughly two cuts by year-end, terminal near 3.0% rather than the high-2s. Into the data window, front-end P&L is about speed, not direction hot prints shave the path; benign prints restore it.

Tactical Portfolio

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.