Macro Regime Tracker: Why Is The Dollar Rallying?

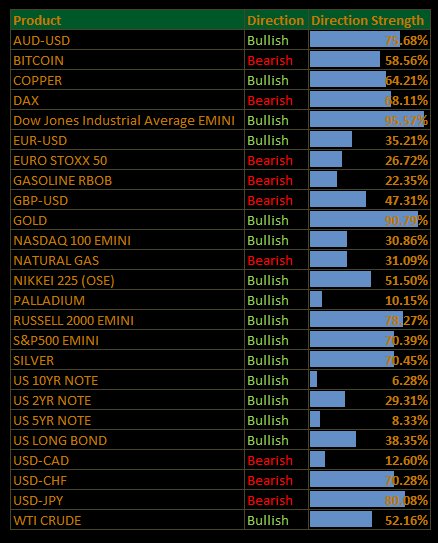

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

Since FOMC, we have seen the DXY rise. This is primarily driven by monetary policy differentials as opposed to a dollar shortage, causing risk off behavior in equities:

As we moved into FOMC, I explained the causal drivers behind the dollar and the potential for a bottom here:

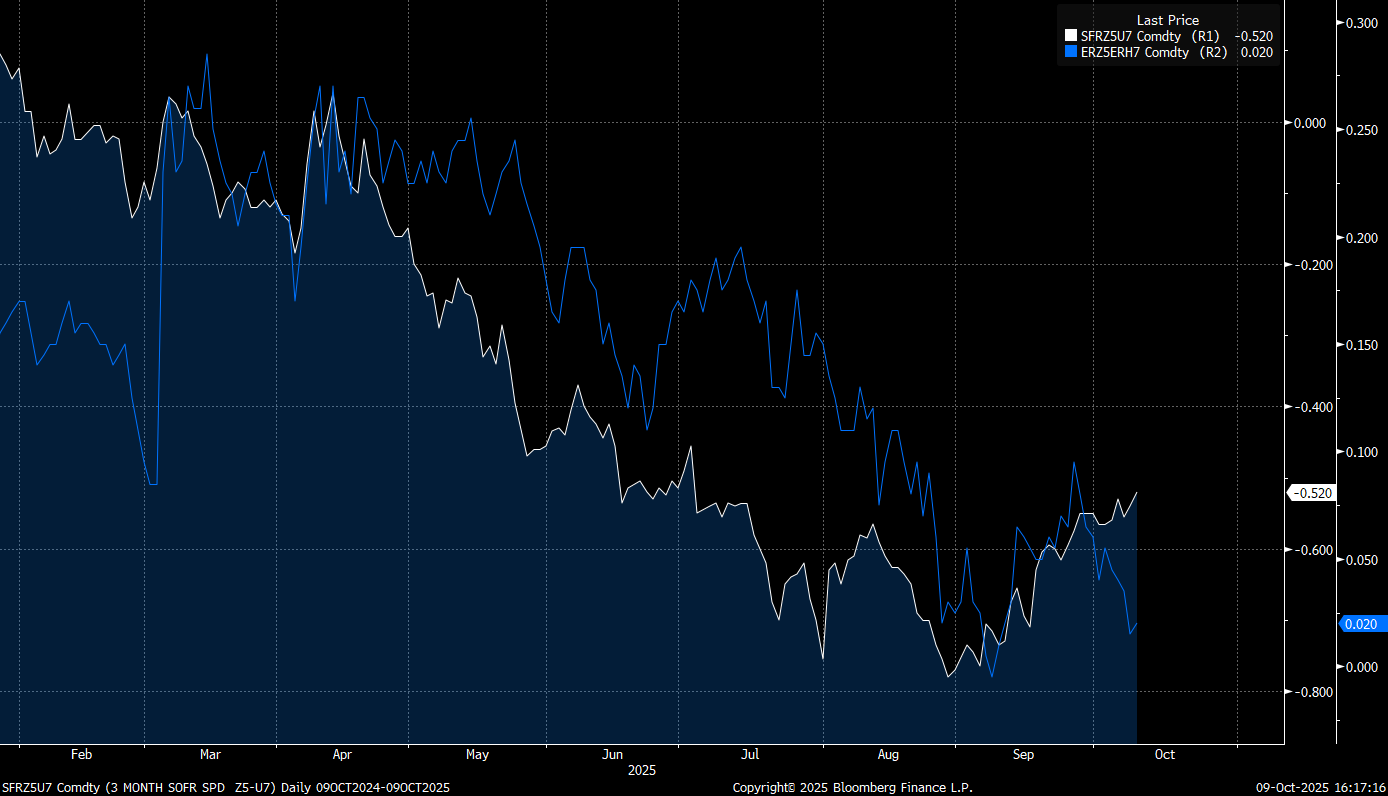

Here is the basic idea, since the Fed and the market have baked in 2 more cuts for this year, everyone is shifting to HOW MANY cuts take place in 2026. The SOFR spread below shows how many cuts the market is pricing in 2026, all the way till Sept of 2027 (which is where the terminal rate sits). So if we assume two cuts are happening this year, as the white line in the chart below moves DOWN, we price more cuts and fuctionally inject a lower price of money into the system. Inversely, if we move UP, we are pricing fewer cuts in the system, which functionally increases the price of money in the system for dollars. The blue line in the chart below shows the same period of time in the Eurozone which has actually fallen over the last 10 trading days. The bottom line is the US as priced less cuts since FOMC while the Eurozone only moved marginally. The net result is the dollar rising against the Euro.

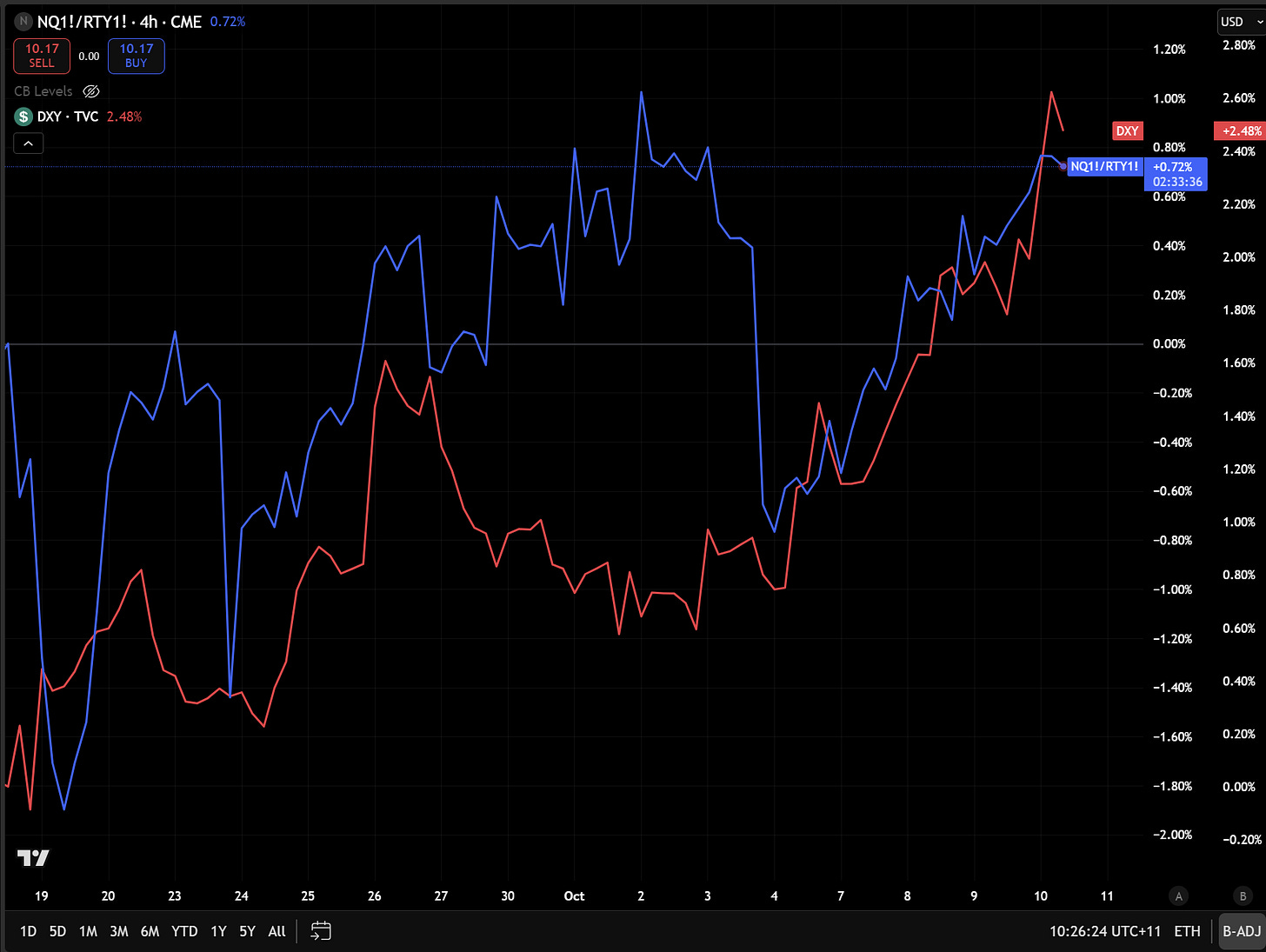

This is why the spread is moving in lockstep with the DXY:

Now think about this for a moment, if the Eurozone just priced marginally more cuts as the US tightened a bit, does it begin to make sense why the DAX has outperformed US equities over the last 15 or so trading days?

This is why I laid out the long DAX view in the recent macro report (for paid subscribers):

You can see we have moved in lockstep with the risk reward:

Now, to be clear, we are not seeing the stronger dollar pull broad equity indicies down. Why? Because it is a shift in monetary policy differentials, not a shortage of dollars, causing systemic risk. The effect is being felt, though, why is why we are seeing the Russell underperform the NASDAQ marginally as the dollar has been making its upward moves:

The implication of these flows is that we are NOT seeing an imminent driver that would end the bull market. I remain long and explained how I am thinking about the redundancy planning here: (baseline is remaining above the 6660 FOMC level)

As I laid out here, we remain in a very bullish environment and sentiment isn’t going to change the direction of the S&P500. The only thing that moves the market is flows. In today’s social media attention market, the bearishness or bullishness doesn’t have predictability on directionality in ES, even if it overlaps occasionally with hindsight bias.

As always, all the systematic models and strategies have been updated below. Thanks

Main Developments In Macro

US Monetary Policy & Federal Reserve

FED DISCOUNT-WINDOW LOANS $6.24B IN WEEK ENDED OCT. 8 AFTER $7.17B

FED SAYS EXPANDED HOURS WILL TAKE EFFECT NO EARLIER THAN 2028

FED ANNOUNCES FEDWIRE FUNDS, NSS HOURS CHANGE IN PRESS RELEASE

FED’S BARR: PRICE STABILITY GOAL FACES ’SIGNIFICANT RISKS’

BARR: RIGHT NOW, OUR POLICY IS PROBABLY MODESTLY RESTRICTIVE

BARR: FED SHOULD BE CAUTIOUS ABOUT ADJUSTING POLICY

BARR: WE MAY HAVE TWO ECONOMIES DEPENDING ON INCOME LEVELS

BARR: UNCLEAR IF SHUTDOWN WILL HAVE NOTICEABLE IMPACT ON GROWTH

WILLIAMS: APPROPRIATE FOR RATES BACK TO `NEUTRAL’ SETTING: NYT

WILLIAMS SIGNALS GOVT DATA LAPSE WOULDN’T DETER FROM ACTION:NYT

WILLIAMS FOCUSED ON RISKS OF FURTHER LABOR SLOWDOWN: NYT

WILLIAMS: INFLATION OUTLOOK NOT AS DIRE AS EARLIER IN YEAR: NYT

WILLIAMS SEES FED HAS FLEXIBILITY TO SHORE UP LABOR MARKET: NYT

FED’S WILLIAMS SUPPORTS FURTHER INTEREST RATES CUTS THIS YR:NYT

FED’S WILLIAMS SUPPORTS FURTHER INTEREST RATES CUTS: NYT

US Fiscal, Political & Regulatory Developments

SENATORS IN TALKS ON MAKING OFFER TO DEMOCRATS ON VOTE: SEMAFOR

SENATE GOP MULL FUTURE VOTE ON EXTENDING ACA SUBSIDIES: SEMAFOR

DOJ LAUNCHES INQUIRY INTO FIRST BRANDS GROUP’S COLLAPSE: FT

US JUSTICE DEPT LAUNCHES INQUIRY INTO FIRST BRANDS GROUP: FT

US WEIGHS ACTION AGAINST CHINA-CONNECTED ROUTER GIANT TP-LINK

INVESCO SEPT. MONEY MARKET NET OUTFLOWS $2B

US Trade, Technology & Corporate

MICROSOFT FORECASTS SHOW DATA CENTER CRUNCH PERSISTS INTO 2026

SOME CUSTOMERS TURN AWAY FROM AZURE ON CLOUD CONSTRAINTS

VENTURE GLOBAL SUFFERS DEFEAT IN BP LNG ARBITRATION

CANADA’S BAYTEX ENERGY WEIGHS $3 BILLION EXIT OF US OPERATIONS

US Foreign Policy & Geopolitics

TRUMP: MIGHT DO MORE RUSSIA SANCTIONS

TRUMP: WE’RE STEPPING UP THE PRESSURE FOR UKRAINE DEAL

TRUMP: WOULD LOOK AT PALESTINIAN STATEHOOD ‘AT THE TIME’

TRUMP: STRICT DEADLINE ON HOSTAGE RELEASE IS MONDAY OR TUESDAY

TRUMP: HOSTAGES TO BE RELEASED MONDAY, TUESDAY; I’LL BE THERE

TRUMP: PLANNING ON GOING TO MIDDLE EAST SOMETIME SUNDAY

TRUMP: TRIP WOULD BE TO EGYPT, TO HAVE AN OFFICIAL SIGNING

TRUMP: LAST NIGHT WE REACHED MOMENTOUS MIDEAST BREAKTHROUGH

TRUMP: ISRAEL INVITED HIM TO SPEAK AT KNESSET, HE AGREED

TRUMP: IRAN WANTS TO WORK ON PEACE NOW

TRUMP: WE’D LIKE TO SEE IRAN REBUILD COUNTRY TOO

TRUMP: BUYING THE FINEST ICEBREAKERS IN THE WORLD

TRUMP: WE’RE BUYING ICEBREAKERS, BUILDING THEM WITH FINLAND

STUBB: WILL BUILD 11 ICEBREAKERS WITH THE US

STUBB: IT’S ‘CORRECT’ FOR EUROPE TO NOT BUY RUSSIAN OIL, GAS

STUBB CONGRATULATES TRUMP ON ‘HISTORIC’ GAZA DEAL

US AND SAUDI ARABIA MAKING PROGRESS ON CHIP DEAL: WSJ

US AND SAUDI ARABIA COULD FINALIZE A DEAL SOON: WSJ

US FINALIZES $20B CURRENCY SWAP LINE FRAMEWORK WITH ARGENTINA

US TREASURY INTERVENED IN ARGENTINA FX MARKETS ON THURSDAY

US TREASURY INTERVENED IN ARGENTINA FX MARKET: LA NACION

BESSENT: FINALIZED A $20 BILLION CURRENCY SWAP FRAMEWORK

BESSENT: DISCUSSED ARGENTINA’S STRONG ECONOMIC FUNDAMENTALS

MILEI THANKS BESSENT FOR STRONG SUPPORT FOR ARGENTINA

ARGENTINA BONDS ACCELERATE GAINS; 2035 NOTES UP 5 CENTS

ARGENTINE PESO TUMBLES 2.7% AT THE START OF TRADING

BRAZIL, US TEAMS TO MEET SOON IN WASHINGTON: BRAZIL MINISTRY

BRAZIL SAYS FOREIGN MINISTER VIEIRA HAD PHONE CALL WITH RUBIO

GAZPROM CEO, TURKEY ENERGY MINISTER DISCUSS GAS COOPERATION

Middle East Peace & Geopolitical Risk

HAMAS NEGOTIATING CHIEF SAYS AGREED TO OPEN RAFAH CROSSING

HAMAS NEGOTIATING CHIEF ANNOUNCES DEAL TO END WAR WITH ISRAEL

HOUTHIS SIGNAL HALT TO MILITARY OPS IF GAZA CEASEFIRE HOLDS

KALLAS: FIRST STAGE OF GAZA DEAL IS MAJOR STEP TOWARDS PEACE

ISRAEL PRESIDENT’S OFFICE SAYS TRUMP TO VISIT ISRAEL

ISRAEL FOREIGN MINISTER SA’AR SPEAKS TO FOX NEWS

SA’AR: REDEPLOYMENT IMMEDIATELY WITHIN 24HRS AFTER GOVT AGREES

SA’AR: TO IMMEDIATELY HAVE CEASEFIRE AFTER GOVT APPROVES DEAL

ISRAEL FOREIGN MINISTER SA’AR: WE ARE COMMITTED TO TRUMP’S PLAN

JOHNSON: TRUMP CALLED ME LAST NIGHT AFTER PEACE DEAL WAS DONE

JOHNSON: TRUMP AND I LAMENTED THE ‘TERRIBLE’ SHUTDOWN SITUATION

MODI: CONGRATULATED TRUMP ON GAZA PEACE PLAN

Global Central Banks & Macro Policy

ECB’S ESCRIVA: INFLATION IS ALREADY AT 2%

A FEW ECB OFFICIALS VIEWED INFLATION RISKS TILTED TO UPSIDE

BOE’S MANN: LABOR MARKET SOFTENING, BUT CPI WELL ABOVE TARGET

BOE’S MANN: UK INFLATION PERSISTENT, GROWTH OUTLOOK MODEST

MEXICAN CENTRAL BANK PUBLISHES MINUTES TO SEPTEMBER MEETING

TAKAICHI: WEAK YEN HAS BOTH MERITS AND DEMERITS

TAKAICHI: NO IMMEDIATE NEED TO REVISE BOJ-GOVERNMENT ACCORD

TAKAICHI: NOT IN POSITION TO COMMENT ON RATE HIKE

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

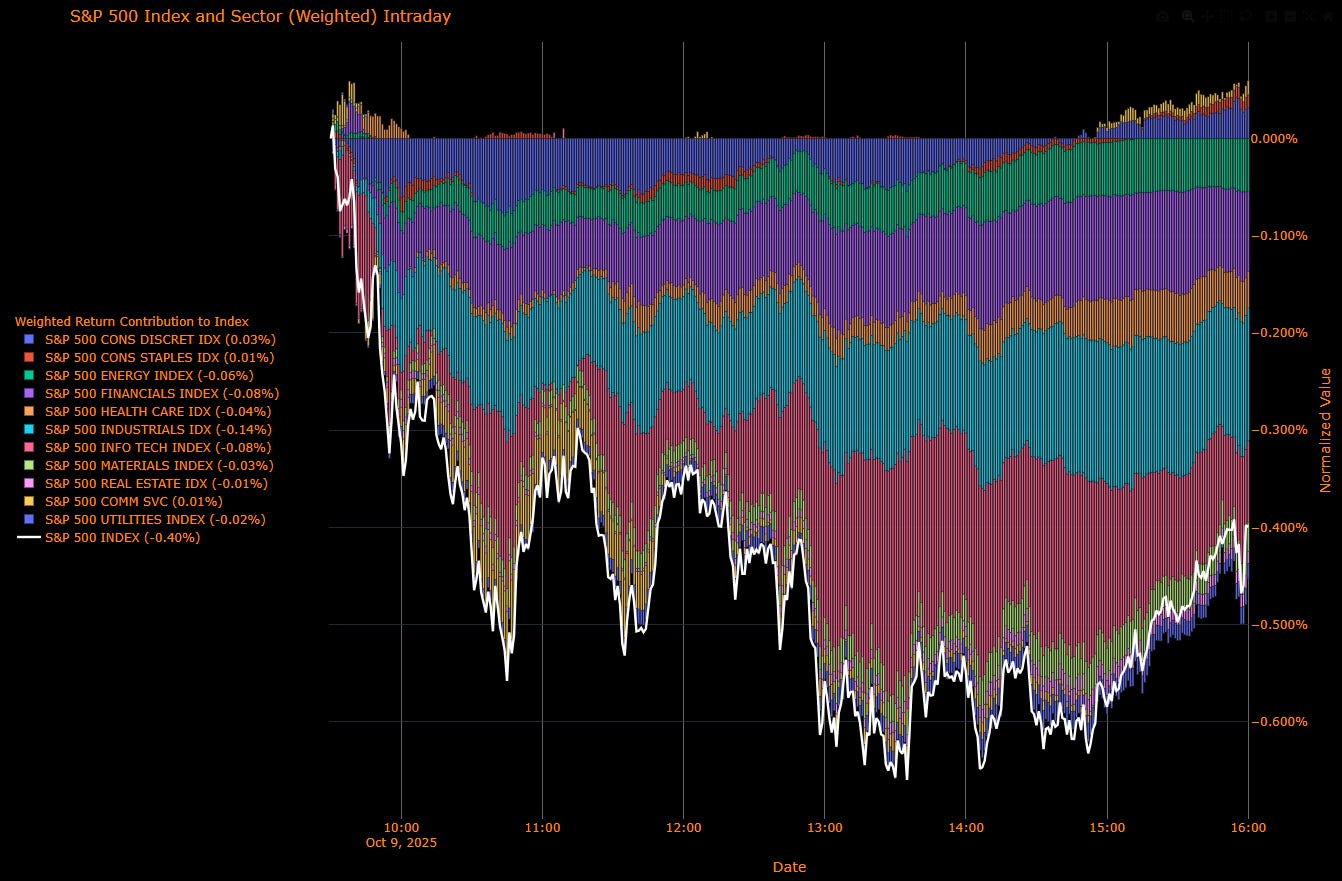

US Market Wrap: Broad Pullback as Cyclicals Slide, Dollar Firms (S&P −0.40%)

The index cooled as rising yields and a firmer dollar nudged crowded AI/growth leadership to pause while cyclicals did the heavy lifting on the downside. Breadth weakened: seven sectors fell, with Energy, Industrials, and Materials leading declines. Fed rhetoric stayed easing-biased (Williams), but with data visibility still patchy, earnings are set to carry more macro weight near-term.

Sector Attribution

Weighted Return Contribution (to S&P −0.40%)

Leaders: Consumer Discretionary (+0.03%), Consumer Staples (+0.01%), Communication Services (+0.01%)

Laggards: Industrials (−0.14%), Financials (−0.08%), Info Tech (−0.08%), Energy (−0.06%), Health Care (−0.04%), Materials (−0.03%), Utilities (−0.02%), Real Estate (−0.01%)

Unweighted Performance (Breadth)

Leaders: Consumer Discretionary (+0.31%), Consumer Staples (+0.26%), Communication Services (+0.14%)

Laggards: Energy (−1.95%), Materials (−1.74%), Industrials (−1.67%), Utilities (−0.67%), Real Estate (−0.65%), Financials (−0.62%), Info Tech (−0.24%)

S&P 500 (cap-weighted): −0.40%

Macro Overlay

Flows & positioning: After a powerful run, breadth is tiring and “buy-the-dip” is meeting a bit more resistance. AI remains the secular bid, but today’s tape favored defensives at the margin while economically sensitive groups (Energy/Industrials/Materials) bore the brunt.

Rates & FX: 10-yr USTs edged up to ~4.14%, curve little changed; USD pushed to a 10-week high—both consistent with the cyclical softness in equities. Gold slipped back below $4,000/oz; oil fell as Middle East risk premia eased.

Fed tone: NY Fed’s Williams reiterated openness to more cuts this year if labor softens further. That keeps the easing bias alive, but without fresh government data, markets will lean harder on earnings and high-frequency proxies.

Earnings sensitivity: With a buyback blackout window and valuation heat, prints/guidance matter more. Tech’s capex cycle (AI infrastructure) still underpins the medium-term story, yet near-term leadership is vulnerable to any hint of margin or supply-chain strain.

The Read-Through

Concentration risk cuts both ways. When Tech isn’t carrying, the index struggles—today’s negative contribution from Info Tech plus weakness in cyclicals left the S&P in the red despite small defensive gains.

Macro still supportive but not decisive. A dovish-leaning Fed and contained long rates are tailwinds, yet a stronger dollar and stretched marks argue for consolidation over reversal.

Takeaways & Tactics

Bias: Neutral-to-constructive medium term; tactically patient near term.

Equity stance: Respect the uptrend but trim chase risk in cyclicals; let earnings reset expectations.

Pairs/overlays: Prefer quality/defensives vs. cyclicals on days when USD↑ & UST10y↑. Keep AI-infrastructure exposure core but sized for volatility.

What flips the script: Softer labor + steady inflation → leadership can re-accelerate; a hawkish rates/FX impulse or margin squeeze would extend breadth deterioration.

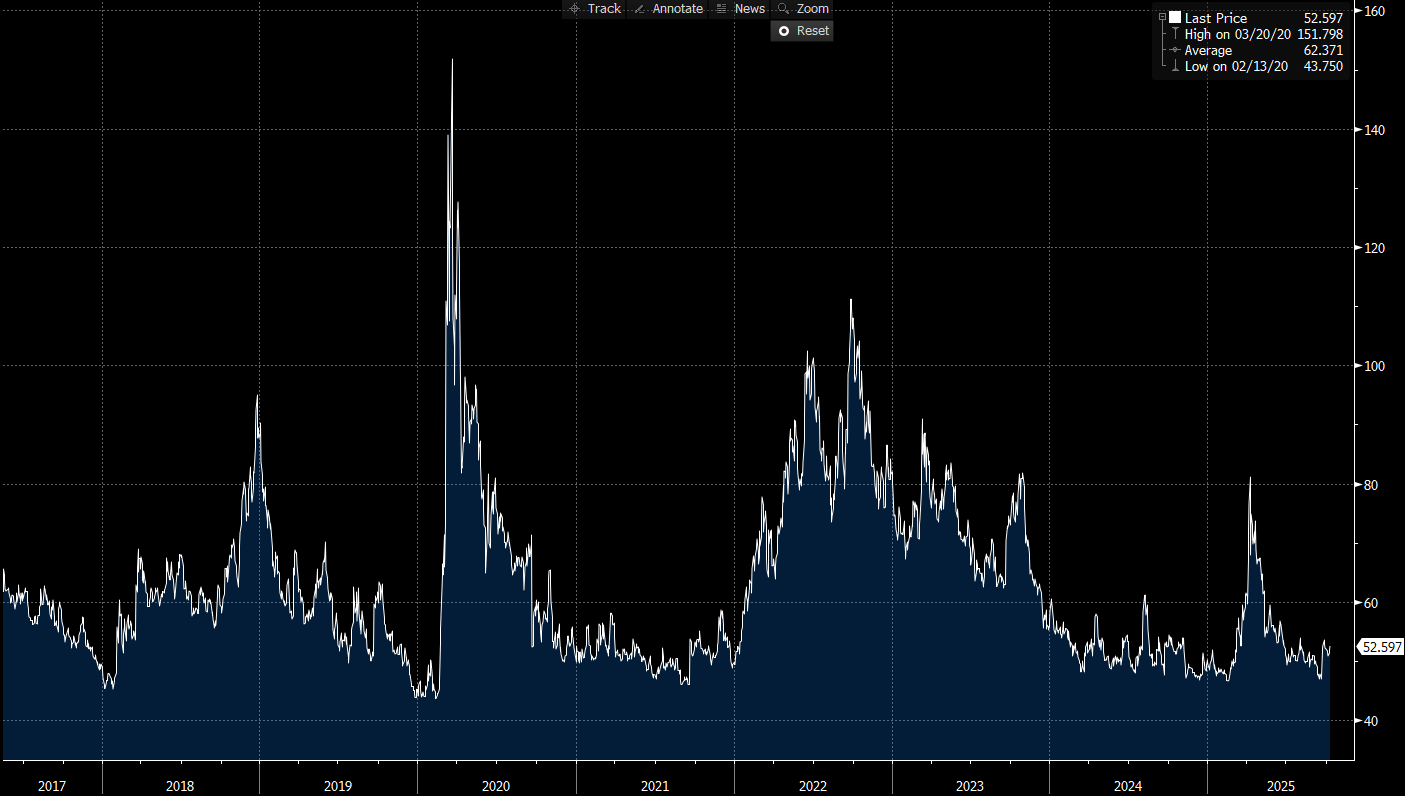

US IG Credit Wrap: Low-50s Hold Despite Risk-Off; Slight Widening on USD/UST Drift (IG OAS ~52.6 bp)

IG spreads nudged a touch wider but stayed firmly in the carry channel. Bloomberg US IG OAS closed around 52.6 bp (≈ +0.7 bp d/d) as a stronger dollar and a small backup in UST 10s to ~4.14% met still-dovish Fed rhetoric (Williams). The tone remains sideways, carry-first; dispersion > direction.

Where we sit (from the chart)

IG OAS: ~52.6 bp

5-yr avg: ~62.4 bp → ~9.8 bp inside

Cycle tights: 43.8 bp → ~8.8 bp off

Pandemic wides: 151.8 bp → ~99 bp tighter

(Chart stats: Last ~52.6 | High 151.8 on 03/20/20 | Avg 62.37 | Low 43.75 on 02/13/20.)

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

Macro overlay

Equities: S&P −0.4%; leadership narrowed, cyclicals (Energy/Industrials/Materials) weak.

Rates/FX: UST10y ↑ to ~4.14%; USD at 10-week highs. Gold < $4,000; oil −1.7%.

Fed: Williams keeps an easing bias on the table if labor softens; minutes cautious but not hawkish.

Mapping to IG

Carry > convexity: Low-50s OAS keeps “clip the coupon” intact; no impulse for systemic widening.

Duration cushion: Long-end stability continues to attract A/AA long-duration demand.

Dispersion watch: Today’s cyclical equity weakness argues for BBB cyclicals (Energy/Industrials/Materials) to underperform on any further rates/FX headwind; single-name moves tied to guidance/M&A/capex.

Correlation check: USD↑ and UST10y↑ usually lean modestly wider; the move so far is orderly.

The Read-Through

Base case remains a sideways grind in the low-50s: supportive policy path, contained rates, and robust demand for high-quality carry. Near-term risk is breadth deterioration in cyclicals plus a strong USD; offset is Fed optionality and steady duration demand.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

All of the interest rate sensitivity models are now reserved exclusively for paid subscribers. If you would like to do a free trial, you can with this LINK.

Launch video for these models is here: LINK

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.