Hey everyone,

I hope your weekend is off to a good start!

I previously wrote “educational primers” on both bonds and the S&P 500. You can find them here:

In this article, I want to provide some updated thoughts on bonds, SPX, and the other trades I am thinking about.

Balanced Life?

My first boss in the industry said to me, 'Listen, you’re incredibly young and inexperienced compared to your competition. The only way you can have an advantage is by working harder and learning more than everyone else.' There was a clear expectation that an eight-hour workday was a one-way ticket to failure.

I have never regretted the amount of time that I put into my work. There have been so many people that have told me to work less and rejecting their advice has been one of the highest ROIs of my life.

There is always going to be some person that says you should work smarter, not harder. At this point, I think it should be clear that all the top performers are working smarter and harder. You’re not going to go to an elite-level athlete and provide him with a revelation by telling him he should work smarter, not harder.

A lot of this comes down to goals. Some people are just trying to make enough money so that they can have more of their day to themselves. Other people are in the game because they love it and want to be the best at it. The latter will always win because they take every advantage of working smarter as an opportunity to push themselves even more. And again, a lot of this comes down to the goals people have.

I say all of this as a reminder. The competition is fierce and you have to pick your battles. The amazing thing about today is that there are a lot of Substacks (such as this one) where people share the fruit of all their hard work. I would also suggest these Substacks:

. Truly amazing work is being put out!Personally (aside from the exceptional Substacks noted above), I subscribe to a number of smaller research services/people. Generally, I stray away from the bigger official Wall Street research services. I want to hear what the fringe crazy people are saying.

Bonds:

Alright let’s shift to bond price action

I noted multiple times in the Substacks and on Twitter that I believe there was additional downside in bonds.

See the previous piece I wrote: Link

I also noted this as an example in the SPX primer: Link

Bonds have continued to move lower:

However, it is important to identify the driver of the move! There are two key things you need to know:

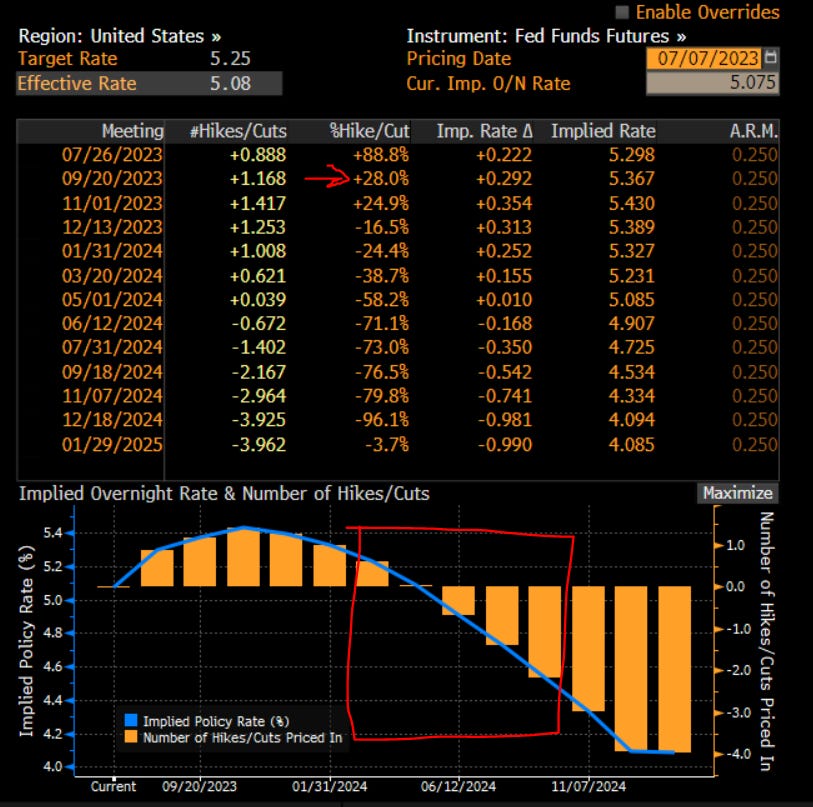

First, the September FF contract hasn’t priced a rate hike even though Powell said he intends to hike 2 more times. This is the dynamic on the short end of the curve.

The second thing to note is that as the LEVEL of inflation remains elevated, the contracts that are farther out need to reprice to the current FED funds rate.

Fundamentally, we have uncertainty about if there will be hikes or cuts. However, as information moves across the spectrum from uncertainty to certainty, the market will reprice the probabilities of hikes/cuts. This is why the data prints this past week served as catalysts for positioning to reprice the futures on the farther end of the curve.

This is also why we have seen the yield curve steepen marginally. The sell-off in bonds was driven by the long end.

If and when we begin to price a higher probability of a September rate hike, we are likely to see the 2-year fall further. I still believe we have some downside in the 2-year unless something else blows up.

I am watching closely for signs of stress but we remain between these two forces of low unemployment and high inflation. This was further confirmed by the GDP prints last month:

I wrote an entire macro report on this dynamic of the extremes between unemployment and inflation:

Macro Report/Insights: MACRO REPORT

Hey everyone, I hope your weekend went well. As promised, here is the macro report that I wrote: https://bit.ly/45kK5SG For those of you who are new, here is the tweet thread with all the educational articles I wrote and a list of books I have found helpful in understanding markets:

I have updated some of my views marginally, but I still see the same scenarios. Half of the battle is simply ensuring that you have a proper understanding of the current macro regime so that you can know WHEN to get in and out of trades.

Big picture, I don’t want to buy bonds yet. I think we are still in the process of rates peaking. The thing that pays here is inaction. I don’t need to know the exact week in the future that I will get long bonds. All I need to know is that I don’t want to be long right now.

Also, a friendly reminder that you get paid over a 5% risk-free return to NOT take duration risk. There is nothing wrong with just sitting and watching.

S&P500:

I am going to pull together several insights connected to the S&P500 “primer” I wrote (link)

I provided my view in this article that I believe ES is range bound for the time being:

Week Ahead Strategy: The next move

Hey everyone, We have some events this week that will be important for running trades. First, we don’t have any major economic data prints this week. I will be watching initial claims as usual though: Second, I already provided a breakdown of how to think about the dot plot and Powell’s comments:

4400-4500:

We have almost perfectly stayed in these ranges. We broke below momentarily but we didn’t see any type of intraday characteristics that would indicate a fundamental sell:

Let’s talk about where we are heading from here.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.