"You have power over your mind—not outside events. Realize this, and you will find strength." — Meditations 4.3

We will continue to move forward with speed and intensity as we apply rigorous research to achieve clarity of thought. Thinking clearly is paid a premium in financial markets (and life). The leverage of the world makes HOW you think one of the most important things about you. This is why your educational journey is the thing you should invest in the most.

“You wasted $150,000 on an education you coulda got for $1.50 in late fees at the public library.”

-Good Will Hunting

Where are we?

I laid out my views in the comprehensive macro report. These continue to be confirmed with explicit clarity.

Comprehensive Macro Report

All of the research on interest rates and equities has been provided. I continue to hold the long ES trade published May 30th noted here: Here are the links to all the main pieces I have done recently explaining the tensions of the macro situation. Equity Report:

I shared all the trades I have been running in the alpha report:

Alpha Report: Rates, Equities, Catalysts

In this report I am going to over 3 things: Why the risk-reward and hit ratio of your trading (and life) matters. How the tensions I noted in the macro report are likely to play out Trades I am running in connection with the macro skew Intro: If you haven’t read the macro report, please review it here:

And I have been updating the analysis as we move forward:

Link (I laid out all the equity research and trades YTD here. I am holding the long ES trade still!)

I shared the SOFR trade here for paid subscribers: Link. This is now in the money.

I also took some duration risk getting long ZN: Link. (These active set ups constantly change and are shared with paid subscribers.)

Big picture: We remain in a positive growth regime where stocks AND bonds are likely to rally. Having optimal entries and exists is critical for generating alpha. While I continue to hold these trades, opening new trades at these levels has a lower risk-reward.

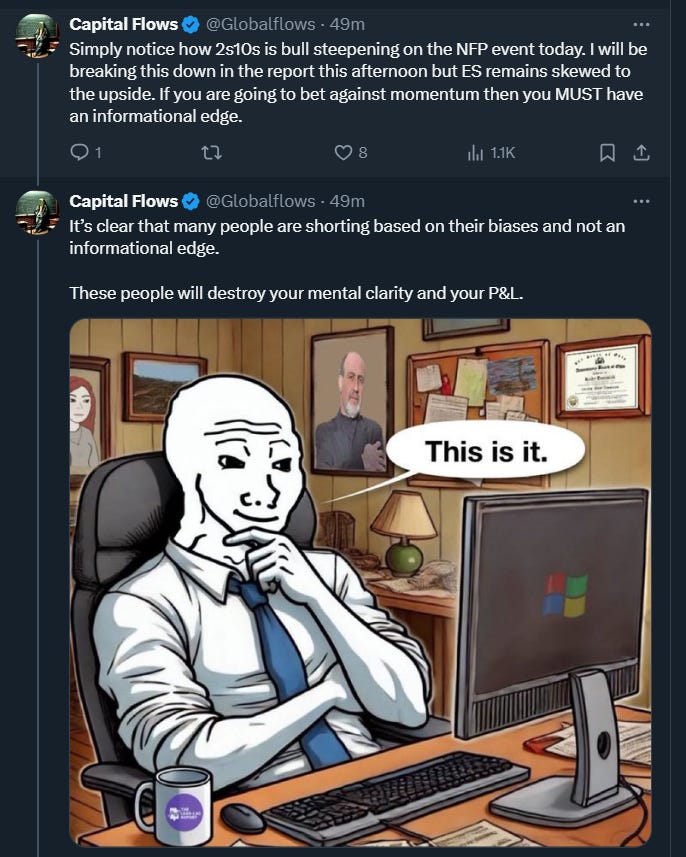

Any time you are running trades in confluence with the macro regime, you need to execute and manage your risk incrementally in connection with how much positioning is realizing the expected returns. What does this mean tangibly? It means you need a very clear informational edge into the macro regime and HOW the market is pricing that macro regime. When you overlay a technical edge that has statistical significance on this, you are able to achieve significantly better returns.

See all the educational articles for more on this:

Research Synthesis / Direction Of Capital Flows Substack

Hello everyone, There has never been a time in history when understanding the world from a global perspective and interpreting it accurately paid such a high premium. Since the very beginning of this Substack, I have talked about the nature of the time we live in and how to act intentionally in it.

NFP:

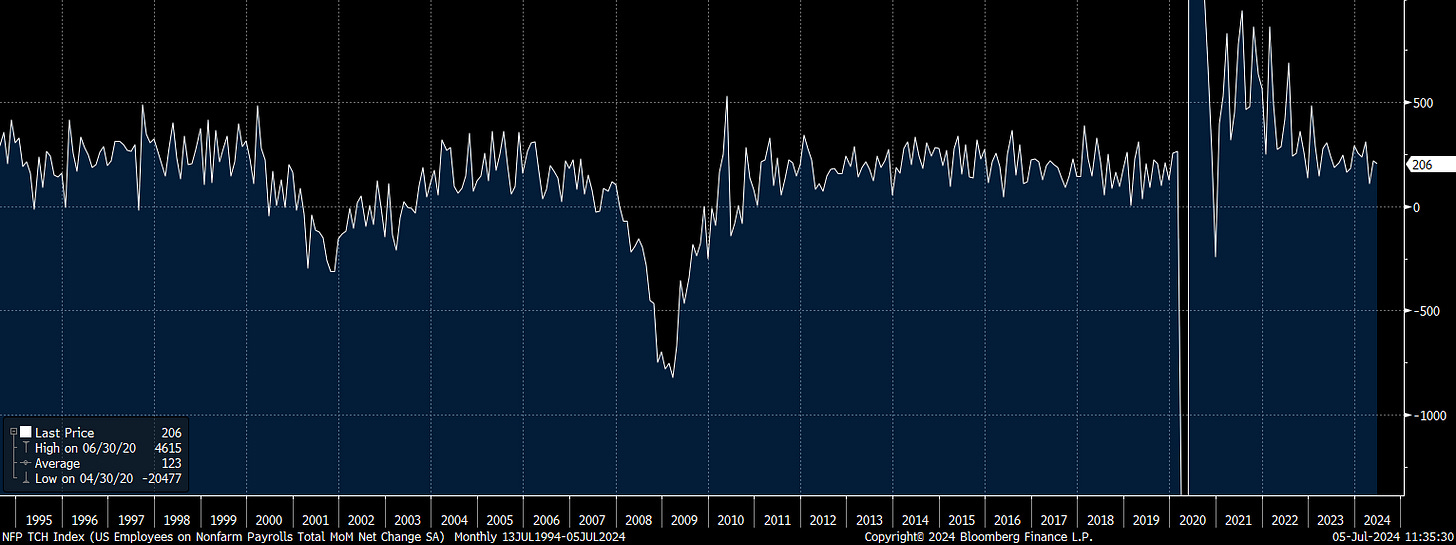

As I noted over and over this week, NFP would be the main event this week. Basically, jobs came in above expectations but the unemployment rate rose:

How should you think about this NFP print? It’s very simple. As I laid out in the macro report (link), we are going to have some marginal softening in growth but are unlikely to have a recession in 2024.

Remember, you need to quantify your views into QoQ GDP which means for a recession you need multiple negative real GDP prints. You’ll notice that all the perma bears will NEVER quantify their view into how it transmits into real GDP. They always skirt around the issue. GDP is the most comprehensive reflection of economic activity.

Nowcasts remain positive:

Now the key thing you need to notice is that this marginal softening in growth is allowing the Fed to bring more rate cuts to the table. We are in a tension where rate cuts occurring will support growth but Fed Funds still remain significantly above inflation.

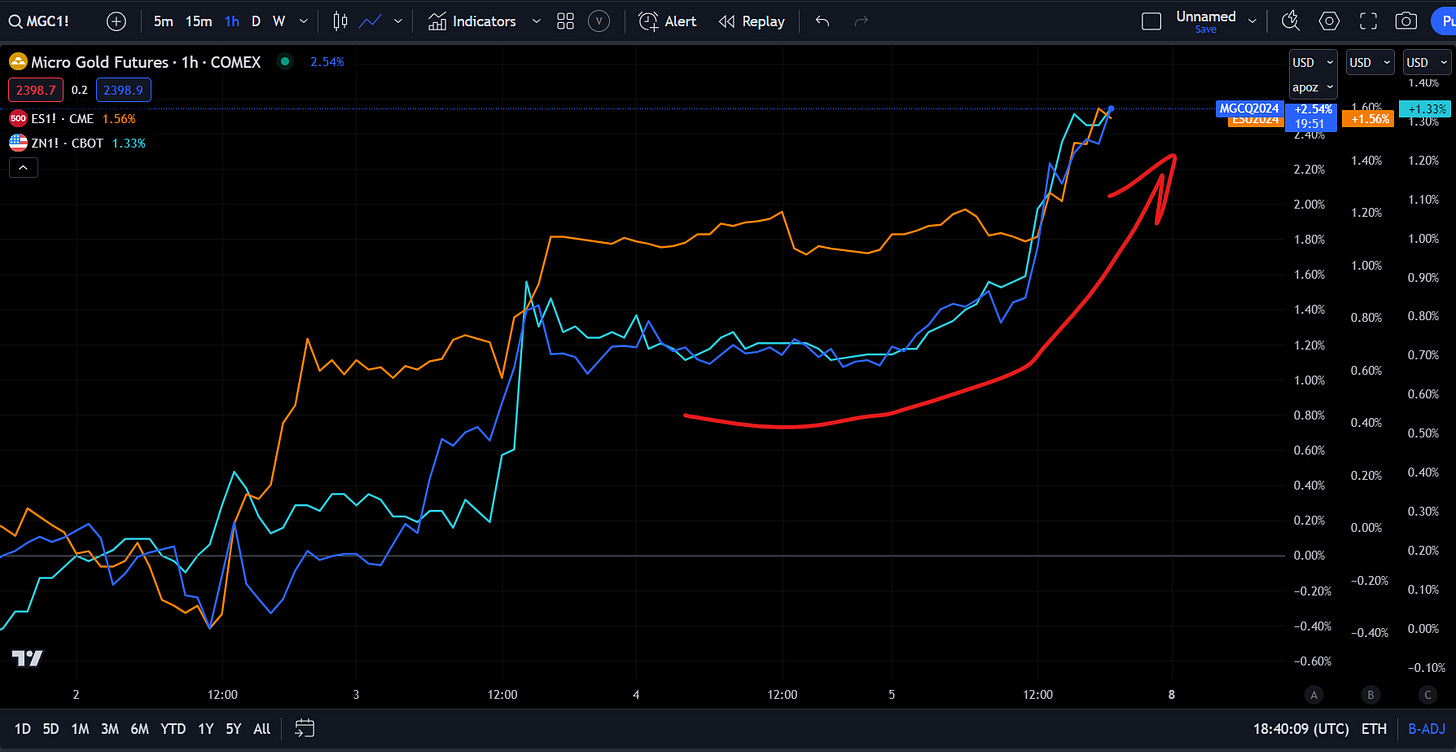

This is why stocks AND bonds are rallying along with gold today. If we were entering a real recession, stocks would be selling off as bonds bid. As I explained previously, when rate cuts are done during positive growth and low credit risk, this pushes financial assets up.

See my thread here on this: Link

Trade Updates: BTC, Rates, and ratios

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.