THE Model for taking bets in markets (and life)

The tools and framework that thrive when uncertainty is the highest

If you are new to the Substack welcome to the journey. We are moving fast but I promise no one will be left behind. You are going to want to read this article to the end because I will be sharing THE Model for taking bets in markets and life.

Social media will throw heuristics at you but never actually break down the principle for taking bets. Rarely do people connect their betting framework to HOW bets are dynamically evolving in the environment. We are doing both today.

Why Thinking In Bets Is THE ONLY WAY

When many of us entered markets it started by seeing some flashy returns, a compelling macro view, or seeing the magic-like abilities of someone trading. These set the fire of motivation to get from where we are to the vision of success we hold.

The difficulty is that along the way you get beaten down as you realize the alluring vision requires a foundation that is incredibly difficult to build. On top of this, there is so much misinformation, misdirection, and outright deception in the industry that stunts your ability to learn. This is why I am sharing the following bet-taking framework with everyone for free.

Two Principles:

We need to start with two fundamental principles:

Thinking in probabilities THE ONLY way to survive in a world of uncertainty. There are always many different future scenarios that could take place. If you deterministically think a specific outcome SHOULD happen then you will be humbled very quickly. Thinking in probabilities is THE WAY because it matches the nature of the TYPE of world we live in. When uncertainty, false signals, and nonlinearity exist in a system, it is impossible to know the future.

Thinking in probabilities isn’t enough though. You need to take bets in a way that matches the TYPE of probabilities you are facing. Thinking in future probabilities and scenarios is only the foundation for taking bets that consistently make you money. If you bet everything on a future scenario then you are still likely to lose your seat at the table, even if you are aware of multiple outcomes.

When these might make conceptual sense, many times it is hundreds of losing trades that teach us they are actually true.

These two principles set the foundation for THE model I use for bet-taking. This is the model I use in markets and the other businesses I run. If you are a risk taker and practitioner in real life then the only way to succeed is by intentionally acting based on this model.

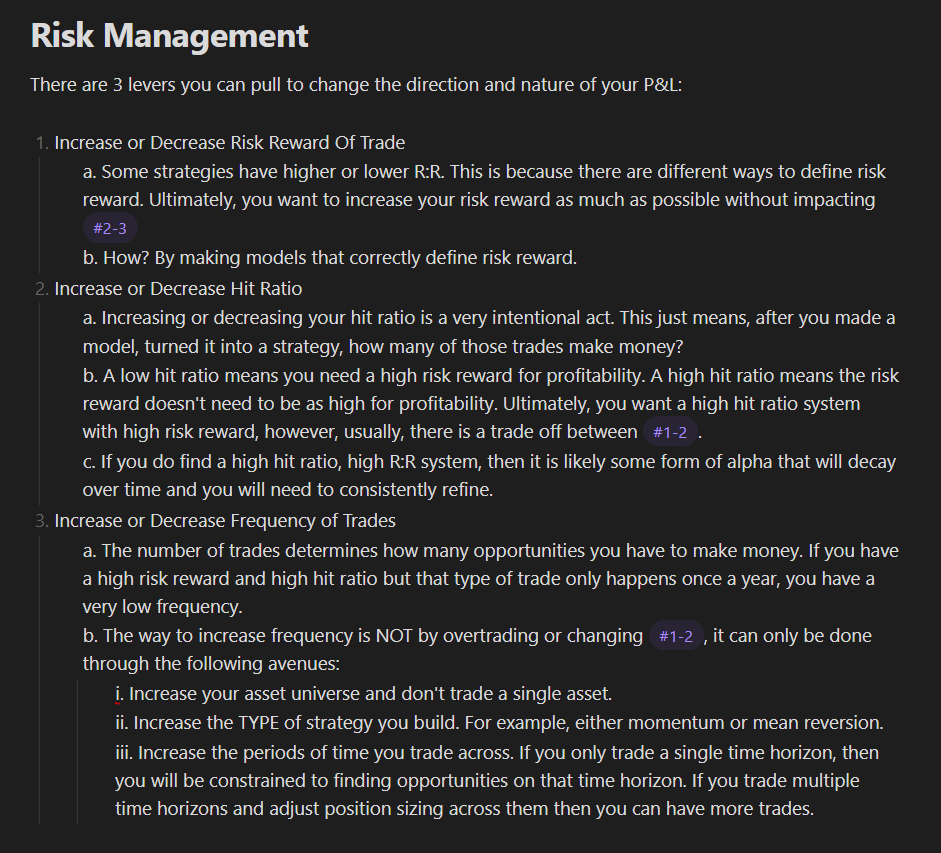

These are the three levers for taking bets in any domain of life. Your job is to accurately translate your domain and its respective signals into a systematic process that connects to each of these levers.

If you are in liquid financial markets then you are aggregating all data points and developing the interpretive ability to see the signal among all the noise. These signals are then connected to each of these P&L levers and then run through your process for taking bets.

For example, I wrote the following reports breaking down sectors in the market:

Real Estate: Real Estate Report: Homebuilders, REITs and Singlefamily Homes

Long Bonds: Trades: Pulling the Trigger / Long Bonds

When you properly research and interpret the causal dynamics of each sector, you can connect them to your levers for taking bets. You could be the best bet taker in the world but if you don’t understand how to interpret your domain properly, you will consistently lose. Inversely, you could be the expert on your domain but if you don’t connect your interpretive insights with your levers for bets then you’ll never be able to monetize your knowledge.

In sum, you need two things: a proper framework for taking bets and the ability to correctly interpret your domain.

Macro Domain:

Now you might be thinking, how do I interpret the macro domain correctly?

Well, you already have all the educational primers that I have written:

Research Synthesis / Direction Of Capital Flows Substack

Hello everyone, There has never been a time in history when understanding the world from a global perspective and interpreting it accurately paid such a high premium. Since the very beginning of this Substack, I have talked about the nature of the time we live in and how to act intentionally in it.

On top of this, you have all the real-time analysis and synthesis that I provide (see “About” section breaking down the paid tier). I want to go even further though and share another model with you.

The primary dataset for interpreting growth and inflation in the economic system is GDP (link). The most recent US GDP print was over $27T. The largest line item in GDP is consumption which accounts for 67%.

If consumption is the primary line item, monitoring it is critical for correctly interpreting the economy and its impact on stocks, bonds, currencies, and commodities.

This is where the Personal Income and Outlays Dataset comes in and it’s the model I am going to share with you today. If there was a single dataset you need to know like the back of your hand for trading macro, it’s this dataset. This dataset functions like a regular income statement. Money comes in from personal income at the top and flows down to personal consumption at the bottom. Notice the personal consumption number? Now compare that amount to the consumption line item in GDP.

You can see why the monthly Personal Income and Outlays Dataset is important for knowing WHERE we are with GDP. Here is a complete model that automatically breaks down this dataset for you:

On top of the Personal Income and Outlays dataset, I added tabs on foreign transactions data, import/export data, savings/investment data, national income data, corporate profits data, and motor vechicle data. Why am I adding all of these? Because the goal of this Substack is to provide you with all the tools you need to be successful in the information age:

In the information age, you simply need to be at the right place, at the right time, with the right information to succeed

Now you have THE Model for taking bets and an entire model that seamlessly breaks down the largest component of GDP. You also have analysis tabs in the model for 6 additional economic datasets.

If you are reading this and think it’s a lot to take in or constantly analyze, it’s completely understandable. This is why I do monthly macro reports (most recent: link) and webinars (most recent: link and link) to break down all economic data points and connect them to financial markets. I have turned on free trials for the Substack and they are available until January 1st so you can check out everything without worrying about paying for something that might not be a fit.

If you are interested in synthesizing all of these moving parts to your individual goals and constraints, I have one slot open for a Bespoke client in January. I honestly don’t have the capacity for more than that right now. If this is something you are interested in then you can email me at capitalflowsresearch@gmail.com.

Bringing It Home:

As we move toward the end of the year, I will be adding A LOT more educational primers to the arsenal for paid subscribers (all previous ones here: link). The ultimate destination will be a primer on every country, sector, and asset in the world.

I have one favor to ask of you. You are here because you saw this Substack on social media or a friend sent it you. If this Substack has improved your ability as a risk taker and thinker then do me the favor of sharing it. It would mean a lot to me personally.

Like I said at the beginning, we are moving fast. We are about to move even faster. The best is yet to come!

i find your writing and research to be very thorough, which i greatly appreciate! it doesnt feel like you rush into your opinions.

Thank you!

Been reading and getting passionate a lot about risk lately and the you write this. Thanks a lot.