Daily fundamentals are the path to an exceptional future

I am starting with the quote above because the only thing published on social media is the exceptional life people live. This is amazing for inspiration but most of the time, effort is spent focused on daily tasks that are performed with excellence.

Before we move to the market side of things, I just want to encourage everyone to take control of their own education. I see so many people today believing misguided wisdom about education or acting out of fear. This doesn’t mean you shouldn’t go to college or go a formal route.

However, as Mark Twain said:

“I have never let my schooling interfere with my education.”

CPI and FOMC:

I want to start with several insights as we move into CPI tomorrow. First, as I have stated multiple times, I have a long ES position and am holding it into CPI tomorrow (link). Because we executed this position at an extreme, we have room to breadth during clearing events like this.

Second, below is the chart of the ES risk reward I originally shared when opening the trade (link) and ALL the CPI prints marked since the beginning of 2022.

There are several things you need to think about when trading equities through CPI prints in this environment:

1) Does anyone remember when CPI was causing ES to blow out pre-2020? NO! Because no one in equity land cared about CPI. There is a reason for this though which I will get into.

2) CPI played a dominant role in the bear market of 2022 because it was an inflationary bear market. What does this mean? It means that we were having a repricing of the valuation component of equities as opposed to the cash flow component (see my article here if this is a new concept: Link). This confused a lot of people because everyone used 2008 and 2020 as the comparable scenario for a bear market.

You’ll notice that it was a repricing of valuations during this time. Here is a chart of SPX with the valuation bands:

Third, you will notice that when inflation began to top, it was the CPI releases that began to set the bottom in equities. Notice the CPI prints on these dates:

As we moved through 2023 and 2024, these CPI prints continued to be catalysts where the market rallied. We had a short detour from August to October of 2023 due to the bear steepener from the QRA announcement. We actually had a similar situation in April of this year but it turned out to be an exceptional buying opportunity for equities.

During April of this year, I was very aggressive in saying this was a dip buying opportunity (link): Note from April

On top of this, I shared the ES trade when the market pulled back marginally (link). If it isn’t clear, I am bullish on equities.

The marginal VIX spike into this week is going to be unwound as traders monetize their hedges.

As I noted in the interest rate report, we aren’t seeing the same type of imbalances in the economy to support the idea of inflation reaccelerating.

Interest Rate Report: Strategy and Trades

Hello everyone, The trading week is officially over but I wanted to summarize several important things for rates. First, I wrote the interest rate primer and my views on ZT. Check them out in these articles: Interest Rates Primer Macro Insights/Report: The Forward Curve

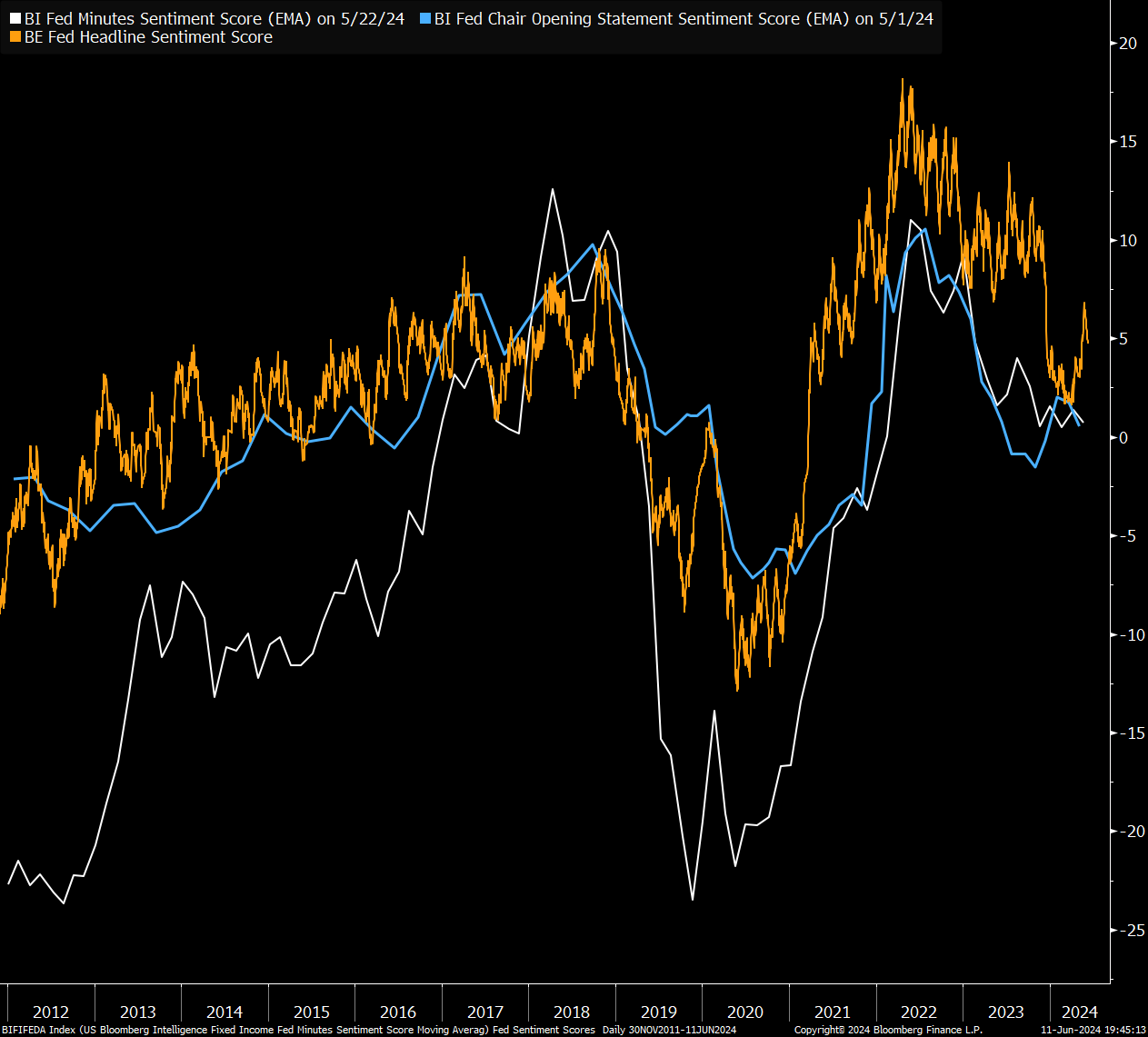

The big picture takeaway is that stocks are likely to continue rallying. I will touch on rates below but overall we are very likely to move lower across ALL these sentiment metrics:

People continue to conflate the Fed’s actions and the dynamics in the underlying economy. Let me just make several points on this before touching on interest rates. First, I noted in this write-up that just because interest rates are going down doesn’t mean there is a recession. Recession typically = interest rates down but interest rates down doesn’t = recession. This is macro 101.

Interest Rates, Equities, Recession?

Hello everyone, There has been some confusion among people in the news media and social media regarding how the relationship between stocks and bonds functions in both the presence and absence of a recession. For example, I keep hearing that if rates are going to come down, a recession is likely to occur. This is a conflation of two separate variables.

Next, remember that the Fed is saying they are data dependent but that doesn’t necessarily mean they will continue to be. Remember in 2021 when they held rates at zero and inflation went through the roof? That wasn’t being data dependent. Now that is the extreme example but the smaller marginal changes will begin to shock positioning on the forward curve.

Interest Rates:

The current stance by the Fed and forward curve pricing sets up an opportunity in rates.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.