The Research HUB: Inflection Points

Nonlinear moves

I have done several research-based articles this week on the following topics:

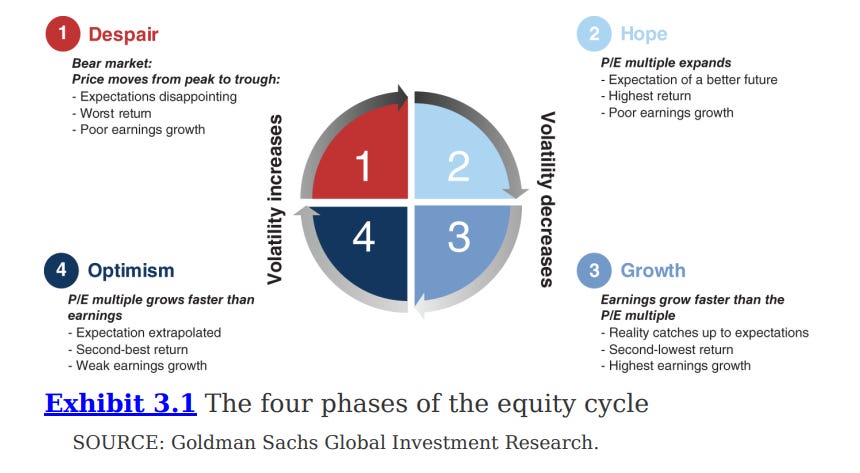

Understanding how regimes function and WHY assets have different expected returns in regimes is critical for managing any type of portfolio or generating alpha. Assets in a portfolio always have varying sensitivities to the TYPE of macro regime:

Many times people conceptualize these regimes with broad characteristics:

Fundamentally, assets exhibit different returns (positive and negative) and different TYPE of returns (momentum vs mean reversion) as you move through different parts of different regimes:

Check out the Long Good Buy. it’s a great book on this topic:

I have written extensively on this topic in the educational articles which can be found here:

I want to zoom in on a specific aspect today and elaborate further on its implications.

MAIN IDEA: Nonlinear returns occur at inflection points.

Here are a couple of papers on regime analysis:

Why do nonlinear returns occur at inflection points? Because an infection point is a moment in time where positioning is significantly skewed in one direction. Typically, inflection points show sharp reversals from positive momentum which means trading an inflection point typically requires a bet against momentum. Betting against momentum has a lower hit ratio than betting with momentum. This is why you can get paid so much for trading an inflection point correctly.

As I said in “The Path” article, I do not hold to any specific TYPE of trading. I will adapt incrementally and accordingly to the highest expected return. If this means betting against momentum then I will do it.

Conviction for betting against momentum is ALWAYS built on having an informational edge. This informational edge is based on rigorous research, extreme discipline, and the absence of delusional biases. The mental elasticity required for this is rare.

My life consists of a lot of research, thinking, and testing ideas. The market is the ultimate one who grades my work.

A book I have always enjoyed is Self Reliance by Ralph Waldo Emerson. At the end of the day, you are the only one who can make your own decisions about risk. You will feel the urge to shirk responsibility but success comes from extreme ownership.