Hey everyone,

We are nearing the end of Q3 and there is a lot of talk surrounding end-of-quarter flows. I thought this would be a good opportunity to talk about the logic of events like this and analyze our current situation.

The Big Picture Logic:

First, let’s take a step back from financial markets. In any system, there will be specific catalysts that have a regular degree of occurrence. For example, we could look at any business in the real economy that is making decisions about the future. If we look at a sector like shipping, it has a very complex yet precise schedule for moving goods and services. Another example would be a SaaS company projecting out when contracts for services need to be renewed or changed. The sales team can gauge the renewal probability via weekly and monthly sales calls with the client or look at usage metrics.

All of these domains have different frequencies in which information is released. In markets, we have the economic calendar, fiscal calendar for the government, quarterly earnings for companies, and derivative expirations such as futures rolls or option expirations.

Instead of trying to find patterns in the market, start by thinking about how temporal catalysts are involved with information moving across the spectrum of uncertainty to certainty.

Current Market Situation:

Now let’s dig into our current situation a little bit. For the purposes of this article, we will only be examining equities and bonds. When you begin to move into commodities, you inject more bottom-up seasonality that is dependent on how inventories interact with supply and demand. If you want to look into this dynamic in commodities more, check out this book.

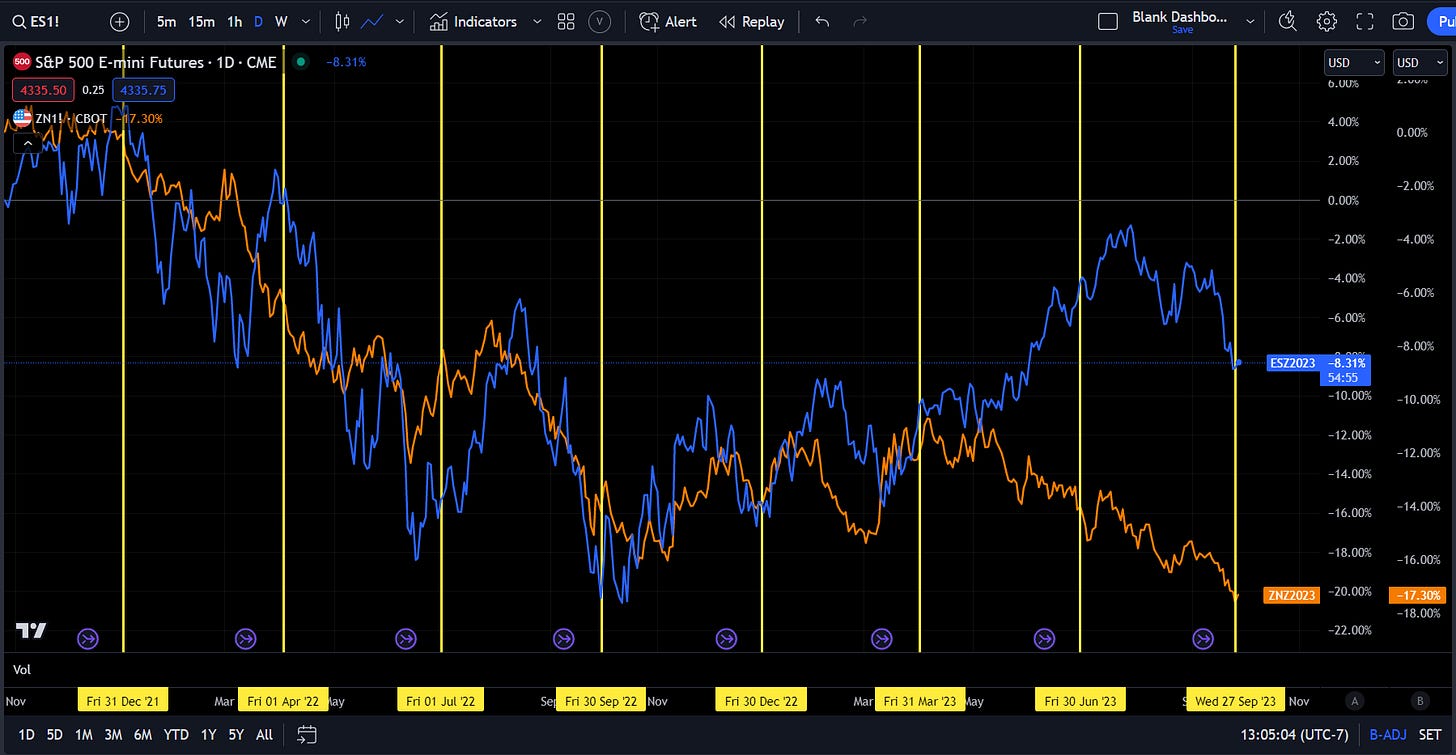

Here is a chart of stocks and bonds with each quarterly event marked:

Now we often talk about momentum, mean reversion, and correlations among asset prices (if these concepts are new, see the educational articles I’ve written: link). However, we want to compare these with the catalysts that occur through time. The goal is to have EXTREME TESTABILITY in your thesis.

This idea of extreme testability is what I see lacking the most in conversations about financial markets. A great book on this is The Beginning of Infinity which starts by saying a scientific hypothesis is one that is falsifiabile. In today’s world where “science” is weaponized for propaganda, people have lost the skill of creating ideas that are testable and falsifiable. The “problem” with providing a thesis with clear testability is that you have to embrace uncertainty and that you might actually be wrong. Potentially being wrong is not palpable to most people.

So when I think about the end of quarters in financial markets, I view it very similarly to other catalysts. These temporal catalysts have a higher probability of functioning as short-term (or maybe even long-term) inflection points. For example, it’s not surprising that the 2022 bear market started at the very beginning of Q1.

Now does this imply that any changes in the quarter = a pivot in financial assets? No! However, it is a piece of evidence which means if you have a preexisting thesis, there are certain periods of time where you can attribute higher significance and potentially get a higher signal-to-noise ratio in your interpretation of price action.

Are We At An Inflection Point?

Everyone wants to know if this quarter-end will be the inflection point for stocks and bonds. I will provide several thoughts on this:

First, market participants do have constraints regarding buying and selling during various quarters. However, the asset managers executing trades aren’t stupid. Their goal is to have the least impact on price action as they put up and take down exposure. If you want to dig into this more, check out this article: link

Second, there is a tension with the stock-bond correlation right now. During 2022, we saw a positive stock-bond correlation as stocks and bonds sold off together. This put a lot of pressure on managers who were betting on one of these assets offsetting their volatility. As a result, managers sold both stocks and bonds in order to limit their downside volatility. As we moved into 2023, we saw a divergence due to growth surprising to the upside. Stocks rallied and bonds continued selling off. Since August 1st, the stock-bond correlation has turn positive due to the bear steepener.

Now here is the deal, none of us know how flows are going to work as we move into October. However, the stock-bond correlation and bear steepener will be key to watch. It is very possible that as we move into Q4, managers begin putting up more exposure in bonds. This could be at the expense of equities or simply moving out the duration risk curve.

Third, the macro analysis I have laid out in the macro report stands (link). Signals I am watching for:

If bonds can’t catch a bid into the beginning of Q4, there could be a lot more downside into the bond issuance by the Treasury.

If we begin to see a bear steepener with a strong dollar, it is unlikely for any buying in equities to be sustained.

If we begin to see bonds catch a bid at the expense of equities, I don’t think this would have a high degree of sustainability since inflation remains the dominant impulse in markets.

If we see a bid in bonds, I will be watching US equity sector relative performance to see if tech or semiconductors lead the way. Alchemist Investor and I just had a great conversation on this: link

Gold continues to be a key signal in this framework given its sensitivity to the bear steepener and DXY.

Conclusion:

There is no clear-cut implication for the quarter end in our current situation. There are multiple scenarios that could take place IF positioning needs to adjust its exposure. The main thing you can do is figure out the logic of positioning on the fly and adapt your exposure to it.

Adapt to the chaos or be crushed by it. That is the name of the game.