Top Macro Narratives Distracting You From The Big Picture

Why fear of uncertainty blinds you and keeps you from seeing the true market

Narratives:

In The Black Swan, Nassim Nicholas Taleb explains that humans have a deep-seated tendency to create narratives and causal explanations for events, particularly in retrospect. This inclination leads to the "narrative fallacy," where we impose order and logic on random or complex events to make them seem predictable or understandable, even though they were actually influenced by randomness or unforeseen factors. Taleb argues that this distorts our perception of risk and uncertainty, as we focus on explaining the past rather than recognizing the unpredictable, rare events—Black Swans—that shape history and the world in ways we cannot foresee.

False Macro Narratives:

A lot of ground has been covered on this Substack over the past 10 days. The Alpha Report and Macro Report have set the context for WHERE we are. One of the most critical things to remember is that in the attention economy, everyone wants you to believe them. The danger of this is that subtle biases can be implanted into your mind about the directionality and magnitude of moves in assets that have zero validity.

For example, some people will say, “Look the market just hit an all-time high again, the final collapse must be incredibly close!”. The ironic thing is that all-time highs in the market is one of the most bullish things statistically (see study here: link). Why would someone feel the fear of an all time high? Why would there be an suble inclination to think a 1987-type crash is imminent?

This isn’t meant to support the position that you should never think or plan around tail risks. The implication is your decision-making is based on the proper redundancy planning and NOT fear.

Main Idea: You will notice that all incorrect narratives are reductionistic and ignore critical data points for interpreting the environment.

Main Narratives:

There are two primary narratives in markets right now that people are clinging onto for dear life in spite of contradictory data.

Narrative #1: Economists are still forecasting a 30% probability of a recession within the next year. This is significantly elevated above the historical average:

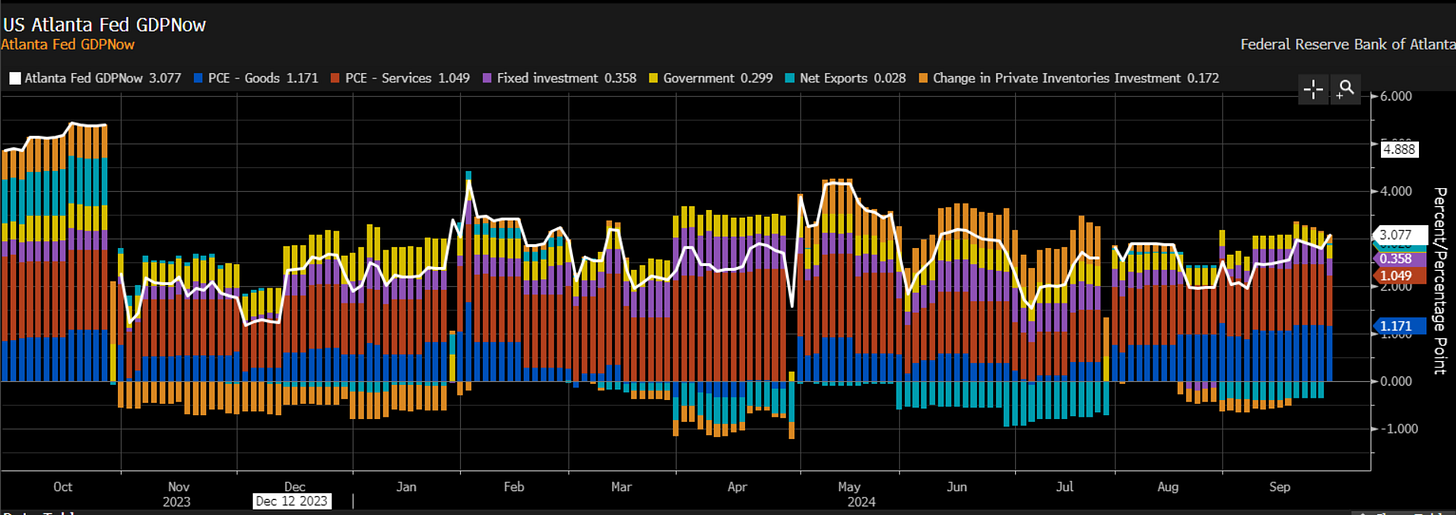

The fact of the matter is, that the Atlanta Fed GDPnowcast remains positive in all major components:

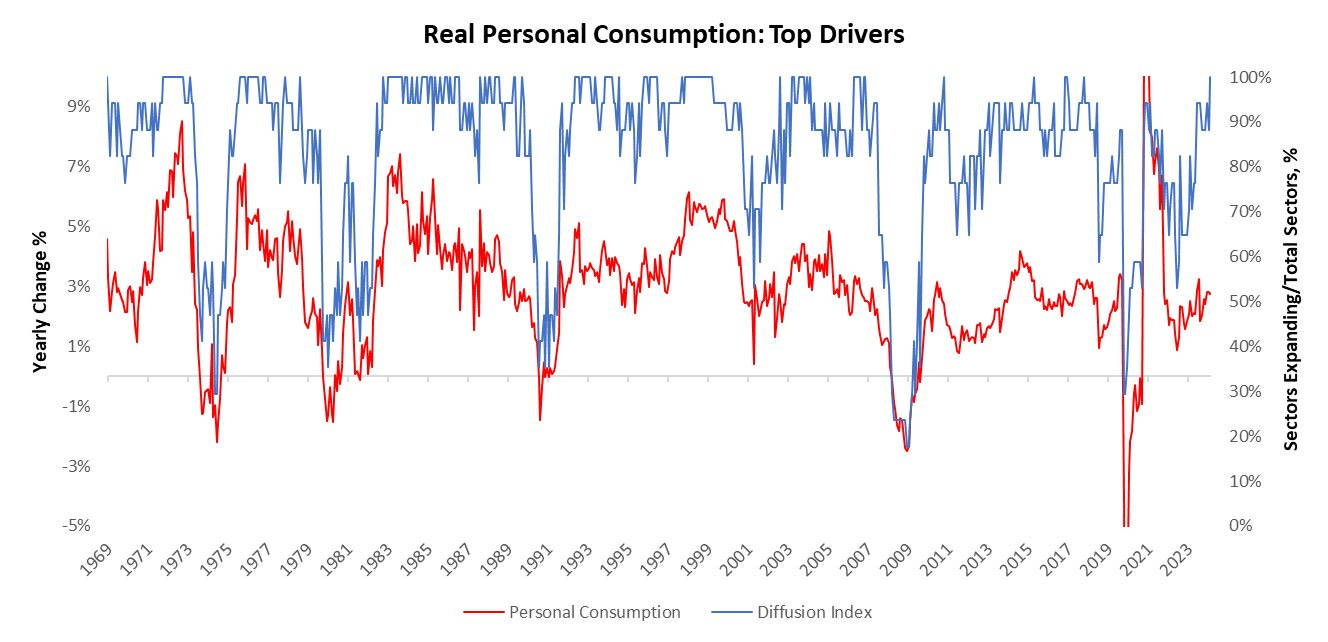

Consumption continues to show tremendous broad-based strength (chart from Prometheus Research )

Will a recession happen one day? OF COURSE! Timing and path dependency are the rules in markets. All of us know growth goes up and down, that’s not the question. The question is WHEN are these moves taking place and HOW should we moderate our actions properly?

Narrative #2: valuations are too high and this is a reply of previous “bubbles.” The chart below is the S&P500 and the price-to-earnings expectations ratio:

Are valuations high? Yes on a historical basis. The question to ask is WHY they are high? One of the main ideas explained in the macro report was how the dollar’s reserve currency status increases overall valuations:

Fundamentally, the dollar’s reserve currency status is like an extra liquidity boost to all dollar-denominated assets. When you have an increase in liquidity like this, the way in which you generate alpha shifts marginally. This structural backdrop laid out in the macro report informs the Macro Alpha Primers that were originally written on how to map these drivers and flows:

Macro Alpha Primers:

Macro Alpha Primer: Credit Risk and Duration Risk and Macro Podcast: Macro Alpha Primer

Macro Alpha Primer: Correlations and Macro Podcast: Macro Alpha Primer

Macro Alpha Primer: Macro Catalysts, Hedging Pressure, and Positioning and Macro Podcast: Macro Alpha Primer

Macro Alpha Primer: Positioning Premiums and Macro Podcast: Macro Alpha Primer

Where does this leave us?

Instead of trying to nail down a single trade, think like a business. Create a framework that can stand the test of time through ALL market regimes. Even if you don’t have the ability to code and run sophisticated models, you can create mental models and processes that equip you to thrive in ALL market regimes.

(see original article explaining these mental models: Link).

All of the macro educational primers have been written for this very reason. They have set the foundation for opportunistic action. Now we take action!