Week Ahead: Interest Rates and Equity Trades

The macro framework and micro levels for running trades this week

Hello everyone,

I have consistently laid out my views on here regarding growth and inflation as it impact equities and rates. The macro report laid this out and functioned as the context for taking positions in last week’s volatility blow up:

I laid out my views on equities, bonds, metals and the Yen here:

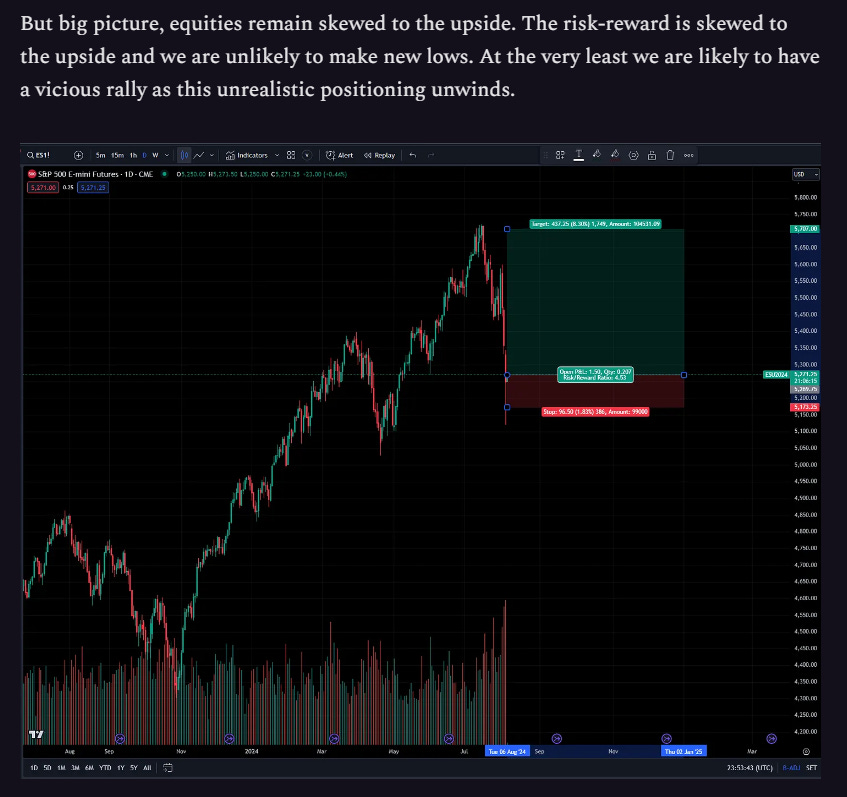

This is the risk-reward I shared for ES which we continue to confirm (link)

The entire point of trading is extracting returns due to the uncertainty around outcomes. The views I laid out about the growth scare and interest rate cuts are now being repeated by the mainstream consensus economists AFTER the fact.

Where does this leave us now? Well, what happened last week sets the context for updated views moving into the week ahead. If you didn’t understand all the moving parts of asset prices from last week, check out the video I posted on Twitter. The link is in this chat:

Before we get into this week, I want to encourage all of you to read and follow the Substacks below. These guys are doing an exceptional job at providing unique insights that can be monetized in markets:

Week Ahead:

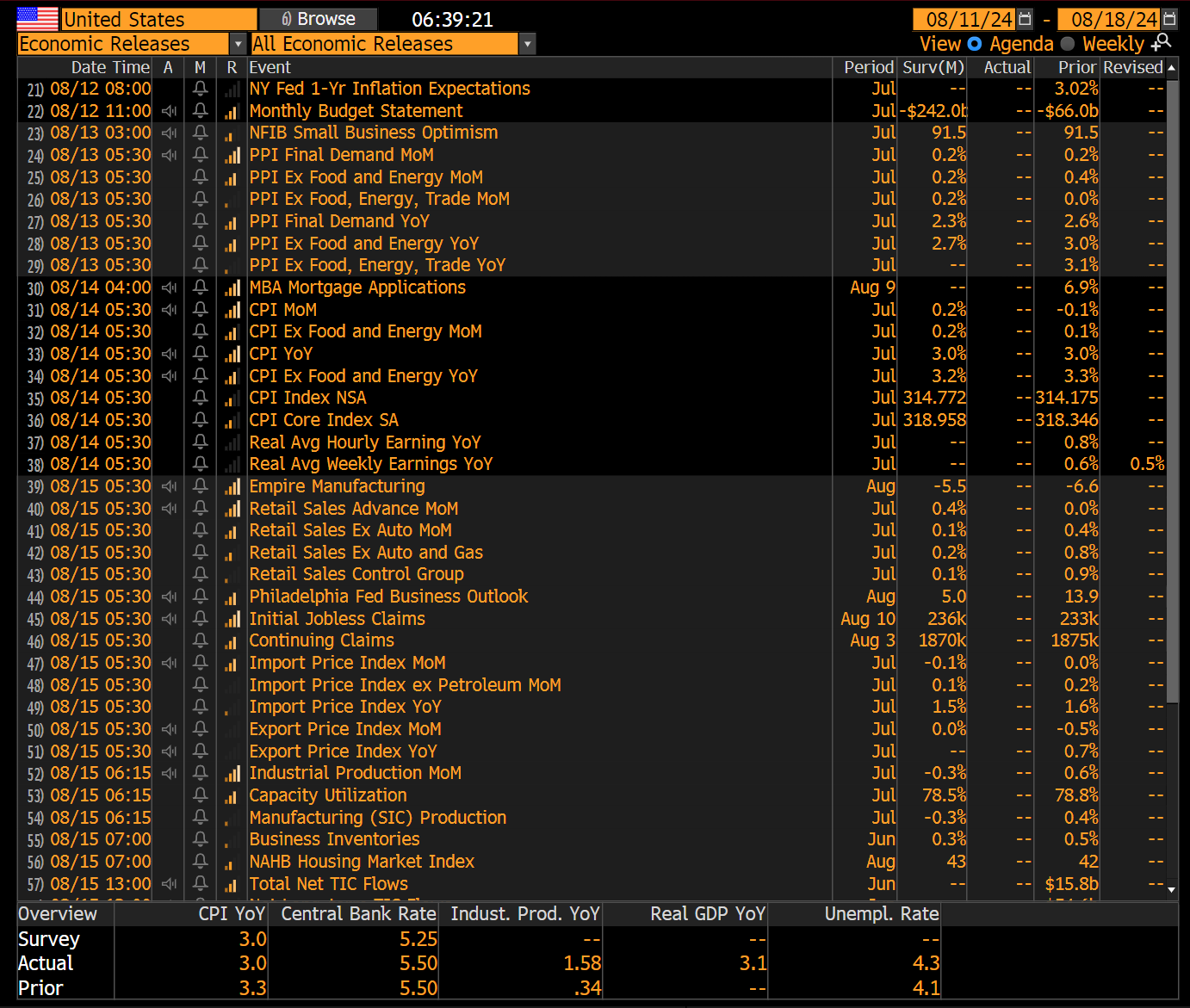

The main events this week are PPI, CPI and retail sales:

Keep in mind that the last CPI and PPI prints set short term tops and bottoms in the ranges for OHLC levels on a daily basis:

Core CPI is expected to decelerate on a YoY basis which is the main thing to be watching for. You will remember that the last PCE print came in above expectations in its core number but when we looked under the surface, it was due to a marginal acceleration in goods but core services actually decelerated.

We are in a regime where growth is positive and inflation is decelerating. This is resulting in the Fed cutting interest rates into positive growth. When this TYPE of context is taking place, there are two things you need to keep in mind for running trades:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.