Positioning Unwind And The Next Trade

Institutional capitulation, unwind in assets, and where equities are going this week

Hello everyone,

This Substack has been about more than just understanding macro and trading. It is about understanding the structural environment on a fundamental level. There is a clear deterioration of institutional trust, educational institutions cannot be relied on for preparation in the workforce and financial advisors are failing at their job to actually add value to investors.

On top of this, we are entering a world where the quality of your ideas is one of the most important things about you. The advent of AI has created permissionless leverage that is accessible to everyone. Similar to how computer chips have been increasing their computing power every year, AI is going to bring the speed of computation across all domains to lightning speed. However, this doesn’t imply the quality of ideas will increase. In the same way, the calculator and spreadsheet enhanced the speed of innovators to make decisions, AI is increasing the speed at which you can test and implement your ideas.

This is why I continue to share the two following ideas over and over. These need to be ingrained in our minds because they contextualize how we need to view the world:

“You wasted $150,000 on an education you coulda got for $1.50 in late fees at the public library.”

In the information age, you simply need to be at the right place, at the right time, with the right information to succeed

Failure:

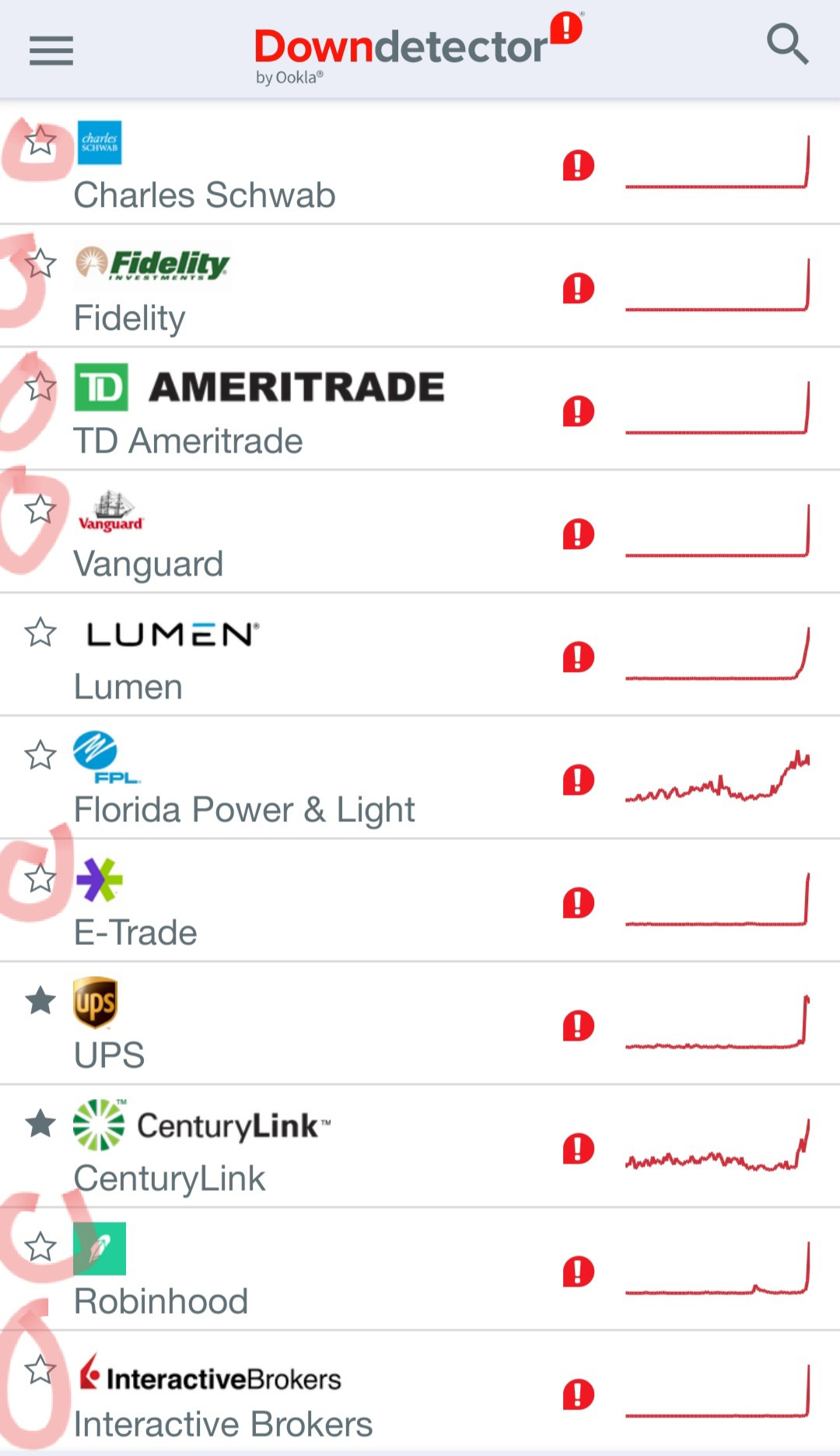

The failure of institutions is not just in the educational or political realm. It is very tangibly displayed in the financial realm. When all retail brokerage platforms go offline and there is clear institutional trading of positions, it is hard to think there isn’t a sinister plan behind it. Even if there isn’t, the perception is that it is destroying the little guy.

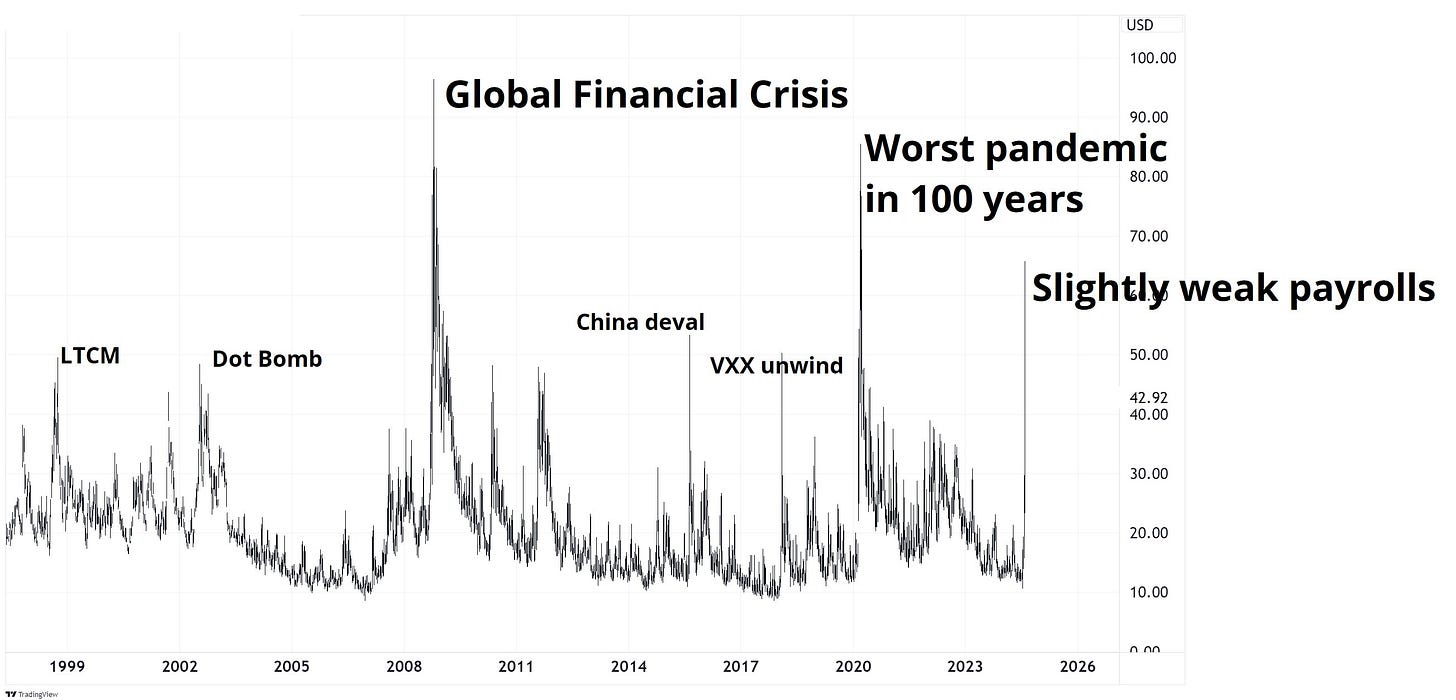

On top of this, we are having one of the most significant volatility blow-ups in financial history that is supposedly attributed to the unemployment rate rising by 20bps: (chart from Brent Donnelly)

Let’s zoom out a little and talk about where we are in the macro context and then zoom all the way into the specific levels in both equities and bonds we want to connect these big-picture ideas.

The Macro Context:

I have already laid the macro context in the comprehensive macro report:

And for anyone who has missed it, there will be a price increase today.

Everyone who is currently a Paid Subscriber has access to all of the in-depth macro research and trades at the current price ($60/month or $720/year). This price will never change for you. In order to continue future innovation and the quality of research, the price for new subscribers will be increasing.

This price will be increasing to $70/month or $840/year on Monday, August 5th. If you subscribe BEFORE then, you will lock in the lower price ($60/month or $720/year) and never pay more than this. If you are here early and long the Capital Flows Substack, then you get to lock in the lower price for all the future upside.

Big picture, we remain in a regime where growth is positive and accelerating. The GDP Nowcast remains positive:

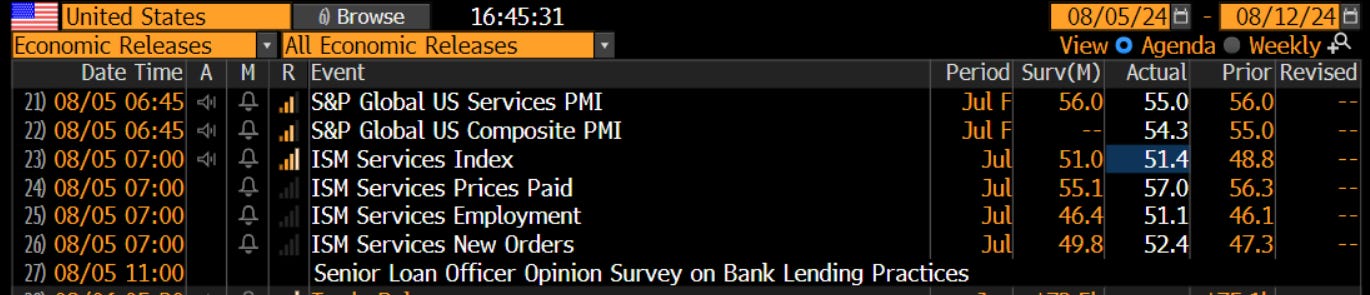

And the ISM services PMI just came in above expectations today.

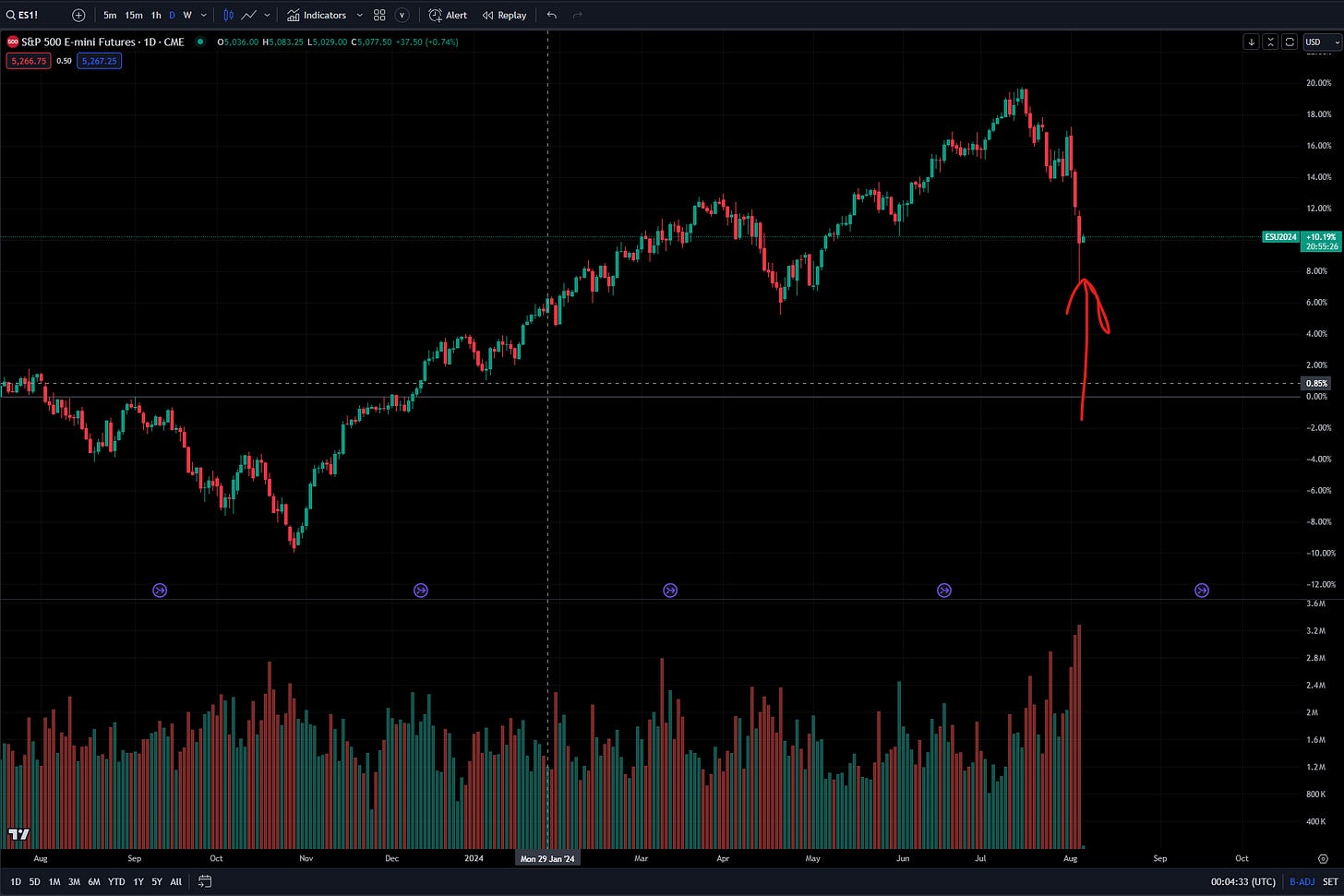

The labor market didn’t collapse over the weekend, we are seeing a massive positioning unwind where the expected returns in risk assets remain constant but the degree to which traders realize those are making MUCH BIGGER fluctuations. This is one of the largest implied vol premiums historically:

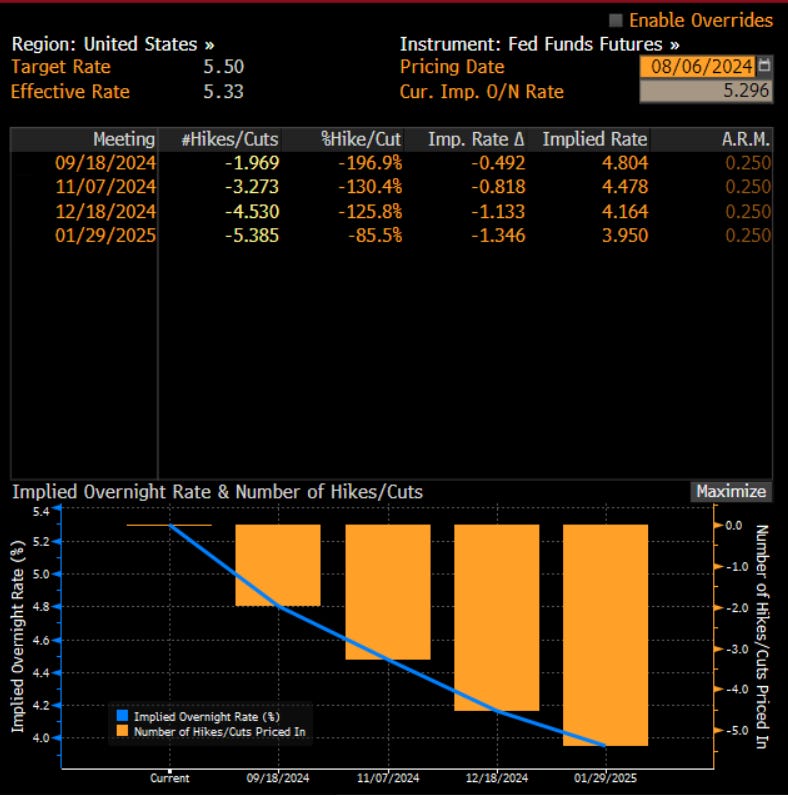

I want to zoom in on one very specific aspect of this. Notice that the market is still pricing an almost 100% probability of a 50bps cut in September.

This means the marginal weakening we have seen in bonds since Sunday futures open hasn’t even begun to price in the fact that it is highly unlikely that we get 50bps of cuts. The implication is that we are going to remain BELOW 115 in ZN until the Sept SOFR contract reprices to 25bps. You can follow all the forward curve pricing on the CME Tool: Link

When price action is driven by a positioning unwind as opposed to a macro impulse, it means that we are unlikely to see a change in the stance of the FED.

I have already laid out all of the trades I am running here:

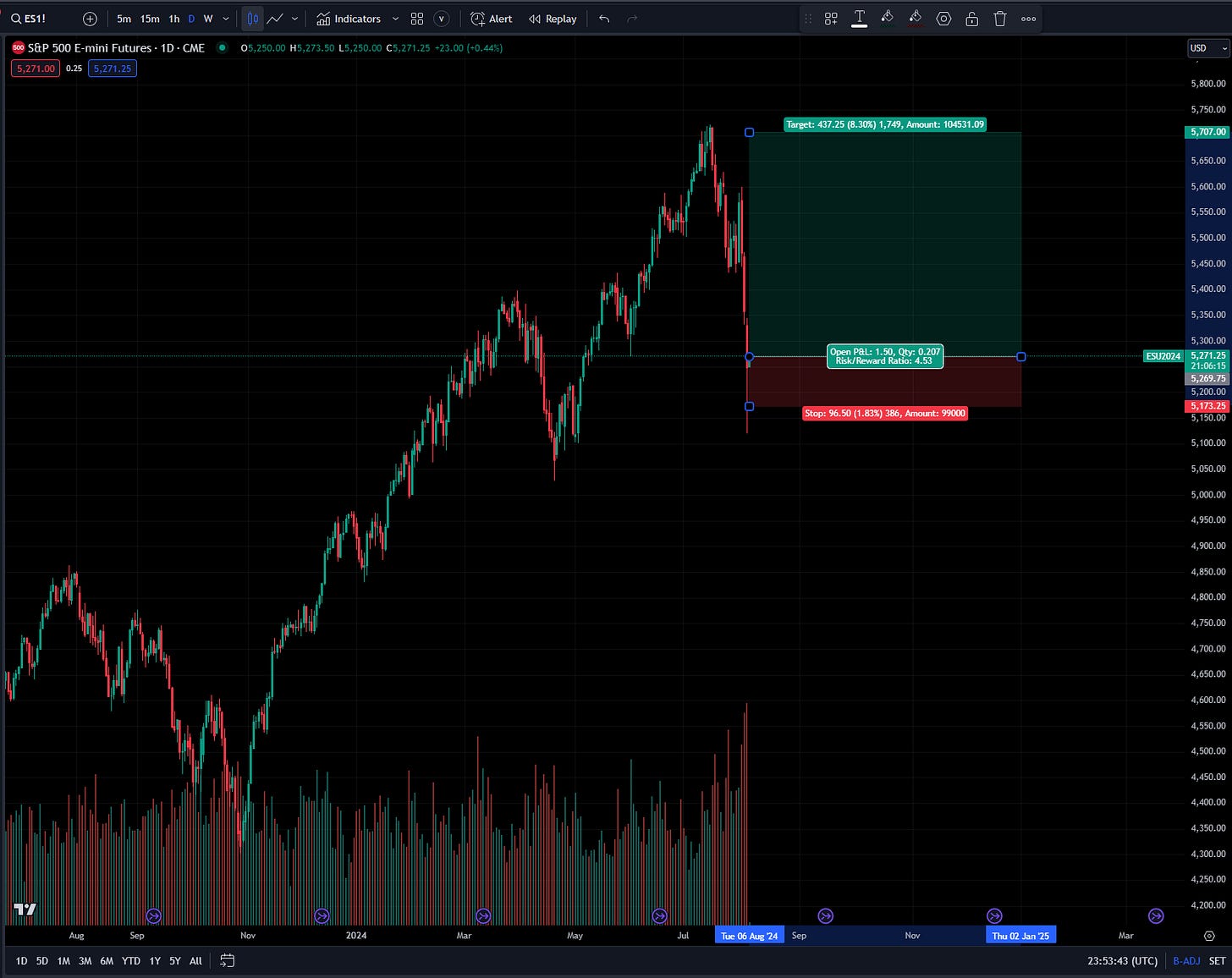

But big picture, equities remain skewed to the upside. The risk-reward is skewed to the upside and we are unlikely to make new lows. At the very least we are likely to have a vicious rally as this unrealistic positioning unwinds.

The Asia session Sunday night opened a window of weakness where ES sold off considerably. As soon as we got to the higher volume of cash equity, we set a bottom.

I even noted before the market opened that stocks were likely to bid:

Where are we going from here? Higher in stocks and lower in bonds. The thing to understand about this is that it will NOT be smooth. We will need to manage the positioning risk constantly because bonds only need to reprice marginally. Once the positioning unwind from last week and Sunday overnight is over, this will be when we actually need to map how the macro regime and positioning interact to move equities and bonds. I will be mapping this in real-time for Paid Subscribers on here.

Educational Points:

You already know that there is a complete list of educational articles on macro that I have written (link). I want to draw your attention to a very specific one: The intraday trading primer

Even if you are not trading intraday, the signals you receive are instructive for how you want to execute and inform higher timeframe views. For example, this type of reversal taking place within a positive growth context during a high implied vol premium is statistically significant. It is difficult for these types of reversals to take place without setting bottoms, at least in the short term:

One of the things I noted in the primer is how execution works:

Fundamentally, you need to execute against comparable size or move the price until you attract enough participants to take the other side of your trade. You will notice the TWAP from VWAP deviation during the overnight session was significant until we hit the higher volume of the US open which is when we were able to consolidate against comparable volume.

Intraday or even weekly signals are never distributed evenly. We have had a reversal and we are unlikely to have a weekly close below it. However, we can still see significant deviations on an intraday basis as market participants move the price around to find their fill.

The final point I want to make is about the standard deviation of price and information:

The farther you have a standard deviation away from the mean, the larger or more significant the informational catalyst you need to cause a reversal. So for example, everyone is extrapolating the unemployment print to a recession and we have seen a very large deviation in the pricing of bonds. We need to see significant informational catalysts bring this deviation or mispricing back to a reasonable expectation of the future. This is where extracting returns becomes much clearer because you know WHY you are generating returns.

As always, continue learning and adapting

“You wasted $150,000 on an education you coulda got for $1.50 in late fees at the public library.”

In the information age, you simply need to be at the right place, at the right time, with the right information to succeed

A Pepe for the culture