Zooming Out: Macro Systemic Risks

What are the tails and how do they function?

The attention economy is now intricately intertwined with financial markets.

The attention economy is the concept that human attention is a valuable and scarce resource, especially in media and technology. Businesses and individuals compete to capture this attention to monetize it through advertising, sponsorships, and subscriptions. Social media platforms and influencers, for instance, leverage their large followings to generate revenue by keeping users engaged and selling that attention to advertisers.

In the same way that a piece of information about inflation or the Fed gets priced into markets with lightning speed, content races across all platforms to reach every user. Recent illustrations of this include these two women in separate instances:

Here is the thing though, in order to succeed in the attention economy, you need to talk about extreme scenarios. If you say that things will carry on as normal, you will immediately move to the bottom of the priority list in the content algorithm.

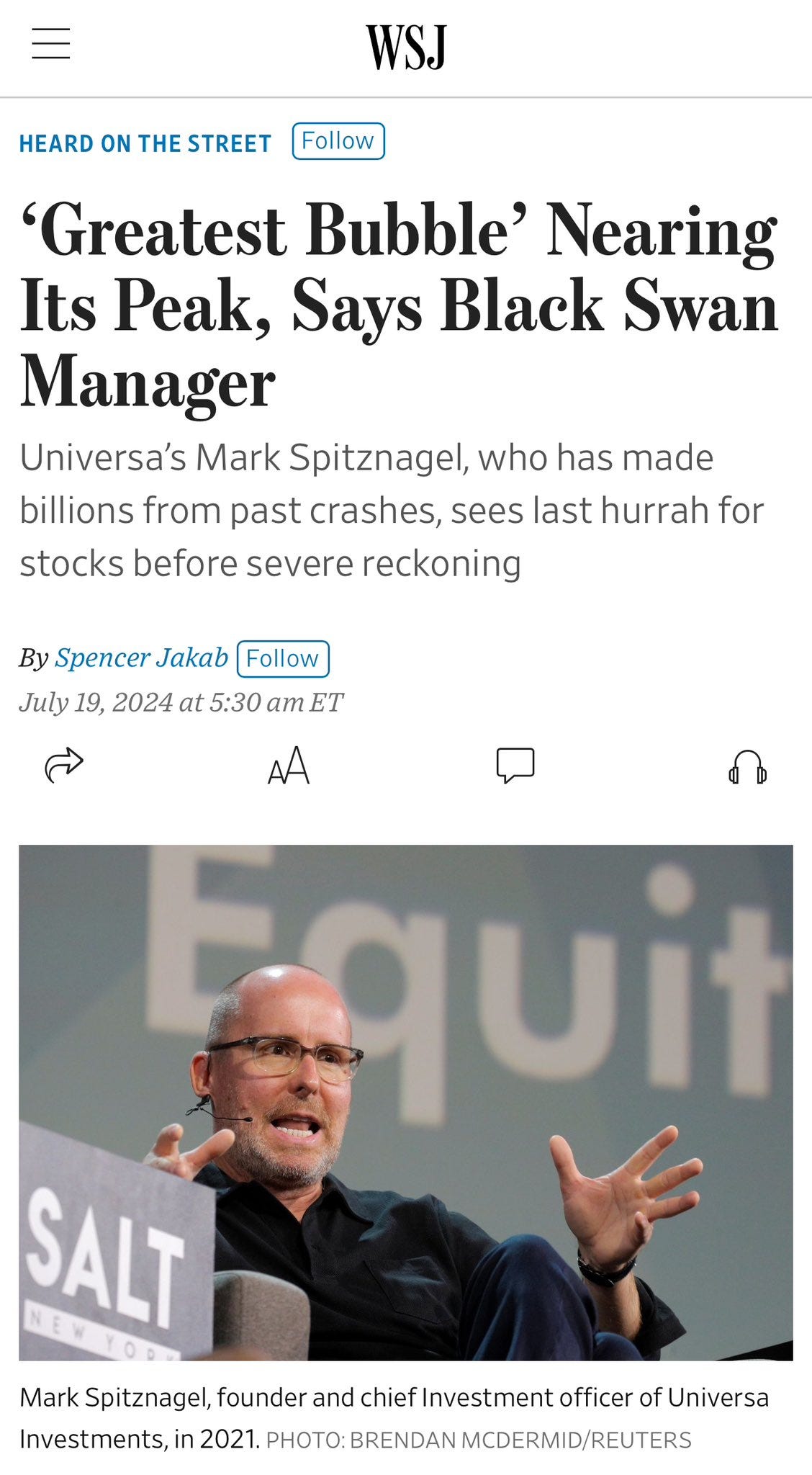

If you have a headline like this, you will immediately get more clicks (see my breakdown of this here: Link):

Since so many people talk about the extreme tails, they become the boy who cries wolf. By definition, the tails occur with less frequency but amplifying them brings you more attention. (meme source: Link)

Here is the main problem: As people talk about the tails more, no one takes the middle part of the distribution seriously. At the end of the day, your goal in life is to manage ALL parts of the distribution well. This applies to financial markets and life. You need to manage the crisis well but also manage the every day things well.

Here is what I will say about this, becoming exceptional at managing the middle part of the distribution allows you to be better at managing the tails. At the end of the day, if you are actively trading, you are hoping there is a market crash or some type of extreme volatility in any market. However, if you aren’t actively refining your skills when things are calm, you’ll never be ready for the volatility when it comes.

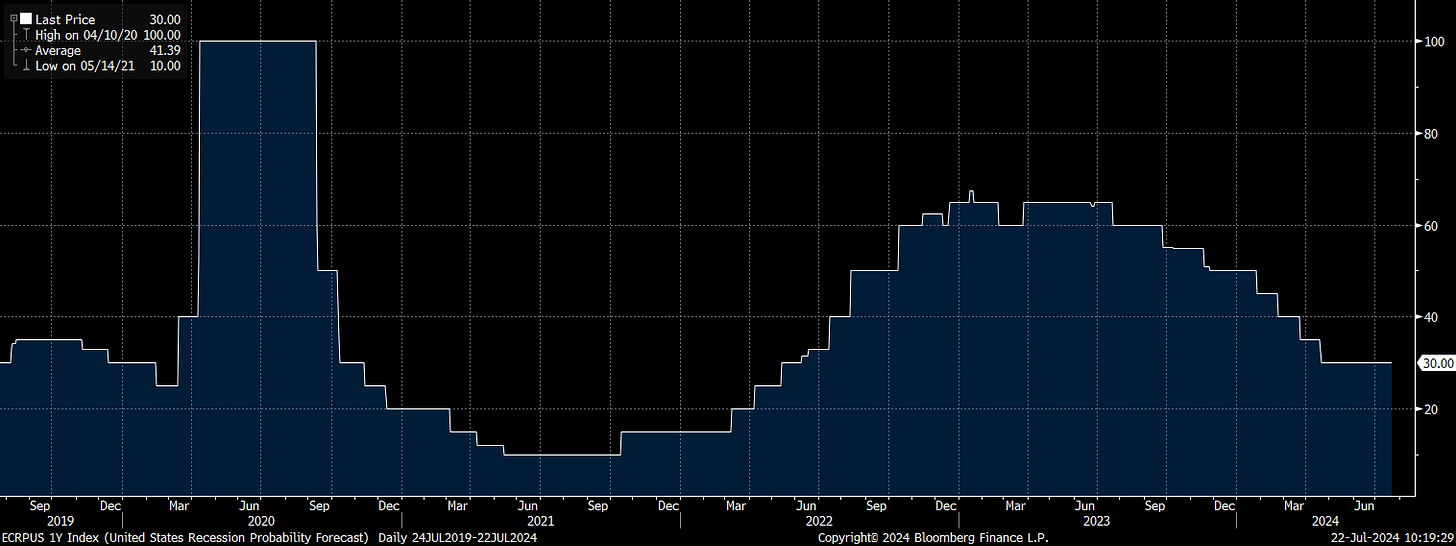

How does all of this connect with where we are on a macro basis? Well, there has been a consistent consensus among economists that a recession is a high probability. This was a consistent view through all of 2023 and when it didn’t happen, the bearish positioning had to be unwound thereby pushing equities UP. (chart: consensus probability of a recession in 1 year)

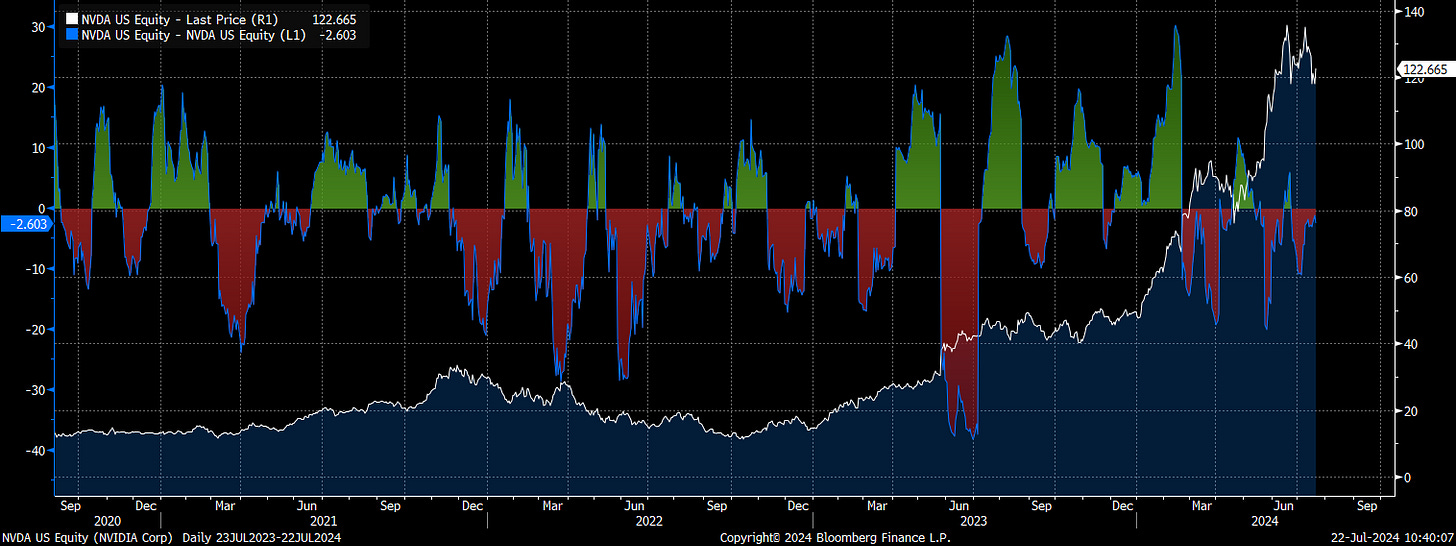

There is a reason NVDA 0.00%↑ continues to rally as positive sentiment chases the price. This shows the reflexive feedback loop between the attention economy and financial markets. If the price goes up, people write articles about NVDA 0.00%↑. If people write articles on NVDA 0.00%↑ then this brings more focus on it.

We are now pricing an implied vol discount in NVDA 0.00%↑ as positioning becomes marginally complacent about how wide the price can move:

What is the main idea?

The impact (if any) that the attention economy has in financial markets can ALWAYS be quantified in how the positioning is pricing the standard deviation of moves and the implied future of the price.

Remember, there is always an embedded expectation about the future in the price. This is explicitly reflected in the forward curve SOFR contract for the Fed’s decisions but every other asset has the exact same dynamic.

I have broken down my current views on this dynamic in equities right now:

The main idea is that if you know WHERE you are on the distribution of probabilities and what is likely to happen, then you can extract returns from people who are over-extrapolating the tails of the distribution. You accomplish this by developing an informational edge in a specific asset. See my macro podcast here on this:

So what are the systemic risks?

I wrote an entire article on how to think about systemic risks and the redundancy planning around them:

However, let’s focus on THE MAIN risk everyone in the financial news media and value investors club talks about: Are stocks overvalued on a structural basis?

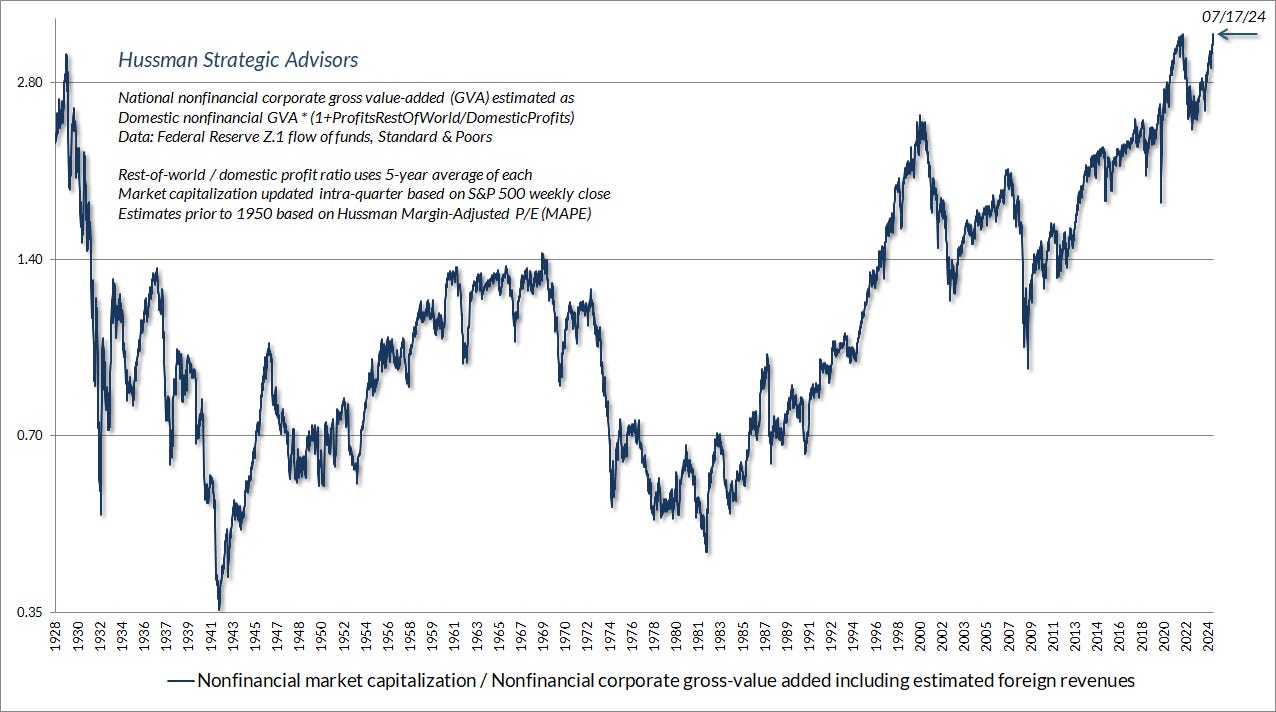

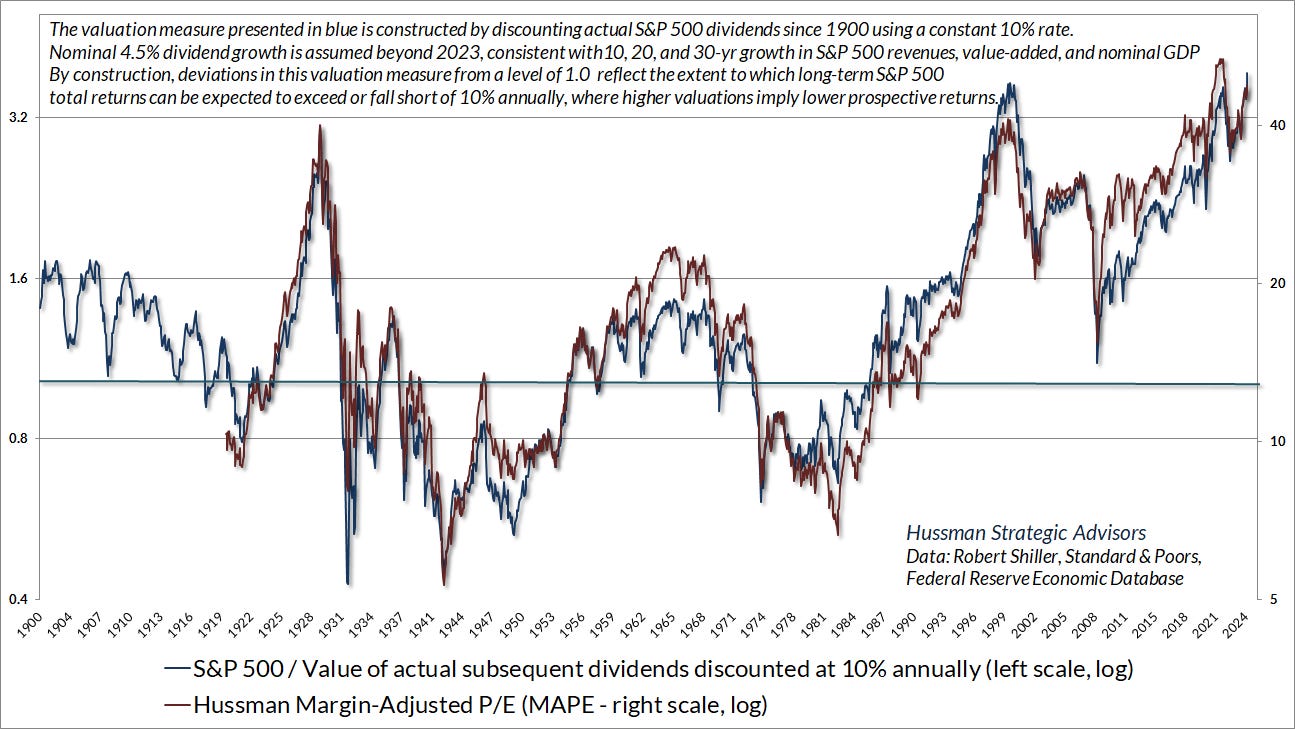

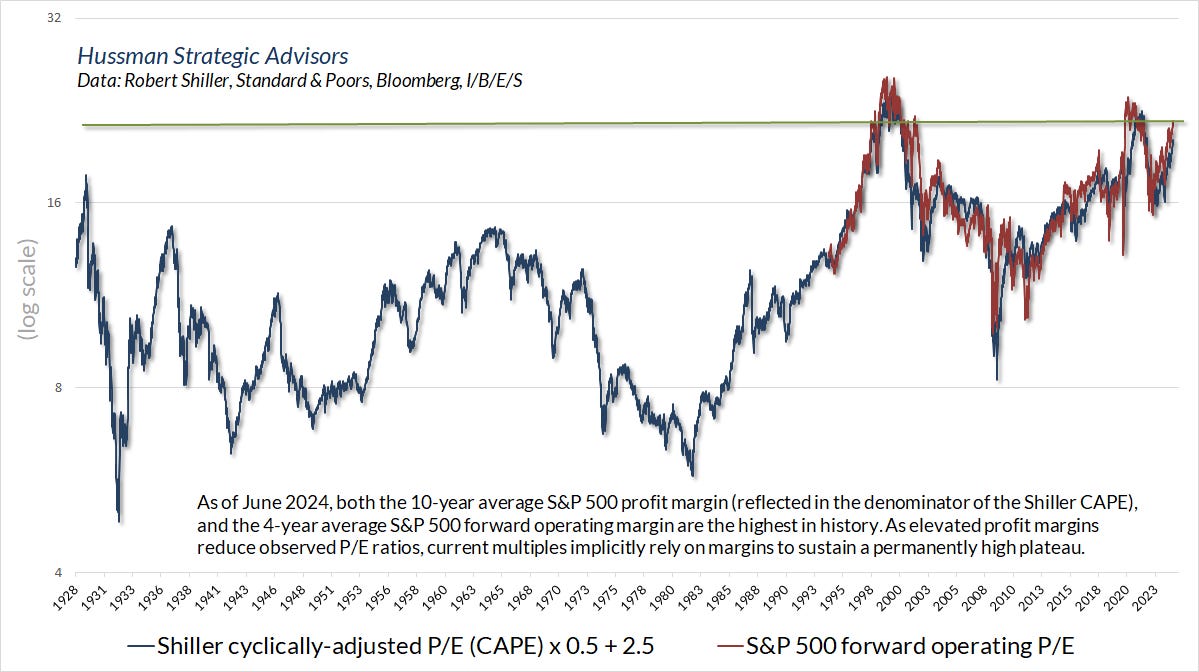

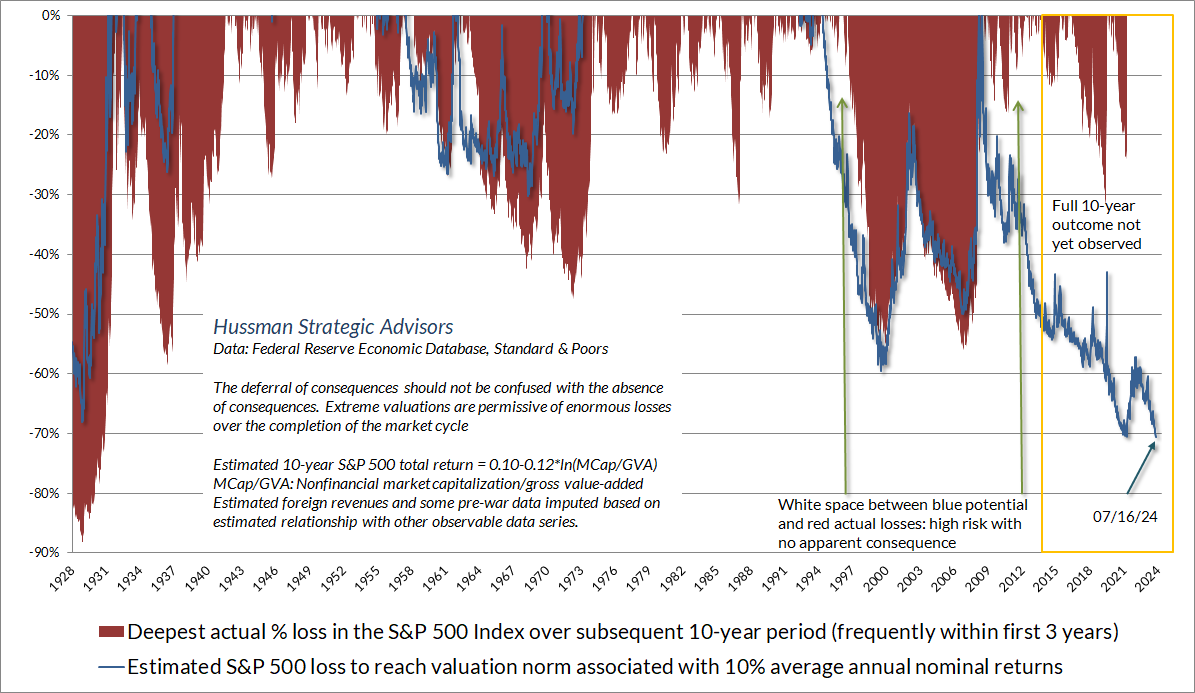

If you have spent any time in financial markets, you have seen charts like these:

Let me explain something about valuations. No matter how cut the cake, valuations are not simply driven by “sentiment.” This idea that “people are being greedy and overpaying for assets” is completely misguided. The financial market functions based on constraints where valuations are an input NOT the source of authority for all actions. Can you have idiosyncratic situations where the tradable float of a stock is so small that it pumps incredibly high? Yeah sure.

And to be fair, we are seeing a marginal impact in the characteristics of indices due to passive investing. This is part of the reason you want to adjust your view for how its transmitted through the tradable float.

However, overall, assets continue to reflect the constraints that exist from free flowing capital markets. Part of the assets and capital flows in markets are from the sovereign authorities managing the monetary base. The chart below is the data for the total monetary base:

As you have additional money and liquidity in the system, this moves through the liquidity transmission mechanism and impacts ALL assets across the duration and credit risk curve. Concoda has done a great job at showing this process. When you have an expansion of this TYPE of money supply, many times it can create a balance of payments crisis where foreign capital flees. However, this liquidity expansion by sovereign authorities hasn’t seen the negative consequences of capital flows due to the dollar reserve currency status. As a result, we have seen a valuation expansion in risk assets. A valuation expansion to reflect this reality between the quantity of the currency and dollar reserve currency status is 100% logical. It makes complete sense!

If you want some great books on this, read these:

Trade Wars Are Class Wars: Link

Exorbitant Privilege: The Rise and Fall of the Dollar and the Future of the International Monetary System: Link

Everyone talks about the “End Game” for the dollar or US assets as if everything is going to collapse one day. In reality, everything is working out in a completely logic and orderly fashion. The problem is, value investors running their models on what is “historically normal” for valuations don’t take into account how macro liquidity and cross-border flows function. If you want the best person on this, check out Prometheus Research. He is a good friend and has been an invaluable resource over the years on this topic.

If you actually want to get an edge into what began the unwind in positioning during 2000 and 2008, look at real rates, macro liquidity and cross-border flows in connection with asset valuations. Valuations in risk assets are simply a reflection of the macro liquidity that is flowing through the system.

Bringing it together:

At the end of the day, conducting rigorous research is THE ONLY WAY to exit the clickbate attention economy and develop an information edge in financial markets (and life!)

I love the fact that when I read books or long boring reports that they are difficult to get through. If it’s difficult, I know it will weed out even more people and the monetizable edge will be even higher.

My challenge to you is to know the game you are playing. Don’t get distracted by the people amplifying the tails for the purpose of marketing. Develop a clear and consistent framework for thinking CLEARLY about all portions of the distribution of returns.

“Clear thinker” is a better compliment than smart

-Naval

This is the way