Country Primer: India

The coming wave of disruption

Intro To Country Primers:

We will cap off this round of Country Primers with India! I am intentionally focusing on countries that have heightened significance in the decade we are moving into:

When you develop an exceptional understanding of macro and marry it to a clear understanding of a country, you are able to consistently monetize your knowledge in financial markets. Here are all of the educational articles:

In the information age, you simply need to be at the right place, at the right time, with the right information to succeed

Why should you care about India? The country of India has exceptional asymmetrical upside over the next decade because of its geopolitical position and because it is modernizing incredibly fast.

India is beginning to access technology at the same pace and in the same way the United States did two decades ago:

There has been a long-term upward trend in USDINR but the question is, will that structural changes in India begin to reverse this trend?

On top of this, many geopolitical traders who are incredibly bearish in China want to bet on a Yuan devaluation and Chinese collapse. The problem with this is that betting on a collapse in China is incredibly difficult because there are so many levers Xi can pull to keep things together. The thing about India is that if China collapses, India’s manufacturing base will benefit tremendously. If you want to bet on a collapse in China, you don’t get short the Yuan or the Chinese stock market, you get long India and Mexico (see Mexico Primer: link)!

It is already clear that some traders have on a short China and long India trade on because the most recent news out of China caused the Hang Seng to rally which caused Indian stocks (along with the Nikkei) to sell off. Traders likely have on a pair trade where they have to unwind both sides.

Notice the long NIFTY / Short HSI and long Nikkei / Short HSI ratios. Weston Nakamura brought attention to this in his recent articles. I would encourage everyone to follow his work!

Right now the manufacturing sector is having the largest YoY acceleration contributing to GDP:

This is well-above trend and likely indicates an underlying shift connected to the new deglobalized world we are moving into:

When you connect these structural changes to cyclical views then you exponentially increase your asymmetry for trades. These primers are meant to function as a foundation for generating alpha. Keep a close eye on the SpearPoint Equity Alpha publications I am part of because we will be pitching single-name equities from India. This is how you produce uncorrelated alpha!

Overview: Here is the structure for this primer

Country Overview

Geography and Demographics

Economic Data: GDP, GNI, BoP, and Balance Sheets

Financial Markets: Stocks, Bonds, and the Indian Rupee

History of growth, inflation, and liquidity on a structural and cyclical basis

Current growth, inflation, and liquidity regime and its connection to each financial asset

Additional resources for research and trading in Indian markets

Country Overview:

Background

The Indus Valley civilization, one of the world's oldest, flourished during the 3rd and 2nd millennia B.C. and extended into northwestern India. Aryan tribes from the northwest infiltrated the Indian subcontinent about 1500 B.C.; their merger with the earlier Dravidian inhabitants created the classical Indian culture. The Maurya Empire of the 4th and 3rd centuries B.C. - which reached its zenith under ASHOKA - united much of South Asia. The Golden Age ushered in by the Gupta dynasty (4th to 6th centuries A.D.) saw a flowering of Indian science, art, and culture. Islam spread across the subcontinent over a period of 700 years. In the 10th and 11th centuries, Turks and Afghans invaded India and established the Delhi Sultanate. In the early 16th century, the Emperor BABUR established the Mughal Dynasty, which ruled India for more than three centuries. European explorers began establishing footholds in India during the 16th century.

By the 19th century, Great Britain had become the dominant political power on the subcontinent and India was seen as the "Jewel in the Crown" of the British Empire. The British Indian Army played a vital role in both World Wars. Years of nonviolent resistance to British rule, led by Mohandas GANDHI and Jawaharlal NEHRU, eventually resulted in Indian independence in 1947. Large-scale communal violence took place before and after the subcontinent partition into two separate states - India and Pakistan. The neighboring countries have fought three wars since independence, the last of which was in 1971 and resulted in East Pakistan becoming the separate nation of Bangladesh. India's nuclear weapons tests in 1998 emboldened Pakistan to conduct its own tests that same year. In November 2008, terrorists originating from Pakistan conducted a series of coordinated attacks in Mumbai, India's financial capital. India's economic growth following the launch of economic reforms in 1991, a massive youthful population, and a strategic geographic location have contributed to India's emergence as a regional and global power. However, India still faces pressing problems such as environmental degradation, extensive poverty, and widespread corruption, and its restrictive business climate challenges economic growth expectations.

Geography and Demographics:

India is in a very unique place from a geopolitical perspective.

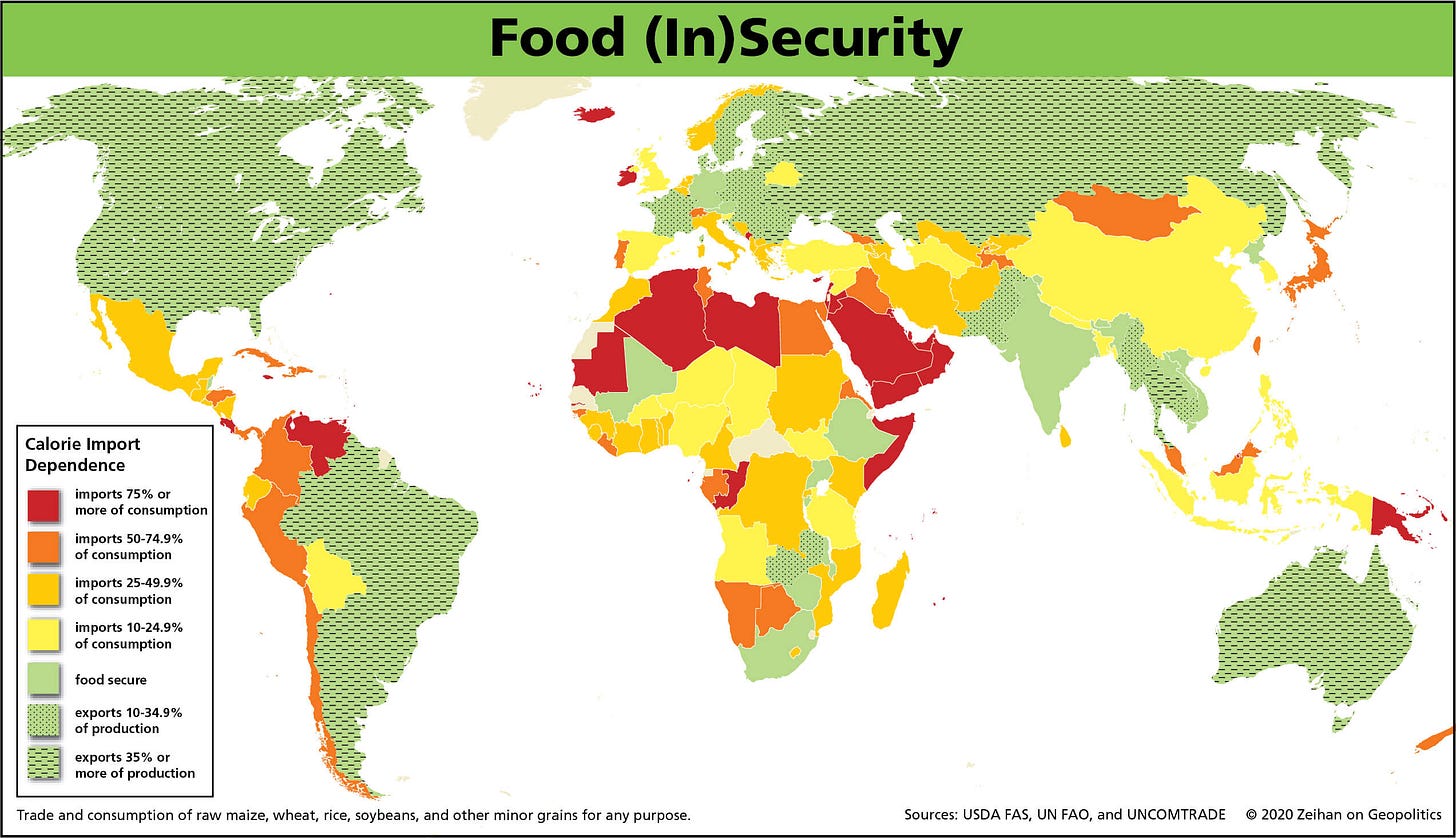

First, its geography places it directly between 3 major entities: The Middle East, the Indian Ocean, and China. You basically have either mountains, deserts, or the ocean on any side of India. This creates a “geographic box” that makes it hard for India to break out of from an economic or militaristic perspective. This also means it is hard for other people to break into India (link).

Second, India has excellent agricultural wealth and natural resources.

Natural resources

coal (fourth-largest reserves in the world), antimony, iron ore, lead, manganese, mica, bauxite, rare earth elements, titanium ore, chromite, natural gas, diamonds, petroleum, limestone, arable land

Land use

agricultural land: 60.5% (2018 est.)

arable land: 52.8% (2018 est.)

permanent crops: 4.2% (2018 est.)

permanent pasture: 3.5% (2018 est.)

forest: 23.1% (2018 est.)

other: 16.4% (2018 est.)

This means that if there are transportation issues or geopolitical risks, India is unlikely to have a complete collapse due to famine (a scenario very possible for China due to their situation).

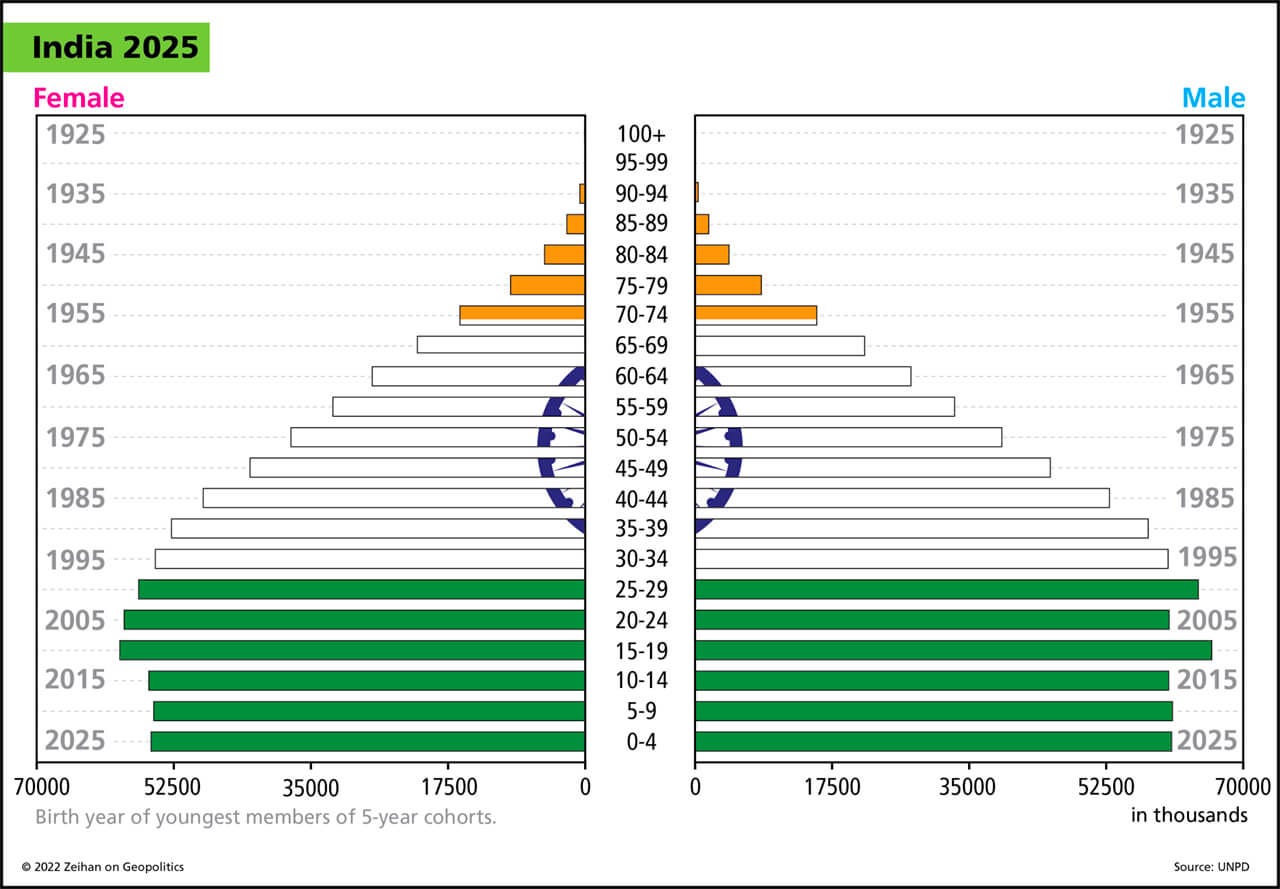

Third, India is at an amazing place in terms of their demographics. They also have a lot of skilled labor which can dramatically change the TYPE of exports other countries source from India.

In a world of deglobalization, supply chain issues, scarcity, and geopolitical tension, India is unlikely to collapse. Furthermore, their country continues to modernize exponentially which will bring higher and HIGHER amounts of productivity.

The specific products and their destination in the current account will be important to monitor moving forward as geopolitical volatility occurs. Connecting these variables to economic data and financial markets is how we can generate trade ideas.

It is these bigger-picture issues that set the context for the economic data in India.

Economic Data: GDP, GNI, BoP, and Balance Sheets

Now that we have the big-picture context for India, we need to quantify each moving part of the economy with data. When we approach economic data, we want to quantify the FLOW and CAPITAL STRUCTURE for each agent (households, corporates, sovereigns, financial institutions). If you want a good book on this, check out The Volatility Machine.

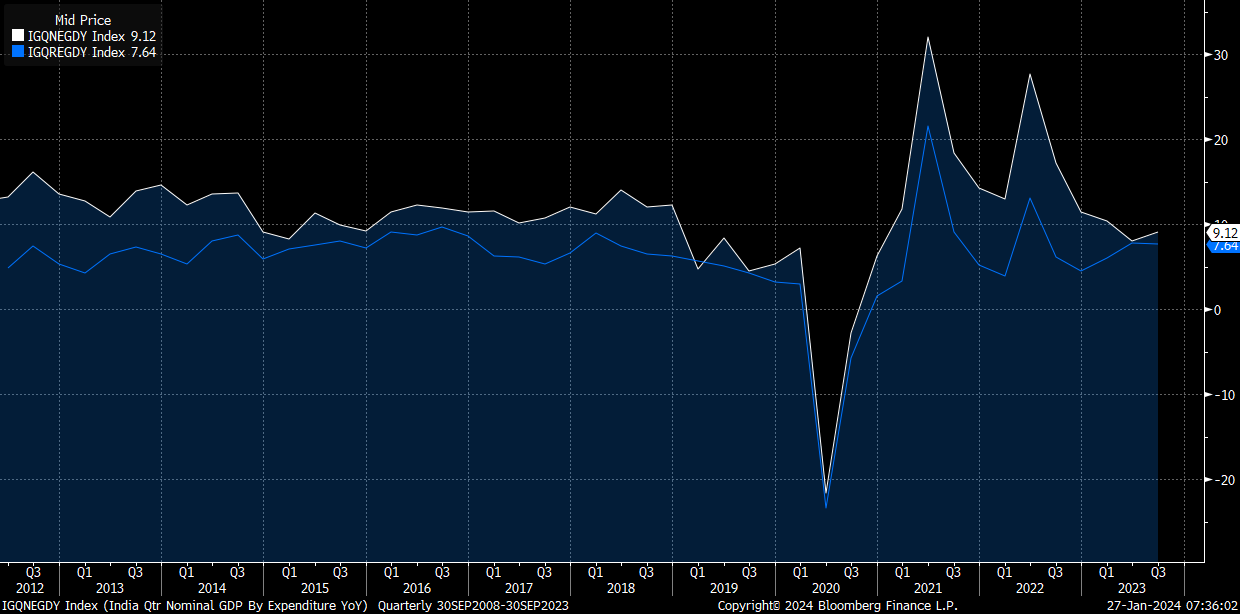

Big picture, India's nominal (white) and real (blue) GDP have been incredibly elevated over the past decade excluding 2020.

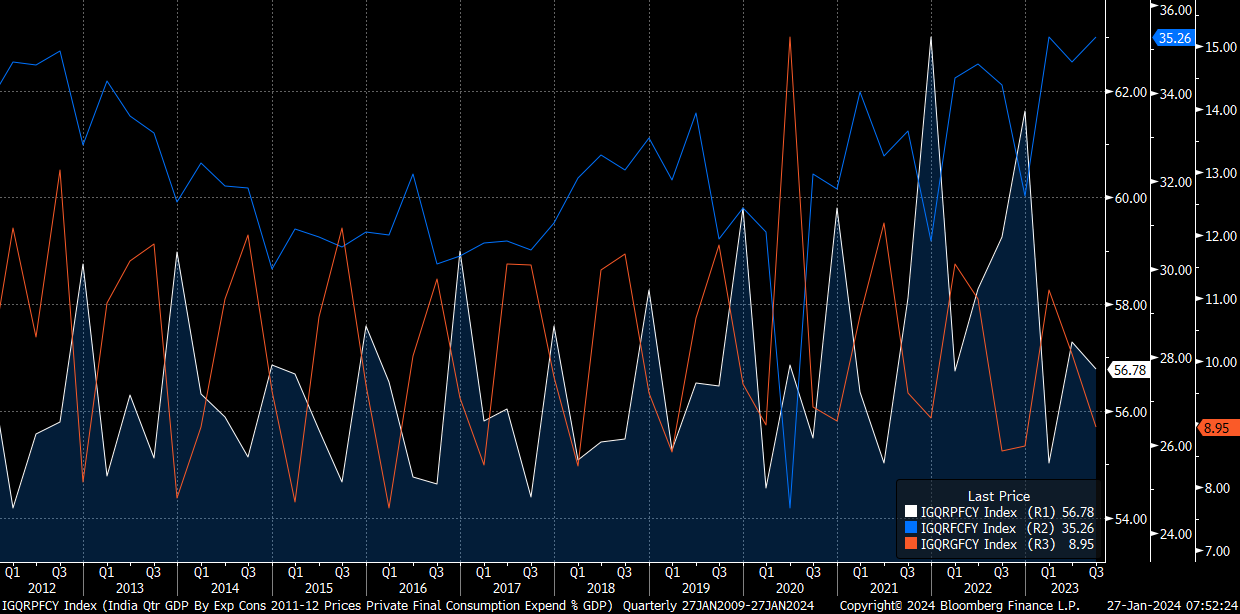

Private consumption is the largest line item of GDP with fixed capital formation coming in second. This is a key observation!

When you have fixed capital formation as a large and growing attribution of GDP, that is a signal about the durability of underlying growth. Notice that fixed capital formation as a % of GDP (in blue) is accelerating significantly. This is occurring while government spending as a % of GDP (orange) remains low. Private consumption (white) remains a durable attribution.

Fundamentally, India is investing in its economy to increase output. Right now, they are running a trade balance deficit which means they are importing more than they are exporting. A negative trade balance is a reflection of high demand relative to the amount of output:

All of these economic and capital flows directly connect to the geopolitical situation:

These flows are directly reflected in the earnings and valuation differentials between India and China. (I will touch on this more later)

Back to the economic data side, India's GDP by sector is directly connected with the insights from the geopolitical section above. Notice that manufacturing and finance are the largest line items:

Total loans and assets of the largest bank by market cap are accelerating considerably:

One of the largest companies in the manufacturing sector is showing considerable growth as well:

Their stock price has been making huge gains:

Revenues and earnings are accelerating as well:

Watching the specific fundamentals of companies like this in connection with foreign investment flows and the trade balance will be key because all of these various data points reflect the same underlying system.

Within this manufacturing theme, industrial production continues to run at an elevated level:

Given the amount of structural changes, geopolitical volatility, and the country’s placement in global value chains, India’s inflation doesn’t have a high correlation with US inflation rates:

Monitoring the growth and inflation differentials between India and G7 countries will be key for quantifying FX moves. As I noted above, the Rupee has been in a prolonged downtrend against major currencies. However, if India begins to attract significant amounts of foreign capital, turn their trade balance into a surplus, and maintain its current growth rates, there is a high probability we could see this trend shift on a structural basis. See the FX primer for more on this. Also, one of the best FX books I have ever read is Foreign Exchange: Practical Asset Pricing and Macroeconomic Theory. I recommend it to everyone!

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.