Macro Report/Insights: Inflation Swaps

Goldilocks Signals

I laid out the Goldilocks trades and bond long in this article: link

I then provided a comprehensive Excel economic model and risk management principles in this article: link

The main thing to know about this current regime is that the dominant impulse in markets is Goldilocks, NOT recession. People assumed that since bonds were rallying it was an indication of a recession. It is now becoming clearer to people that the probability of a recession is decreasing.

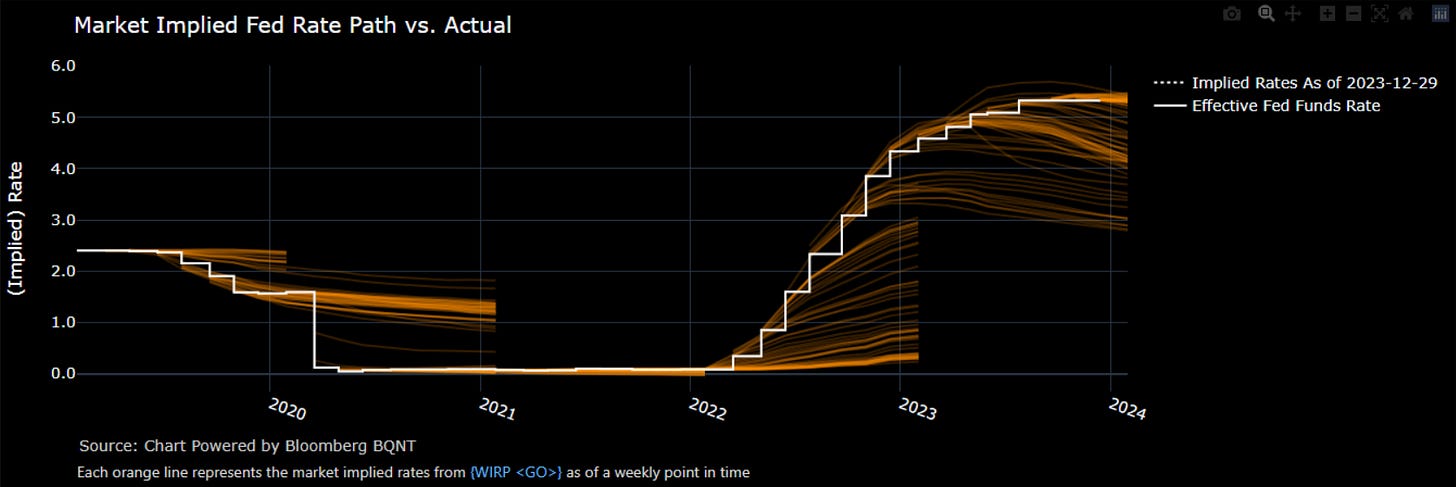

Something I laid out in a previous macro report (link) was that the bond market is NOT “the market of truth.” If anything, it is almost always wrong in its forward pricing but this is the whole purpose of a market. It is there for you to hedge uncertainty and get compensated for inventorying risk.

Microcaps don’t do this in a recession:

The question is, how long will Goldilocks persist? One key signal to watch is inflation swaps as we move through economic data prints. If inflation swaps begin to rally as inflation prints come in above expectations, goldilocks is likely to decrease. Inversely, if inflation swaps begin breaking their level and falling while growth is resilient, the goldilocks impulse in markets will increase significantly.

My view is that goldilocks will continue into Q1 of 2024 (see 2024 views here if you want to know more on this: Link).

Some views:

I have a bearish view USDJPY and did a comprehensive primer on Japanese markets to explain the context: Link

I have a bullish view on the Mexican Peso and Mexican equities (EWW ETF as a proxy). Here is the Mexico Primer where I laid out the case for a structural change in the Mexican economy: link

I am bullish crypto during goldilocks because real rates are falling while growth is resilient. Crpyot is fundamentally a liquidity release valve that will respond to macro liquidity. Here is the crypto primer I wrote explaining this: link

I will be releasing the monthly macro report and having the monthly webinar next week. Quantifying goldilocks and determining how it will impact every asset class is going to be critical for running trades in Q1 of 2024. For now, keep a close eye on inflation expectations as we move into the January inflation prints.

Congratulations on making it to the last trading day of the year! The best is yet to come!