The Research HUB: Risk Management And The Mental Game

Quantify your actions correctly

Every human by default desperately craves certainty on a mental and emotional level. This is reflected in people demanding to know the future returns of their target date fund or something as simple as looking for emotional certainty within a relationship. Everywhere humans crave certainty to the extent that they will pay money to know something or simply for the feeling of certainty.

This is why markets exist. The problem is if you are a trader in markets you enter into a mental dilemma. You want the reward for accepting uncertainty but also have difficulty operating under uncertainty. This is why risk management and mental preparation exist as core building blocks for success.

The problem I see the most is people talking about “the mental game” but rarely do they show how to quantify and connect this to the actual risk management process. On top of this, few people want to talk about the actual risk management decisions because they are so individualized to each person’s situation.

In this article, I want to show how you’re supposed to connect risk management and the mental game.

The Risk Side:

Risk management at its core is about the principles you use in order to operate under uncertainty. In other words, how do you operate in a world with the “Disorder Family” from Taleb’s Antifragile book?

I have already written multiple articles on the basics of risk management and even had Mythic Market Research write several guest articles:

Check out this book if you are brand new to risk management: Super Trader

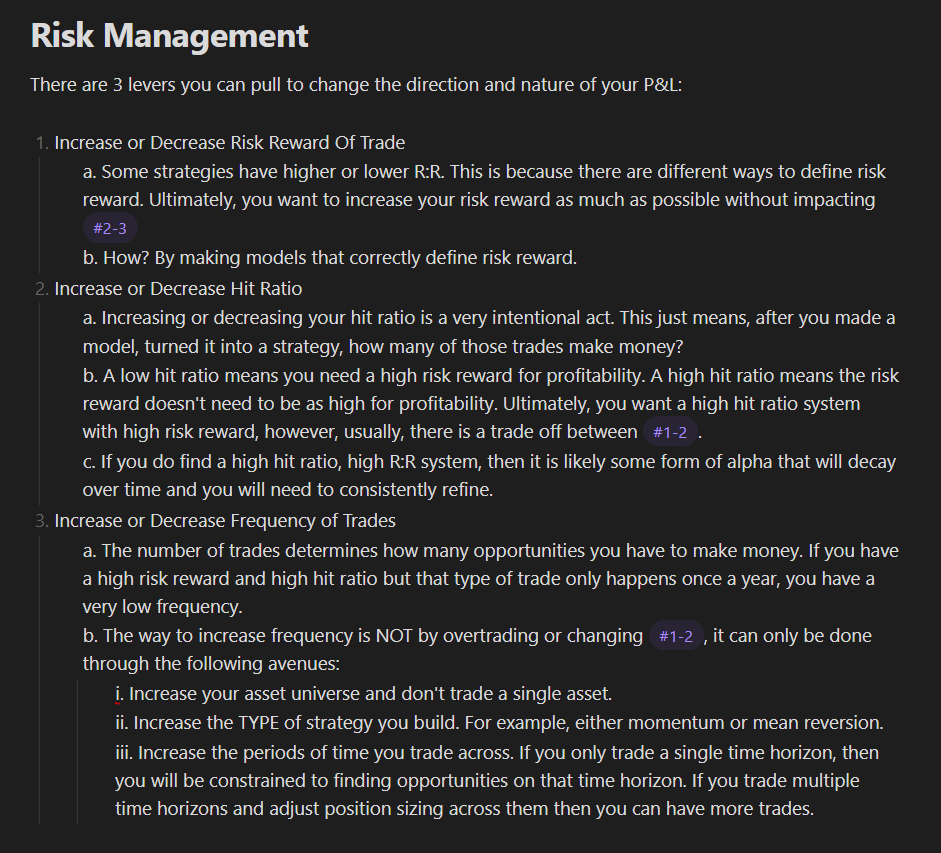

In these articles, I shared the three levers you can pull to change the direction and nature of your P&L (link). These are incredibly simplistic but foundational for the sophistication you develop.

At the end of the day, the risk management procedures at any major hedge fund or institution are sophisticated and complex (for good reason!). In this article, we are going to simplify BIG TIME!

One of the main things new traders misunderstand is HOW P&L for a portfolio even occurs. When someone says “ride your winners” or “swing for the fences” what does this tangibly mean in terms of the actual numbers?

Let’s go through several simple examples. (For those who have a lot of experience in markets and risk management, a lot of these ideas will seem very basic. Everyone is at a different place in their learning journey though).

Let’s start with a very simple breakdown. Below is a spreadsheet where I am assuming that I started with $1m. Let’s say I have worked hard YTD and made $100k using this $1m. I started with a principle of $1m (top cell) and my current portfolio value is $1.1m. This means I am UP on my principle by $100k.

Now I want you to notice several things about the cells above:

In the third cell down it says “Additional Risk From Market Money.” This simply means how much money I currently have in excess of my original principle. These are profits.

You can see there is a spectrum of position sizing from 25bps of risk to 200bps of risk based on the current risk budget. There should always be predetermined position sizes that you moderate across depending on the quality of ideas and conviction.

I have set the “max drawdown on principle” to be 5%. What does this mean? Let’s say I am managing someone’s money and they say, I will give you this $1m in capital but if you lose more than 5% of it then I am pulling it. If this is the case, you are going to be incredibly careful to never hit that 5% drawdown limit. As a result, you are likely to size your positions incredibly small until you have some cushion (like $100k cushion). Once you have this cushion, then you have “earned the right” to take large swings. It would be incredibly unlikely that you’d risk 2% of a portfolio on a trade if you aren’t significantly up with a cushion from profits.

Now you might be asking, what does it mean to risk 25bps in a trade? Well let’s use the example of the ES trade I have been running for everyone:

Here is the original R:R I shared in the article. This means that if the price hits my stop, I will lose 25bps of capital (in other words I will lose $2,500).

If the fill is at 5,268 in ES with a stop at 5,200 and a take profit at 5,576 then based on the ES contract size, I would actually be risking $3,400 (see tradingview breakdown below of the tick values) with the potential to make $15,400. You can see that the ES contract size is actually too large if I only want to risk 25bps (based on the current portfolio size of $1m). As a result, the MES contracts would have to be used but you can begin to see how a move to the stop loss level would result in a specific notional loss. (Obviously, this trade is now in the money).

Now let’s circle back to the original spreadsheet. We can begin to see how a specific position size can result in a specific $ loss. If I continue to take trades risking 25bps based on the original $1m principle then I will continue to risk $2,500.

Now this is where part of the mental game comes in. Let’s say I am showing consistency in my idea generation and risk management. I am now up $100k on my principle and I have “earned the right” to bet more. If you are down on your principle you have not earned the right to take bigger bets.

So notice in the fourth cell down it has a box highlighted yellow saying “% of Additional Risk From Market Money.” This is a percentage that I can begin to increase and it will begin to incrementally size up my position sizing. For example, let’s say I want to use 25% of the $100k gains to take larger bets. I input this into the box and it increases the “current risk budget” number that is used to determine the bps of risk. Notice that my 0.25% of risk is now just a little larger. This is because I am using 25% of my profits ($100k) to size up marginally.

Now to recap just a little: With this basic idea of position sizing, you can begin to see that the specific position sizing you use and the amount of profits you use to size up both need criteria to be determined. Some people will just create systematic criteria and not worry about it. Traders who have discretionary inputs into their decisions will individually decide their position size (for example in this example there is a spectrum of 25bps to 200bps of risk) and if you should use your profits to increase your bet size because you have “earned the right” to size up.

Knowing when to size up and when to size down are the aspects of trading that require incredible experience to master. There are so many things that go into this tension of correctly determining the amount of risk you want to take for a trade. However, the idea is that you need a predetermined framework with rules for sizing up and sizing down.

When traders talk about sizing up in trades, they likely have some cushion from profits and have a predetermined position size for these types of scenarios.

This risk control manual is in recognition of the fact that no trader can maintain quality performance over time without a systematic approach to risk control in conjunction with risk control rules that will not be violated at any time. This is not to say that there are not times to take extraordinarily relative amounts of risk. This is only to say that these instances should have a set of criteria that define them before they occur.

-Paul Tudor Jones

Connecting Returns To Strategy Metrics:

The second thing I want to cover along this same line of logic is HOW returns actually occur with a specific risk-reward ratio and hit ratio. Remember the levers for P&L I noted above:

Let’s connect these to our $1m portfolio. Let’s say we will only take trades that have a 4:1 risk reward. What does this tangibly mean? It means that if we risk 25bps of our $1m book then we are expecting to lose $2,500 if the trade doesn’t work and make $10,000 if it does work. The problem we are now faced with is that there is always a variety of risk rewards and hit ratios. For example, the spreadsheet below shows 10 trades where all of them risk 25bps and gain 100bps (4:1 risk reward). The hit ratio below that shows what the total $ you would make through various hit ratio scenarios. If you have a 40% hit ratio (meaning 4 of the 10 trades noted above work) then you’ll make $25,000.

This is where you need to begin to stress test your ideas and ask, is my specific risk reward and connected hit ratio going to produce a positive P&L?

From here, you can begin to say, “ok so I need x amount of trades a month that have y R:R and z hit ratio.”

Let’s use the example from above where $100k in profits is achieved and this “earns us the right” to increase position sizes to 1%. If we maintain the 4:1 risk reward criteria for trades, look at how dramatically the hit ratio scenarios change!

You might ask, well how would I know the risk reward, hit ratio and frequency? This is where understanding markets and building strategies comes in! This is why this Substack exists. It is here to explain the logic behind how markets move and thereby frame these metrics for the respective risk management processes you have.

Pulling these ideas together:

Now here is the deal, let’s say you want to be THE GOAT and make over 100% in returns this year (or 100% a month? I mean who is to say it’s impossible?). Well, you would break this down and say, how many trades do I need with x risk reward and y hit ratio? You might begin to run more trades and get stopped out more thereby driving your hit ratio down. You’ll have to find a solution for this (almost as if it’s a regular job! Imagine that!).

There should be a seamless connection between idea generation, strategy development, risk management, and your P&L. Once you have this framework and connection, you can actually make the right mental decisions. You can’t “play the mental game” in markets if you don’t even know the game you're playing. It would be like if you went to play poker and didn’t know any of the hands. It doesn’t matter how good you are at reading people or mental discipline, if you don’t even know the game you’re playing, your failure will be inevitable.

See all the articles I have written on these topics here:

The goal in markets is survival and ensuring your success is inevitable. If you want to make the greatest returns this world has ever seen then that is awesome. Tangibly, you’ll need to quantify these returns in the risk-reward ratio, hit ratio, and frequency of opportunities. These three things are informed by strategy development and idea generation.

Part of the reason I share all of this is because not many people are talking about this stuff. In truth, it’s not super exciting. It’s a spreadsheet. On top of this, in today’s specialized world, many people who work on the institutional side of finance don’t even think in these terms because they have such niche roles. Since the prop desks at big banks were closed down, things operate very differently.

The days when guys like this worked at banks are over (link)

The financial landscape is drastically changing. We now see individuals become incredibly sophisticated at trading and increase their net worth by hundreds of millions of dollars. (if you think this guy is an idiot then you're underestimating him!)

Conclusion:

I will end with the transcript from PTJ on why risk management and mental preparation are critical for the success of a trader. I found it incredibly helpful. Enjoy!

Dairy of a trader - PTJ

“Although 1994 might not register in your memory, there was no presidential election, no significant geopolitical events, no recession or stock market crash, it remains a year that ought to be remembered, because in 1994, the bond market suffered its worst sell-off in 60 years. Fixed income securities lost $1 trillion in value. For the first time, since its inception in 1976, the Lehman Brothers aggregate bond index showed a negative total return.

By September 1994, investors had pulled roughly $900 million out of hedge funds, and the withdrawals were still coming. Financial magazines pointed out indignantly that hedge funds were not actually hedged, and Forbes magazine proclaimed, not for the first time, the hedge fund party is over. Paul Tudor Jones handed back a third of his capital to investors, while Bruce Kovner decided to give back two-thirds.”

“Both cited the difficulty of maneuvering in and out of markets with too much capital. On December 20, 1994, Paul Tudor Jones sat down to write a letter to all his traders. He was excited about the opportunity to trade on a much smaller capital base in the new year.

He explained that he is increasing Tudor's risk exposure to his own trading relative to the past. Where a 10% drawdown from original capital or starting equity was historically tolerable, he was now focused on even tighter risk parameters. He then outlined his plan.

Allow me to read from his letter. The key to putting together a good year is to never fall behind early in the year. I can only remember one instance when a trader has been down at mid-year and recovered to have a really good year.

At best, people claw their way back to even, which in itself is only a mental victory. Occasionally, someone does turn around spectacularly at year end, but those are few and far between. It is so critical to be disciplined, patient, and precise in the early going.

“Similarly, it is just as important to press early profits into much more highly leveraged bets because that is the only possible way of having a home run year. I certainly do not want to gamble with my hard earned profits. I will always have a trend portfolio, no matter what.

I will not enter any substantial position which does not have at least a 4 to 1 reward risk ratio. I will treat profits radically different than I treat original capital. I am a strong believer that good trading begets good trading and bad trading begets bad trading.”

“Discretionary trading necessarily entails an unquantifiable and sometimes undetectable psychological element that implies traders have different levels of peak performance and perform at different psychological states over the course of any time period. If we could be completely aware of our psychological state, then this leveraging and deleveraging process would not be necessary, for we simply never trade unless we were at peak. Five times a day on each and every trading day, I will break from the momentum of the moment and take control of all trading situations by re-establishing my vision, my game plan and my invincible physiology.

I will enter my power room, drink fresh water, take three deep abdominal breaths and take the following five steps. One, separate the forest from the trees. Check sentiment, if it looks bad, buy it, if it looks good, sell it.

Time, recognize how fast it moves away from low or high. Price, implications of crossover, volumes extremes, violations of specific points. Bias, explore that which is not obvious and make the hard trade, not the obvious trade.”

“Two, be Mr. Tough and hold contempt for the weak trader. Destroy the guy who can't make the hard trade. Destroy the cookie monster and Mr. Easy.

Three, visualize and experience the rewards and the purpose of my work. Refocus and get associated to what this 13 month process means to me and to all those I empower today and will empower in the future. Because of what I'm doing today, I'll be able to give and contribute more for a lifetime.

Four, visualize numbers. Visualize achieving 12 plus consecutive winning months. Visualize the growth and experience the excitement of your nav growing.

See the growth that has already occurred from 61K to 70K. Now grow it from 70K to 75K. Now grow it to 80K.

Now grow it to 90K. Now grow it to 100K. And five, take pain, take pain, take pain.”

“This risk control manual is in recognition of the fact that no trader can maintain quality performance over time without a systematic approach to risk control in conjunction with risk control rules that will not be violated at any time. This is not to say that there are not times to take extraordinarily relative amounts of risk. This is only to say that these instances should have a set of criteria that define them before they occur.

No trade can be entered without concurrently committing to pay for a stop loss and profit objective for that and any trade. If possible, these stops should be given to an associate to ensure execution. Cancelling stops almost inevitably leads to larger losses.

No trade can be entered unless the reward-risk ratio is greater than four to one. The reason that four to one has been chosen is two-fold. A, slippage on losses is typically greater than one's original estimate, and B, traders are generally wrong on their opinions.

“At the close of every day, every position should be re-evaluated on a reward-to-risk basis using the close as the new entry point. This reward-to-risk ratio generally has to remain relatively high throughout the month if one is to win. Clearly, if one begins the day with a ratio between one and two, the account is at risk.

Just as Michael Jordan and Joe Mantana need a coach, and a heavyweight boxer needs a standing eight count, so too does every trader need someone to help them in times of severe stress, that is, during a drawdown. Determining a predefined unit size is absolutely key to making money. Anyone who arbitrarily or intuitively buys or sells a hundred or ten or one is doomed to failure.

That style of trading consciously or subconsciously ignores maximizing profitability through a portfolio approach to trading and abandons scientific inquiry as a cornerstone for managing risk. Predefined risk control allows a trader to better define his or her downside exposure, thereby keeping him or her in the game longer. One of the best ways to make money in a world of continuously leveraged bets is to figure out how not to lose it.

“We are trying to develop traders that can quickly recognize when to lever up and more importantly, when to de-lever. This is absolutely critical to a trader's success. We have found it necessary to force traders to sit out of the market when these drawdown levels are reached for many reasons, including the following.

1. They are usually so emotional and angry, timeout gives them a chance to cool off, detach from the market, and develop a rational game plan again. 2.

This gives them time to evaluate their goals and objectives, reasons for failure, always money-majorant in cases of a quick drawdown, as well as their trading methodology. 3. It gives them time to do some psychological self-evaluation, isolating those behaviors that may be sabotaging their success.”

“And 4. It gives them a chance to interrupt negative behavior patterns and create new behaviors more conducive to profitable trading. Traders who are likely to succeed over time are those who take complete responsibility for their trades by 1.

Unit-size determination 2. Stop and profit objective evaluation 3. Daily trade reevaluation and qualification and 4.

Total risk identification each and every day as a percentage of capital. Traders must never let temporary defeat or setback take them out of the game. Do not let a temporary crisis turn into ruin.

It's a part of the game. Traders must learn to bounce back from defeat. The key is to transform financial crisis into financial opportunity.

Turn all defeats into a challenge. Traders need to make new distinctions that they can take with them so they can make better decisions in the future. They need not let yesterday's crisis become today's mistake.”

“A trader must have absolute faith in his or her ability to bounce back. Successful traders are larger than anything that can happen to them financially. Overcome today's adversity and make it happen tomorrow.

Traders need to learn to evaluate how they link emotions to every aspect of trading and then eliminate disempowering emotions and linkages and reinforce empowering ones. Traders must avoid saying that a negative behaviour is okay, if in actuality it is really not okay. Traders must avoid justifying negative behaviour thereby avoiding success.

Traders must realise their day-to-day actions may jeopardise their trading destiny. Traders need to learn to take solid, consistent, positive action each and every day based on knowledge and preparation. Once a trader has learned a method that generates market opportunities with positive expectations and has learned to manage risk through time, he must then learn to manage his emotions in order to take this knowledge to the market for profitable results.”

“Only traders that are able to consistently stay in a resourceful state on a daily basis achieve successful results through time in this business. Successful trading then requires a trader to first avoid making negative associations in the present tense so that negative behaviours are not reinforced, impacting future performance. Secondly, work on eliminating any negative associations or patterns that have already been developed and replace them with more positive associations and behaviours so that future outcomes are impacted positively as well.

Traders must never ease up, no matter what degree of success they are experiencing. Do not get lax on your financial responsibilities. Continue to follow through with quality analysis, execution, money management and state management every single day.

Those traders that do well with what they have continue to get more as they grow and expand with each new success. The biggest reasons traders fail to make money is because they don't follow through. They don't practice the daily fundamentals required for continued success.”

“It takes absolute commitment, dedication, belief and discipline on a daily basis to make it happen. Successful traders are more committed and more willing to do more and give more than unsuccessful traders. Follow through each day and take control of your financial destiny.

Traders are instructed to determine what they may be doing physically and mentally to create negative, disempowering emotions and behaviours. Negative emotional states destroy a trader's profitability and can result in a serious losing spiral if not interrupted. Traders need to learn exactly how they are generating their results, whether positive or negative.

Only a trader that can master his state on a daily basis will find consistent success in the markets. Paul Tudor Jones then goes on to list a set of psychological questions. Do you have a ritual to get you into a peak state, fully prepared to take advantage of market opportunities each and every day?

Do you have a tendency to get too euphoric after a winning series? Do you have a tendency to get too depressed or frustrated following losses? Do you have a tendency to carry negative feelings with you into the next trading day?”

“Do you have a tendency to avoid taking responsibility for your losses? Do you have a tendency to look externally rather than internally to find the cause of problematic trading? Do you know how to distinguish between justifiable losses and unjustifiable losses?

Do you know how to distinguish between justifiable wins and unjustifiable wins? Do you have a tendency to emphasize the downside or the upside potential of a trade? Do you have a tendency to thoroughly plan a trade and then fail to execute the plan when the market reaches your levels?

Are you satisfied with starting out with a basic position you can maintain for the campaign, or do you feel compelled to start with excessive size? Do you have a tendency to watch the screen excessively resulting in second-guessing or doubting the potential of your position? Do you have a tendency to trade your analysis or trade your money?”

“Do you have a tendency to get obsessive about a trade strategy? Do you try to learn from every trade taken, whether the results were profitable or not? Jones continues, The primary emphasis on the psychological aspects of trading are the elimination of fear and self-doubt that can act as a barrier to trading success.

Traders are taught to profit from all mistakes by learning how to identify losing behaviors and replacing them with winning strategies. There are many psychological barriers that can stand in the way of a trader and ultimate success. We will try and focus on some of the more subtle psychological influences that may impact a trader's performance.

We cannot stress enough how important a role emotional self-discipline plays in the trading process. This section is designed to focus attention on some of the most common psychological trade barriers we continually encounter that sabotage trading success. Recognition of these potential threats is a strong starting point to helping traders develop and maintain winning habits so critical to a trader's ultimate success.”

“Here's a list of numerous psychological trading barriers that we encounter on a regular basis. One, letting the past affect the present. Often traders get euphoric and careless after a win and then give back substantial profits, or they become frightened and defensive following a series of losses generating self-fulfilling negative expectations.

This results in traders taking profits too quickly in an attempt to cover previous losses or prevent traders from pulling the trigger and entering quality positions. Traders must learn to approach each day as a new day breaking completely with the past. A trader never knows when that profitable trading run is about to occur.

2. Looking externally for causes of losses. Often traders will abdicate responsibility for their losses.

This habit prevents a trader from learning from potential mistakes and perpetuates negative feelings, that is excessive anger, blaming others, blaming the market. A trader cannot look externally to find the cause of problematic trading, but must learn to look internally and confront potential weakness. Only then will a trader find true success.”

“3. Not adequately analysing losses. Traders need to distinguish between justifiable losses and unjustifiable losses if they are going to avoid repetition of the same mistakes.

Traders that fail to properly evaluate trading results will end up torturing themselves unnecessarily and doom themselves to repeating the same mistakes. Traders need to review trade journals periodically so positive trading habits are reinforced and poor ones can be eliminated. 4.

Fear of losing. If a trader is overly fearful of losing, he will reinforce this fear by failing to take well-developed trades. This will result in total trade paralysis and likely lead to a habit of making excuses for non-involvement in the marketplace.

The whole concept of risk control involves skillfully committing risk capital to the market for gain, not to avoid losing. Traders must learn to de-emphasize the downside and learn to trust their analysis and good judgment and just let trades happen while staying within pre-established risk control guidelines. Only then will traders ride out their positions and avoid the fear of loss or fear of leaving the money on the table.”

“5. Overtrading This can be both a symptom and a cause of psychological barriers. It can be a symptom of greed or desperation when a trader is up or down.

It can cause psychological barriers to develop because it puts undue pressure on a trader when risking more than he or she can comfortably lose. The internal pressure that is generated by assuming excessive risk will force a trader's hand and cause a mistake of some type to occur, that is using too tight of a stop, exiting a quality position to alleviate internal pressure or second-guessing analysis. Traders need to stay within their volatility adjusted unit sizes and learn to regulate risk through time if wealth accumulation is to occur.

6. Trading analysis rather than money This occurs when a trader let's his or her ego interfere with trading objectives. When a trader allows the emotional need to prove analysis correct, override the true goal of making money, serious losses can occur.

A fund manager's goal is to make money, not predictions. Losing sight of this fact is analogous to a football player running for the sideline rather than the end zone. 7.”

“Getting emotionally attached to positions Traders must avoid getting married to a single trading idea. This obsession can lead to severe losses, if not detailed by a strict money management program. Traders need to allocate a certain percentage of risk capital to any one idea per month, and when this benchmark is reached, they must take themselves out before serious financial damage occurs.

8. Lack of discipline and commitment This can cause any number of psychological barriers and will lead a trader to believe losses are a result of something other than his or her lack of hard work. Slacking off reinforces the failure cycle and could result in the beginning of a crippling negative spiral.

Traders that repeatedly fall into this trap deceive themselves into believing that the markets are difficult, thereby displacing their future, rather than owning up to the poor results. Only traders that are totally committed to trading success, that are disciplined and fully prepared each and every day, will find profitability through time. 9.”

“Trading in a suboptimal mental state Often traders will treat their vocation like any other job and take profitability for granted. The markets are far too competitive for this type of attitude. Traders need to mentally prepare themselves daily if they are to achieve continued success.

Lack of emotional self-control has probably destroyed more traders in time. Traders need to get themselves into a peak state fully prepared to take advantage of whatever market opportunity presents itself. 10.

Letting faulty beliefs inhibit trading Quite often, a trader will be restricted in performance by limiting beliefs. These conflicts need to be identified and eliminated when they arise. Unfortunately, there is no way to isolate these until they become evident.

11. Reinforcing negative beliefs or behaviours Traders need to avoid overreacting to a loss or a series of losses. To excessively punish yourself every time a mistake is made can create an enormous amount of negativity and frustration that will carry over into the following trading day.”

“If this disempowered state continues to linger indefinitely, a chain interaction can take place resulting in a losing spiral. Successful traders learn everything they can from a loss, then they detach themselves and move forward, leaving it behind. Traders need to master their internal positive dialogue so that they avoid reinforcing any of these negative emotions.

Rather than saying, how could I have been so stupid? They need to ask themselves, what can I learn from this trade so future results are positive? Successful traders do not let their self-respect fluctuate with daily performance.

Rather, they believe in themselves and what they are trying to accomplish. They have mastered their emotions and are able to maintain emotional equilibrium. 12.

Impatience Trader impatience is more a function of inexperience than anything else. Novice traders are notorious for taking their trade strategy to the market incorrectly because they believe they will miss out on a move. Poor entry creates unnecessary stress forcing traders out of a quality position before actual analysis is proven wrong because of the increased risk.”

“This problem usually resolves itself in time. In closing, Paul Tudor Jones provides his final piece of advice. Those traders who can really look into themselves and realistically evaluate the person that they are and not become frightened by what they find.

Those that can address weaknesses and develop plans to overcome those deficiencies are the traders that eventually achieve stellar results. Those traders that become flustered, that get angry when others try and help, that are unable to find reasons internally for their lack of progress will usually peak out early and never achieve great things in the market. A trader needs to think and believe he or she deserves success.

A trader needs to stay fixated on positive expectations. On the desired results he or she is working for, and the daily rituals that are required for success. The more positive reference points a trader has, the greater his or her ability to draw upon those positive resources resulting in the positive results they are after.

I hope you found this to be valuable. Good luck trading and thank you for listening.”

From Stray Reflections: Diary of a Trader, May 17, 2024

Great writing (lenghty so i didnt read everything to be honest) 😊

Great piece!

Saying that Roaring Kitty (Keith Gill) is an idiot would be like saying Druckenmiller doesn't know how to manage a fund.

Keiths content is gold, especially if someone wants to start learning how stocks behave in extremes and start getting a feeling for valuations, copying his style is a great way to do that. Running a long only value strategy with companies from 100 million to 1 billion market cap like Keith can lead to significantly outperforming the markets at many times.