The Research HUB: Stages Of The Economic Cycle

It's harder than you think

Hey everyone,

If you have been following me for any amount of time, you will know I typically recommend The Long Good Buy as a good intro to the macroeconomic cycle. If you are looking for a comprehensive book list for financial markets, check out the “Book Recommendations” link in this article: Link

Today, I want to expand on a couple of ideas that get glossed over by most people when doing macro research/trading. Let’s start big picture though.

We have the basic stages of the economic cycle:

The problem with most financial news media is that they just talk about these four stages and don’t quantify them correctly. For example, YTD, we have seen an acceleration in growth but financial news media continues talking about recession. Just because the media is talking about it, doesn’t mean that is the stage we are in. These stages need to be quantified in actual positioning and market pricing.

How would we do that though? Well, you basically want to quantify all economic data in both nominal and real terms. Then you compare this with nominal and real EPS growth as well as valuations. (See the SPX, Bond, and FX Primer for this: link, link and link)

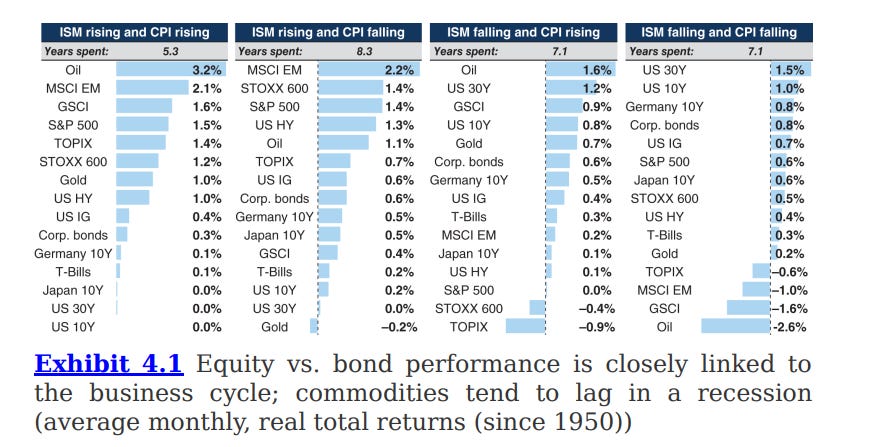

Then you can map this onto specific assets in a country:

Here is the thing, a historical study isn’t incredibly useful for action if it isn’t quantifying the continuity and discontinuity with the present. You can study the “fear and green” cycle through history but this will primarily be descriptive as opposed to helpful for having foresight.

Fundamentally, you want to map all economic data and asset price returns through these various stages of the cycle:

From here, you can have a reasonable idea of the specific assets you want to overweight or even leverage:

Is it that easy?

Here is the problem though, these stages of the economic cycle don’t provide a framework for TIMING, AMPILTUDE, or DURATION.

Why do these ideas matter? Arguably, you need to take some type of view on these ideas in order to put ideas into action. It is easy to describe what HAS and IS taking place, but it is much harder to anticipate the TIMING, AMPLITUDE, and DURATION of what WILL take place.

Did you anticipate this inflation cycle would last this long and be this extreme? How long will a future recession be?

This requires accounting for all variables in a system, synthesizing them correctly with proper weightings of the causal factors, and then having reasonable success in estimating future probabilities in comparison to how the market is pricing those probabilities.

You can begin to see that you need BOTH historical research and continuous synthesis of the present. This is the goal of the Substack, to build on the historical foundation of rigorous research and synthesize things correctly in the present. There should be a seamless continuity between your research, action, and adaptation.

If you want a clearer picture of this, check out these recent articles: link and link

It might be a little complex but keep mapping all of the variables and synthisizing them.

In the information age, you simply need to be at the right place, at the right time, with the right information to succeed

Thanks for reading

Please confirm my understanding. "earnings grows faster than p/e multiple": the earnings of the company or the stock are increasing or accelerating, and the share price is not catching up with this reality. Vice versa, "p/e multiple grows faster than earnings" : the share price (P) is growing faster than the earnings per share (EPS) wich are declining or stagnating, so that price are not reflecting this reality. Thank you very much