Week Ahead: Equities, Rates, and NFP

How macro flows are likely to shift across the risk curve

In markets (and life), information is never evenly distributed. On top of this, the information that is distributed (unevenly), is not correctly interpreted evenly across all participants. On top of both of these layers, patience and impatience in participants' decision-making further amplifies the first two layers.

I say this because I see so many people getting upset at the misinterpretation of markets by “supposed experts.” By definition, we need uninformed market participants to trade against in order to generate the alpha that produces excess returns. Be thankful for suckers ;)

Let me explain how I think about market perceptions:

First, consensus expectations as evidenced by economic data and earnings. We can monitor this through basic expectations vs actual indicies:

These types of hard data points actually help you quantify views of consensus and connect with your view of valuations or risk premias.

Second, I look at short notes by Bloomberg, investment banks and low-level shops. At best, these reports are coincident with market pricing. This means that if they are talking about it then the information is likely priced in. However, this doesn’t necessarily imply the opposite will happen, just that what is known is likely priced in. (And just to burst your bubble a little, if Goldman is talking about a trade, its 90% over. I can’t tell you how many times I have taken the other side of a trade that the Goldman boyz publish as a recommendation.)

Third, I think about Twitter, media articles, and all the financial influencers as the Greeks on the layers of consensus I noted above. I like to think of these people as the Greeks of consensus because some people talk about tails and others just get whipped around like a gamma squeeze on a meme stock.

I will always emphasize this but sentiment isn’t a strategy. Finding someone to fade as a starting point produces poor results. If you talk to the people who do this successfully, it is because they have so many prior presuppositions about how markets actually work and they are just operating at a higher level than you.

So just enjoy watching the Greeks as they react to the various oscillations in price.

ES Trade:

I want to start by addressing several things with the long ES trade.

First, I shared a long ES trade because the factors for a long were aligned perfectly.

Here is the original R:R I shared and we are now in the money.

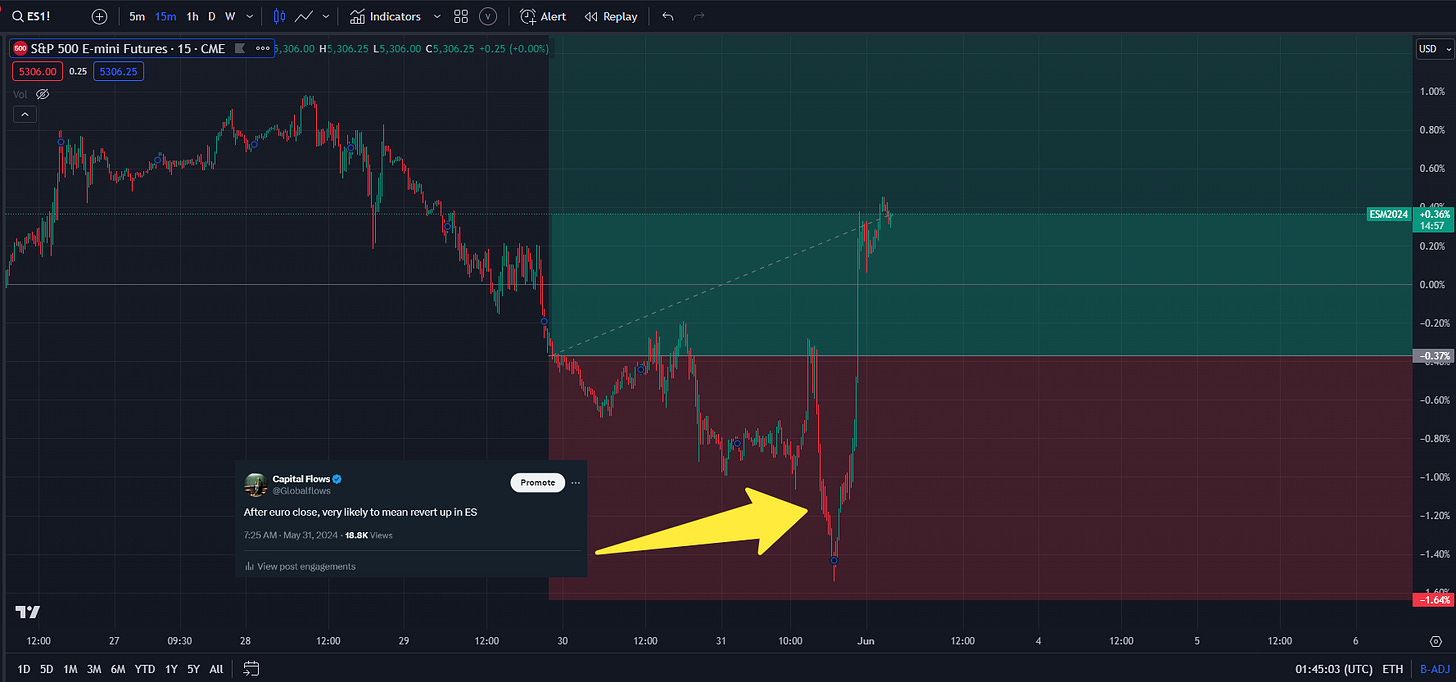

However, one of the Tweets I shared was that there was a high probability that we mean revert up after the Euro close on Friday (link)

As we progressed through the day, the market bottomed and we had an incredibly violent reversal UP in confluence with the view I laid out. This was incredibly likely and I have consistently laid out the research for WHY these types of moves take place.

I explain in the educational articles how the market microstructure creates the transmission mechanism for flows and transactions.

I also laid out how to model and trade these types of dynamics in the intraday trading primer.

I will say this, liquidity is incredibly simple in one sense and infinitely complex in another. For example, someone can always tell you what time a clock says but can they explain to you how the clock works? Can they build the clock? Unlikely but they always know how to tell the time.

Liquidity is the same, the end result is always clear but what goes on under the surface eludes most people. For example, here (link) is a graphic from Trades, Quotes and Prices: Financial Markets Under the Microscope: (by the way, if you haven’t read this book, what are you doing with your life?)

This graphic shows how execution liquidity functions. In a bigger sense though, liquidity works like this on a macro basis. There is a reason why trends take place as opposed to mean reversion. Many people know that they take place but WHY they take place is difficult to understand.

So in a tangible sense, where are we heading with equities? Equities are bullish in all of my models and strategies. I shared a breakdown of the logic here and shared the long ES trade. When the time comes, we will move out stops up to protect our gains. For now, we sit patiently.

Week Ahead: NFP

The main event this week is NFP.

Consensus already expects this to have significance toward the Fed’s decisions:

The actual dynamic is that when you are trading, you need to execute at extremes. The analysis of WHERE these extremes are in rates was laid out in the following reports:

Getting long ZT last week when we were at the extreme back at the FOMC “hawkish pivot” level was the play shared with paid subscribers: (link)

This was my note: Link

Let’s get into how rates are likely to develop this week and the other trade ideas I have been sharing. If you want to dig into the macro views more, check out the podcast I did here:

Trades:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.