Where is the bear market?

How you connect macro with equity signals

This is one of my favorite sections from Self Reliance by Ralph Waldo Emerson:

The implication behind this is that the worst thing you could do is try to become someone else. You have been given a unique life with a piece of ground you are responsible for. Imitation is suicide.

One of the things I emphasize in this Substack is explaining the logic and thought process behind things so that you can be self-reliant. The worst thing you could do is become dependent on someone else for your education and ability to adapt.

You will notice that I intentionally spend time breaking down the logic of underlying drivers in the market. It would have been easier for me to just say “bullish stocks” in the equity report and posted a bunch of random back fitted charts. That isn’t my goal though. We are here to correct quantify the moving parts of a system in order to execute consistently through time.

So where are we going? I have already laid out the list of educational articles here:

Over the next month, I will be releasing A LOT of additional models for alpha generation. We have built the foundation for understanding macro and now we will build alpha return streams ON TOP of this foundation.

If you feel like this is all a lot to take in and difficult, good. Embracing difficulty is WHY you get paid a premium to operate in markets (and life).

If you are trying to dial in your thinking on how this type of thinking should be applied to any domain of life, I would challenge you to read work by Naval Ravikant: Link and Link

Equities:

We are moving forward with momentum as the ES trade remains in the money (link). I want to expand on an idea from the equity report (link).

When we analyze equities within a macro framework, we are looking at sector and factor drivers for each equity. If we look at the attribution for equity, typically 70% is macro, 20% is the sector and 10% is individual fundamentals. Now obviously this can change and identifying when the rules change is where you generate outsized returns.

"Markets are constantly in a state of uncertainty and flux and money is made by discounting the obvious and betting on the unexpected."

-George Soros

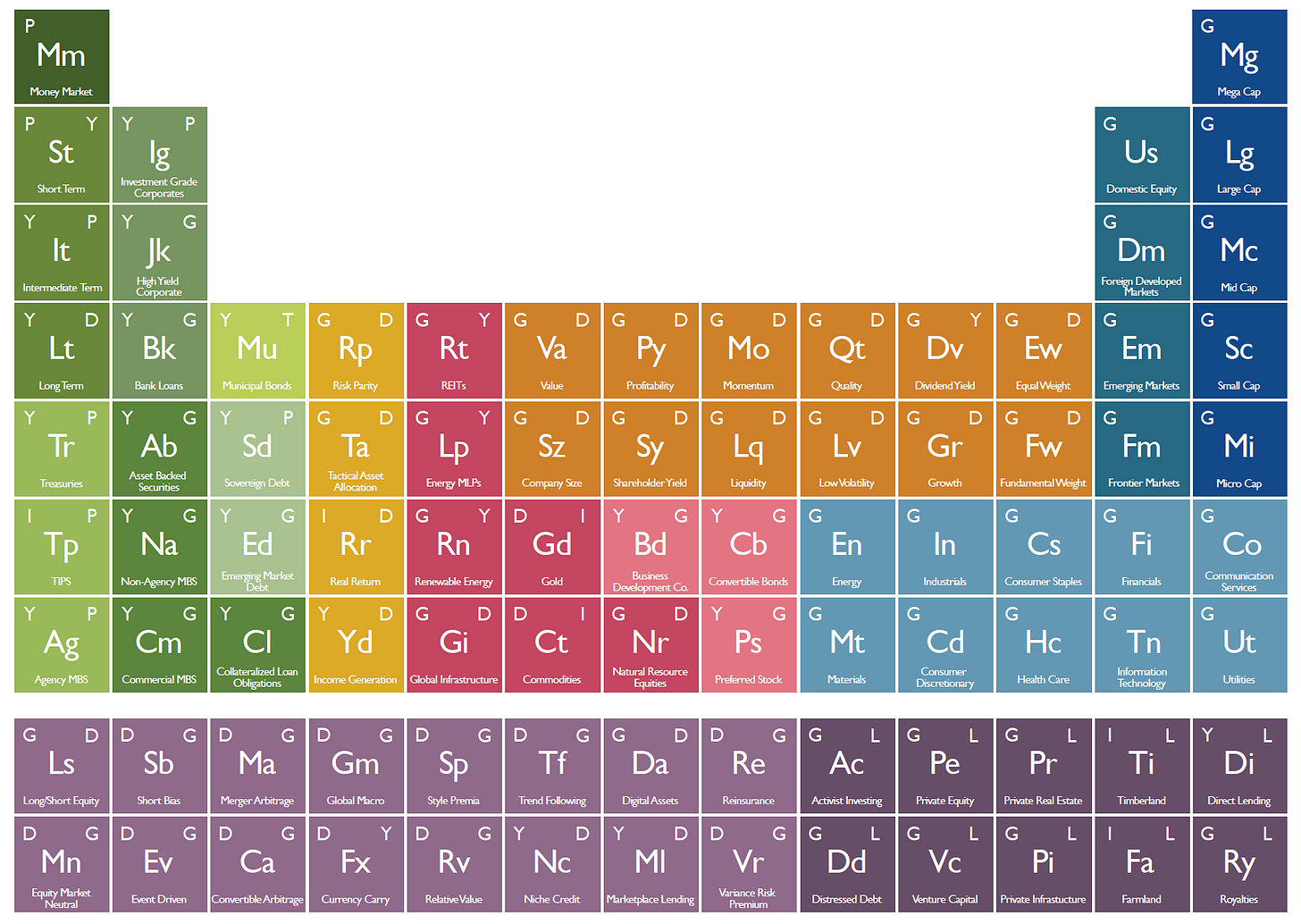

When we think about factor exposure, most of us breakdown things in some manner similar to how the Allocators Edge (link) does. What you will realize is the way you define these factors can make a big difference which is why a lot of hedge funds have their own proprietary process for doing this.

Within this context, I mentioned in the equity report how quality vs junk factors are functioning. Well, a lot of this depends on the index. For example, here is the Russell 2000 low-quality factor. In plain English, here are all the companies in the Russell that really suck with tons of debt. They are still trending down.

Here is the same logic for the S&P500. You can see that there is a dramatic difference between “junk” companies in the S&P500 and in the Russell:

If you want to dig into this more, just look at the debt metrics in the S&P500. I did a whole chart deck of these in this article:

Big picture takeaway: There is always a bear market somewhere depending on the sector and factor exposure. When people are getting mad at “stocks always going up” they are missing that the S&P500 literally cycles through the highest quality companies in the entire world.

The rise in rates has most certainly hurt many companies and this is reflected in the Russell. However, we need to make sure we always correctly quantify how much this impact is getting transmitted into the S&P500.

If you want to dig into this a bit more, check out the audio recording of this Twitter Spaces I did here: https://x.com/Globalflows/status/1803849827429777714

Enjoy your weekend. I will be publishing the beginning of the alpha breakdowns for paid subscribers. Be ready, a lot is coming your way.

“You wasted $150,000 on an education you coulda got for $1.50 in late fees at the public library.”