Macro Alpha Views: Equities, Bitcoin and Rates

How Jackson Hole and Labor Market are setting the market up for the next big move

Hello everyone,

If you did not catch it, I was on Blockworks breaking down my macro framework and current macro views. You can find the podcast and referenced reports here:

I did a short Twitter thread with all the main podcasts and resources I have published here: Link

In this article, I am going to cover the following:

A simplistic breakdown of where we are in the cycle, macro events this week, and how to think about recession risk.

A sophisticated and more complex analysis of assets as it relates to the macro regime.

A side note: If things are difficult to understand, I would encourage you to check out all of the educational primers and recent macro report (I took the paywall off of this for you!):

Educational Primers on all aspects of macro: Link

How to generate exceptional returns in markets and life podcast: Link

Comprehensive Macro Report: Link

A simple breakdown:

There continues to be a prevailing sentiment among market participants that we are in a recession or going to have an imminent recession. Let me start by saying, that all of us understand there will be a recession one day in the future. You aren’t a contrarian to think a recession is coming.

At the end of the day, the goal is to make money in markets and not get some arbitrary call right. One of the points of trading is to make money consistently so that when a view is wrong, you have gains to offset the losses. Individuals who consistently buy some type of insurance or have a higher allocation to cash will have a drag on their portfolio returns.

There is a reason the VXTH index hasn’t made all-time highs while the S&P500 total return index has:

There is nothing wrong with having hedges or a higher allocation to cash but there are tradeoffs to this. These trade-offs need to be weighed against simply holding a long position and taking a drawdown during a market correction. So many people wait and eventually buy bottoms to have the same ultimate returns as the person who just buys and holds.

I am not implying any specific action or outcome but simply drawing attention to the trade-offs that need to be managed. This is what I laid out in the first article I wrote. Fundamentally, preparation for multiple scenarios precedes prediction.

Let me say, that even if we do enter a bear market, we will continue to align our actions with how positioning overextrapolates information and execute at extremes. The chart below shows the S&P500 with implied vol premiums and discounts. When you overlay these with how the realized trend is taking place as it develops with fundamental information, you have a clearer view of WHAT to do even if you don’t know exactly what the future holds.

For example, I shared the long ES trade when the implied vol premium was MASSIVE. I was executing at an extreme so that I can have P&L cushion now that implied volatility is at a significant discount: See this article.

Where does this leave us? We are in a regime with several tensions that need to be mapped with care. Let’s just address the “weakening growth” argument:

Over the last 3 years we have been dealing with all of the impulses surrounding the Fed’s hiking cycle. During 2022 we see cyclical components of the economy get hit marginally as interest rates increased. People began to realize that housing isn’t the business cycle and that you can’t just overlay building permits as a “leading indicator” for the entire economy.

During this period of time, the labor market remained incredibly resilient INSPITE of the level of interest rates. As a result, both the market and the Fed began weighting these data points with higher significance. As a result. a small tick-up in unemployment caused an entire growth scare that was unjustified.

As a result of this new focus in the market, we are likely to see a DECREASE in hedging flows surrounding inflation prints and an INCREASE in hedging flows surrounding labor market data. These will function as positioning signals and important levels in stocks and bonds.

As the underlying economic situation develops, equities and rates will continually oscillate around linear extrapolations in fundamental information. These extremes will function as entries and exist to incrementally provide opportunities to generate alpha.

There has recently been a lot of focus on the BLS revisions:

Many people will say revisions mean recession:

Here is what I will say: revisions CAN mean a recession but we need to look at data holistically. The difference between a growth scare and a recession is that the underlying components of growth (income, consumption, employment etc) begin moving in a reflexive feedback loop with each other resulting in a pervasive contraction. It is this marginal difference that determines if the tail hedge portion of returns pays out or if equities continue rallying:

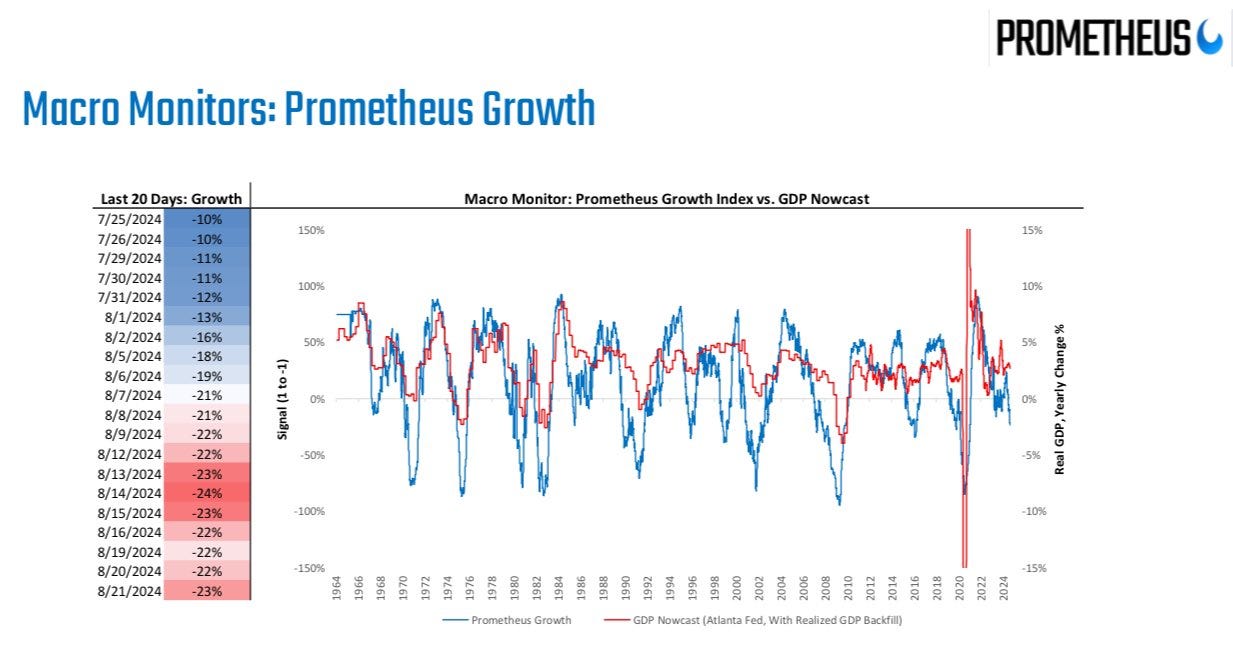

Bottom line: The dominant regime remains Goldilocks in both the economic data and impulse in markets. While there are some marginal weakening as Prometheus Research indicated, we aren’t at a place to be short stocks. Being long stocks and long bonds provides better optionality because it has positive exposure to Goldilocks and the bond portion for if a growth scare takes place.

If you want to dig into this dynamic more between stocks and bonds, check out my primer here:

Deeper Dive Into Macro: A little more complex

I have already laid out my cyclical view on rates and short-term view on rates in the following reports:

Trades: TLT short and CPI analysis (short term view that has been falsified)

The initial bond short I shared in the macro report played out betting on a reversion of credit risk. We have remained below the CPI level on the short end:

However, the long end has drifted up since we are so close to the uninversion. This caused us to push through the short-term risk reward I had shared (link). As I noted in the report though, you don’t want to get too caught up in counter-trend moves when we are skewed to the upside on a cyclical basis (link)

This move off the lows in bonds has caused the curve to flatten marginally:

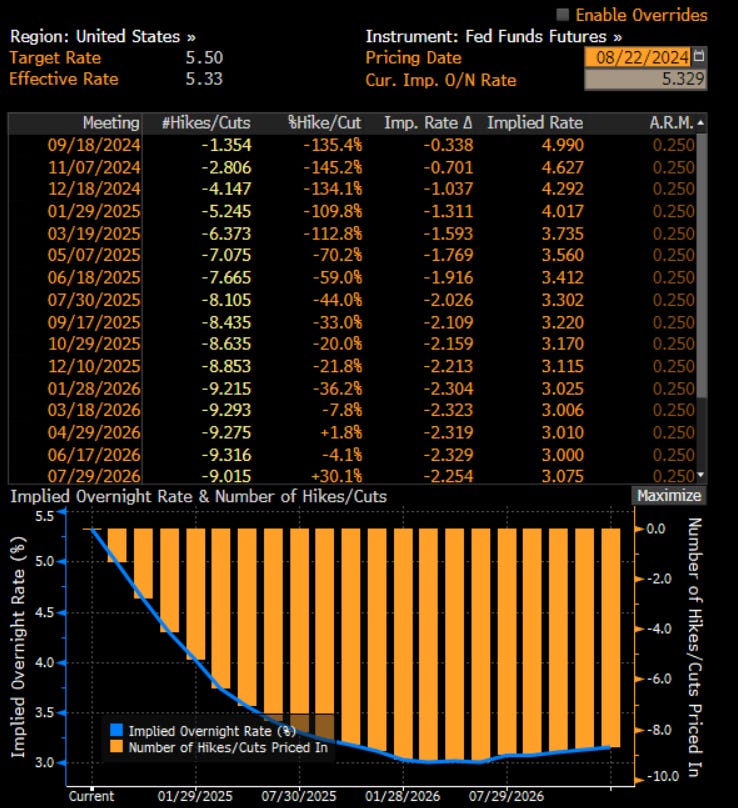

With a smaller probability of a 50bps cut in the Sept meeting:

As I have noted, we are unlikely to get a 50bps cut in Sept or have a recession in 2024. Any of the deviations we have in terms of the aggressiveness in the forward curve pricing cuts or risk assets pricing a recession should be faded when a positioning premiums exists.

As I noted above, we are now at an implied vol discount in the S&P500 which means the probability of a marginal pullback is higher. I am still holding the long ES position I opened but I would not be increasing risk here. As we move into Jackson Hole, we will have more clarity on the equities and rate trend.

I am definitely still bullish but I only execute positions at extremes. We are likely to continue fluctuating between Goldilocks market pricing and growth scare market pricing in the stock-bond correlation.

Notice how we saw the inverse correlation during the equity liquidation and then this has decreased in strength marginally since then. You will notice on some of the data prints there is a sharp inverse correlation or positive correlation. Comparing this intraday correlation and the data will be important.

As I noted above, we are likely to see higher intraday volatility and hedging pressure during growth prints like initial claims and NFP. Watch for this tomorrow.

Bitcoin outperformed NQ just marginally as we were rallying off the lows. Bitcoin continues to hold its levels

Bitcoin’s correlation to bonds shows this flip-flop between Goldilocks and growth scare pricing. Once there is clarity that we aren’t moving into an imminent recession, we are likely to see Bitcoin rally (see my Bitcoin view here: Link):

Watching the correlations between equities, bonds, and Bitcoin in connection with economic data that is being released and the clear technical levels from the liquidation two weeks ago provides a multidimensional picture into what is occurring.

On top of this dynamic, we have the crude gold correlation flipping around and more recently the GC/CL ratio rallying with a ton of strength:

Implied vol is elevated in crude but isn’t blown out right now:

I am watching the skew closely here and a potential for a bottom in crude overlaps with gold slowing its rally. Gold is likely to rally as long as we are in Goldilocks with a bull steepening. However, if crude begins finding a bottom and rallying against gold marginally then this could begin setting a short-term bottom (long HG is the clearer trade here though).

The final thing I will touch on is the DXY. As long as the US yield curve bull steepens into Goldilocks on a relative basis to the Eurozone, the DXY is likely to fall. I still think we break down further:

Cross-currency basis swaps remain at highs for the Euro and Pound:

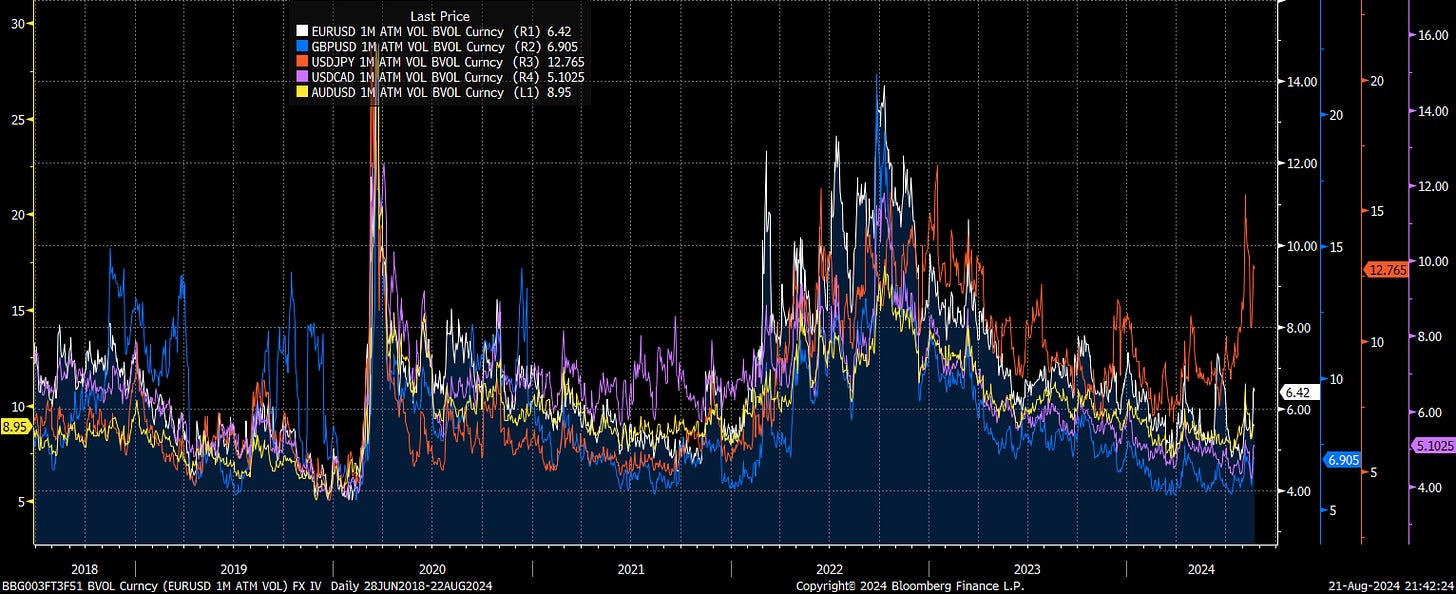

And the Yen is the primary pair seeing vol blow out. Ironically, if the Yen is rallying then it is likely doing so with US bonds rallying:

Pulling Things Together:

We need some clarity from Powell right now on how things should be priced on the forward curve ever since the liquidation and new data. It is unlikely for him to change his stance on the Sept meeting to 50bps but we could see him put a comment out there that walks back the aggressiveness of cuts priced after that.

I will keep you updated on this.

Thanks!

A Pepe for the culture!

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

Great stuff!

Bull steepening (long term yields falling faster than short term) into moderate growth and in inflation (goldilocks) is bearish for DXY

Yes?

If so does this dynamic occur the exact same way with other countries or the effects of bull steepening varies across countries.